February/25 Alpha Hedge AI Algo Portfolio Rebalancing

Monthly Portfolio Allocation Overview

February/25 Alpha Hedge AI Algo Portfolio Rebalancing

The Future of Investing in an Uncertain World

What if I told you that the biggest mistake investors make isn’t picking the wrong stocks, misjudging interest rates, or even failing to time the market? The biggest mistake is assuming the future will look like the past.

I’ve spent years analyzing market cycles, economic indicators, and the psychology behind investing. I’ve seen fortunes built and destroyed by a single assumption: that yesterday’s trends will repeat tomorrow. But here’s the truth: markets evolve, and those who fail to adapt are left behind. Today, I want to talk about how we can navigate this ever-changing landscape with confidence, leveraging data, trends, and a clear investment strategy that protects and grows wealth in an uncertain world.

The market isn’t just about numbers, it’s about recognizing cycles, adapting to change, and staying ahead of the curve. Today, we’re at a pivotal moment where interest rates, global equities, and investor sentiment are shifting dramatically. The key to building wealth is not just reacting to these changes, but anticipating them.

The Rise of U.S. Equities & The Power of Allocation

This year, we’re seeing U.S. equities hit new highs while international markets, emerging economies, and real estate struggle. This isn’t a coincidence. It’s a direct result of capital flowing toward stability and performance. The lesson? Investors must be willing to shift their exposure, not based on emotion or past loyalties, but on real-time data.

The Role of Interest Rates & Fixed Income Strategies

The Federal Reserve’s recent decisions have created a standstill in fixed income markets. Bond prices remain under pressure, and uncertainty around tariffs and government policies means we’re not likely to see immediate clarity. The best move? Rather than chase yield, positioning portfolios in floating rate strategies, essentially mimicking Treasury bills, providing safety while waiting for the next opportunity.

The Economic Catalysts That Will Shape 2025

Three forces will define the next chapter of investing:

GDP Growth: The U.S. economy grew at 2.5% last year—slower than before, but still resilient despite inflation fears.

Consumer Spending: Americans have defied expectations with record spending, keeping the economy afloat.

Federal Reserve Policy: The Fed’s pause on rate cuts signals caution, and investors should take the same approach, watching closely, but not acting impulsively.

So what can you do today? Three things:

Follow the Trends, Not Your Emotions: Don’t get attached to yesterday’s winners, stay where the data leads you.

Stay Nimble: Your portfolio should be like a chess game, where every move is intentional and based on the current board, not the last one.

Be a Student of the Market: The economy is a living, breathing thing, and those who study it will always have the upper hand.

The future of investing isn’t about certainty, it’s about agility. It’s about making decisions with clarity, confidence, and strategy.

One way to achieve this agility is through a focused, 1-asset portfolio strategy. By concentrating capital into a single asset that aligns with the dominant market trend, investors gain the ability to pivot quickly, reduce unnecessary exposure, and maximize returns when conditions shift. This approach removes the inefficiencies of over-diversification and allows for precise, data-driven decisions, making it the ultimate strategy for staying ahead in an evolving market.

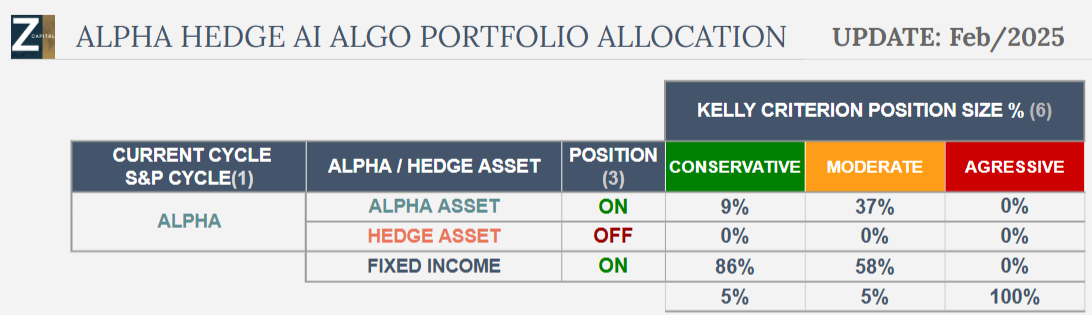

Alpha Hedge Portfolio Allocation February/2025

The Alpha Hedge Portfolio will remain in RISK-ON MODE. The allocation adjustments solely reflect the market movements observed in January.

The S&P 500 remains in Phase 4 of the Cycle, so the portfolio allocation will be maintained with only minor adjustments. These adjustments are strategically calculated based on the January performance of key assets.

Overview of the Analysis

The top 13 assets in the S&P 500 are analyzed based on percentage movement in January.

The X-axis represents market capitalization (heavier weight means more influence on the index).

The Y-axis represents price appreciation for the month.

S&P 500 Performance in January

The S&P 500 gained 2.7% in January.

This growth was driven by major tech stocks, particularly:

Amazon AMZN 0.00%↑

Meta META 0.00%↑

Alphabet GOOG 0.00%↑

Tesla and AVGO 0.00%↑ (Broadcom) also contributed positively, but their weight in the index is smaller.

Stocks That Had Little or Negative Impact

Microsoft MSFT 0.00%↑ remained nearly unchanged, with a 0.02% increase.

Apple AAPL 0.00%↑ and Nvidia NVDA 0.00%↑ dragged the index down, posting negative returns for the month.

Indicators Suggesting the End of the S&P 500's Current Market Cycle

Several indicators—rising volatility, interest rate cuts, and historical election cycle patterns—suggest that the S&P 500 may be approaching the end of its current cycle.

Rising Volatility as a Warning Signal

The volatility index has been trending upwards for months.

Historically, when this occurs, the S&P 500 enters a downtrend a few months later.

Interest Rate Cuts and Market Reactions

The U.S. government has started cutting interest rates.

The best phase for stocks is typically the pause between rate hikes and the first rate cut.

Stock market growth slows after the first cut, signaling potential weakness ahead.

Election Cycle and Market Performance

Election years typically yield strong market performance, while the first year of a new administration often sees a downturn.

The S&P 500 has outperformed the historical election-year average return (16%), with a 23.31% gain last year.

Mean reversion is expected, potentially leading to a 15-20% decline over the next two years.

Historical Market Cycle Analysis

Research from Stan Weinstein, covering over 100 years of U.S. market cycles, suggests market declines are independent of political parties.

Given historical patterns, investors should prepare for a potential downturn.

Investment Strategy Recommendations

New investors should adopt a conservative position.

Suggested allocation: maximum 9% of the portfolio in this market.

Aggressive strategies should be avoided, with high-risk allocations kept at zero.

A potential market correction of 15-20% is expected over the next two years. As a precaution, investors should maintain a conservative approach and avoid aggressive positions.

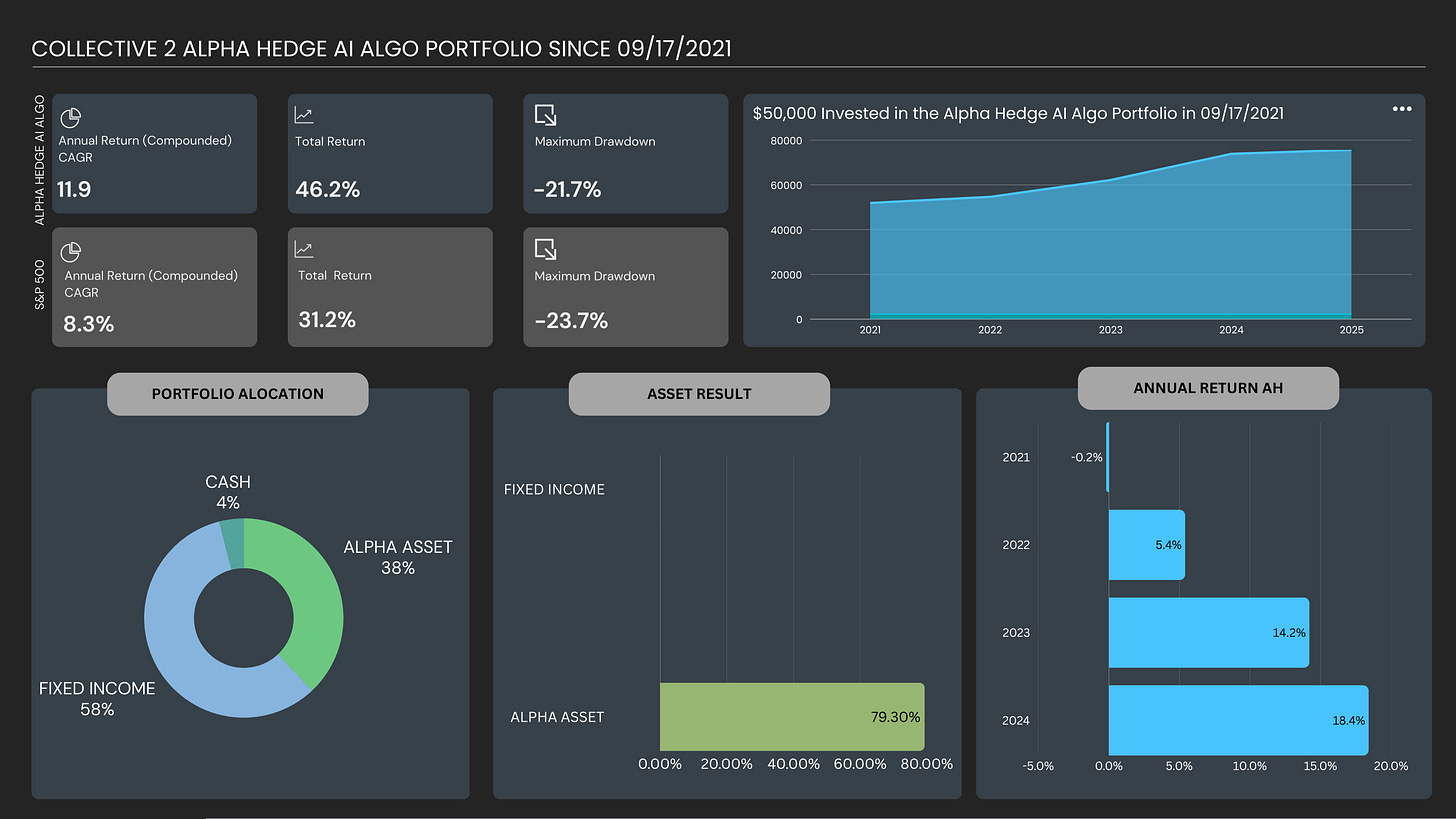

Alpha Hedge Portfolio Result January/2025

09/17/2021 to 01/31/2025

Alpha Hedge Portfolio Result January/2025: +2.5%

Alpha Hedge Portfolio Result 2025: +2.5%

Since we publicly shared the evolution of our portfolio, the Alpha Hedge Portfolio has grown significantly, with its value reaching $73,103 from the original investment of $50,000, a 46.2% gain since September, 17, 2021 (date we public shared publicly the evolution of our portfolio and considering typical broker commission and platform subscription).

The S&P 500 had a gain of 31.2% in the same period.

After analyzing the performance of the Alpha Hedge Portfolio, here are the key takeaways:

Annual Return (Compounded): The Alpha Hedge Portfolio has achieved 11.9% compounded annual return since its inception on September 17, 2021.

Win Trades and Win Months: The portfolio has a win rate of 53.6% in trades and 54.8% in profitable months.

Profit Factor: The portfolio boasts a profit factor of 4.5 : 1, which means the gains are 4.5 times the losses.

Correlation with S&P 500: With a correlation of 0.201 to the S&P 500, the portfolio exhibits low correlation, indicating its potential as a diversification tool within a broader investment strategy.

Sharpe and Sortino Ratios: The Sharpe Ratio of 0.66 and Sortino Ratio of 0.92 reflect the portfolio's risk-adjusted returns.

Beta and Alpha: The portfolio's beta of 0.15 suggests low market sensitivity, while an alpha of 0.02 indicates its ability to generate excess returns above the market benchmark.

Max Drawdown: The portfolio experienced a maximum drawdown of 21.7%.

Understanding the Collective2 Portfolio

The Collective2 Portfolio was established on September 17, 2021, with an initial investment of $50,000 to ensure confidence in the presented results. This Platform allows our Premium Subscribers to access the Alpha Hedge Portfolio in real-time and join us on our journey to increase our portfolio tenfold within a decade.

⚠️*We execute the Alpha Hedge Strategy in a Real-Life Brokerage Account with Interactive Brokers integrated with the Platform Collective2, a U.S. regulated company based in New York.

This way, to ensure confidence in the presented results, we enable Premium Subscribers access to our positions in real time.

Alpha Hedge Portfolio Historical Data

2013 to 01/31/2025

Unlock the Alpha Hedge AI Algo Portfolio ↓