📊Winners & Losers of the Week #14/2024

Inside the Cycles of Bonds, Currencies, Equities, Growth Stocks and Cypto.

Winners & Losers of the Week #14/2024

Mixed results across the Markets last week.

In the equity market, the S&P 500 and the Dow Jones Industrial Average experienced slight declines, whereas the Nasdaq Composite saw modest gains, indicating a divergence in market sentiment. The bond market faced a sell-off, with 10-year Treasury yields rising, pointing towards investors' expectations of a strengthening economy.

Economic indicators such as the US manufacturing sector's expansion and a strong jobs report suggest an accelerating economy, which raises questions about the Federal Reserve's interest rate path.

The winner of the week was the Currency Portfolio, and the loser was the Bonds Portfolio. Let's dive into the performance of all the Alpha Hedge Portfolios, including Bonds, Currencies, Equities, Growth Stocks, and Crypto.

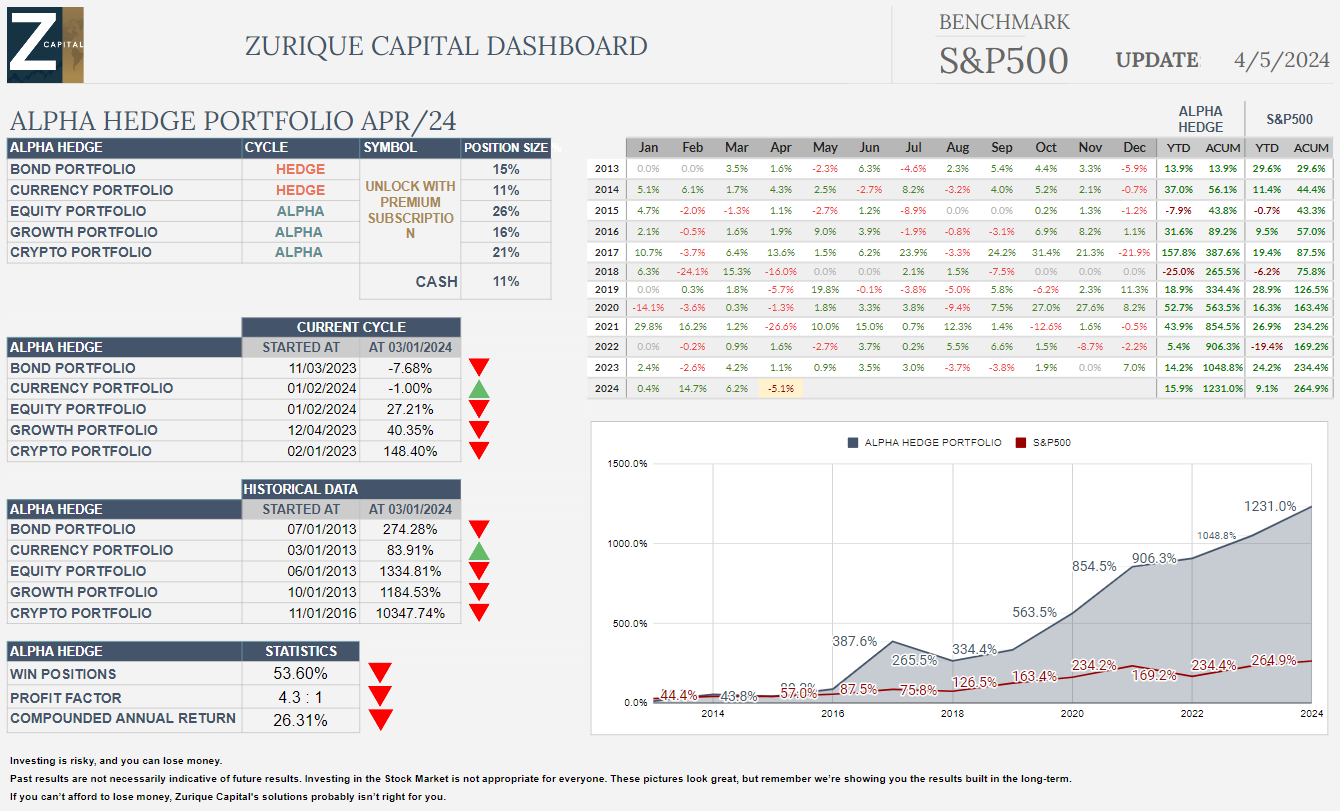

1. Alpha Hedge Portfolio

1.1. Alpha Hedge Portfolio Evolution: 2013 to 04/05/2024

The Alpha Hedge Portfolio experienced a -5.1% decrease last week. The Alpha Hedge Portfolio has yielded +1,231.0% since March 2013, and +39.7% since It became public in September 17, 2021.

2. Portfolios Evolution: Week #14/2024

2.1. Portfolios Performances

Alpha Hedge Bonds: -6.27%

Alpha Hedge Currency: +0.58%

Alpha Hedge Equity: -3.43%

Alpha Hedge Growth Stocks: -3.33%

Alpha Hedge Crypto: -4.03%

All portfolios, with the exception of the Currency Portfolio, had negative performances in Week 14 of 2024.

Combining these outcomes, the Annual Compounded Return has decreased to 26.31% since 2013, and the Profit Factor has declined to 4.3 to 1.

In 2022, the Alpha Hedge Portfolio increased 10x, yielding a 900% return on the initial investment. This was achieved without any new contributions or withdrawals, with profits and dividends excluded throughout the period.

In 2021, we restarted the 10x journey.↓

3. Alpha Hedge Collective2 Portfolio

3.1. Alpha Hedge Collective2 Portfolio Evolution: 09/17/2021 to 04/05/2024

3.1.1. Understanding the Collective2 Portfolio

The Collective2 Portfolio was established on September 17, 2021, with an initial investment of $50,000 to ensure confidence in the presented results. This Platform allows our Premium Subscribers to access the Alpha Hedge Portfolio in real-time and join us on our journey to increase our portfolio tenfold within a decade.

⚠️We execute the Alfa Hedge Strategy in a Real-Life Brokerage Account with Interactive Brokers integrated with the Platform Collective2, a U.S. regulated company based in New York.

4. Inside the Cycles

4.1. Bond Market

The 10-year Treasury yield rose 12 basis points to 4.32%, nearing its highest level of the year, indicating selling off in US bonds.

This rise in yields reflects market expectations about economic acceleration and its potential impact on the Federal Reserve's interest rate decisions and showcasing the ongoing struggles in the bond market amidst speculation about the timing of interest rate cuts.

4.1.1. Alpha Hedge Bond Portfolio

The Bond Market's driving force is the 20-Year Rate, currently in Phase 6 (Denial Phase). A Hedge Position was established in November 2023. As of April 5, 2024, this Hedge Cycle experienced a return of -7.68%, the Alpha Hedge Bond Portfolio has yielded +274.28% since July 2013.

The benchmark for this portfolio is the TLT 0.87%↑ ETF, which recorded a -16.44% performance since July 2013.

The Alpha Hedge Bond Portfolio currently represents 15% of the Alpha Hedge Portfolio.

Understand the Alpha Hedge Bond Portfolio.

4.2. Currency Market

US manufacturing sector's strength and job market resilience, can impact the Federal Reserve's path on interest rates, potentially influencing the value of the US dollar.

4.2.1. Alpha Hedge Currency Portfolio

The Currency Market's driving force is the US Dollar, currently in Phase 6 (Denial Phase). A Hedge Position was established in January 2024. As of April 5, 2024, this Hedge Cycle experienced a negative return of -1.00%, yet it has yielded +83.91% since March 2013.

The benchmark for this portfolio is the UUP 0.00%↑ ETF, which recorded a +26.44% performance since March 2013.

The Alpha Hedge Currency Portfolio currently represents 11% of the Alpha Hedge Portfolio.

Understand the Alpha Hedge Currency Portfolio.

4.3. Equity Market

The S&P 500, Dow Jones Industrial Average, and Nasdaq Composite experienced mixed performances, reflecting investor reactions to economic data, Federal Reserve commentary, and other macroeconomic events.

The equity market are having a 2024 on a high note with numerous closing records in the first quarter.

4.3.1. Alpha Hedge Equity Portfolio

The Equity Market is in Phase 3 (Belief Phase). Accordingly, an Alpha position was assembled in January/24. In this Alpha Cycle, up until April 5, 2024, it yielded a return of +27.21%, and +1334.81% since June 2013.

The benchmark for this portfolio is the SPY 0.02%↑ ETF, which had a +219.28% performance since June 2013.

The Alpha Hedge Currency Portfolio currently represents 26% of the Alpha Hedge Portfolio.

Understand the Alpha Hedge Equity Portfolio.

4.4. Growth Market

The tech-heavy Nasdaq Composite experienced slight gains. Tech leads market surge after a jobs report, indicating a strong performance by growth and tech stocks.

4.4.1. Alpha Hedge Growth Portfolio

Growth Market is in Phase 4 (Euphoria Phase). Accordingly, an Alpha position was assembled in December/23. In this Alpha Cycle, up until April 5, 2024, it yielded a return of +40.35%, and +1,184.53% since October 2013.

The benchmark for this portfolio is the QQQ 0.15%↑ ETF, which had a +458.33% performance in the same period.

The Alpha Hedge Currency Portfolio currently represents 16% of the Alpha Hedge Portfolio.

Understand the Alpha Hedge Growth Portfolio.

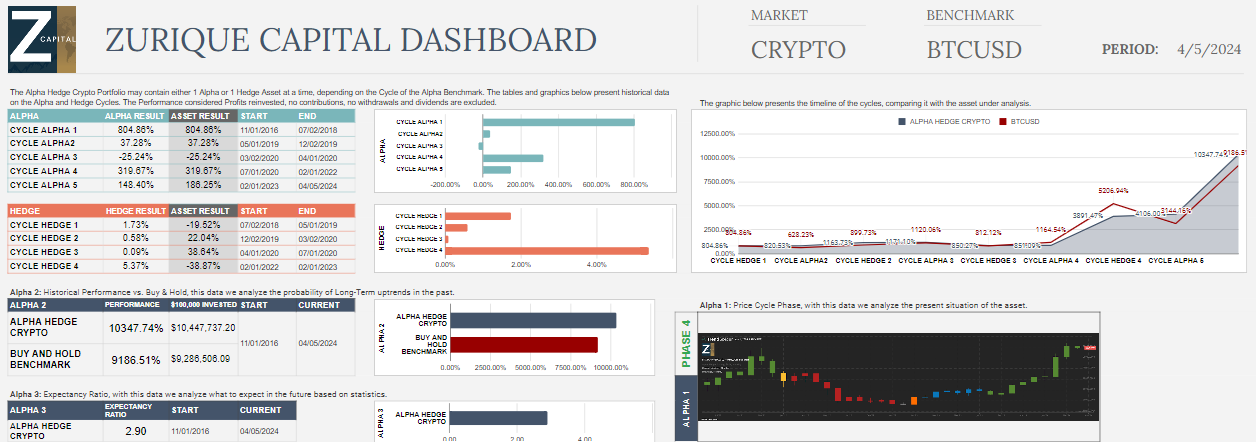

4.5. Crypto Market

The halving of Bitcoin typically serves as a bullish catalyst by reducing Bitcoin's supply.

The recent launch of ETFs may have pre-emptively increased demand, potentially dampening the halving's price impact.

The long-term outlook remains positive, with expectations of continued positive effects on Bitcoin's price and ETF flows.

4.5.1. Alpha Hedge Crypto Portfolio

Crypto Market is in Phase 4 (Euphoria Phase). Accordingly, an Alpha position was assembled in February/23. In this Alpha Cycle, up until April 5, 2024, it yielded a return of +148.40%, and +10,347.74%% since November 2016.

The Benchmark for this portfolio is the Bitcoin, which had a +9,186.51% performance since November 2016.

The Alpha Hedge Currency Portfolio currently represents 21% of the Alpha Hedge Portfolio.

Understand the Alpha Hedge Crypto Portfolio.

5. Market Cycle Mastery Course

If you want to know more details about the Alpha Hedge Strategy and Portfolio, learn about the importance of recognizing trends, understanding how timing is crucial in investments, and how the right strategy can make all the difference in your financial growth, join the Market Cycle Mastery Course:

https://www.wallstreetinsiderreport.com/s/market-cycle-mastery-course