📊Case Study: Michael Burry's Bold Stock Market Bets

Is It Time To Hedge? Dive into Michael Burry's recent stock market bets and understand the implications for the broader market

#Market Cycle and Portfolio Updates

📆23-08-14

Click here for access the Market Cycle and Alfa Hedge Portfolio II Update

#keypoints

📊Case Study:

Michael Burry's Bold Stock Market Bets

Is It Time To Hedge?

Burry's Bold Bets

The Power of Put Options

The Stakes of the Game

Reading the Market's Tea Leaves

Behind Burry's Bets

📈Market Cycle Analysis Nasdaq’s QQQ 0.00%↑ and Short Nasdaq’s SQQQ 0.00%↑

Bottom Line

🔉Case Study: Burry's Stock Market Bets

Is It Time To Hedge?

Michael Burry, the financial wizard who famously profited from the 2008 subprime mortgage crisis, is back in the spotlight.

His recent moves suggest he's betting against the stock market, but is It time to Hedge? Accordingly with our Market Cycle analysis, the answer is a resounding No.

Let’s dive in.

Burry's Bold Bets

Burry's firm, Scion Asset Management, hasn't been shy about its skepticism. They've acquired put options contracts against:

2 million shares of SPDR S&P 500 ETF Trust (SPY 0.00%↑ )

2 million shares of Invesco QQQ Trust (QQQ 0.00%↑)

For those scratching their heads, let's delve into what put options really are.

The Power of Put Options

In the financial world, put options are akin to insurance.

They grant investors the right (without obligation) to sell a stock at a set price within a certain timeframe.

Essentially, it's a gamble on a stock's decline. If you're holding put options, you're anticipating stormy weather ahead for that stock.

The Stakes of the Game

Burry's bets are not small change. The options target stocks worth:

$886.6 million in SPY 0.00%↑

$738.8 million in QQQ 0.00%↑

Interestingly, both ETFs have been performing well this year, with SPY up 17% and QQQ soaring by 38%.

Reading the Market's Tea Leaves

Despite the Nasdaq's stellar performance in the first half of 2023, there's a shadow of doubt.

With 11 interest rate hikes in the past 18 months, whispers of a potential recession are growing louder. Yet, many investors remain hopeful, banking on a "soft landing" for the economy.

Behind Burry's Bets

The specifics of Burry's investments came to light in a 13F filing, showcasing holdings as of June 30, which may be delayed now.

However, the waters are murky post-Q2. While QQQ 0.00%↑'s value dipped by about 1%, SPY held its ground.

The exact details of the put options remain a mystery, but one thing's clear.

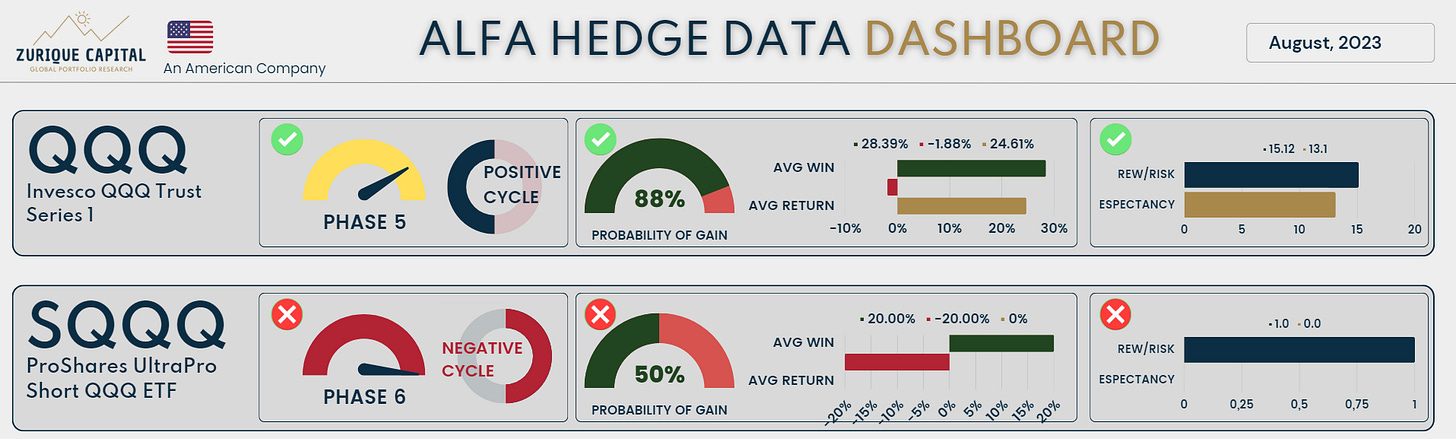

📈Market Cycle Analysis Nasdaq’s QQQ 0.00%↑ and Short Nasdaq’s SQQQ 0.00%↑

The Alfa Hedge Data Analysis was developed by Zurique Capital, to identify the Markets Cycles (through ETFs) combining:

Market Cycle Phase, with this data we analyze the present situation of the Market.

Historical positive volatility (highest probability of Long-Term uptrends), with this data we analyze the past.

Reward/Risk Ratio and Expectancy ratio, with this data we analyze what to expect in the future based on statistics (not astrology or opinions).

This analysis are not investment recommendations and investors must do their own research (please read the Disclaimer section).

We invest our own money and share our Portfolio with Premium Subscribers.

Premium Subscribers have full access to our Alfa Hedge Portfolio II in a Real-Life Brokerage Account in Real Time.

As seen on the Data above, there is no reason to Hedge Nasdaq now. All the odds are against the investor, while Nasdaq have all green lights.

Nasdaq, despite loosing momentum in august/23, is on Positive Cycle.

Hedge Nasdaq now is try to predict the future anticipating the next move, and the investor make more money reacting to the market, not predicting.

Maybe Burry’s moves makes sense if you are a Hedge Fund, this way you can wait years loosing money, but not for the retail investor, that don’t have all the time nor all the money.

By the time I write this market I have 1 Hedge position on my portfolio, but is not on Nasdaq.

Do you want to see inside our Portfolio now?

Become a Premium Subscriber and get full access to our Alfa Hedge Portfolio II in real time.

Every business day we update the evolution of the Alfa Hedge Portfolio II.

Premium Subscribers have full access to our Alfa Hedge Portfolio II in a Real-Life Brokerage Account in Real Time.

Bottom Line

Michael Burry's moves always attract attention.

His recent bets against the stock market have raised eyebrows and sparked debates. As the market continues its unpredictable dance, the question remains: Is it time to hedge? In our Market Cycle analysis, the answer is a resounding No.

If you liked this content, you will love our Report.👇

Wall Street Insider Report

Demystify the MARKET CYCLES investing SMARTER in Wall Street

Theory + Action: Learn & Replicate a High Performance + Low Maintenance + Long-Term Portfolio

Join +13k Global Investors and Really Master the Market Cycle Investing