AI for Investment: Google Search Volume & Investor Attention

📊7 Winning Assets Identified by AI & Alpha Hedge AI Algo Portfolio Review

Wall Street Insider Report

AI-Powered Insider-Level Insights to Exponentially Expand Wealth by Decoding Wall Street.

Join our global community of investors who are leveraging cutting-edge technology to build and preserve wealth for future generations.

AI for Investment: Google Search Volume & Investor Attention

Missing Out on Key Market Trends?

Here is what can help you.

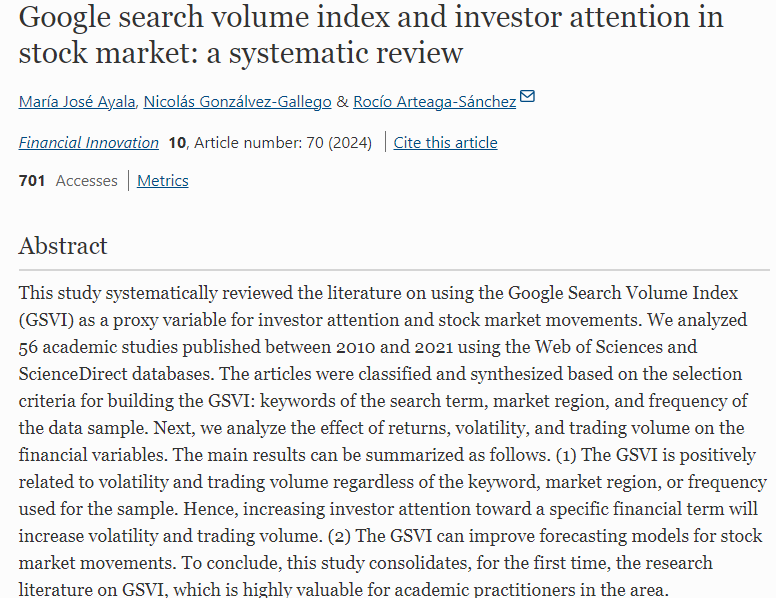

The article "Google search volume index and investor attention in the stock market: a systematic review" systematically reviews 56 academic studies on the use of the Google Search Volume Index (GSVI) as a proxy for investor attention and stock market movements. It covers various financial metrics such as returns, volatility, and trading volume.

Do you ever feel like you're always a step behind in the market? With so much data out there, it’s hard to know which signals matter and which ones are just noise.

Imagine this: While you're scanning headlines and news articles, millions of other investors are already acting on something you haven't even seen yet — Google search data. What’s worse? These investors are using that data to stay ahead, while you’re left catching up.

Investors' attention directly impacts stock market moves. If you're not keeping an eye on investor attention, you're potentially missing out on massive opportunities.

There’s a solution to this — something smart, fast, and built with AI.

let’s dive into It.

The Key to Beating the Market Isn’t What You Think

Market movements driven by investor attention. It’s not just about reading financial reports or watching stock tickers. It’s about understanding what investors are thinking and focusing on in real time.

That’s where Google Search Volume comes in. This data shows exactly what investors are searching for, and that can predict stock volatility, price moves, and more.

Here’s the best part: My AI-driven solution taps directly into this Google Search Volume Index - GSVI and other key data to predict where the market is headed. With the help of AI, you can ride these trends, rather than chase them.

Imagine having AI as your personal market analyst, using real-time data to ensure you're always a step ahead of the crowd.

I'll break it all down with the research that backs it.

The Research That Proves It: Google Search Volume & Stocks

Here’s the truth: Investor attention drives market behavior, and it's measurable.

Here are the key insights from the article "Google search volume index and investor attention in the stock market: a systematic review":

GSVI and Financial Variables:

The GSVI positively correlates with volatility and trading volume, implying that increased search volume for financial terms heightens investor activity and market volatility.

The relationship between GSVI and stock returns varies; some studies find positive correlations, while others show negative or mixed results.

Forecasting Potential:

Many studies suggest that GSVI enhances forecasting models for stock market movements, particularly for predicting short-term volatility and trading volume.

Keywords play a critical role, with terms like company names, stock tickers, and financial terms providing different levels of predictability.

Regional and Methodological Differences:

Studies on US and European markets tend to show more consistent results regarding the predictive value of GSVI, while results for Asian and South American markets are less conclusive.

There are discrepancies in how frequently GSVI data should be sampled (daily, weekly, or monthly), affecting the results' robustness.

Implications for Investors:

The GSVI can serve as a useful tool for investors by capturing real-time attention data that can help in making informed decisions, particularly during periods of heightened market interest in specific stocks or sectors.

it’s one thing to know what’s driving the market, but it’s another to act on it. That’s where my AI-driven solution comes in — using data like GSVI to predict market trends with precision.

I’ll show you how we put this into practice by presenting the top 7 assets identified by our AI algorithm.

7 Winning Assets Identified by AI (and There’s More)

Let’s get into action.

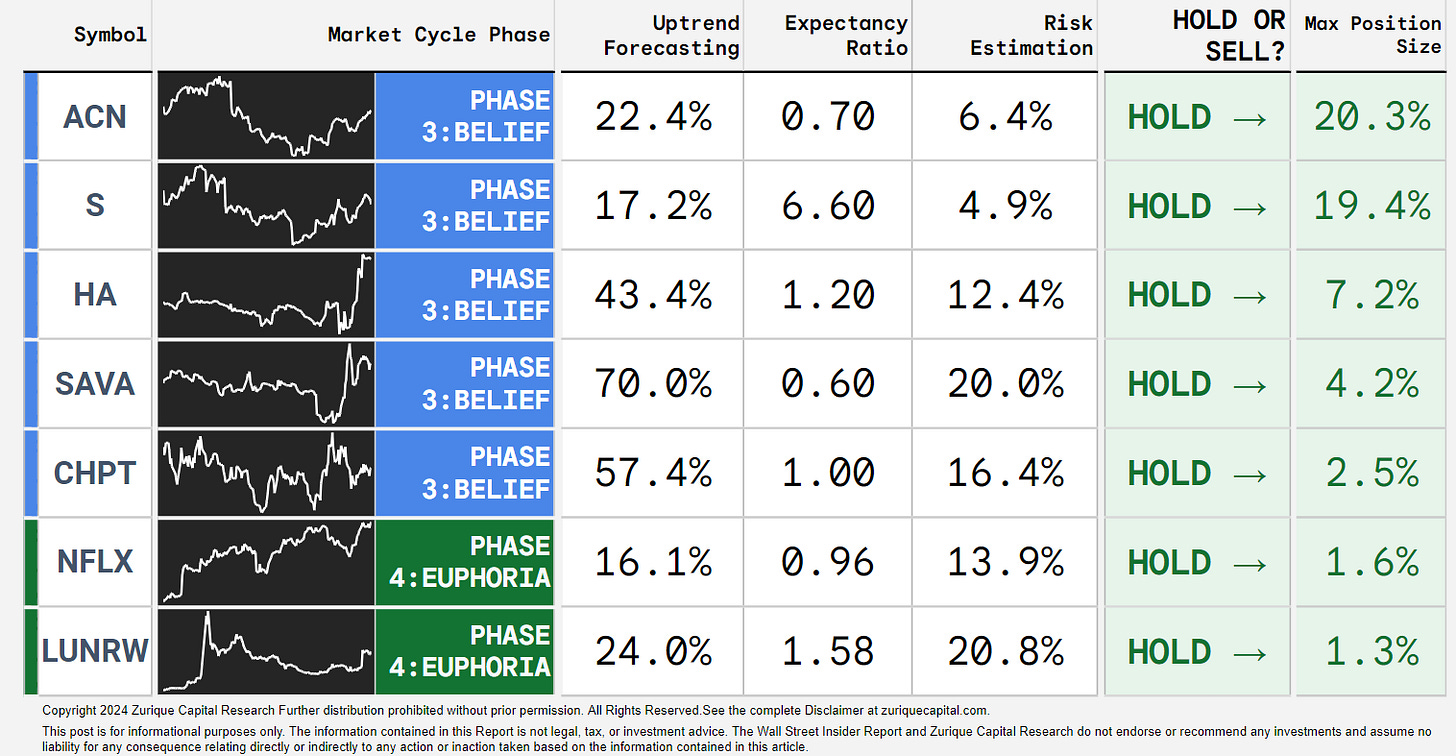

Our Alpha Hedge AI algorithm has identified today’s top 7 assets based on investor attention, market volatility, and Google search trends: ACN 0.00%↑ S 0.00%↑ HA 0.00%↑ SAVA 0.00%↑ CHPT 0.00%↑ NFLX 0.00%↑ LUNRW 0.00%↑

STEP 1: OPPORTUNITY MARKET SCANNER

The Alpha Hedge AI Algorithm decodes market movements to identify assets with high long-term growth potential.

STEP 2: USE MATHEMATICS TO MAXIMIZE WEALTH

Optimize buy and sell decisions by analyzing market cycles to pinpoint the perfect moment to act. Discover high-potential assets, use math to maximize wealth with minimal risk, achieving the ideal portfolio balance.

STEP 3: TOP MUST-WATCH ASSETS

Assets in Phases 3 or 4 with strong quantitative data are given higher weight; all the others are excluded.

These are the assets driving market activity today. But here’s the thing — while these assets are hot right now, AI can do even more. By leveraging market volatility and investor attention data, it doesn’t just help you capture today’s gains. It positions you to grow your wealth exponentially over time.

Have access to more insights like this every day—ensuring you’re always in a position to make informed investment decisions, even during turbulent market conditions.

Follow our Notes and access all the assets analyzed in the day:

I’ll reveal how you can access our AI-powered Alpha Hedge AI Algo Portfolio — a hands-off solution for building wealth in any market condition.

The Secret to Long-Term Wealth: AI + Alpha Hedge AI Algo Portfolio

What if you could consistently grow your wealth — not by chasing trends, but by getting ahead of them?

That’s what our Alpha Hedge Portfolio is all about. Powered by AI and backed by real-time data like Google Search Volume, this portfolio is designed to:

Manage volatility with precision

Capture opportunities others miss

Optimize your taxes for maximum gains

Grow your wealth exponentially, all while you focus on other things

This isn’t just about today’s hot assets. It’s about building wealth for the long term, leveraging AI to make informed decisions in any market condition.

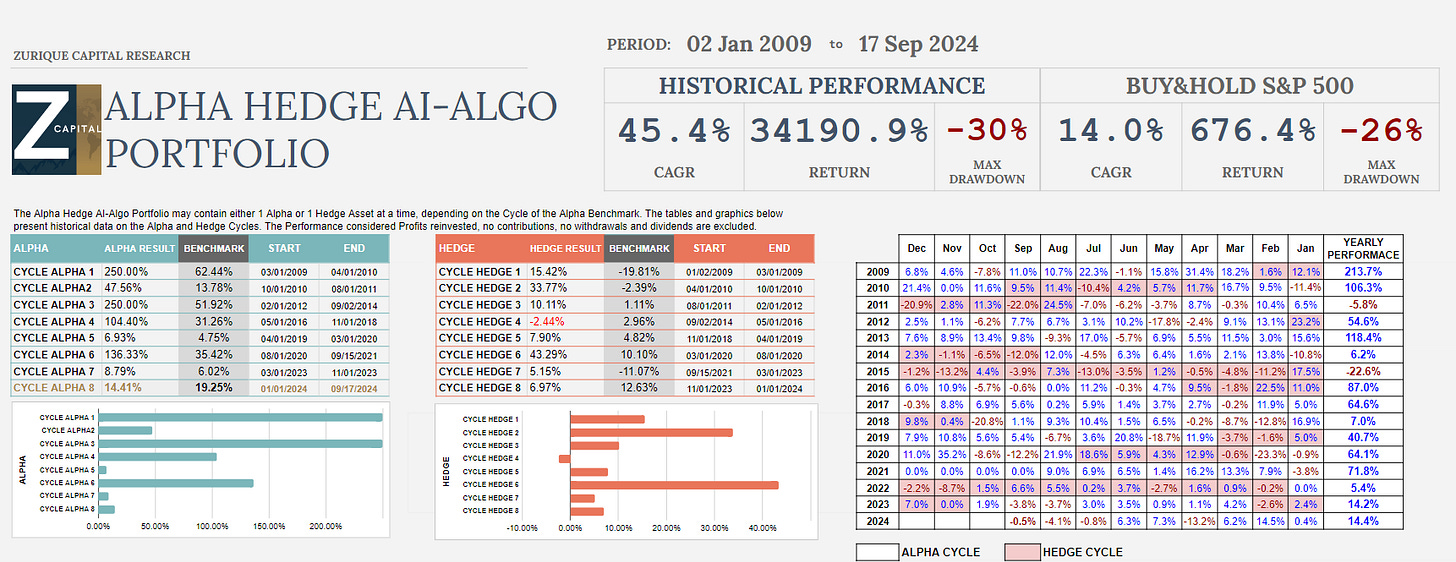

The Alpha Hedge AI-Algo Portfolio may contain either 1 Alpha or 1 Hedge Asset at a time, depending on the Cycle of the S&P500.

The tables and graphics below present historical data on the Alpha and Hedge Cycles. The Performance considered Profits reinvested, no contributions, no withdrawals and dividends are excluded.

Alpha Hedge AI-Algo Portfolio Review: 09/16/24

Over the past decade, we developed the Alpha Hedge Algorithm using advanced quantitative methods, machine learning, neural networks, and, more recently, AI to build a portfolio designed to exponentially grow wealth while minimizing risk.

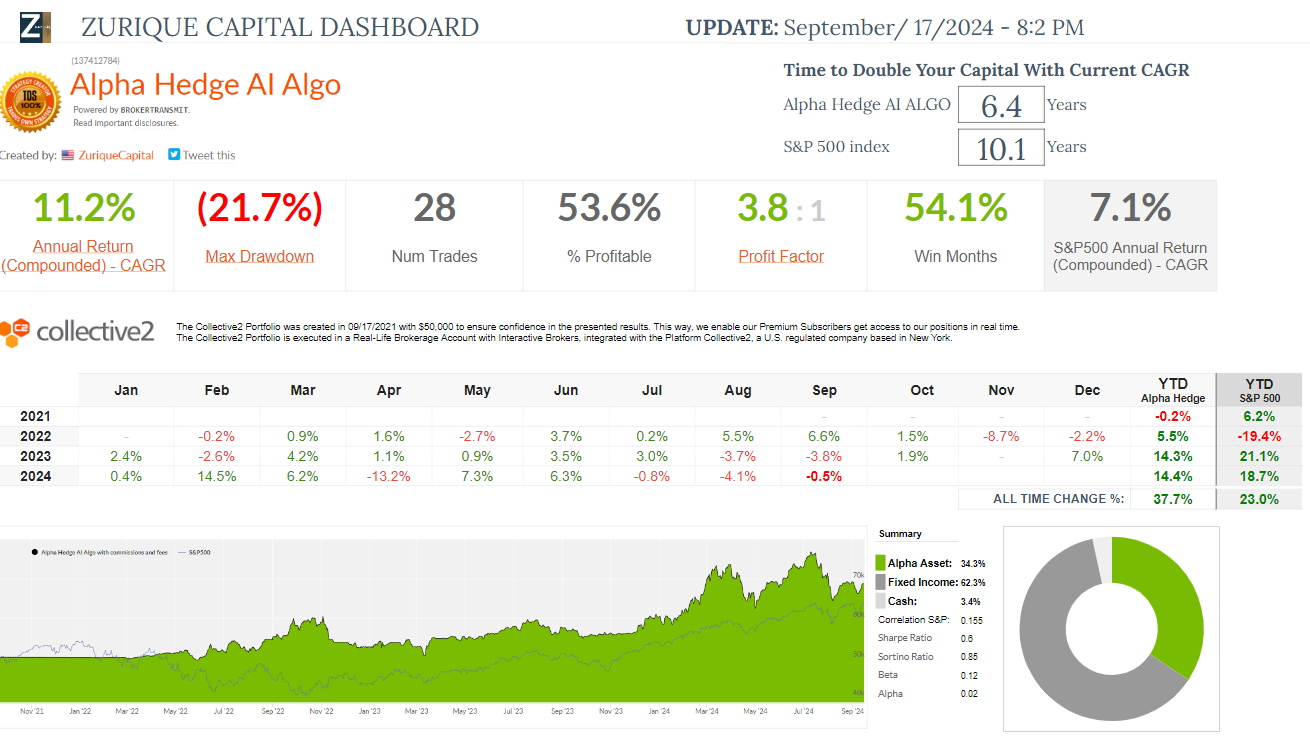

To ensure confidence in our results and uphold our commitment to full transparency, since September 2021, we have shared our performance in real time from a live brokerage account, allowing our clients to track the portfolio’s progress.

Over the past 36 months, the Alpha Hedge Portfolio has delivered a total return of 37.7% (CAGR 11.2%), compared to the S&P 500's total return of 23% (CAGR 7.1%).

The portfolio is down 0.5% this month but has gained 14.4% year-to-date.

At a CAGR of 11.2%, the portfolio doubles capital in 6.4 years, whereas the S&P 500, with a 7.1% CAGR, takes 10.1 years to do the same.

Ready to get started? Join the Wall Street Insider Report Premium and get real-time access to the Alpha Hedge Portfolio, daily AI-driven insights, and actionable strategies to grow your investments.

▶️Read what the Wall Street Insiders wrote about us↓