September/24 Alpha Hedge AI Algo Portfolio Rebalancing

Monthly Portfolio Allocation Overview

Wall Street Insider Report

AI-Powered Insider-Level Insights to Exponentially Expand Wealth by Decoding Wall Street.

Join our global community of investors who are leveraging cutting-edge technology to build and preserve wealth for future generations.

September/24 Alpha Hedge AI Algo Portfolio Rebalancing

Monthly Portfolio Allocation Overview

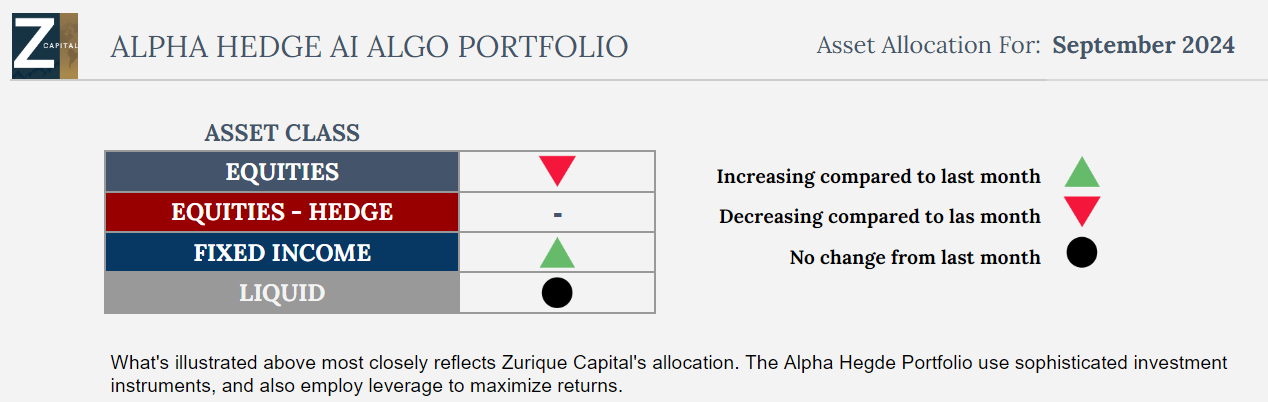

As we move into a new month, it's crucial to review and adjust our asset allocations based on evolving market trends. This month, slight changes are being made across equities and fixed income asset classes to optimize performance and manage risk.

Let's dive into the specific adjustments and the rationale behind each decision.

U.S. Equities: A Shift

We reduced our exposure to U.S. equities through our risk management process at the beginning of August.

The positive trends following the decline early in August signal that this asset class is still a powerhouse in our portfolio. By maintaining a MODERATE position, we're capitalizing on its sustained strength while making room for other emerging opportunities and controlling risks.

Interestingly, the reduction in U.S. equity exposure is being reallocated to fixed income, which has been gradually gaining traction. This shift reflects our commitment to keeping the portfolio balanced and dynamic.

U.S. Fixed Income

In fixed income, we're seeing gradual improvement in trends, leading to an increase in exposure. While we're cautiously optimistic about this trend continuing, even with the next expected rate reductions in the coming months.

In August, the S&P 500 kept Its Phase 4 of the Market Cycle.

The positions in the Alpha Hedge Portfolio for the Equities market was reduced in August and will be maintained in September.

The Alpha Hedge Portfolio will remain in RISK-ON MODE.

Alpha Hedge Portfolio Result August/2024

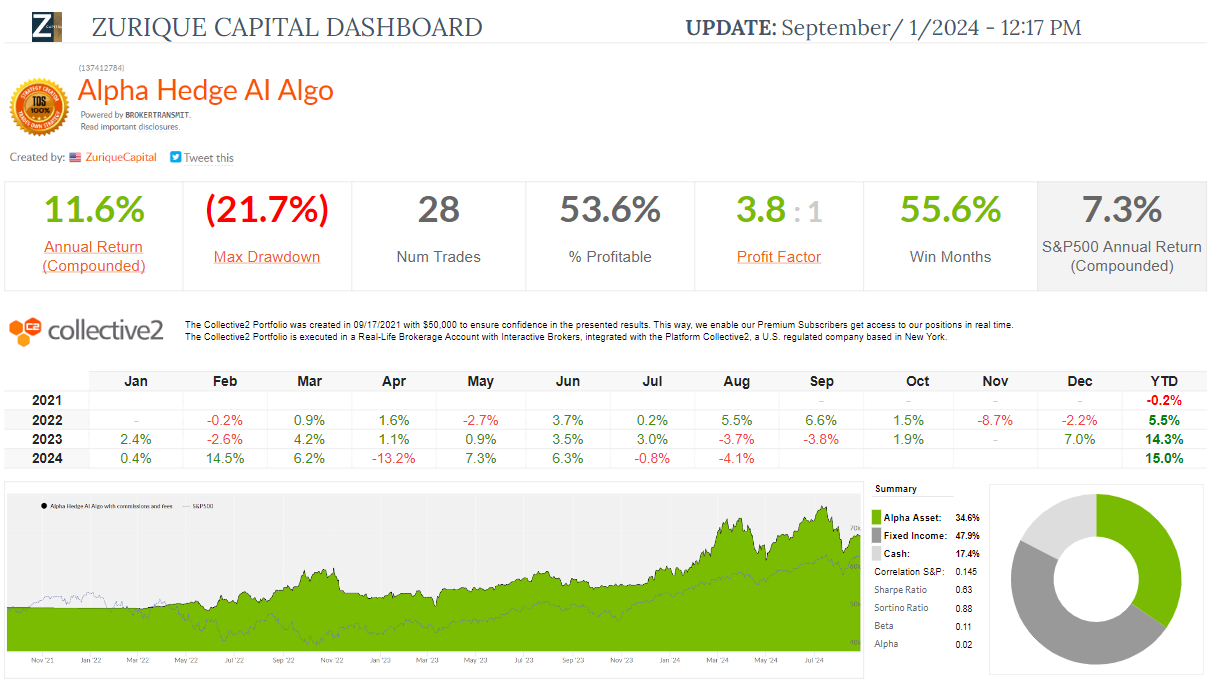

09/17/2021 to 09/01/2024

Alpha Hedge Portfolio Result August/2024: -4.1%

Alpha Hedge Portfolio Result 2024: +15%

Since we publicly shared the evolution of our portfolio, the Alpha Hedge Portfolio has grown significantly, with its value reaching $69,104 from the original investment of $50,000, a 38.2% gain since September, 17, 2021, date we public shared publicly the evolution of our portfolio.

The S&P 500 had a gain of 26.4% in the same period.

After analyzing the performance of the Alpha Hedge Portfolio, here are the key takeaways:

Annual Return (Compounded): The Alpha Hedge Portfolio has achieved 11.4% compounded annual return since its inception on September 17, 2021.

Win Trades and Win Months: The portfolio has a win rate of 53.6% in trades and 55.6% in profitable months.

Profit Factor: The portfolio boasts a profit factor of 3.8:1, which means the gains are 3.8 times the losses.

Correlation with S&P 500: With a correlation of 0.145 to the S&P 500, the portfolio exhibits low correlation, indicating its potential as a diversification tool within a broader investment strategy.

Sharpe and Sortino Ratios: The Sharpe Ratio of 0.63 and Sortino Ratio of 0.88 reflect the portfolio's risk-adjusted returns.

Beta and Alpha: The portfolio's beta of 0.11 suggests low market sensitivity, while an alpha of 0.02 indicates its ability to generate excess returns above the market benchmark.

Max Drawdown: The portfolio experienced a maximum drawdown of 21.7%.

Understanding the Collective2 Portfolio

The Collective2 Portfolio was established on September 17, 2021, with an initial investment of $50,000 to ensure confidence in the presented results. This Platform allows our Premium Subscribers to access the Alpha Hedge Portfolio in real-time and join us on our journey to increase our portfolio tenfold within a decade.

⚠️*We execute the Alpha Hedge Strategy in a Real-Life Brokerage Account with Interactive Brokers integrated with the Platform Collective2, a U.S. regulated company based in New York.

This way, to ensure confidence in the presented results, we enable Premium Subscribers access to our positions in real time.

Alpha Hedge Portfolio Historical Data

2013 to 09/17/2021

In 2021, the Alpha Hedge Portfolio increased 10x, yielding a 967% return on the initial investment. This was achieved without any new contributions or withdrawals, with profits reinvested and dividends excluded throughout the period.

Unlock the Alpha Hedge AI Algo Portfolio ↓