📊Commodities Making a Comeback? Part 3/3

Embark on our three-day journey into Commodities Market Analysis to discover whether now is the right time to invest in commodities.

Commodities Making a Comeback?

We are in the midst of a three-day exploration of the commodities market, covering three key topics.

✅1. In What time of the Market Cycle Commodities are Now?

In the las post, you understood in which phase the Commodities Market is currently in, and whether it's the right time to invest.

If you didn’t see the Post, click here.

✅2. Maximizing Returns and Minimizing Risks in the Commodities Market

In this post, we will delve into strategies for maximizing returns and minimizing Risks in the Commodities Market. This will include a detailed statistical analysis, focusing not just on whether to invest, but also on how much to invest in order to optimize returns.

If you didn’t see the Post, click here.

✅3. Optimizing a Dynamic Diversified Portfolio with Commodities Market

In this post, we will discuss how to incorporate the Commodities Market into a dynamic, diversified portfolio. This approach aims to enable investors to capitalize on positive market cycles while maintaining controlled risk.

Note from the Author

This post sequence is not a one-way road, It's a conversation between you and me. Feel free to answer the quizzes, let me know you and your doubts and suggestions.

You will be able to send me tickers for a personal analysis. And yes I personally answer all responses. That’s why we do a 3-day journey, so I can answer everyone. Go ahead test me.

Answer Quiz 1: Should you Invest In DBC 0.00%↑ based on the Alphas Indicators?

ANSWER: No! As depicted in the graph above, the DBC 0.00%↑ ETF is currently in the DENIAL phase 6, this way, despite the Alpha Hedge Performance is greater than the Buy and Hold Performance, and the Expectancy Ratio is Positive, the asset is failing the momentum. Invest in assets in Phase 6 is put the probabilities against you.

Today, our focus will be on how to incorporate the Commodities Market into a dynamic, diversified portfolio.

Step-by-Step to Build a Dynamic Portfolio in Wall Street

Establishing the Universe of Assets

The objective is to identify the most effective point of diversification.

The Alpha Hedge algorithm selects assets from Bonds, Currency, Equities/Commodities, Growth Stocks, and Crypto, all through ETFs.

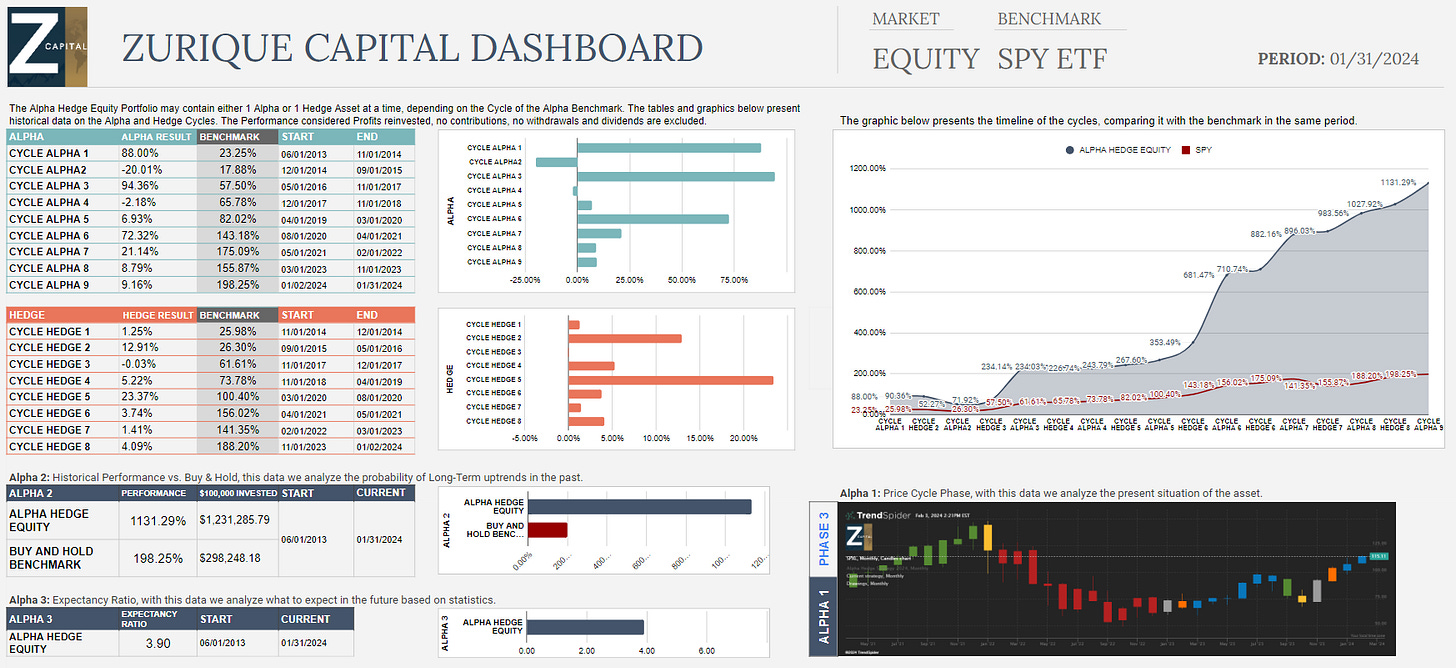

The Alpha Hedge Portfolio may contain either one Alpha or or one Hedge Asset at a time for each Market, depending on the Cycle of the Alpha Benchmark.

Analysis of Alpha Indicators

Developed by Zurique Capital, the Alpha Hedge Data Analysis aims to identify Market Cycles using ETFs via:

Alpha 1: Cycle Phase - Assesses the current market condition.

Alpha 2: High Positive Volatility - Evaluates historical data to determine the highest probability of sustained uptrends.

Alpha 3: Expectancy Ratio - Forecasts future expectations based on statistical analysis.

Assets in established markets with superior Alpha Indicators are chosen.

Portfolio Rebalancing

Investments are typically held for months or years.

On the first Monday of each month, a review is carried out to evaluate the Alpha Indicators of the specified markets, guiding any necessary adjustments based on their risk management and position sizing algorithm.

A key aspect of the Alpha Hedge Portfolio's strategy is not to hold all asset classes simultaneously but rather to focus on retaining "winners" and eliminating "losers".

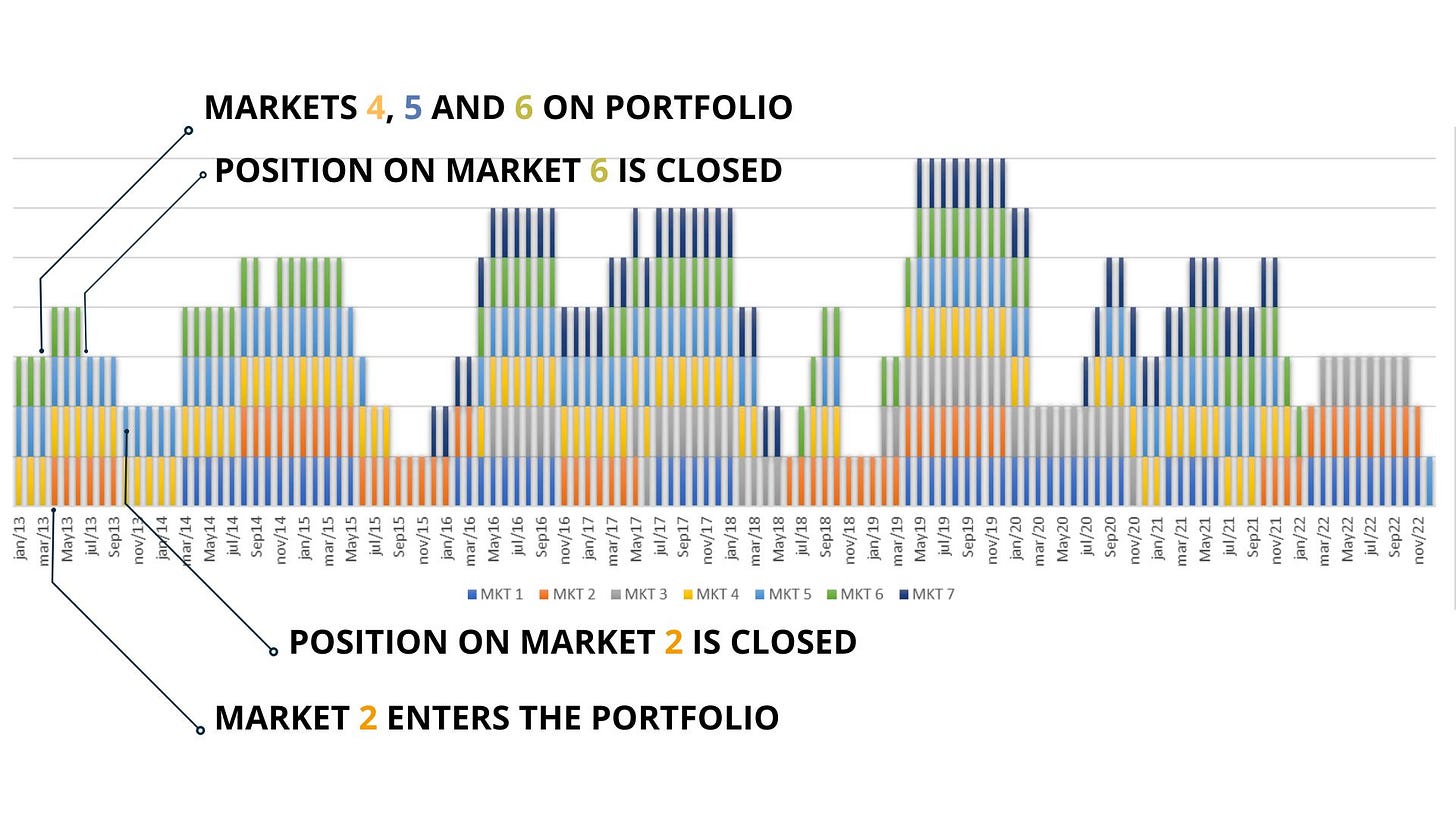

Consider the example from January to November 2013:

In January 2013, Markets 4, 5, and 6 were in our Portfolio.

In April '13, Market 2 entered a Positive Cycle and consequently entered the Portfolio.

In July '13, Market 6 entered a Negative Cycle, and consequently, we closed the position.

In October '13, it was Market 2's turn to close the position, leaving only Markets 4 and 5 in the Portfolio.

The Numbers

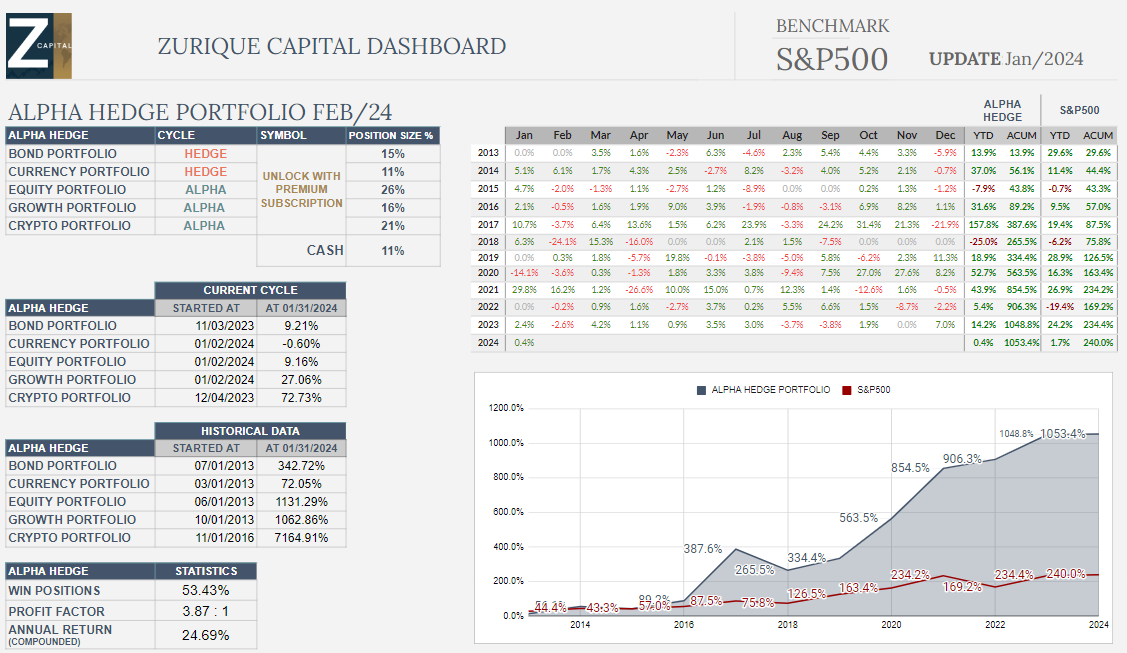

Alpha Hedge Portfolio February/24 Update*

⚠️*We execute the Alfa Hedge Strategy in a Real-Life Brokerage Account with Interactive Brokers integrated with the Platform Collective2, a U.S. regulated company based in New York.

This way, to ensure confidence in the presented results, we enable Premium Subscribers access to our positions in real time.

Case Study

Here is the plot. Despite the cycle of the ETF and its performance in January, we have identified a superior alternative for inclusion in our portfolio.

Commodities and Equities form a combined segment in our Portfolio. Historically, when Equities are in a Negative Cycle, Commodities tend to be in a Positive Cycle, allowing us to use Commodities as a hedge.

This strategy was adopted because Equities generally exhibit higher positive volatility than Commodities, and Commodities often perform well during bear markets in the Equity Market.

As of February 2024, the Equity Market is in Phase 3 (Positive Cycle), and consequently, we do not currently hold any Commodities positions.

This practice has enabled us to achieve a return of 1,131.29% in our Equities Portfolio since June 2013, compared to the S&P 500 Index, which achieved a return of 196.25% over the same period. This performance considers profits reinvested, excludes any contributions or withdrawals, and does not account for dividends.

Presently, 26% of our Portfolio is allocated to Equities, based on our statistical data analysis.

Wall Street Insider Quiz (+Bonus)

If you answer all the 5 quizzes of the 3-day posts about the Commodities Market, you will be awarded 30 days of free access to the Wall Street Insider Report Premium, a bonus valued at $80.00*.

*If you already won this Bonus in the last 12 months, I will surely answer you, be you will not be able to receive the 30 day access to the Wall Street Insider Report Premium.

Quiz 5: You Quiz Me (Bonus)

Most of our clients are discreet and prefer not to share their questions in public comment sessions. So, through the Form below, send me an Asset Ticker and I will make an individual Market Cycle analysis for you.

If the Button doesn’t work, please click the link below or paste It in your browser.

https://forms.gle/hLeFGk2k9XzHgzsf9

Unlock the Alpha Hedge Portfolio👇

Alpha Hedge Portfolio Daily Updates