📊Commodities Making a Comeback? Part 2/3

Embark on our three-day journey into Commodities Market Analysis to discover whether now is the right time to invest in commodities.

Commodities Making a Comeback?

We are in the midst of a three-day exploration of the commodities market, covering three key topics.

✅1. In What time of the Market Cycle Commodities are Now?

In the las post, you understood in which phase the Commodities Market is currently in, and whether it's the right time to invest.

If you didn’t see the Post, click here.

2. Maximizing Returns and Minimizing Risks in the Commodities Market

In this post, we will delve into strategies for maximizing returns and minimizing Risks in the Commodities Market. This will include a detailed statistical analysis, focusing not just on whether to invest, but also on how much to invest in order to optimize returns.

3. Optimizing a Dynamic Diversified Portfolio with Commodities Market

On the third day, we will discuss how to incorporate the Commodities Market into a dynamic, diversified portfolio. This approach aims to enable investors to capitalize on positive market cycles while maintaining controlled risk.

Note from the Author

This post sequence is not a one-way road, It's a conversation between you and me. Feel free to answer the quizzes, let me know you and your doubts and suggestions.

You will be able to send me tickers for a personal analysis. And yes I personally answer all responses. That’s why we do a 3-day journey, so I can answer everyone. Go ahead test me.

Answer Quiz 1: In what time of the Market Cycle Psychology Chart DBC 0.00%↑ is now?

ANSWER: As depicted in the graph above, the DBC 0.00%↑ ETF is currently in the DENIAL phase 6, as of February 2024 according to the Alpha Hedge Algorithm.

Therefore, it is not advisable to hold a position in this asset at the moment. In Part 3 of this series, we will discuss how we incorporate commodities into our Alpha Hedge Portfolio.

Today, our focus will be on strategies to maximize returns and minimize risks in the Commodities Market.

Understanding the Alpha Indicators

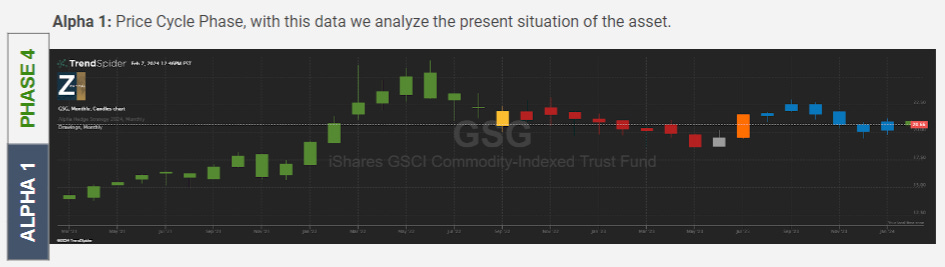

Alpha 1

Alpha 1 involves analyzing the current phase of an asset's cycle to determine its present condition. The Alpha Hedge Algorithm assesses the asset's phase, and if it's in Phases 3, 4, or 5 (Positive Cycle), such as the GSG 0.00%↑ ETF in Phase 4, it indicates that the conditions are favorable. Conversely, if the asset is in Phases 1, 2, or 6 (Negative Cycle), it is not an opportune time to invest, as exemplified by the DBC 0.00%↑ ETF in Phase 6.

The Alpha Hedge Algorithm determines optimal entry and exit points as follows:

ENTRY: At the opening of the first month following the start of a Positive Cycle.

EXIT: At the opening of the first month following the start of a Negative Cycle.

Consider the SPY 0.00%↑ ETF example, where the optimal entry point was at the beginning of July 2020, and the exit point was at the beginning of February 2022. This resulted in an Alpha Hedge Performance of +45.58% for this cycle.

However, decision-making isn't solely based on cycle phases. It's crucial to also consider the probabilities.

Alpha 2

Alpha 2 focuses on comparing the Historical Performance against the Buy & Hold strategy to analyze the likelihood of long-term uptrends. If the Alpha Hedge Performance surpasses the Buy & Hold Performance during the same period, and the asset is in a Positive Cycle, Is It Ok to make a position in the asset? Not yet…

Alpha 3

Alpha 3 is about the Expectancy Ratio, which helps forecast future outcomes based on statistical analysis. The Expectancy Ratio is calculated as follows:

Expectancy Ratio = [Probability of Win x (Avg Win/|Avg Loss|)] – (Probability of Loss)

The interpretation of Expectancy Ratio is the probability of profit per dollar risked.

A positive Expectancy Ratio, coupled with superior Alpha Hedge Performance over the Buy & Hold strategy during a Positive Cycle, indicates a green light for investment.

The GSG 0.00%↑ Case Study

✅ Alpha 1: The asset is in a Positive Cycle Phase 4.

✅ Alpha 2: Alpha Hedge Performance is +20.6%, surpassing the Buy & Hold Performance of -59.10% over 17.5 years, the maximum period analyzed by the Trendspider Platform.

✅ Alpha 3: The Expectancy Ratio is positive at +0.3.

Thus, the asset meets our three criteria, allowing us to consider a position in this asset.

Key to differentiating our approach is how we manage buying to maximize returns while controlling risk.

How to Maximize returns and control risks

Properly sizing your positions is the Holy Grail of the Financial Market.

John Kelly's contribution to position sizing is fundamental to financial market success. The Kelly Formula helps in managing capital growth over the long term by determining the optimal size for a series of bets or investments. It considers the probability of winning and the potential return to calculate the ideal bet size.

Kelly Formula = Expectancy Ratio / Reward Risk Ratio

Kelly's rule, or the Kelly criterion, is a money management strategy that aims to maximize the growth of capital over the long term.

It provides a formula to determine the optimal size of a series of bets or investments. The rule takes into account both the probability of winning and the potential return to calculate the optimal bet size.

The Result of the Kelly Formula is the Maximum Position Size you should have of the asset you should have in your portfolio so you can maximize the gains and minimize the losses.

Let’s take the example again of GSG 0.00%↑:

For the ETF, the Trendspider Platform has calculated the Expectancy Ratio and the Reward/Risk Ratio, leading to:

MAXIMUM POSITION SIZE = 0.3/3.36 = 8.9%

Wall Street Insider Quiz (+Bonus)

If you answer all the 5 quizzes of the 3-day posts about the Commodities Market, you will be awarded 30 days of free access to the Wall Street Insider Report Premium, a bonus valued at $80.00*.

*If you already won this Bonus in the last 12 months, I will surely answer you, be you will not be able to receive the 30 day access to the Wall Street Insider Report Premium.

Quiz 3: I Quiz You

Now look at the Data of DBC 0.00%↑ . The fund pursues its investment objective by investing in a portfolio of exchange-traded futures on Light Sweet Crude Oil (WTI), Heating Oil, RBOB Gasoline, Natural Gas, Brent Crude, Gold, Silver, Aluminum, Zinc, Copper Grade A, Corn, Wheat, Soybeans, and Sugar (Yahoo Finance).

*The answer will be in tomorrow’s post.

Quiz 4: You Quiz Me (Bonus)

Most of our clients are discreet and prefer not to share their questions in public comment sessions. So, through the Form below, send me an Asset Ticker and I will make an individual Market Cycle analysis for you.

If the Button doesn’t work, please click the link below or paste It in your browser.