AI-Powered Market Analysis and Anticipation [Lesson 3/7]

Free 7 Lesson Course: How to Build Legacy Wealth with AI

Meet Your Instructor

Dan Castro

Investment Management Specialist (University of Geneva/Switzerland), graduated in Electronic Engineering.

Founder and CEO of Zurique Capital Research, an American company specialized in Data Analysis, Investment Portfolio construction, Investors Training and Consulting.

Guide of over 1.8K Investors in 55 Countries.

How to Build Legacy Wealth with AI [Lesson 3/7]

AI-Powered Market Analysis and Anticipation

1. Leveraging AI for Market Cycle Analysis

1.1. The Emotional Pitfalls of Traditional Investing

Investing can become highly emotional, often driven by gut feelings and personal biases.

Many investors find themselves emotionally attached to the companies they invest in, particularly those that are popular or personally significant. For instance, companies like Tesla and Apple often dominate the trading plays of younger, tech-savvy investors on platforms like Reddit.

While there's nothing inherently wrong with supporting companies you believe in, successful investing —especially Market Cycle investing—requires a different mindset. It demands emotional detachment and a focus on data-driven decision-making.

1.2. The Venture Capitalist Approach

Consider the approach of a venture capitalist (VC). VCs invest in a broad portfolio of companies riding active trends. They might admire the founders and their visions, but ultimately, each investment is just a position in their portfolio. Most will fail, and that's acceptable because the few successes will significantly outweigh the losses.

In investing, it's easy to become attached to what you're investing in. But to invest successfully, we must shift our focus to:

Which market are we investing in?

What is the current market cycle?

How profitable were the last cycles?

Is this the best reward-to-risk point to enter a position?

Is the gain expectancy positive?

What is the exit strategy for this position?

Market Cycle investing is about jumping on and off positions based on market situation, not stories.

Some positions will lose, and that's okay. The key is that the winners will heavily subsidize the losers.

1.3. Case Study: AI Alpha Hedge Algorithm Applied

This graph summarizes the performance potential of a systematic AI-driven Alpha Hedge Algorithm applied. Let’s break down the data.

Over 15.6 years, the overall growth was 9,192.2%, translating to a compound annual growth rate (CAGR) of 33.71%. With this compounded annual return, investors could double their capital every 2.1 years (assuming aggressive risk tolerance, no new contributions, no withdrawals, and reinvestment of profits, excluding dividends).

The portfolio was adjusted 8 times, achieving a 100% success rate. The maximum overall drawdown was 30%, and the average holding period was 17.6 months. Despite some significant value drops, the portfolio demonstrated impressive long-term growth.

Now, let’s compare this with the S&P 500 over the same period:

Buying and Holding the S&P 500 index in the same 15.6 years has grown 482.5% in the same period. , this is a CAGR of 11.96%. With this compounded annual return, investors double their capital every 6 years (assuming aggressive risk tolerance, no new contributions, no withdrawals, and reinvestment of profits, excluding dividends). The maximum overall drawdown was 25.1%.

2. The Secret to Wealth Generation Through AI Market Cycles Analysis

Imagine standing at the edge of a vast financial landscape, filled with opportunities yet obscured by fog.

The market's volatile nature creates uncertainty, posing a significant challenge to investors.

You have the ambition to grow your wealth, but the journey is fraught with external market unpredictability, internal anxiety about making wrong choices, and a philosophical conflict between taking risks and securing your future.

2.1. Clearing the Fog with AI

What if the fog could clear? What if there was a way to navigate the market's volatility with confidence?

That's where AI and our Alpha Hedge Algorithm for Market Cycle analysis approach come into play. With 11 years of experience and a proven track record, I'm here to guide you through this journey.

Our approach demystifies Market Cycles, showing that it's not just economics but emotions driving the market.

Understanding this is your first step towards clarity.

2.2. The Psychology of Market Cycles

Investing is more than just numbers; it's about understanding the emotional rollercoaster investors ride through different phases of a market cycle.

Let's delve into the psychology that drives these cycles and how AI can provide you with a significant edge.

2.2.1. Phase 1: Hope

Characteristics: Marked by fundamentally strong companies with attractive growth prospects and increasing institutional interest.

Investor Approach: Detect early price shifts, focus on strong stocks, and await confirmation of an uptrend.

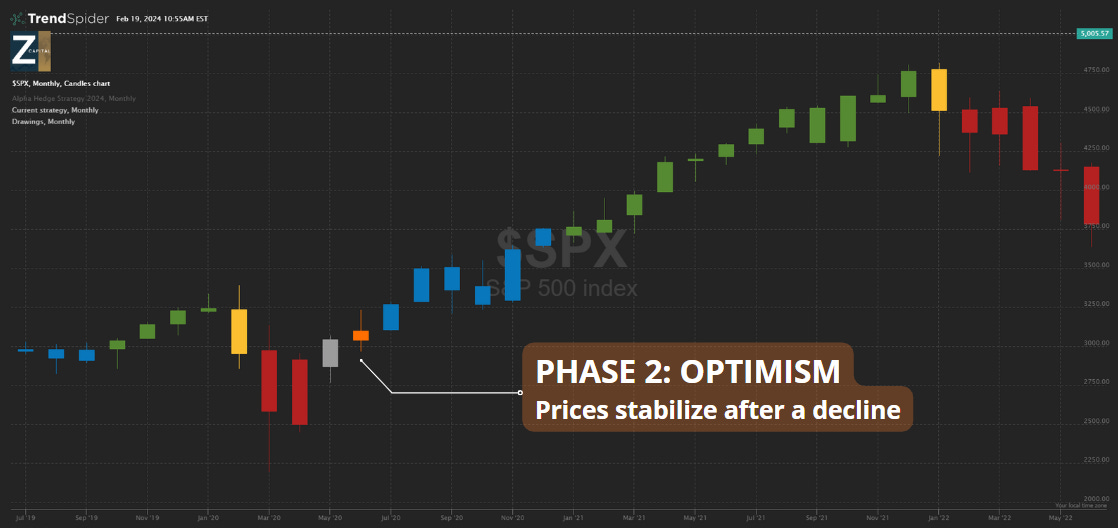

2.2.2. Phase 2: Optimism

Characteristics: Prices stabilize after a significant decline, indicating a potential bottoming process.

Investor Approach: Observe the market for signs. If the month closes in Phase 2, investors should buy at the opening of the following month

2.2.3. Phase 3: Belief

Characteristics: A strong uptrend with increasing buying pressure, representing the best reward-to-risk point for buying.

Investor Approach: Buy at this phase to maximize returns, marking the start of the positive cycle.

2.2.4. Phase 4: Euphoria

Characteristics: Extensive attention from media and influencers, with retail investors showing significant interest, driving rapid price appreciation.

Investor Approach: Maintain positions constructed in Phase 3 and resist the urge to sell too early.

2.2.5. Phase 5: Anxiety

Characteristics: The uptrend loses momentum, signaling the peak of market euphoria and potential unsustainability.

Investor Approach: Be cautious of market weakness and prepare for potential downturns.

2.2.6. Phase 6: Denial

Characteristics: The end of the positive cycle and the beginning of the negative cycle, with a significant reversal indicating a bearish environment.

Investor Approach: Focus on risk management, prioritize capital preservation, and consider hedging strategies.

3.3. Case Study: Bubble Proof Strategy

From November 2000 to November 2011, the market experienced the Dotcom and Subprime bubbles. During this period, the S&P index incurred a loss of 12%, meaning a negative return over 11 years. Traditional investment strategies would argue that such risk is inherent to the market.

While this may have been true for outdated portfolio construction methods, it no longer holds. The Alpha Hedge Algorithm anticipated this bubbles and applied over the same period achieved a 30.7% return with 7 portfolio adjustments (4 winning positions and 3 losing positions).

Some tools that are integral to our algorithm today did not exist back then. In the current market, the results would likely be at least twice as large.

Conclusion

Today, we've explored how AI can transform market analysis and anticipation, helping you navigate the emotional highs and lows of market cycles with confidence.

By understanding the psychology of market cycles and leveraging AI, you can make informed investment decisions that protect and grow your wealth.

In our next lesson, we'll delve deeper into building an AI-optimized investment portfolio. You'll learn how to use AI identify assets with potential exponential expansion and enhance your investment strategy.

Thank you for joining me today. Let's continue this journey together, transforming your approach to wealth management and building a lasting legacy. If you have any questions or comments, feel free to leave them below.