October/24 Alpha Hedge AI Algo Portfolio Rebalancing

Monthly Portfolio Allocation Overview

Wall Street Insider Report

AI-Powered Insider-Level Insights to Exponentially Expand Wealth by Decoding Wall Street.

Join our global community of investors who are leveraging cutting-edge technology to build and preserve wealth for future generations.

October/24 Alpha Hedge AI Algo Portfolio Rebalancing

Monthly Portfolio Allocation Overview

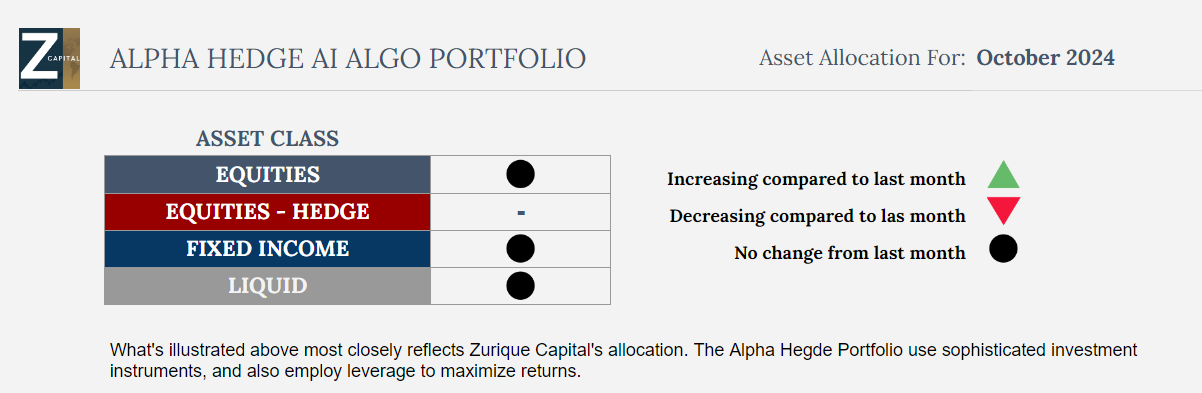

As we enter October, it is essential to review our asset allocations in light of evolving market conditions.

However, after a thorough analysis, no adjustments will be made to the portfolio this month. The current allocation continues to align with our performance and risk management objectives.

Let's explore the rationale behind maintaining the existing allocation and how it supports our long-term strategy.

U.S. Equities

We will maintain our exposure to U.S. equities in September.

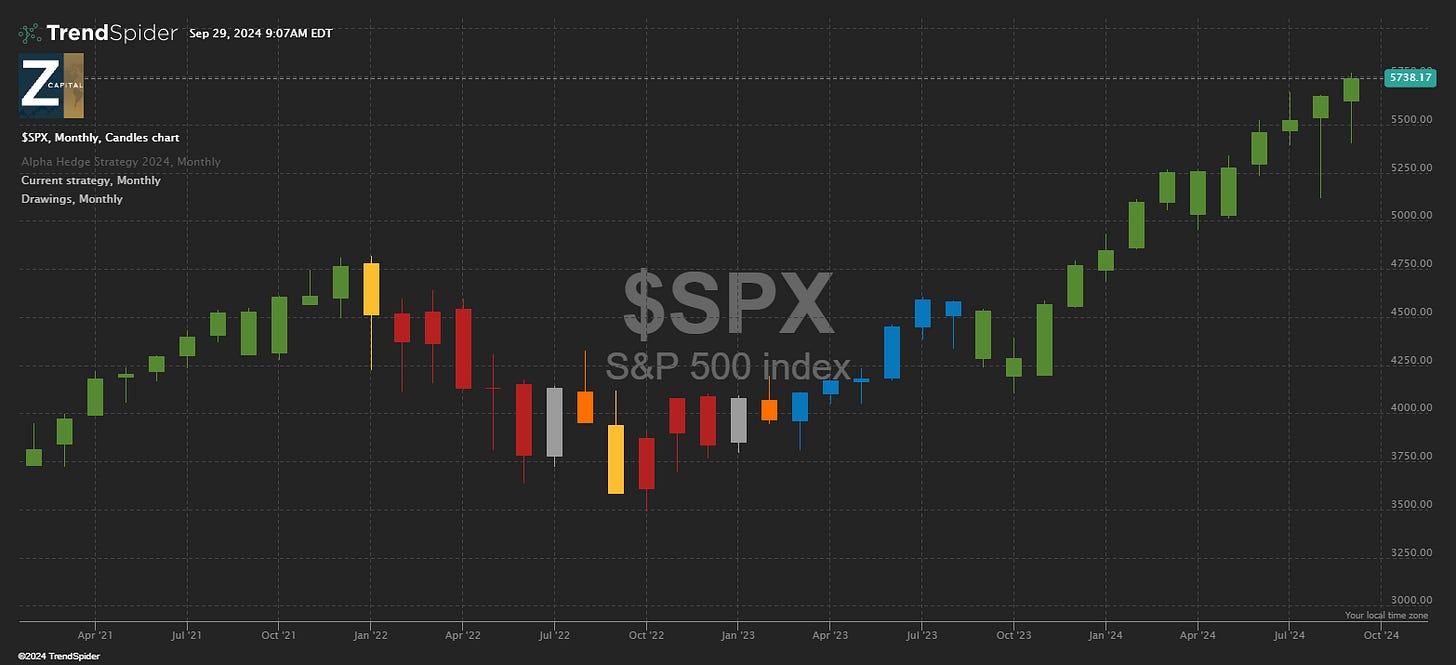

In September 2024, the S&P 500 experienced a positive performance, driven by investor anticipation of Federal Reserve interest rate decisions.

During the first half of the month, the S&P 500 saw a strong rebound, rising by about 4% during the second week of September, with the index hovering around 5,626.

This rise was partially attributed to expectations of a potential rate cut by the Federal Reserve, which fueled optimism among equity investors.

U.S. Fixed Income

In September 2024, the U.S. fixed income market saw significant fluctuations, primarily driven by evolving expectations around Federal Reserve policy. Treasury yields moved higher, with the 10-year Treasury yield reaching 3.65%, reflecting the market's anticipation of possible interest rate cuts later in the year.

This dynamic environment highlighted the importance of interest rate expectations in driving bond market movements, with investors recalibrating their strategies based on signals from both economic data and Fed communications.

In August, the S&P 500 kept Its Phase 4 of the Market Cycle.

The positions in the Alpha Hedge Portfolio for the Equities and Fixed Income will be maintained in October.

The Alpha Hedge Portfolio will remain in RISK-ON MODE.

Alpha Hedge Portfolio Result September/2024

09/17/2021 to 09/27/2024

Alpha Hedge Portfolio Result August/2024: +1.3%

Alpha Hedge Portfolio Result 2024: +16.4%

Since we publicly shared the evolution of our portfolio, the Alpha Hedge Portfolio has grown significantly, with its value reaching $70,056 from the original investment of $50,000, a 40.2% gain since September, 17, 2021 (date we public shared publicly the evolution of our portfolio). The S&P 500 had a gain of 25.2% in the same period.

After analyzing the performance of the Alpha Hedge Portfolio, here are the key takeaways:

Annual Return (Compounded): The Alpha Hedge Portfolio has achieved 11.7% compounded annual return since its inception on September 17, 2021.

Win Trades and Win Months: The portfolio has a win rate of 53.6% in trades and 55.6% in profitable months.

Profit Factor: The portfolio boasts a profit factor of 4.0:1, which means the gains are 4 times the losses.

Correlation with S&P 500: With a correlation of 0.157 to the S&P 500, the portfolio exhibits low correlation, indicating its potential as a diversification tool within a broader investment strategy.

Sharpe and Sortino Ratios: The Sharpe Ratio of 0.64 and Sortino Ratio of 0.90 reflect the portfolio's risk-adjusted returns.

Beta and Alpha: The portfolio's beta of 0.12 suggests low market sensitivity, while an alpha of 0.03 indicates its ability to generate excess returns above the market benchmark.

Max Drawdown: The portfolio experienced a maximum drawdown of 21.7%.

Understanding the Collective2 Portfolio

The Collective2 Portfolio was established on September 17, 2021, with an initial investment of $50,000 to ensure confidence in the presented results. This Platform allows our Premium Subscribers to access the Alpha Hedge Portfolio in real-time and join us on our journey to increase our portfolio tenfold within a decade.

⚠️*We execute the Alpha Hedge Strategy in a Real-Life Brokerage Account with Interactive Brokers integrated with the Platform Collective2, a U.S. regulated company based in New York.

This way, to ensure confidence in the presented results, we enable Premium Subscribers access to our positions in real time.

Alpha Hedge Portfolio Historical Data

2013 to 09/17/2021

In 2021, the Alpha Hedge Portfolio increased 10x, yielding a 967% return on the initial investment. This was achieved without any new contributions or withdrawals, with profits reinvested and dividends excluded throughout the period.

Unlock the Alpha Hedge AI Algo Portfolio ↓