Building Your Dynamic Portfolio Following the Market Cycles

Market Cycle Mastery Course: Lesson 3

Market Cycle Mastery: Lesson 3

Welcome to the final step of our Market Cycle Mastery series.

Throughout our journey together, we have explored the emotional foundations of the market cycles and introduced you to the Alpha Hedge Strategy. This method has enabled us to expand our investment portfolio more than 10 times in the past decade.

Now, we will transform these insights into a concrete plan for your financial future.

You've learned that the market is a complex beast, swayed by fear, greed, and hope. But with knowledge and strategy, it's a beast that can be tamed. The final challenge is building a dynamic portfolio that adapts, grows, and protects in any market condition.

As your guide, I'm here to provide you with the blueprint for this dynamic portfolio. Our Alpha Hedge Strategy is your toolkit for this construction—a method tested and proven over years of market fluctuations.

In this lesson you will learn:

Get Started Now ↓

1. Building Your Dynamic Portfolio Following the Market Cycles

1.1. Step 1

Market Cycle Analysis, as introduced in Lesson 1, involves determining the current state of the market—whether it's in a Positive Cycle (bullish) or a Negative Cycle (bearish). This analysis guides the selection of assets—choosing an Alpha asset during a Positive Cycle and a Hedge asset during a Negative Cycle—according to the prevailing market conditions.

1.2. Step 2

The Alpha Hedge Algorithm focuses on the S&P 500 cycle. During S&P 500 Positive Cycles, an ETF that tracks this index is chosen based on the Alpha 1, Alpha 2, and Alpha 3 indicators. When the S&P 500 is in a Negative Cycle, a Hedge Asset is selected.

This process is repeated on a monthly basis. The average cycle lasts 13 months.

1.3. Step 3

Portfolio Composition. The Alpha Hedge Portfolio may include either an Alpha or a Hedge based on the S&P500 Market Cycle. We analyze statistical data, prioritizing assets with superior Alpha Indicators, as outlined in Lesson 2 of this course.

1.4. Step 4

Optimizing Position Size to Minimize Risks. Regarded as the financial market's Holy Grail, the optimal position size was developed by computer scientist John Kelly in his 1956 paper, cited in William Poundstone’s book Fortune's Formula and was popularized by Edward Thorpe in blackjack. It has also been applied by Jim Simons, founder of the Medallion and Renaissance hedge funds.

The Kelly Formula is crucial for calculating the ideal bet size by considering win probability and potential return, thus optimizing capital growth and minimizing losses over the long term.

1.4.1. Kelly Formula (K)

1.5. Step 5

Risk Tolerance: Investors must decide their risk tolerance level: Conservative, Moderate, or Aggressive. According to historical statistical data, an efficient parameter to define your risk tolerance is the drawdown you are willing to accept.

"Drawdown is the measure of a decline in the value of an investment portfolio or individual asset from its peak to its lowest point over a specific period. It represents the difference between the highest value achieved and the subsequent lowest value before the investment recovers, indicating the extent of financial loss during that downturn."

Aggressive: Approximately 30% drawdown

Moderate: Approximately 20% drawdown

Conservative: Approximately 10% drawdown

1.6. Step 6

Portfolio Rebalancing. On the first Monday of each month, a review is conducted to assess the Alpha Indicators of specified markets, leading to any necessary adjustments based on the cycle.

Our assets are generally held for months or years. Premium Subscribers of the Wall Street Insider Report receive a spreadsheet on the first Monday of each month, among other benefits, allowing them to access the Alpha Hedge Portfolio in real time from an actual brokerage account.

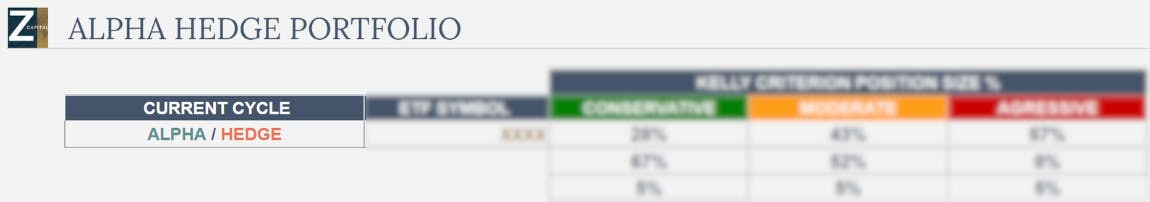

The spreadsheet columns are defined as follows:

1: Current market cycle (Alpha or Hedge);

2: ETF Symbol (Ticker of the ETF);

3: Position (Indicates if there's a current position in the asset: On or Off respectively);

4: Last month's closing price;

5: Protective sell order price (for abrupt market falls);

6: Size of the optimized position size depending on the risk tolerance of the investor.

7: If there was an adjustment to the Stop Price Sell order from last month, the Protective Sell Order price will be highlighted in red.

2. Next Steps Through the Market Cycle

Your journey to mastery doesn't end here—it's just beginning.

Imagine a future where your investments are no longer a source of stress but an opportunity for growth. This is the power of a dynamic portfolio. Without action, the market's volatility remains a threat to your financial stability. But with the Alpha Hedge Portfolio, you turn potential threats into opportunities.

Thank you for embarking on this journey with me. While our series concludes today, your journey to financial mastery is ongoing. I invite you to join our community of global investors by becoming a Premium Subscriber to the Wall Street Insider Report.

Together, we'll continue to navigate the market's ups and downs, achieving not just growth but mastery.

Remember, the Market is a Cycle, but your growth is linear. Keep moving forward, keep learning, and keep growing. Until next time, happy investing.

Thank you for taking this first step with me. Send your questions in the link below: