AI For Investment: Application of Artificial Intelligence in Stock Market

📊How These 7 Assets Could Unlock Your Wealth Potential & Alpha Hedge AI Algo Portfolio Review

Wall Street Insider Report

AI-Powered Insider-Level Insights to Exponentially Expand Wealth by Decoding Wall Street.

Join our global community of investors who are leveraging cutting-edge technology to build and preserve wealth for future generations.

AI for Investment: Application of Artificial Intelligence in Stock Market

Why Traditional Investing May Be Hurting Your Wealth

Imagine spending hours analyzing market trends, only to see your investments remain stagnant or even lose value. Sound familiar?

Traditional investing is becoming outdated in today’s fast-paced, volatile markets.

Many investors rely on gut instincts, market rumors, or slow-moving strategies. But in reality, the stock market has become too complex for human intuition to keep up.

Did you know that market fluctuations are no longer random? They’re influenced by vast amounts of data and intricate patterns that are invisible to the naked eye. What’s worse — missing these patterns can lead to missed opportunities, poor decisions, and financial stress.

The problem isn’t your skill or knowledge. It’s that traditional methods simply can’t cope with the speed and complexity of modern markets.

There’s a smarter way to invest.

The Future of Investing: Here’s What You Need to Know

The solution is simple: leverage Artificial Intelligence.

Imagine a world where your investment decisions are powered by AI — technology that can analyze millions of data points, detect hidden market trends, and predict stock movements with precision. AI doesn’t rely on guesswork or emotions; it relies on data-driven insights to give you a real edge in the market.

With AI, you can uncover opportunities that others miss. Picture this: a system that learns, adapts, and works 24/7, optimizing your portfolio for both short-term gains and long-term wealth growth.

That’s the future of investing — and it’s here today.

How AI Is Redefining Stock Market Success

We’ve discussed the power of AI in investing, but let’s take a deeper look at how this works.

According to a study by Chopra and Sharma, AI techniques like neural networks and machine learning are revolutionizing stock market forecasting. AI can detect complex patterns in non-linear stock market data — patterns that humans simply can’t see. This means AI can predict market fluctuations, identify winning stocks, and avoid losses far more accurately than traditional methods.

Key highlights from the study:

AI in Stock Market Forecasting: The paper reviews 148 studies on AI, particularly neural networks and hybrid techniques, which effectively capture non-linear relationships in stock data, improving prediction accuracy.

Challenges: Stock market forecasting is tough due to its dynamic nature. Traditional models like the Efficient Market Hypothesis (EMH) and Random Walk Theory (RW) have limitations. Newer models like the Inefficient Market Hypothesis (IMH) and Fractal Market Hypothesis (FMH) address market inefficiencies better, which AI can handle.

Popular AI Methods: Techniques like neural networks (ANNs), genetic algorithms (GAs), and hybrid models are common. Deep learning, especially CNNs and LSTMs, is popular for its computational power and handling of large datasets.

Model Characteristics:

Data Pre-Processing: Techniques like normalization and PCA are used to clean input data.

Training Algorithms: Back-propagation (BP) is a key training method to reduce errors.

Performance: Models are evaluated using accuracy, precision, and forecasting error rates.

Future Research: More robust AI models are needed, focusing on better input data selection, parameter tuning, and hybrid AI models for both short- and long-term predictions.

Now I’ll share some real-life examples of how AI can transform your investments and reveal the top assets identified by my Alpha Hedge algorithm today.

How These 7 Assets Could Unlock Your Wealth Potential

AI is reshaping the investment landscape. Meet the Top 7 Assets identified by my Alpha Hedge algorithm — a cutting-edge AI-driven tool that uncovers the best market opportunities every single day.

STEP 1: OPPORTUNITY MARKET SCANNER

The Alpha Hedge AI Algorithm decodes market movements to identify assets with high long-term growth potential.

STEP 2: USE MATHEMATICS TO MAXIMIZE WEALTH

Optimize buy and sell decisions by analyzing market cycles to pinpoint the perfect moment to act. Discover high-potential assets, use math to maximize wealth with minimal risk, achieving the ideal portfolio balance.

STEP 3: TOP MUST-WATCH ASSETS

Assets in Phases 3 or 4 with strong quantitative data are given higher weight; all the others are excluded.

What makes these assets special? They were selected by analyzing billions of data points, identifying patterns, and predicting potential price movements. While others rely on outdated methods, the Alpha Hedge algorithm captures volatility and finds growth opportunities — even in chaotic markets.

Have access to more insights like this every day—ensuring you’re always in a position to make informed investment decisions, even during turbulent market conditions.

Follow our Notes and access all the assets analyzed in the day:

These assets are powerful on their own, but I have an even better strategy to grow your wealth exponentially, using AI to minimize risks and optimize performance.

The AI-Driven Portfolio That Could Change Your Financial Future

We’ve talked about how AI can unlock hidden market opportunities, and you’ve seen the assets my algorithm has flagged. Now, it’s time to reveal the ultimate solution: The Alpha Hedge Portfolio.

The Alpha Hedge AI-Algo Portfolio may contain either 1 Alpha or 1 Hedge Asset at a time, depending on the Cycle of the S&P500.

The tables and graphics below present historical data on the Alpha and Hedge Cycles. The Performance considered Profits reinvested, no contributions, no withdrawals and dividends are excluded.

Imagine a hands-off, AI-powered investment strategy that not only identifies the best assets but actively manages your wealth for long-term growth. The Alpha Hedge Portfolio leverages advanced algorithms to:

Navigate market volatility

Minimize losses during downturns

Optimize for tax efficiency

Preserve and grow your wealth consistently

This portfolio isn’t just about following trends. It’s about making data-driven, emotionless decisions designed to maximize returns while protecting your capital.

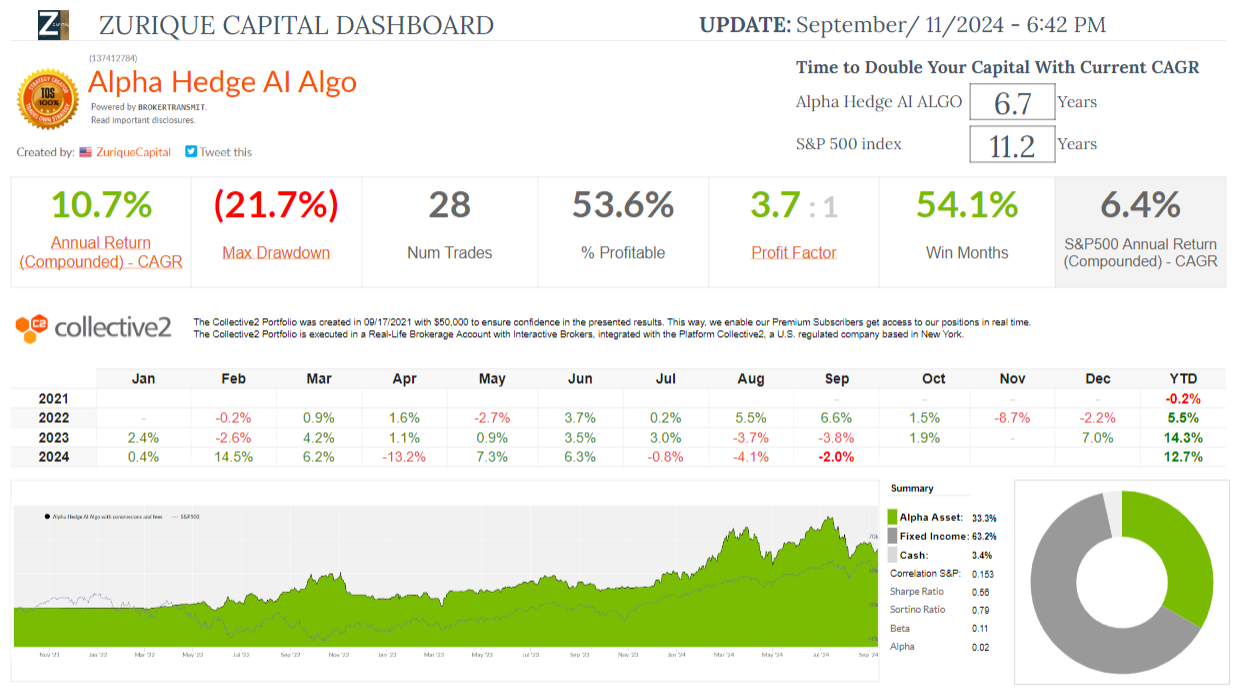

Alpha Hedge AI-Algo Portfolio Review: 09/11/24

Over the past decade, we developed the Alpha Hedge Algorithm using advanced quantitative methods, machine learning, neural networks, and, more recently, AI to build a portfolio designed to exponentially grow wealth while minimizing risk.

To ensure confidence in our results and uphold our commitment to full transparency, since September 2021, we have shared our performance in real time from a live brokerage account, allowing our clients to track the portfolio’s progress.

Over the past 36 months, the Alpha Hedge Portfolio has delivered a total return of 35.6% (CAGR 10.7%), compared to the S&P 500's total return of 20.6% (CAGR 6.4%).

The portfolio is down 2% this month but has gained 11.7% year-to-date.

At a CAGR of 10.7%, the portfolio doubles capital in 6.7 years, whereas the S&P 500, with a 6.4% CAGR, takes 11.2 years to do the same.

You deserve an investment strategy that’s built for the future — and that’s exactly what the Alpha Hedge Portfolio offers. Subscribe to the Wall Street Insider Report Premium to get real-time access to the Alpha Hedge Portfolio, daily AI insights, and monthly actionable strategies that will help you take control of your financial future.

Don’t wait — take the leap into AI-powered investing today!

▶️Read what the Wall Street Insiders wrote about us↓