📊Trend-Following Strategies vs Buy & Hold Equities

Explore the dynamic of trend-following strategies and how they stack up against Buy and Hold. Dive into investment strategies with a case study on S&P500 in the 21st century.

#keypoints

Daily Educational Content [Free]:

Trend-Following Strategies vs Buy & Hold Equities

Trend-Following Strategies in Comparison to Buy & Hold Equities: An Overview

Trend-Following vs Buy & Hold Equities: A Head-to-Head Comparison

Case Study [Free]:

S&P500 Index in the 21st Century

Bottom Line

Trend-Following Strategies vs Buy & Hold Equities

In the grand arena of investment, two gladiators often find themselves in the spotlight: Trend-Following strategies and Buy & Hold equities.

But how do they compare? Let's dive into the nitty-gritty and unravel the mystique surrounding these two investment strategies and answer, with a case study on S&P500, why Trend-Following is the best strategy.

Trend-Following Strategies in Comparison to Buy & Hold Equities: An Overview

Trend-following strategies are systematic approaches to investing that capitalize on market momentum.

They're like surfers riding the waves of the market, leveraging the power of trends to generate profits.

On the other hand, buy & hold equities, represent ownership in a company and are a cornerstone of many investment portfolios.

The Allure of Trend-Following

Trend-Following strategies have a certain allure.

They're based on the idea that markets exhibit trends over time due to gradual economic evolution, differing speeds of market participants' reactions to news, and behavioral biases of investors.

These strategies are often systematic, using computer algorithms to execute trades, making them a favorite among tech-savvy investors.

The Power of Momentum

One of the key components of trend-following strategies is the concept of momentum.

This strategy banks on the idea that assets that have been performing well will continue to do so, while those that have been performing poorly will continue on a downward trajectory.

It's a bit like Newton's first law applied to the financial markets: an asset in motion tends to stay in motion.

The Art of Trend Identification

Identifying trends is both an art and a science.

Some trend-followers use price changes over a certain period to define a trend, while others compare moving averages of differing durations.

Yet others look for markets 'breaking out', making new highs or lows. Regardless of the method, the goal remains the same: to ride the wave of a trend for as long as it lasts.

Know more about our strategy in this article.

Buy & Hold Equities

Buy & Hold Equities, on the other hand, are a more traditional form of investment.

When you buy a stock, you're buying a piece of a company, becoming a part-owner.

This comes with the potential for significant profits if the company does well, but also the risk of losses if the company struggles.

The Long Game

Equities are often seen as a long-term investment.

While they can be volatile in the short term, over the long haul, they have historically provided solid returns.

This makes them a popular choice for retirement savings and other long-term financial goals.

The Role of Fundamental Analysis

Unlike trend-following strategies, which are primarily based on price movements, investing in equities often involves a deep dive into a company's fundamentals.

This can include everything from the company's earnings reports to its competitive position in the industry.

It's a more hands-on approach that requires a good understanding of business and finance.

Trend-Following vs Buy & Hold Equities: A Head-to-Head Comparison

Now that we've covered the basics, let's pit these two strategies against each other in a head-to-head comparison.

Risk and Return

Both Trend-Following strategies and Buy & Hold Equities come with their own set of risks and potential returns.

Trend-Following strategies can provide substantial profits during trending markets but can also lead to small losses during non-trending or volatile markets.

Buy & Hold Equities, meanwhile, offer the potential for high returns but come with the risk of company-specific and market-wide downturns.

The Impact of Market Shocks

One area where Trend-Following strategies often shine is in their reaction to market shocks.

Because these strategies are based on current market trends, they can quickly adapt to changing market conditions.

Buy & Hold Equities, on the other hand, can be significantly impacted by market shocks, with downturns potentially leading to substantial losses.

The Opportunity Cost of Buy & Hold in Bear Markets

In a bear market, where prices are falling, the Buy & Hold strategy often used in equity investing can lead to significant opportunity costs.

This is because while investors are holding onto their stocks, waiting for prices to rise again, they could be missing out on other profitable investment opportunities.

In contrast, Trend-Following strategies can thrive in bear markets. These strategies can pivot to short-selling or move into different asset classes, thereby potentially generating profits even when the overall market is on a downturn.

This flexibility reduces the opportunity cost associated with sticking to a Buy & Hold strategy in a Bear Market.

Risk Management

One of the key advantages of Trend-Following strategies over Buy & Hold Equities is their flexibility.

Trend-following strategies can adapt to changing market conditions, whether bullish or bearish. This adaptability allows trend-followers to potentially profit from any market situation, unlike Buy & Hold Equities investors who primarily benefit from bullish markets.

Moreover, Trend-Following strategies inherently incorporate risk management.

These strategies typically involve cutting losses quickly when a trend reverses, thereby limiting potential downside. This contrasts with the Buy & Hold Equities, where investors may need to endure significant drawdowns during market downturns.

Improving Skewness with Trend-Following

Another advantage of Trend-Following strategies over Buy & Hold Equities is their ability to improve skewness.

Skewness refers to the asymmetry of a distribution around its mean. Positive skewness indicates that the tail on the right side of the distribution is longer or fatter than the left side, suggesting that the asset may experience larger gains than losses. a desirable characteristic for Investors.

📈Case Study: S&P500 Index in the 21st Century

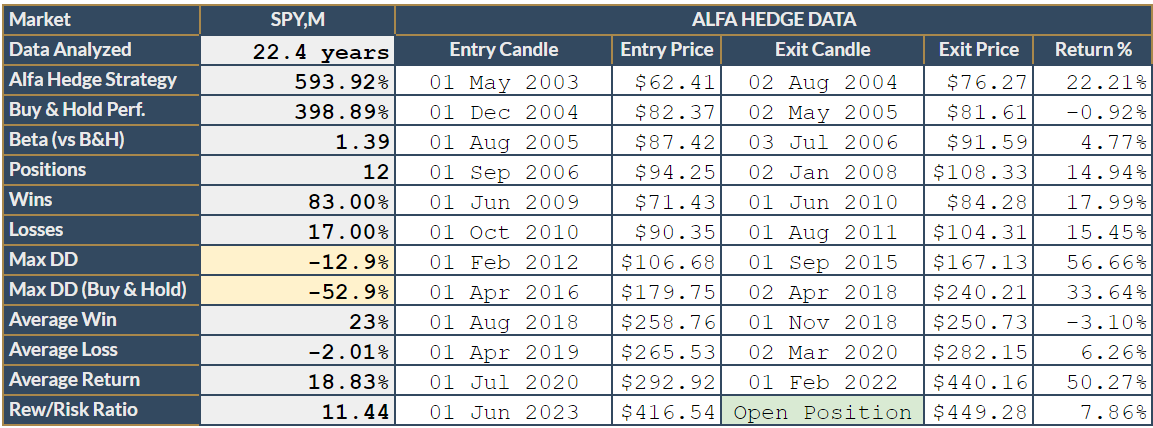

This data compares Trend-Following Alfa Hedge Strategy vs Buy & Hold SPY ETF from 01/01/2012 to 07/14/2023. Considering reinvestment of profits and dividends, and no new contributions during the period.

The main points of this Data are the result of the Alfa Hedge Strategy on this asset 1.39 times the Buy & Hold performance (593% and 398% respectively).

Also important point is the Max Drawdown data, only -13% for the Alfa Hedge Strategy and 53% to Buy & Hold. It takes a 14.9% to recover from a 13% Drawdown, while to recover from a 53% Drawdown is necessary 112.7%.

Also a valid information is the opportunity cost of holding the asset while some others markets are delivering good uptrends.

In what time of the Market Cycle are we now?

It depends on what market. Bonds? Stocks?

Every business day we update the evolution of the Alfa Hedge Portfolio II.

Premium Subscribers have full access to our Alfa Hedge Portfolio II in a Real-Life Brokerage Account in Real Time.

Bottom Line

In conclusion, Trend-Following has statistical advantage over Buy & Hold Equities.

It’s flexibility, inherent risk management, and ability to improve skewness make them a powerful tool for navigating volatile market conditions.

If you liked this content, you will love our Report.👇

Wall Street Insider Report

Demystify the MARKET CYCLES investing SMARTER in Wall Street

Theory + Action: Learn & Replicate a High Performance + Low Maintenance + Long-Term Portfolio

Join +13k Global Investors and Really Master the Market Cycle Investing