The Alfa Hedge Strategy

How to Build a Dynamic Portfolio in Wall Street

Clique aqui para ler em português:

https://www.wallstreetinsiderreport.com/p/estrategia-alfa-wall-street

Seven17am #keypoints

Daily Educational [Free]

The Alfa Hedge Strategy

Establish the universe of assets of the Alfa Hedge Portfolio

Surf the Cycles

ALFA HEDGE PORTFOLIO II

ALFA HEDGE PORTFOLIO I

Actionable Analysis [Premium]: Market Cycle Update

Building Wealth [Premium]: Real-Life Brokerage Account Long-Term Portfolio Positions

The Alfa Hedge Strategy

The Alfa Hedge Strategy is a Global Strategy for Implementing Portfolios with High Performance Long-Term Portfolios, which Outperform the Market, with the controlled Risk.

This is a Global Strategy for 3 reasons:

It can be applied in any country, it has been used in the Stock Exchanges of England, Germany, Brazil and the United States. Today we focus on the US Market;

It's also global because it can be applied to any asset class traded on the Stock Exchange, we focus only and exclusively on ETFs - Exchange Traded-Funds;

And it is still global because it can be applied in any market scenario, whether it's rising, falling, and even in black swans, like the Coronavirus crisis in 2020, the Subprime in 2008, and the Dotcom in 2000.

WITHOUT NEEDING TO SPEND HOURS analyzing the assets, our planning process is monthly.

The selection of ETFs and portfolio assembly is DATA-BASED and not based on assumptions, knowing objectively when to buy or sell an asset.

WITHOUT WASTING TIME watching news or studying Companies details.

For the last 10 years, our clients have outperformed the American market through our Proprietary Investment Strategy.

Now you will have access to the fundamentals of the Alfa Hedge Portfolio.

Establish the universe of assets of the Alfa Hedge Portfolio

Dynamic capital diversification allows the Investor to take advantage of Positive Market Cycles with Controlled Risk.

This form of diversification allows for greater predictability of results and consistent returns over the years, with reduced risks.

Traditional portfolios offer constant allocation to a universe of Assets.

However, the returns from these investments can be variable under different market conditions. The winners "carry" the losers.

Dynamic diversification allows for more stable returns, as the allocation of Assets is determined by the market cycle and its historical volatility.

The Alfa Hedge Rating

The Alfa Hedge Rating was developed by Zurique Capital, to identify the Markets (through ETFs) combining:

highest historical positive volatility (highest probability of Long-Term uptrends), with this data we analyze the past.

highest expectancy ratio, with this data we analyze what to expect in the future based on statistics (not astrology or opinions).

Market Cycle Phase, with this data we analyze the present situation of the Market.

For each market, we have an Alfa ETF, they are the Benchmarks of each Market for our Portfolio, not necessarily this are the most negotiated ETFs, but the ones with greatest Alfa Hedge Rating.

We share this analysis Weekly, but our Portfolio Rebalance is Monthly.

This analysis are not investment recommendations and investors must do their own research (please read the Disclaimer section).

We invest our own money and share our Portfolio with Premium Subscribers.

Premium Subscribers have full access to our Alfa Hedge Portfolio II in a Real-Life Brokerage Account in Real Time.

Know More About Premium Subscription

Surf the Cycles

"Put all your eggs in one basket, and watch that basket."

MAX GUNTHER

You don't go to the beach when it's cold and raining, do you? By following theAlfa Hedge Portfolio, you will end up knowing when it is riskier and it is essential to keep a close eye on all the Assets you already own.

An important point in managing the Alfa Hedge Portfolio is to find the sweet spot of diversification. Within our algorithm, we currently filter the Assets within a set of markets.

But the main difference of the Alfa Hedge Portfolio from the assembly of traditional Portfolios is that in it, you don't need to be with all Asset classes at the same time in the Portfolio. You eliminate the "losers" and keep the "winners".

The key is to react of what is happening on the Market Cycle, not try to predict.

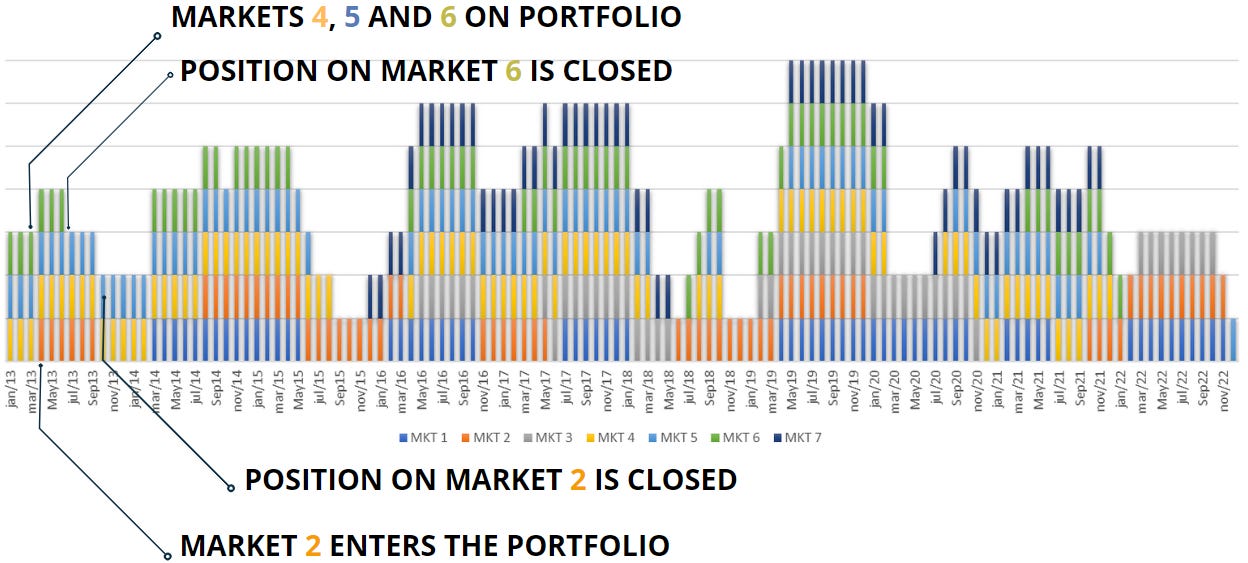

Look at the chart below. It shows the period in which each of the markets was in a Positive Market Cycle and present in the Alpha Wall Street Portfolio from 2013 to 2022.

Observe the example from January to November 2013.

1. In January 2013, Markets 4, 5, and 6 were in our Portfolio.

2. In April '13, Market 2 entered a Positive Cycle and consequently entered the Portfolio.

3. In July '13, Market 6 entered a Negative Cycle, and consequently, we closed the position.

4. In October '13, it was Market 2's turn to close the position, leaving only Markets 4 and 5 in the Portfolio.

ALFA HEDGE PORTFOLIO II

ALFA HEDGE PORTFOLIO I

But, accordingly with the Market Cycle, what assets do we have on Alfa Hedge Portfólio II right now?

Access now the evolution of the Alfa Hedge Portfolio II clicking on the button bellow

If the button doesn’t work, please click on this link: https://www.wallstreetinsiderreport.com/p/dailyupdate