Lesson 3: Cracking the Market Code

Leia também em Português: Lição 3: Decodificando o Código do Mercado

Clique aqui para ler em português.

Lesson 3: Cracking the Market Code

The market isn’t rational. It’s emotional—and predictable if you know where to look.

Imagine standing at the edge of trillions in market capital, Not just watching it move, but understanding why it moves. And more importantly, when.

This lesson isn’t about predictions. It’s about pattern recognition at scale. And how the Alpha Hedge AI Algorithm transforms market cycle psychology into tactical, data-driven allocation.

Welcome to the inside.

1. The Problem: Markets Are Driven by Emotions, Not Logic

Most investors misunderstand volatility.

They think it’s noise. But behind every spike and dip lies something more powerful: human emotion at scale.

From dotcom bubbles to crypto rallies, investor psychology drives capital flows. AI doesn’t eliminate emotion, but it measures it, anticipates its patterns, and acts before the crowd reacts.

Fog of War: Why Most Investors Stay Lost

Fear of making the wrong move

Conflicting data and headlines

Philosophical conflict between growth and protection

Traditional tools weren’t built for this.

AI is.

2. Clearing the Fog: The Role of AI in Market Cycle Intelligence

2.1 The Alpha Hedge AI Algorithm: A New Lens

For over a decade, we've refined a model to interpret and act on market cycle psychology, backed by AI, statistical rigor, and live execution. This framework maps emotional patterns across six phases and connects them to real portfolio actions.

2.2 Market Cycles Are Psychological Cycles

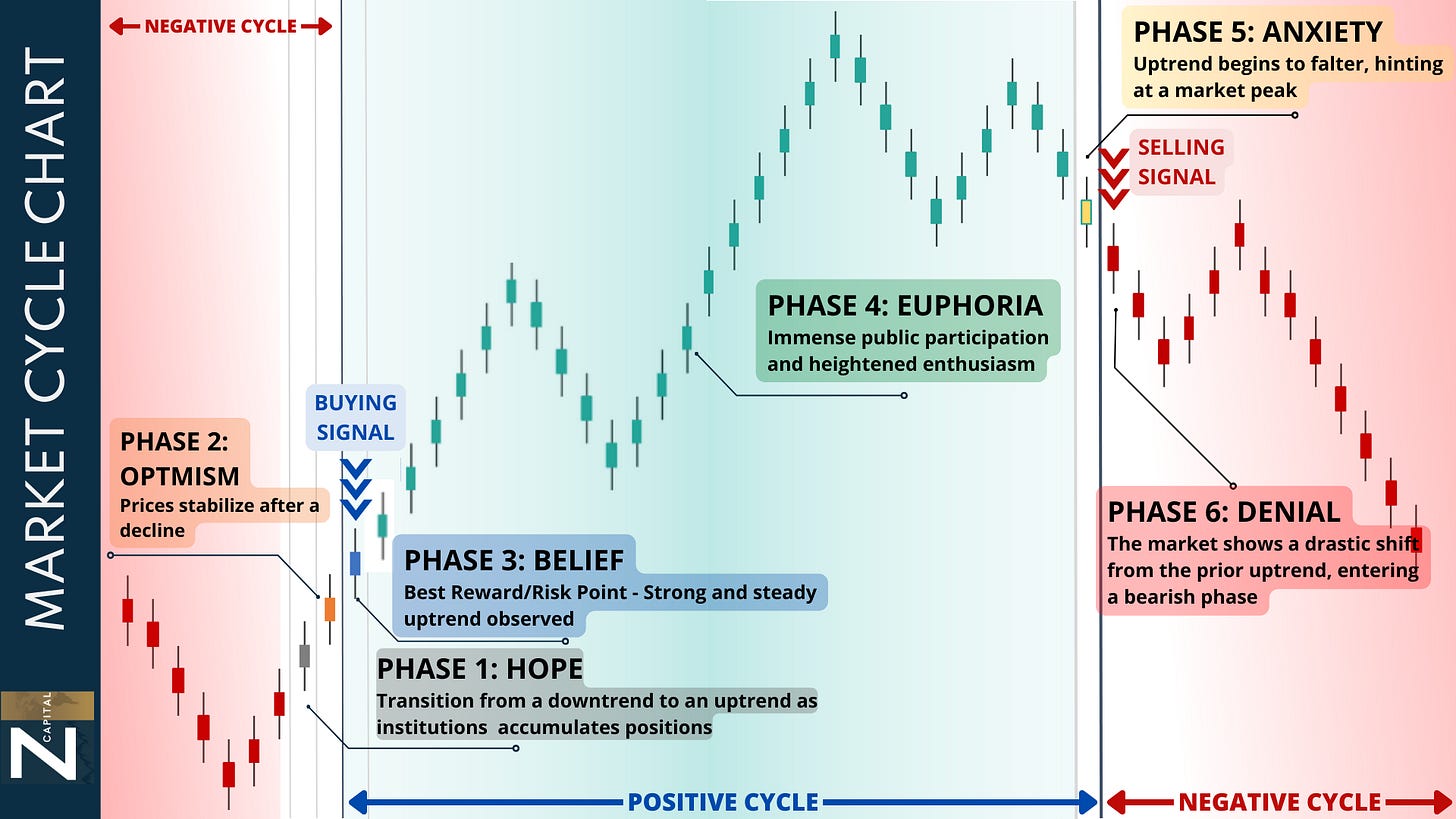

Let’s break down the Six Phases of the Market Cycle, not as a theory, but as an algorithmic signal architecture.

2.2.1. Phase 1: Hope

Characteristics: Marked by fundamentally strong companies with attractive growth prospects and increasing institutional interest.

Investor Approach: Detect early price shifts, focus on strong stocks, and await confirmation of an uptrend.

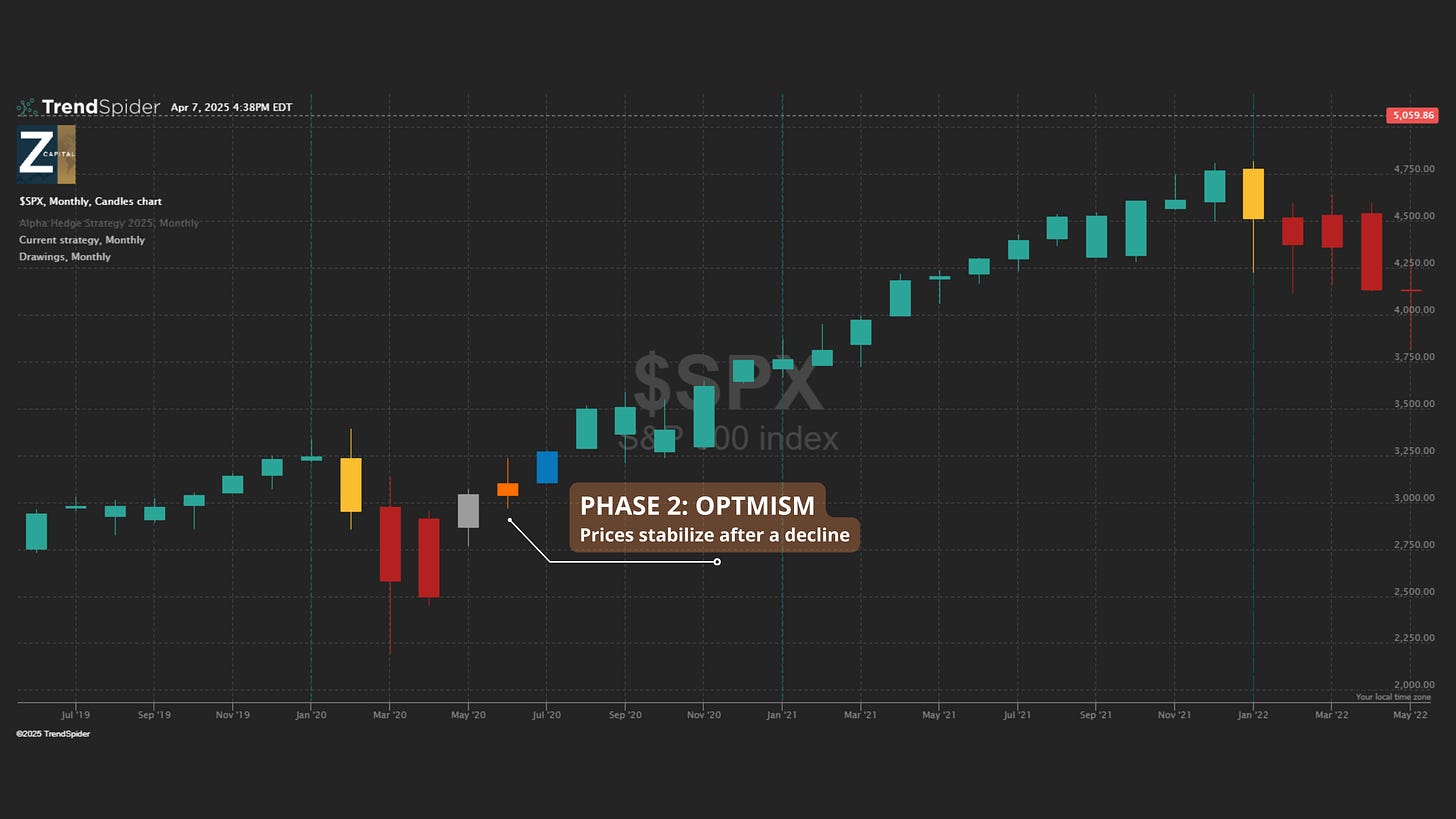

2.2.2. Phase 2: Optimism

Characteristics: Prices stabilize after a significant decline, indicating a potential bottoming process.

Investor Approach: Observe the market for signs. If the month closes in Phase 2, investors should buy at the opening of the following month

2.2.3. Phase 3: Belief

Characteristics: A strong uptrend with increasing buying pressure, representing the best reward-to-risk point for buying.

Investor Approach: Buy at this phase to maximize returns, marking the start of the positive cycle.

2.2.4. Phase 4: Euphoria

Characteristics: Extensive attention from media and influencers, with retail investors showing significant interest, driving rapid price appreciation.

Investor Approach: Maintain positions constructed in Phase 3 and resist the urge to sell too early.

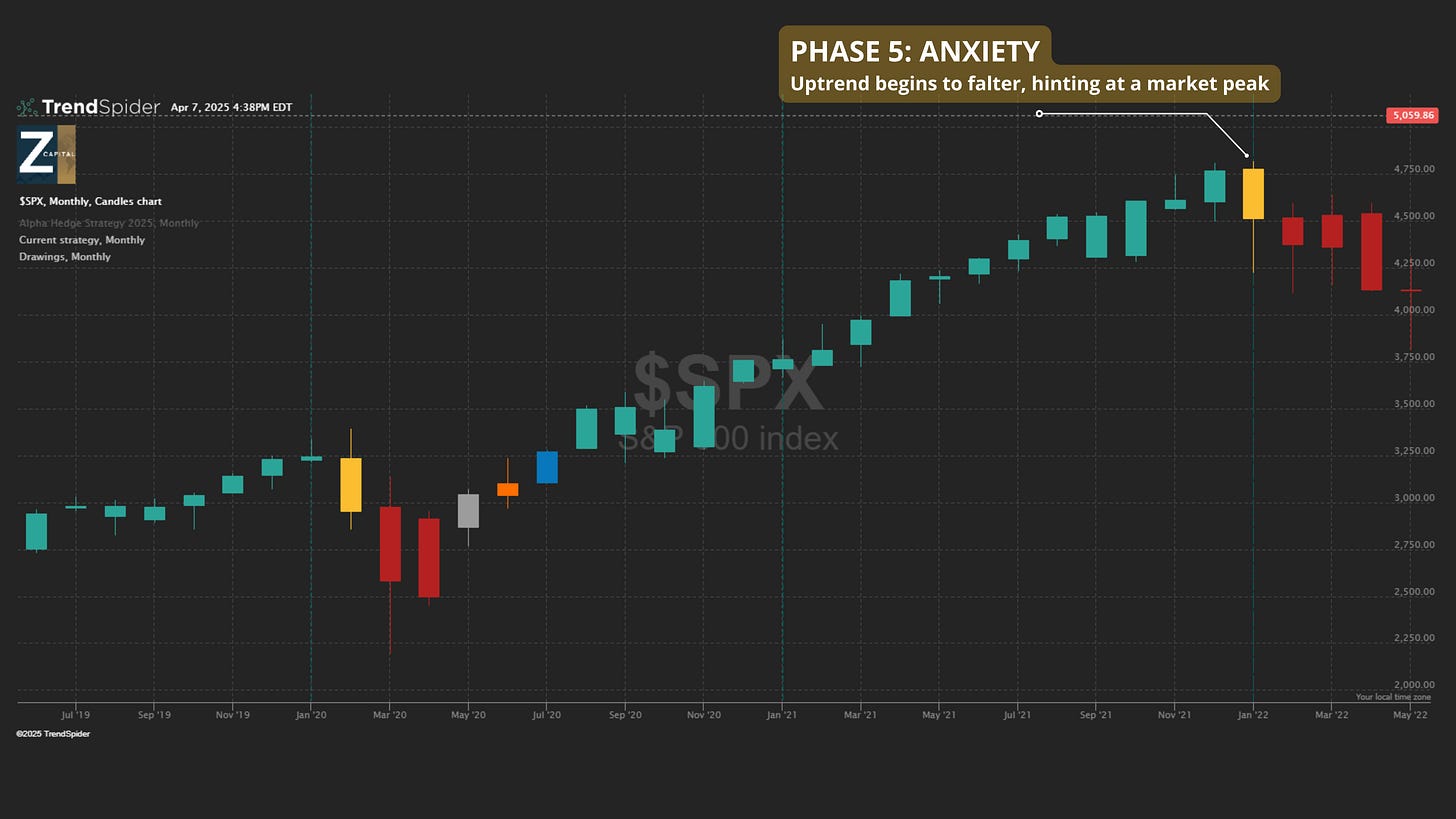

2.2.5. Phase 5: Anxiety

Characteristics: The uptrend loses momentum, signaling the peak of market euphoria and potential unsustainability.

Investor Approach: Be cautious of market weakness and prepare for potential downturns.

2.2.6. Phase 6: Denial

Characteristics: The end of the positive cycle and the beginning of the negative cycle, with a significant reversal indicating a bearish environment.

Investor Approach: Focus on risk management, prioritize capital preservation, and consider hedging strategies.

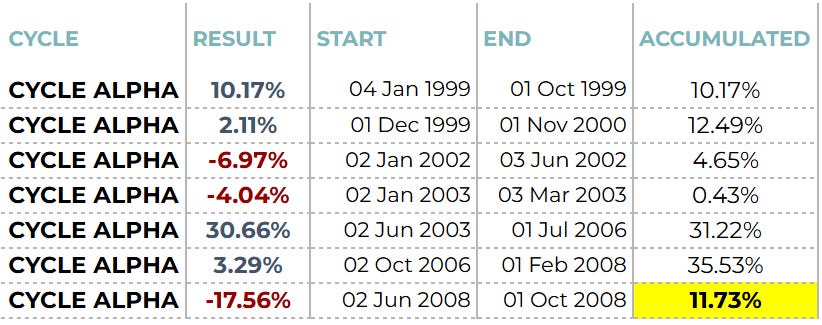

3. Case Study: Bubble-Proofing the Portfolio

Decade The Reality Check:

December 1999 – December 2008

S&P 500 Return: –24.64 % over 10 years

Dotcom. Subprime. Collapse.

But here’s the twist:

What the Alpha Hedge AI Algorithm Did:

+11.73% return over the same period

7 adjustments: 4 gains, 3 losses

All decisions based on cycle detection, not emotion or opinion

Legacy portfolios bled. Ours advanced.

Today’s tools are even more advanced—neural networks, LSTMs, ensemble learning—making the edge wider.

This is more than pattern recognition.

This is AI-powered anticipation of human behavior at scale.

Next Step: Most investors pick assets. The best investors engineer their selection.

You’ve now seen how decoding emotional patterns—mapped algorithmically—can protect and grow wealth even when markets collapse.

Once you understand how markets move— The next question becomes: Where should capital go?

In Lesson 4, we will shift from observing the market to acting on it with precision.

The next session introduces the logic behind strategic asset selection using the Alpha Hedge ai Algorithm, where every position is filtered through a 2-layer system that blends cycle timing, performance comparison, and expectancy math.

Welcome to the next level.

See the full Alpha Hedge AI Algo Portfolio — Subscribe to the Wall Street Insider Report.

Decode the Algorithms Behind Wall Street’s Moves from the Inside.

Turns AI investment management and quantitative investment strategies into results.

Discover AI investment opportunities, curated by our quant-driven AI Advisor Algorithm.

▶️ Read what the Wall Street Insiders wrote about us↓