📊You're Wasting Your Time and Money Switching Investments

Decode the S&P 500 Market Cycle

Wall Street Insider Report

Decoding the S&P500 Market Cycle and sharing the blueprint here in the Wall Street Insider Report.

Join +1.5k Wall Street Insiders across 30 US states and 51 countries.

You're Wasting Time and Money Switching Investments

A disciplined approach to market cycle timing, combined with long-term compounding, significantly outperforms active trading and enhances investment returns by mitigating risks associated with market fluctuations.

Investors Are Cracking Down on Market Timing Errors

Most investors struggle with maintaining a consistent investment strategy due to behavioral biases and the temptation to time the market incorrectly.

Morningstar's annual Mind the Gap report highlights that individual fund investors earn significantly less than the buy-and-hold returns of the funds themselves due to poorly timed transactions and market timing attempts.

This behavior erodes the potential benefits of compounding. When investors become more active in their attempts to time the market, they inadvertently undermine the powerful effect of compounding. Frequent trades and market reactions result in lower returns, demonstrating that a disciplined, less active approach is crucial for maximizing long-term growth.

What Folding Papers and Compounding Have in Common?

The concept of compounding is best illustrated by comparing paper folding and paper stacking. When you fold a piece of paper, its thickness doubles each time, representing geometric growth. Conversely, stacking paper involves adding a fixed number of sheets each time, demonstrating linear growth.

Initially, stacking appears more effective, but after 11 iterations, the folded pile surpasses the stacked one. By 13 folds, the folded pile reaches one meter, and by 27 folds, it towers over Mount Everest. If folded 42 times, it would reach the moon, and at 100 folds, it extends beyond the observable universe. This example underscores the immense potential of geometric growth, which far outpaces linear addition over time.

The Data Never Lies... The Secret for Generating High Returns

The Secret for Generating High Returns is low turnovers.

Even passive investors face challenges with effective turnover in cap-weighted indices like the S&P 500.

The S&P 500 has undergone numerous changes since its inception, and studies suggest that portfolios with minimal turnover often outperform their regularly updated counterparts.

Jeremy Siegel's research indicates that an original S&P 500 portfolio, if left unchanged since 1957, would have outperformed the actual index. This underscores the value of maintaining a stable investment approach, minimizing the impact of frequent adjustments and market noise.

If These Investors Found a Way... You Can Too

The critical role of patience and discipline in market cycle timing cannot be overstated.

Investors must resist the urge to react to short-term market fluctuations and instead focus on the long-term growth potential of their investments.

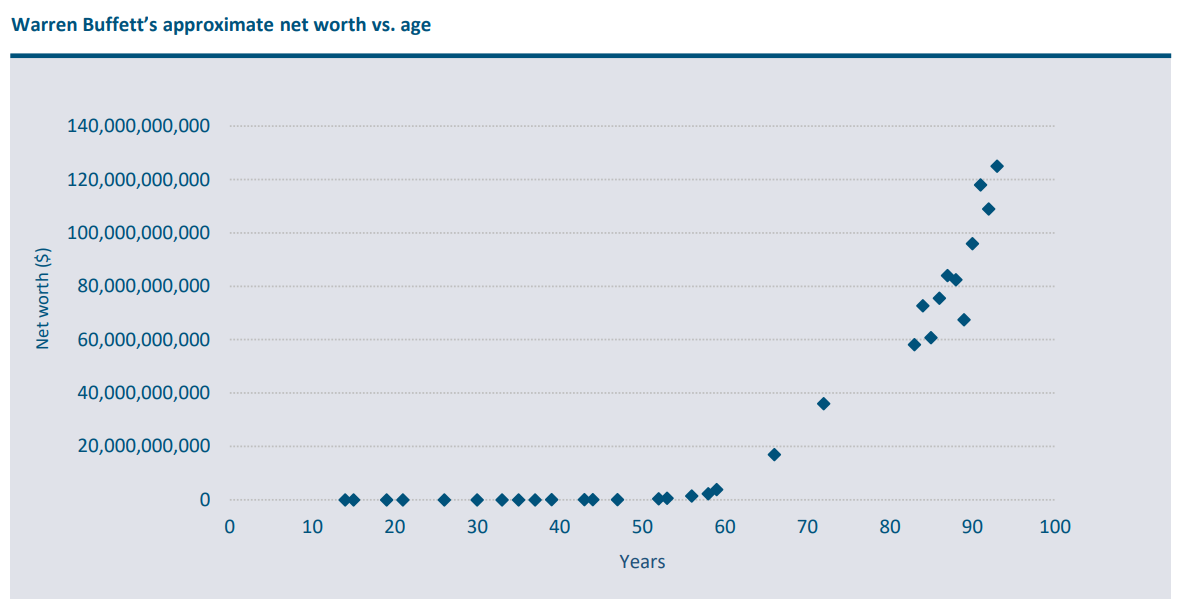

Historical examples, such as Warren Buffett's consistent long-term approach, demonstrate how patience and adherence to a market cycle timing strategy can lead to substantial wealth accumulation. Figure 3 illustrates the impact of compounding earnings at an 11% annual rate, highlighting the significant gains achievable over extended periods.

Wrapping Up

In summary, the essence of successful long-term investing lies in the discipline to stay invested and avoid the pitfalls frequent trading.

As demonstrated through historical examples and theoretical models, combining market cycle timing with long-term compounding can significantly enhance investment returns. The challenge for investors is to overcome behavioral biases and maintain a steady course, echoing Warren Buffett's advice to sit quietly and let compounding work its magic.

By adhering to a disciplined market cycle timing strategy, investors can harness the full potential of their investments, turning even modest initial sums into significant wealth over time.

References

Morningstar, Inc. (2023). Mind the Gap.

Buffett, W. (1965). Berkshire Hathaway Annual Report.

Siegel, J. (2023). Stocks for the Long Run, Sixth Edition.

Barber, B. M., & Odean, T. (2000). Trading is Hazardous to Your Wealth, Journal of Finance.

Dalio, R. (2021). Principles for Dealing with the Changing World Order.

Lindsell Train Limited (2024), A Very Long Hill.

Portfolio Review: 06/10/2024

The Alpha Hedge Portfolio rose by 0.3%, matching the S&P 500's SPY 0.00%↑ daily increase of 0.3%.

This incremental growth contributed to the portfolio's robust monthly performance, which now stands at +2.7%.

Unlock the Alpha Hedge Portfolio with the Wall Street Insider Report Premium

Over the past decade, our subscribers have outperformed the American Market Decoding the S&P 500 Market Cycle.

You too can make investment decisions based on objective data.

That's where the Wall Street Insider Report comes in. We've developed a unique approach to investment management that puts you back in the driver's seat.

Know more about our 5-Year Plan and join +1.5K Pro Investors and Finance Professionals across 51 countries who are exponentially growing their - and their clients - wealth for over a decade.↓

I greatly appreciated your article on the importance of a disciplined and long-term approach to investing. However, I have a question: how do you choose the right stocks that will truly bear fruit over time? I noticed that, at the end of the article, you mentioned the Wall Street Insider Report. Would continuing to subscribe to this report provide me with the insights and tools necessary to make well-informed investment decisions?