Howard Marks Mastering the Market Cycle Summary & Case Study

Dive deeper into the cyclical nature of markets with our expanded summary of "Mastering the Market Cycle" by Howard Marks with 5 case studies.

Clique aqui para ler em português: https://www.wallstreetinsiderreport.com/p/dominando-o-ciclo-de-mercado-de-howard

Seven17am #keypoints

Daily Educational [Free]

Howard Marks Mastering the Market Cycle Summary & Case Study

Mastering the Market Cycle

Case Study 1: The Dotcom Bubble

The Power of Cycles

Case Study 2: The 2008 Financial Crisis

The Role of Greed and Fear

Case Study 3: The GameStop Saga

The Art of Investing

The Importance of Being Cycle-Aware

Case Study 4: The Oil Price Cycle

The Psychology of Investing

Case Study 5: The Tulip Mania

Howard Marks Mastering the Market Cycle Summary & Case Study

"Mastering the Market Cycle: Getting the Odds on Your Side" by Howard Marks is a comprehensive guide to understanding and capitalizing on the predictable patterns of market cycles.

Marks, a seasoned investor, emphasizes the importance of recognizing where we stand in the market cycle and adjusting our behavior accordingly.

He explains that while we can't predict future events with certainty, we can improve our odds by identifying the market's current position in its cycle.

The book delves into the psychological factors that drive market cycles, such as fear and greed, and how these emotions can lead to market bubbles and crashes.

Marks also discusses the role of risk in investing and the importance of maintaining a balanced portfolio.

He provides practical advice on how to use market cycles to one's advantage, stressing the importance of patience, discipline, and a long-term perspective.

This book is a treasure trove of insights, offering a deep dive into the cyclical nature of markets and how savvy investors can leverage these cycles to their advantage.

In this article we will dive into the book concepts with a practical view with case studies.

The Basis Case Studies Analysis

All of the Case Studies of this Article will be based on our Cycle Analysis:

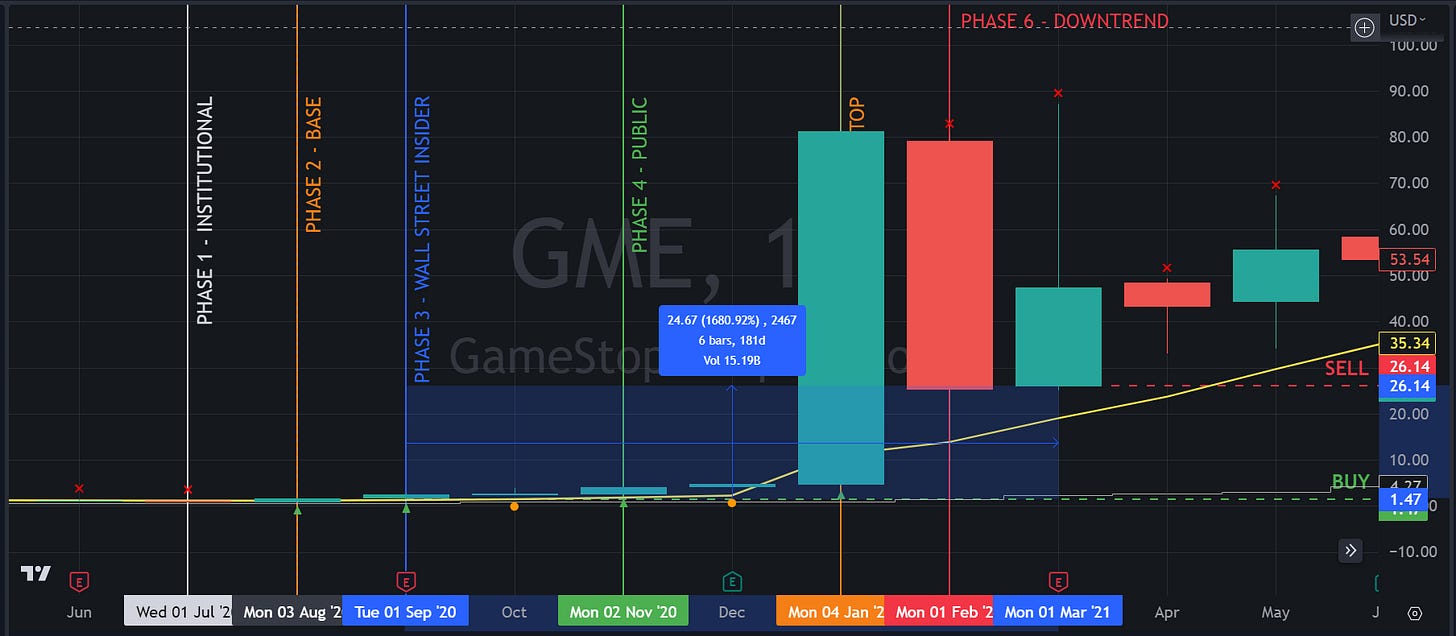

All Markets go through 6 Price Cycle Phases.

In the world of investing, understanding price cycles is crucial for making informed decisions and maximizing returns.

By recognizing and analyzing the six distinct phases of price cycles, this strategy aims to help investors navigate the market more effectively. Let's delve into each phase and explore the corresponding investment approaches.

PHASE 1: Institutional Phase

During the Institutional Phase, prices recover after a significant decline, and smart money starts accumulating positions.

Key characteristics of this phase include a shift from selling to buying pressure.

PHASE 2: Basis Phase

Also known as the Accumulation phase, focuses on the characteristics and behavior of stock prices during this stage of the price cycle.

In Phase 2, stock prices stabilize after a significant decline, indicating a potential bottoming process.

PHASE 3: Wall Street Insiders Phase

In Phase 3, the Market is rising steadily, indicating a strong uptrend.

PHASE 4: The Public Phase

The Phase 4 refers to a stage in the life cycle of the market where widespread public participation and enthusiasm.

During this phase, the general public, including retail investors, starts showing significant interest and participation in the Market, contributing to its rapid price appreciation.

PHASE 5: The Top Phase

Also known as the Distribution phase or the Top, focuses on the characteristics and behavior of prices during this stage of the price cycle.

In Phase 5, the uptrend starts losing momentum, indicating a potential market top.

PHASE 6: The Decline Phase

Also known as the Bear Market phase or the Top Reversal. In Phase 6, the market undergoes a significant reversal from the previous uptrend, indicating a transition into a bearish environment.

Read more by clicking here.

Mastering the Market Cycle

Understanding the Market Cycle

The crux of "Mastering the Market Cycle" lies in understanding the cyclical nature of markets.

Markets, like life, are cyclical.

They have their ups and downs, their booms and busts. Recognizing these cycles and understanding their patterns is the first step towards mastering them.

Case Study 1: The Dotcom Bubble

The Dotcom Bubble of the late 1990s is a classic example of a market cycle.

During this period, internet-based companies, or dotcoms, were the rage among investors.

The promise of the internet drove stock prices of these companies to astronomical levels, despite many of them having no profits or even a viable business model.

However, by 2000, the bubble burst, leading to a rapid decline in stock prices and the failure of many dotcoms.

This cycle of boom and bust underscores the cyclical nature of markets.

Knowing how to read the Market Cycle, you can protect you investment by knowing the exact timing to buy and sell.

In this example of the Nasdaq 100 Index, instead of suffer with the bubble, you can surf the uptrend and exit the right time with a 103% of profit.

The Power of Cycles

Cycles are powerful forces in the market. They can drive prices up or down, create or destroy wealth, and cause economies to boom or bust.

But they are not random or unpredictable.

They follow patterns, and these patterns can be studied and understood.

Case Study 2: The 2008 Financial Crisis

The 2008 Financial Crisis is another potent illustration of the power of cycles.

The years leading up to the crisis saw a boom in the housing market, fueled by easy credit and risky mortgage lending practices.

However, when the bubble burst, it led to a severe financial crisis and a global recession.

This case study highlights how cycles can drive prices up or down, create or destroy wealth, and cause economies to boom or bust.

As seen on the graphic above, the Phase 6 started on January 2008, 8 months before August when the Bubble burst. From the Cycle from 2006 to 2007, you would close the position with 13% of profit and avoiding the fell of more then 50% of this index in 2008.

Remember that to recover from a 50% fall, the asset need to have a 100% gain to recover*. It took more then 4 years to the S&P500 recover from the selling point.

*100 minus 50% = 50 | 50 plus 50% is 75 | 50 plus 100% is 100

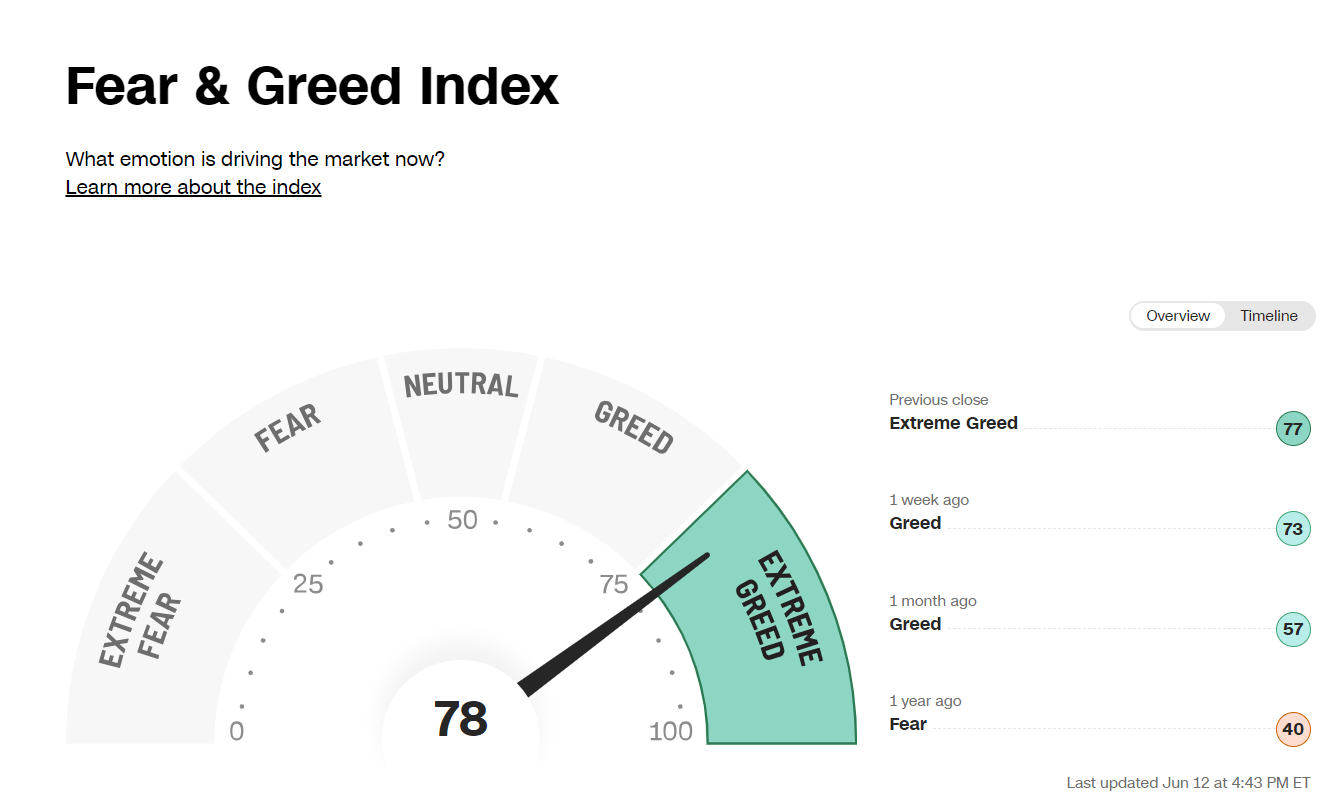

The Role of Greed and Fear

Greed: The Fuel of Bull Markets

Greed is a potent emotion in the market.

It drives investors to chase profits, bid up prices, and take on more risk.

When greed is in the air, markets tend to rise, often to unsustainable levels.

This is the essence of a bull market.

Fear: The Harbinger of Bear Markets

Fear, on the other hand, is the harbinger of bear markets. When fear takes hold, investors sell, prices fall, and markets enter a downward spiral. Understanding the interplay between greed and fear is key to navigating market cycles.

Case Study 3: The GameStop GME 0.00%↑ Saga

The recent GameStop GME 0.00%↑ saga is a perfect example of the role of greed and fear in market cycles.

In early 2021, a group of retail investors on Reddit started buying shares of GameStop, a struggling video game retailer, leading to a massive increase in its stock price.

This was driven by greed and a desire to profit from short squeezes.

However, when the price started to fall, fear took over, leading to a rapid sell-off. This case study shows how greed can fuel bull markets and fear can trigger bear markets.

As seen, in 2020, GME 0.00%↑ started a cycle in July 2020 and had an explosion on January 2021, despite the strong fall on February. Entering and exiting at the right time was possible to extract a 1680% of profit.

Greed and Fear Index: A Barometer of Market Sentiment

The 'Greed and Fear Index' is a tool used to measure the primary emotions driving investors' decisions in the market. Developed by CNNMoney, the index uses seven market indicators, including stock price momentum, safe haven demand, and junk bond demand, to calculate a daily value that ranges from 0 (representing extreme fear) to 100 (representing extreme greed).

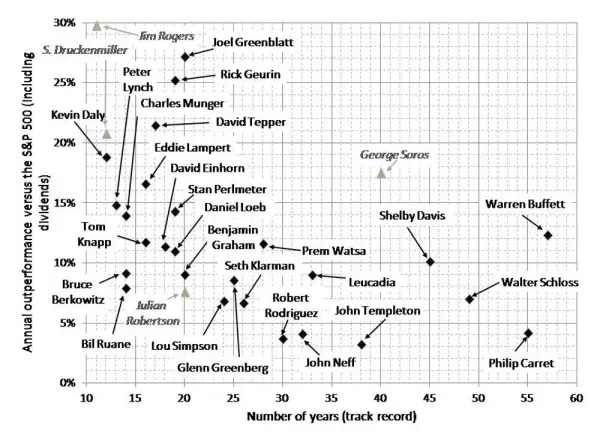

The Art of Investing

Investing in the Face of Uncertainty

Investing is an art, not a science.

It requires judgment, intuition, and a deep understanding of human psychology.

"Mastering the Market Cycle" offers valuable insights into the art of investing, particularly in the face of uncertainty.

image source: https://www.newtraderu.com/2022/06/07/best-investors-of-all-time-returns/

The top ten investors of all time based on both their magnitude and duration of alpha returns: Warren Buffett, George Soros, Shelby Davis, Joel Greenblatt, David Tepper, Walter Schloss, Glenn Greenberg, Walter Schloss, Seth Klarman, Prem Watsa

source: https://www.newtraderu.com/2022/06/07/best-investors-of-all-time-returns/

We named our strategy as Alfa Hedge Portfolio.

Alfa

Alpha (α) is used in investing as a measure of performance of returns of an investment or investor returns that are higher than a relative benchmark index. Alpha is the term used in investing to describe an investment strategy’s ability to beat the average market returns with an edge. Alpha refers to excess return or abnormal rate of return is in contrast to the academic theory that markets are efficient and no way to beat them consistently.

source: https://www.newtraderu.com/2022/06/07/best-investors-of-all-time-returns/

Hedge

A hedge in financial markets refers to a risk management strategy employed by investors to mitigate potential losses or offset risks associated with their investments. It involves taking positions in assets or financial instruments that have an inverse correlation to the primary investment, thereby providing a safeguard against adverse price movements.

source: https://www.investopedia.com/terms/h/hedge.asp

We chose this name because our objective is to overtake the S&P500 (Alfa) in any market landscape (Hedge). And we’ve been doing this for 10 years.

Follow our Portfolio on daily basis by been a Premium Subscriber. Click here to know more.

The Importance of Being Cycle-Aware

Being cycle-aware is a critical skill for investors.

It means understanding where we are in the cycle, what's likely to come next, and how to position our portfolio accordingly.

Case Study 4: The Oil Price Cycle

The oil industry is a prime example of the importance of being cycle-aware.

The price of oil is subject to cyclical fluctuations based on a variety of factors, including geopolitical events, changes in supply and demand, and economic growth rates.

For instance, the 2014-2016 oil price crash was a result of a supply glut caused by increased production from countries like the U.S., coupled with a slowdown in global demand.

Investors who were aware of this cycle could have made strategic decisions to protect their portfolios.

By knowing how to read the Cycles, not only brings profits (obvious, but had to be said). But surely can protect you wealth.

This was the case of the oil chash. The Cycle was interrupted on August/2014 and if the investors could read the Cycle would closed their positions with a -5.97% of loss. But a Loss of -79% would be avoided.

To recover from a -79% loss, It would take 138% gain.

The Psychology of Investing

The Investor's Mindset

The psychology of investing is a central theme in "Mastering the Market Cycle".

Marks delves into the mindset of the investor, exploring how emotions, biases, and cognitive errors can cloud our judgment and lead us astray.

The Role of Emotions in Investing

Emotions play a big role in investing. They can cloud our judgment, lead us to make impulsive decisions, and cause us to buy high and sell low.

Learning to manage our emotions is a key part of mastering the market cycle.

We have a full article about The Psychology of The Market Cycle here.

Case Study 5: The Tulip Mania

One of the earliest recorded financial bubbles, the Tulip Mania in the 17th century, offers a fascinating study into the psychology of investing.

At its peak, the price of tulip bulbs in the Netherlands soared to extraordinarily high levels, only to crash dramatically in 1637.

This event highlights the role of irrational exuberance and herd mentality in driving market bubbles and the subsequent crashes.

image source: https://www.adamsmith.org/blog/was-the-tulip-bubble-really-a-bubble our annotations

The Market Cycle repeats for centuries because the assets and the markets change, but the human behavior don’t.

As shown on the image, the Phases where the same, and understanding this will make you stay ahead and get in positions at the points of more upside with the lower risk and get out as soon as the Cycle ends.

Conclusion

"Mastering the Market Cycle" is a must-read for anyone interested in investing.

It offers a wealth of insights into the cyclical nature of markets, the psychology of investing, and the art of navigating market cycles.

Whether you're a seasoned investor or a novice, this book has something to offer.

But, accordingly with the Market Cycle, what Markets do we have on Alfa Hedge Portfólio II right now?

Access now the evolution of the Alfa Hedge Portfolio II clicking on the button bellow

If the button doesn’t work, please click on this link: https://www.wallstreetinsiderreport.com/p/dailyupdate