March/25 Alpha Hedge AI Algo Portfolio Rebalancing

Monthly Portfolio Allocation Overview

March/25 Alpha Hedge AI Algo Portfolio Rebalancing

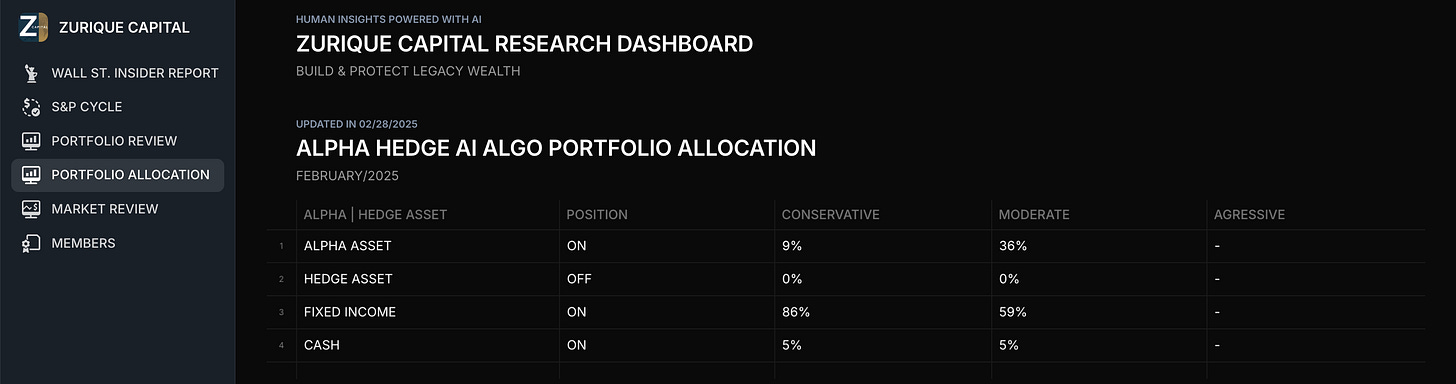

The Alpha Hedge Portfolio will remain in RISK-ON MODE. The allocation adjustments solely reflect the market movements observed in February.

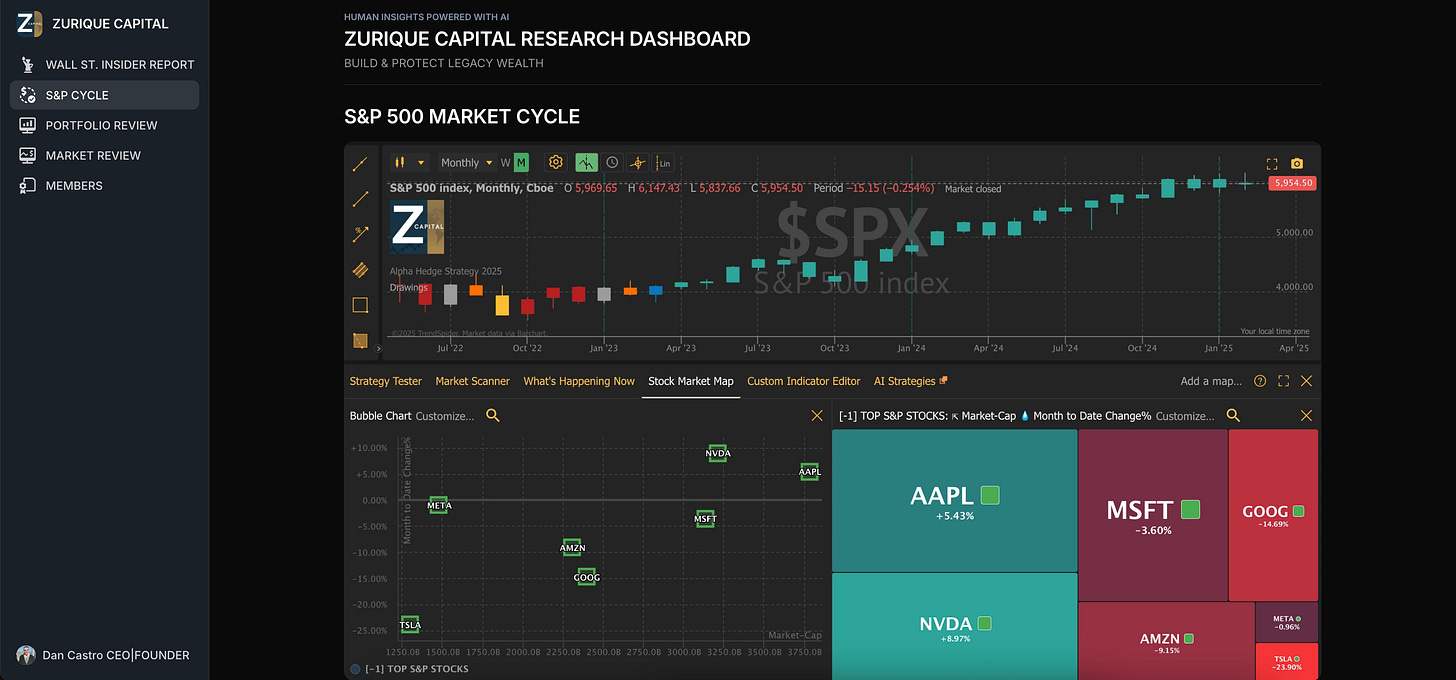

The S&P 500 remains in Phase 4 of the Cycle, so the portfolio allocation will be maintained with only minor adjustments. These adjustments are strategically calculated based on the February performance of key assets.

Our current position is MODERATE. For investors starting the Alpha Hedge AI Algo Portfolio this month, the CONSERVATIVE mode is recommended, or even maintaining a full cash position may be considered. Aggressive positions are not recommended due to indicators suggesting the end of the S&P 500's current market cycle.

Alpha Hedge Portfolio Result February/2025

Portfolio Result February/2025: -1.7%

Alpha Hedge Portfolio Result 2025: 0.8%

Since we publicly shared the evolution of our portfolio, the Alpha Hedge Portfolio has achieved $71,738 from the original investment of $50,000, a 43.4% gain since September, 17, 2021 (date we public shared publicly the evolution of our portfolio and considering typical broker commission and platform subscription).

The S&P 500 had a gain of 34.3% in the same period.

After analyzing the performance of the Alpha Hedge Portfolio, here are the key takeaways:

Annual Return (Compounded): The Alpha Hedge Portfolio has achieved 11.0% compounded annual return since its inception on September 17, 2021.

Win Trades and Win Months: The portfolio has a win rate of 53.6% in trades and 53.5% in profitable months.

Profit Factor: The portfolio boasts a profit factor of 4.3 : 1, which means the gains are 4.3 times the losses.

Correlation with S&P 500: With a correlation of 0.207 to the S&P 500, the portfolio exhibits low correlation, indicating its potential as a diversification tool within a broader investment strategy.

Sharpe and Sortino Ratios: The Sharpe Ratio of 0.61 and Sortino Ratio of 0.85 reflect the portfolio's risk-adjusted returns.

Beta and Alpha: The portfolio's beta of 0.16 suggests low market sensitivity, while an alpha of 0.02 indicates its ability to generate excess returns above the market benchmark.

Max Drawdown: The portfolio experienced a maximum drawdown of 21.7%.

Understanding the Collective2 Portfolio

The Collective2 Portfolio was established on September 17, 2021, with an initial investment of $50,000 to ensure confidence in the presented results. This Platform allows our Premium Subscribers to access the Alpha Hedge Portfolio in real-time and join us on our journey to increase our portfolio tenfold within a decade.

⚠️*We execute the Alpha Hedge Strategy in a Real-Life Brokerage Account with Interactive Brokers integrated with the Platform Collective2, a U.S. regulated company based in New York.

This way, to ensure confidence in the presented results, we enable Premium Subscribers access to our positions in real time.

Alpha Hedge Portfolio Historical Data

01/01/2009 to 02/28/2025

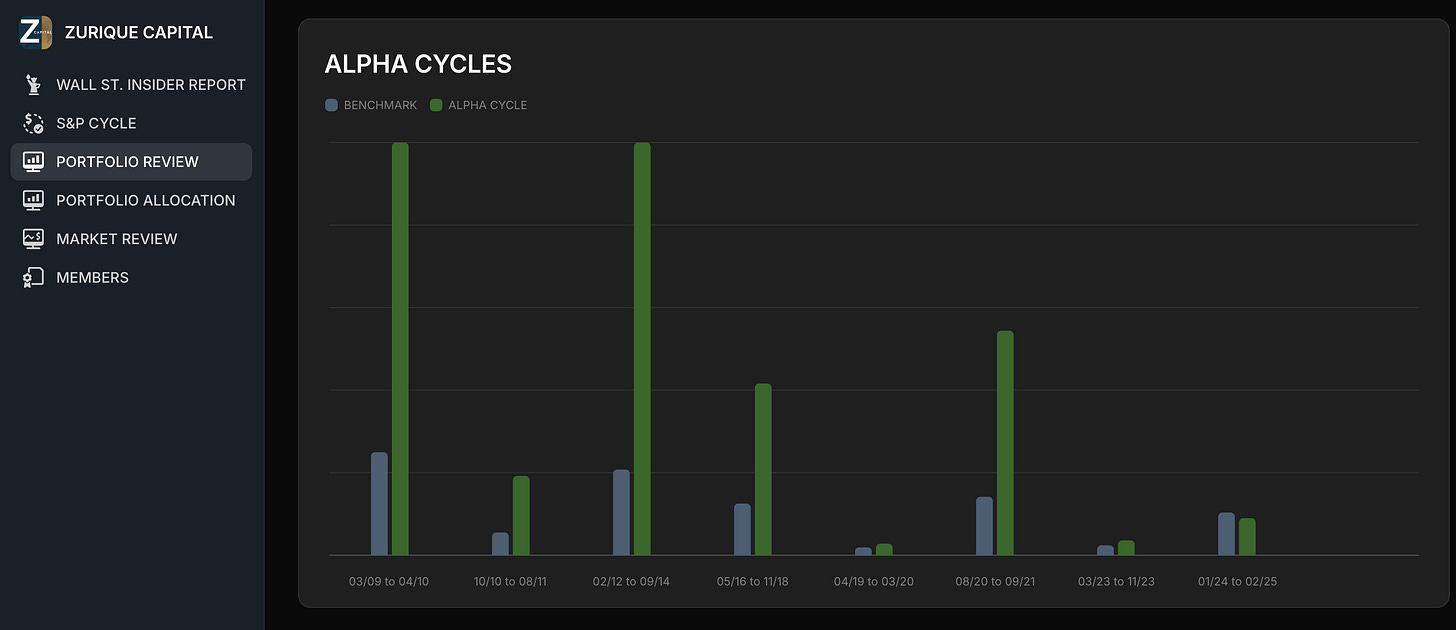

Since 2009, our strategy has navigated through 8 Alpha Cycles. These are periods when the S&P 500 is in an uptrend, and we allocate our portfolio to an Alpha Asset that drives performance.

Currently, we are in an Alpha Cycle, which began in January 2024 and is projected to continue in March 2025.

Historically, at the end of all previous Alpha Cycles, our portfolio outperformed the S&P.

We have also gone through 8 Protection Cycles, which occur when the S&P is in a downtrend. In these periods, we allocate to Hedge Assets that minimize risk and provide opportunities for profit.

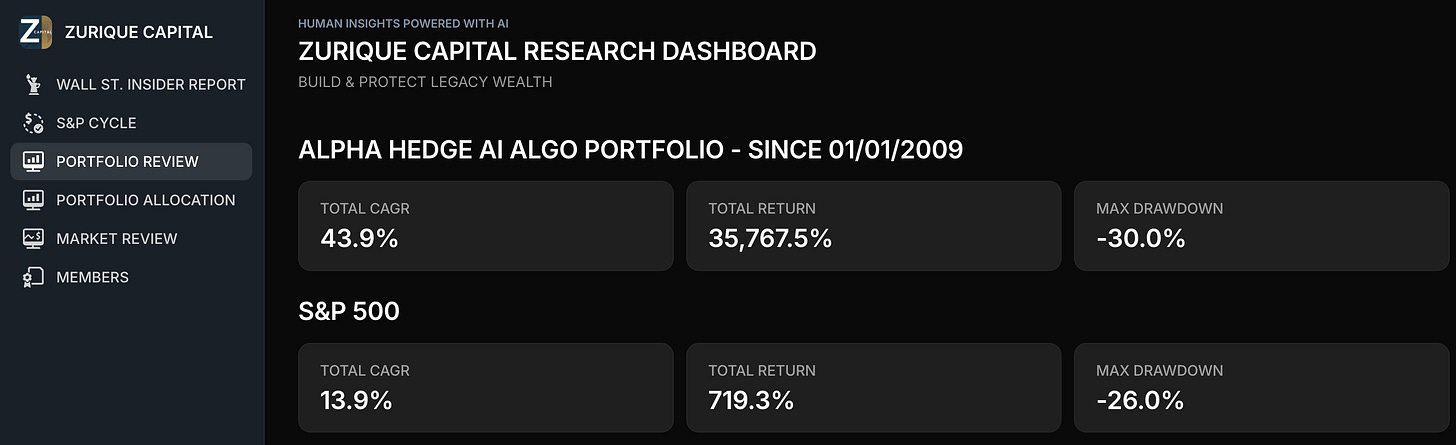

Since 2009, our compounded annual return stands at 43.9% per year, outperforming the S&P’s 13.9%. We had maximum drawdown of -30%, compared to -26% for the S&P.

To put these numbers into perspective, let’s consider a $50,000 investment made in January 2009. By reinvesting all profits and dividends—without withdrawals—the results are striking:

Using the Zurique Capital strategy: The investment would have grown to $15.8 million.

Investing in the S&P 500: The same investment would be worth $329,554.40.

Unlock the Alpha Hedge AI Algo Portfolio ↓