May/25 Portfolio Rebalancing: Simplicity Beats Complexity

Monthly Portfolio Allocation Overview

Simple Investing Beats Complex Strategies When Chaos Hits

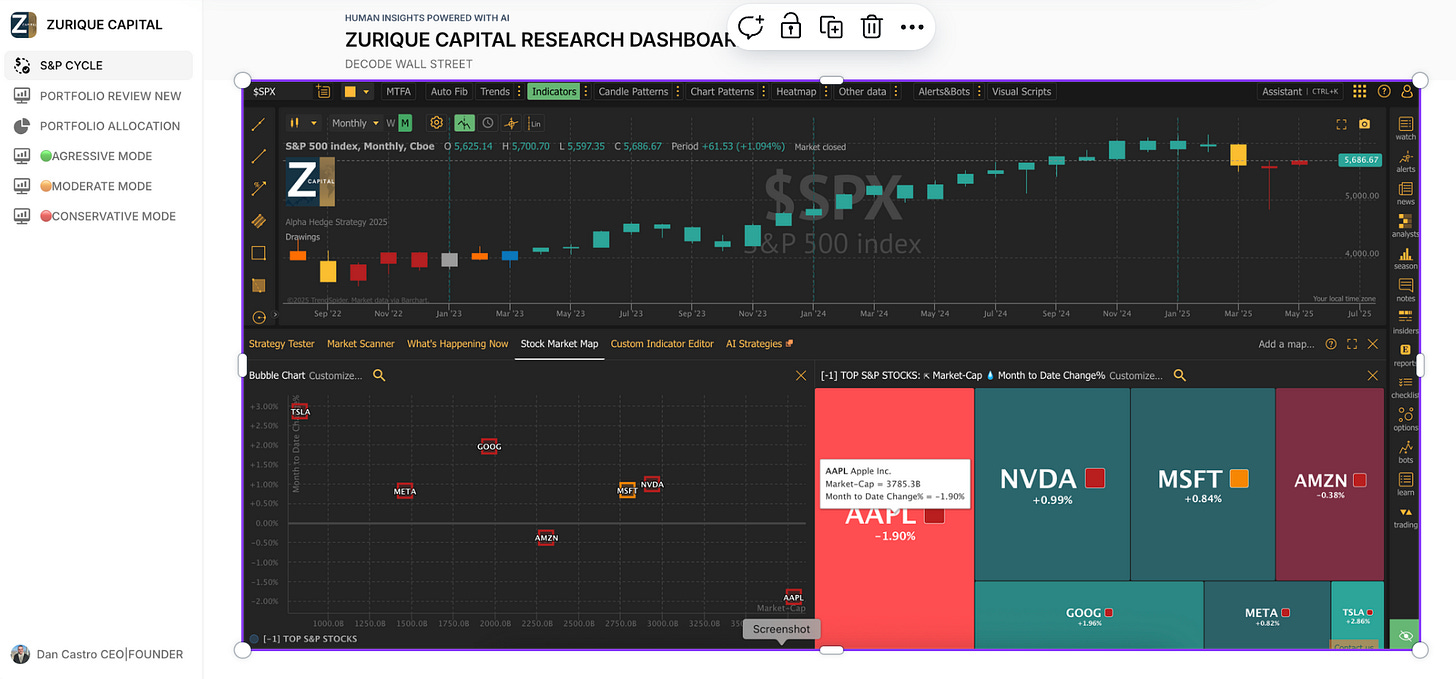

In investing, uncertainty is guaranteed, not a glitch. At Zurique Capital, we've learned complexity doesn't provide safety, it adds vulnerability. April's market swings vividly illustrated volatility clustering, proving once again that extreme market moves happen in waves.

Our Alpha Hedge AI Algo Portfolio isn't designed to dodge every bump but to adapt swiftly, simplifying strategies, prioritizing trends, and consistently minimizing risk exposure. Discipline, flexibility, and systematic simplicity turn volatility into opportunity.

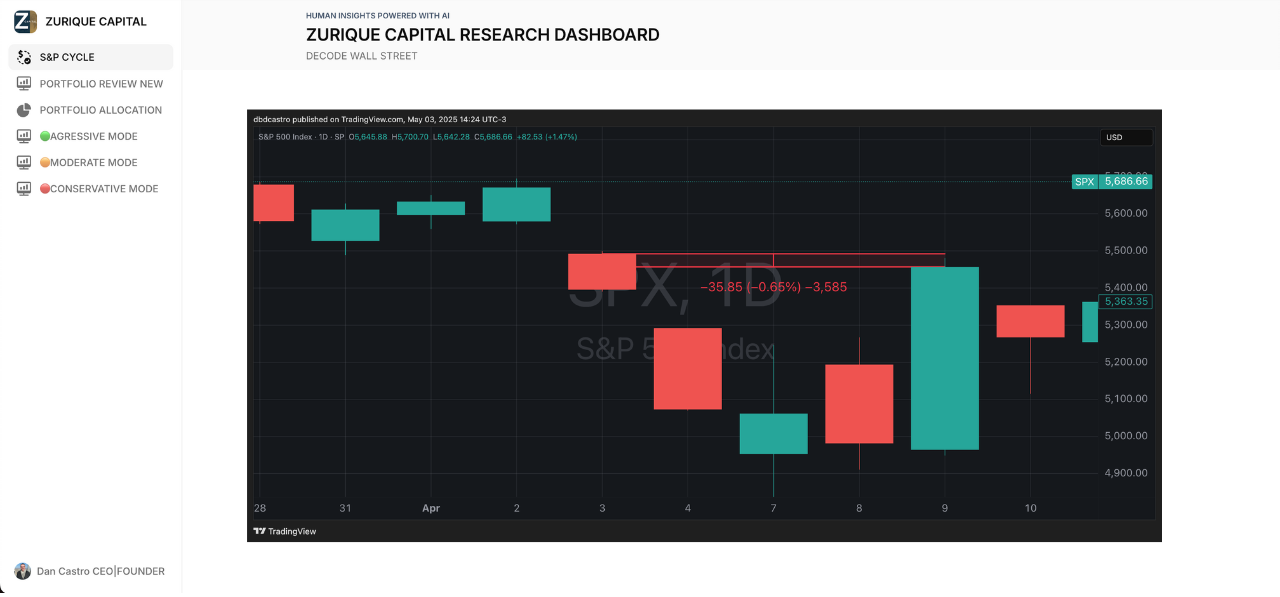

Stocks Crashed 20% In Days, The Fastest Fall Since COVID

April’s equity markets saw their fastest declines since the onset of COVID-19, briefly touching bear-market territory due to tariff uncertainties. Although U.S. stocks stabilized later, the damage triggered clear downtrends. Real estate also weakened significantly, losing its already fragile footing in 2025.

At Zurique Capital, our Alpha Hedge AI Algo Portfolio systematically responded by sharply reducing equity exposure, reallocating to hedged positions, and fixed-income assets. This tactical shift is evidence that disciplined, algorithm-driven strategies can swiftly minimize exposure and reposition for stability.

Our AI Caught 3 Economic Signals Hinting at Major Shifts

Zurique Capital’s AI algorithms detected three critical signals of a potential market shift:

GDP Pullback: U.S. GDP contracted 0.3% in Q1 2025, the largest decline since early 2022—driven by tariff-induced import spikes and slowing consumer activity.

Consumer Sentiment Crash: April’s University of Michigan poll showed sentiment dropping sharply to 52.2, historic lows for Democrats (34.4) contrasting sharply with bullish Republican sentiment (90.2).

Spending Decline: Consumer spending growth fell from 4% to just 1.8% within one quarter, as households notably cut back on discretionary travel and entertainment expenses.

Our Alpha Hedge AI Algo Portfolio is systematically adjusting exposure, proactively responding to these clear economic warnings.

The ‘Best 10 Days’ Investing Rule Is Dangerously Wrong

Perfect market robustness doesn't exist, markets inevitably break historical norms. Zurique Capital’s systematic approach is grounded in the understanding that predicting markets is futile, but robust, simple rules consistently work.

Our research disproves the popular investing myth: "You can't miss the best 10 days." Actually, the data shows these best days cluster alongside the worst days, both typically during downtrends. In April, the S&P 500 surged 9.5% on its third-best day ever, but only after collapsing over 10% in two prior days. Mathematically, investors would have gained by missing them altogether.

Imagine an investor holding $100 invested in the S&P 500 before the volatile days:

Final amount after all three volatile days: $99.35

Analysis:

Initial value before volatility: $100

Final value after volatility: $99.35

Net loss: 0.65%

If an investor had avoided all three days entirely, they would still have $100, outperforming someone who experienced both the severe declines and the subsequent rally.

At Zurique, our Alpha Hedge AI systematically avoids these volatility clusters, hedging U.S. equity exposure precisely when markets signal danger.

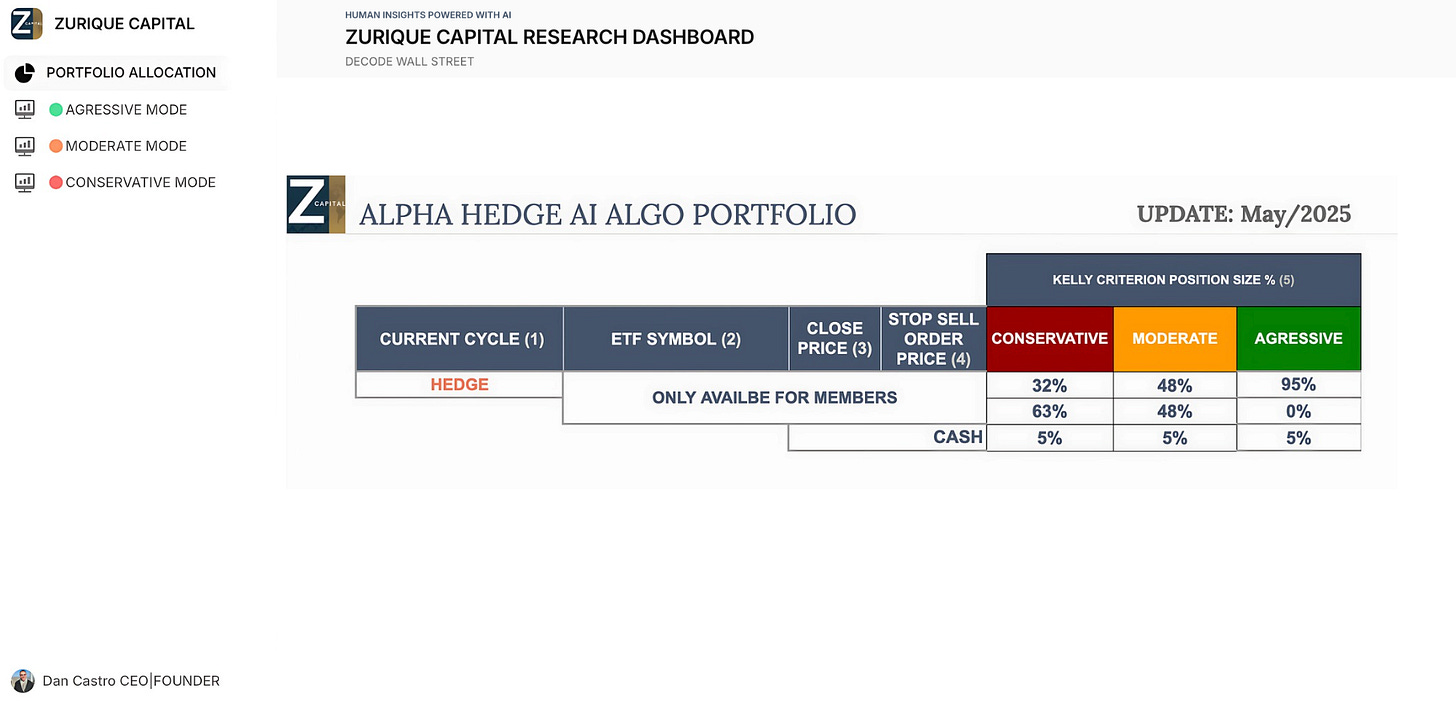

May/25 Portfolio Rebalancing

The Alpha Hedge Portfolio remained in HEDGE MODE for May.

The S&P 500 entered Phase 6 of the market cycle in April, prompting a defensive portfolio allocation adjustment.

Our public portfolio is currently positioned in AGGRESSIVE MODE.

Unlock the Alpha Hedge AI Algo Portfolio ↓