The S&Ps bloodbath? How We Saw It Coming

Markets don’t crash without warning. They whisper before they scream

You’ll find plenty of S&P 500 crash “predictions” online, but only after the bloodbath has already happened.

Not us.

We’ve been signaling the risk before the fall and adjusting our portfolios accordingly.

September/24 Alpha Hedge AI Algo Portfolio Rebalancing (09/02/2024)

click to Read ↑

U.S. Equities: A Shift

We reduced our exposure to U.S. equities through our risk management process at the beginning of August.

The positive trends following the decline early in August signal that this asset class is still a powerhouse in our portfolio. By maintaining a MODERATE position, we're capitalizing on its sustained strength while making room for other emerging opportunities and controlling risks.

Interestingly, the reduction in U.S. equity exposure is being reallocated to fixed income, which has been gradually gaining traction. This shift reflects our commitment to keeping the portfolio balanced and dynamic.

February/25 Alpha Hedge AI Algo Portfolio Rebalancing (02/03/2025)

click to Read ↑

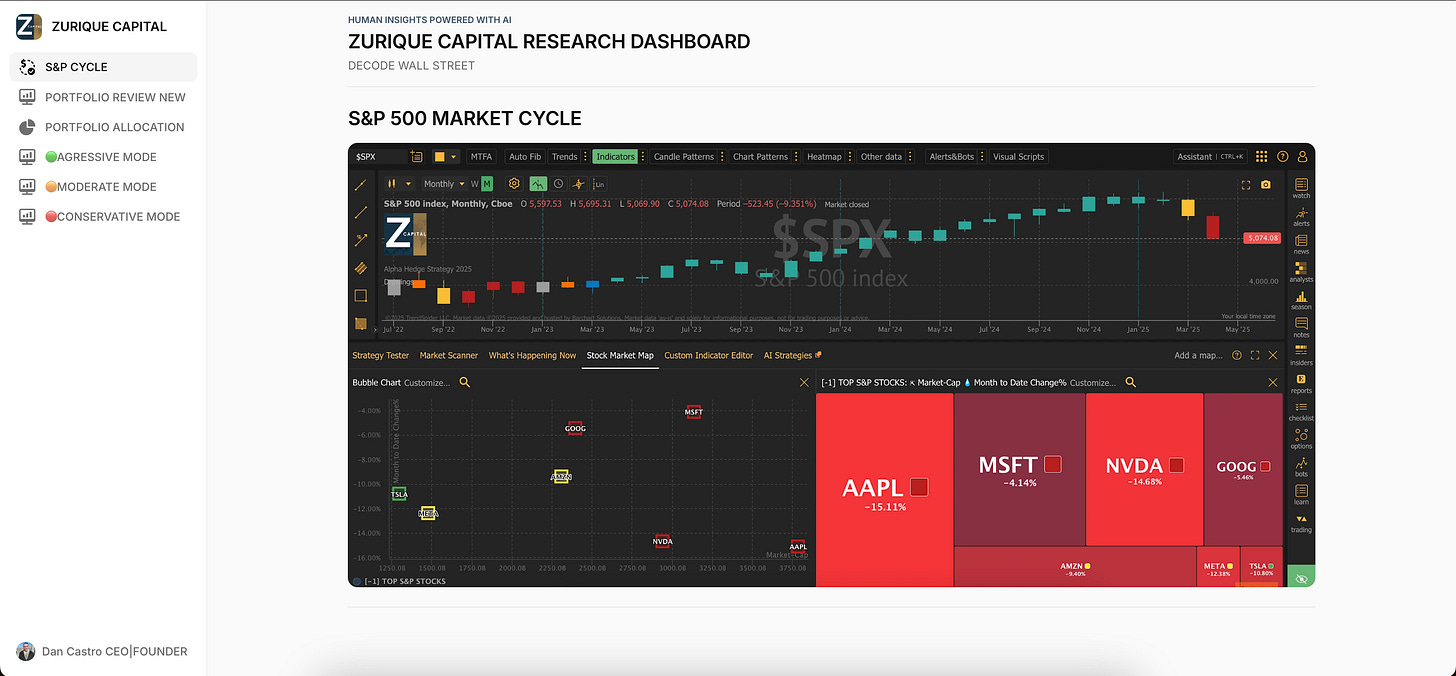

Indicators Suggesting the End of the S&P 500's Current Market Cycle

Several indicators—rising volatility, interest rate cuts, and historical election cycle patterns—suggest that the S&P 500 may be approaching the end of its current cycle.

March/25 Alpha Hedge AI Algo Portfolio Rebalancing

click to Read ↑

Our current position is MODERATE. For investors starting the Alpha Hedge AI Algo Portfolio this month, the CONSERVATIVE mode is recommended, or even maintaining a full cash position may be considered. Aggressive positions are not recommended due to indicators suggesting the end of the S&P 500's current market cycle.

Most investors claim you can’t time the market. But our data suggests you can time risk.

Many blamed the sudden announcement of tariffs — but the data reveals something deeper.

Other indicators had already shown the weakness of the index's movement.

Markets don’t fall that hard without warning.

They signal fatigue long before the crash.

Since 1945, there have only been 31 drops greater than 5% — most occurring during extreme periods like the dot-com collapse or the 2008 crisis.

This movement wasn’t just about tariffs (learn more about the 4-year presidential cycle), it was a market looking for a reason to drop.

This is why headline-chasing investors suffer. While the crowd waits for news, we monitor statistical data and technical breakdowns.

During a recent -9.6% weekly drop in the S&P 500, our portfolio exited high-risk positions before the fall.

This wasn’t luck — it was cycle discipline. Our AI-driven strategy detected a shift to Phase 6, a statistically high-risk environment for drawdowns, and adjusted accordingly.

Of the “Magnificent Seven” stocks, only Tesla TSLA 0.00%↑ remains in Phase 4.

Apple AAPL 0.00%↑ , Nvidia NVDA 0.00%↑ , and Microsoft MSFT 0.00%↑ have already entered late-cycle phases with declining momentum. Google GOOG 0.00%↑, Amazon AMZN 0.00%↑ and Meta META 0.00%↑ are currently in Phase 5. If they close the month at these levels, the downtrend will likely be confirmed in May.

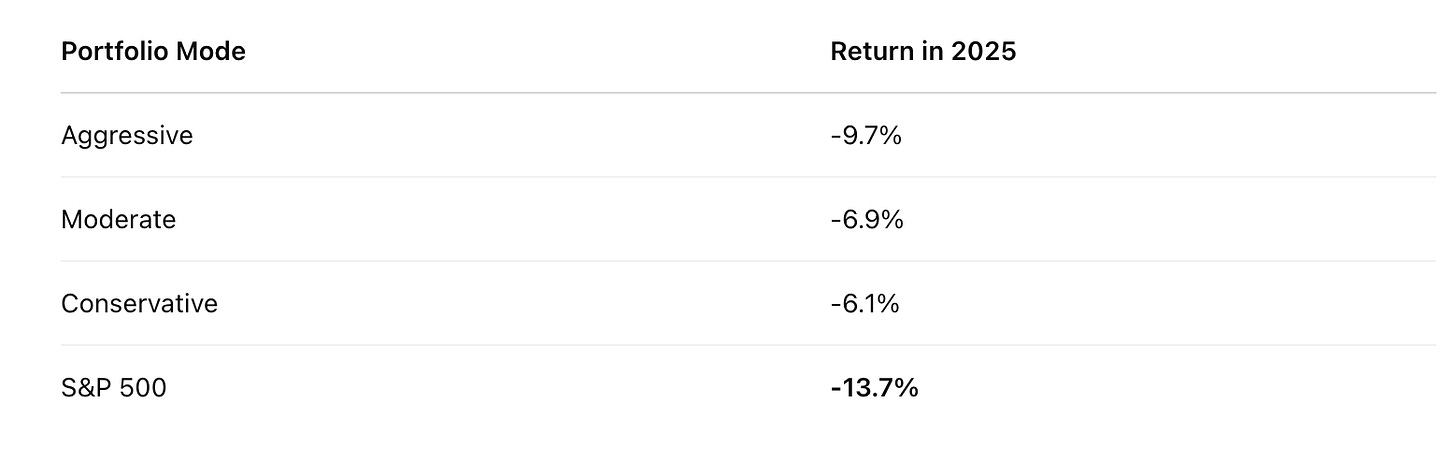

Yes—our portfolios are currently negative this year. But the drawdown is controlled, not reactive. In fact, this is expected at the start of a new bear market phase.

Early in every cycle, correlations spike. Almost everything moves down together due the margin calls.

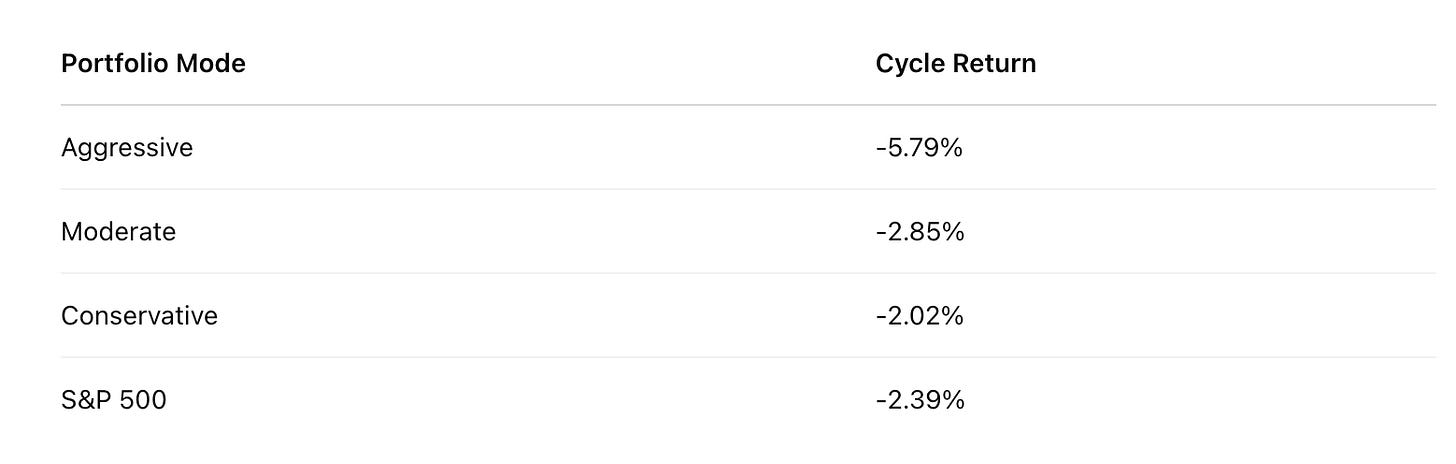

The difference? We’re positioned for what’s next.

Our AI model shows an 88.9% probability of reversal in the current asset,

even while the index remains in bearish territory.

Cycle-based investing isn't about prediction, It’s about reading the map when the terrain changes.

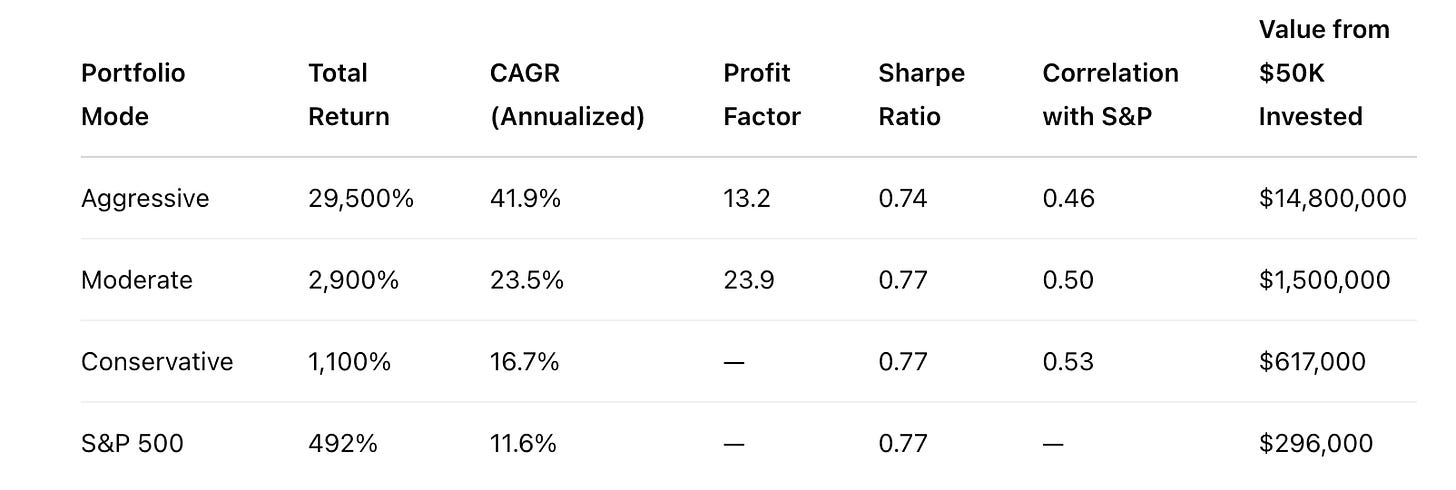

Portfolio Performance Report

Reference Date: April 2025

Evaluation Period: January 2009 to April 2025

Executive Summary

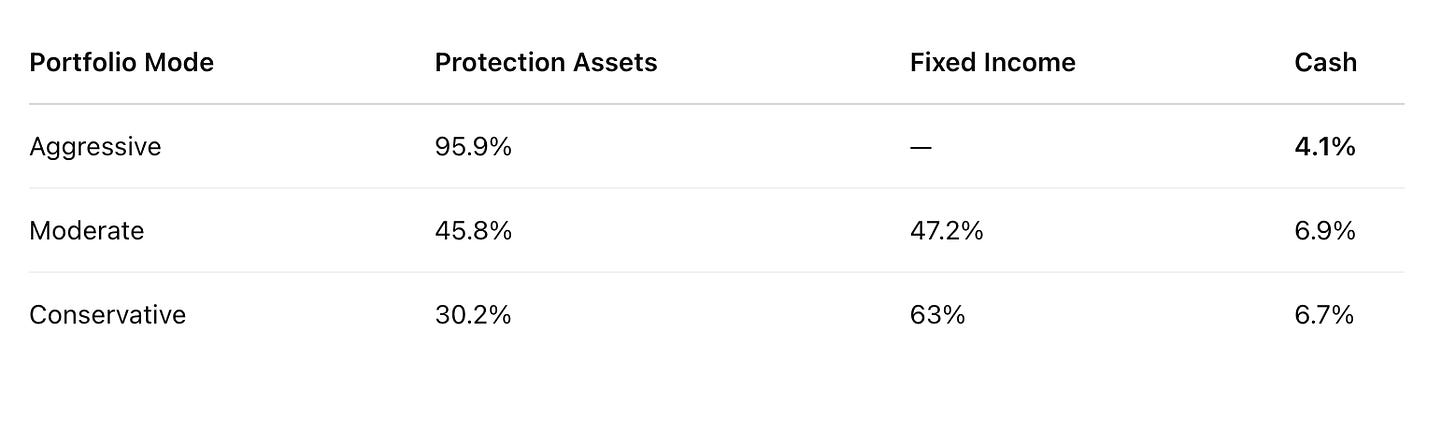

Zurique Capital’s portfolio is structured into three risk profiles — Aggressive, Moderate, and Conservative — each designed to match a different investor profile. Below is a detailed overview of daily, long-term, and current protection cycle performance, benchmarked against the S&P 500.

Cumulative Performance Since January 2009

All data assumes dividend reinvestment, with no additional contributions or withdrawals.

Year-to-Date Performance (2025)

Current Hedge Cycle Performance

(Cycle began in April 2025)

Current Asset Allocation

Conclusion

Despite recent volatility and drawdowns during the current protection cycle, long-term results continue to demonstrate the strength of Alpha Hedge AI Algo strategy across all risk profiles.

The aggressive mode stands out for its exponential growth over the years, while the moderate and conservative modes offer greater capital preservation and lower correlation with the benchmark, providing protection during periods of market stress.

See the full Alpha Hedge AI Algo Portfolio — Subscribe to the Wall Street Insider Report.

Decode the Algorithms Behind Wall Street’s Moves from the Inside.

Turns AI investment management and quantitative investment strategies into results.

Discover AI investment opportunities, curated by our quant-driven AI Advisor Algorithm.

▶️Read what the Wall Street Insiders wrote about us↓