📊Why Investing at Market Highs Can Be Your Best Move

Decode the S&P500 Stocks Market Cycle

Wall Street Insider Report

Decode the S&P500 Stocks Market Cycle. Join +1.5k Wall Street Insiders across 30 US states and 51 countries who are scaling by tenfold their investments.

Why Investing at Market Highs Can Be Your Best Move

Unlocking the Secrets to High-Market Investments

Investing at market highs can be daunting.

After reading this article you know how to navigate these turbulent waters with confidence understanding:

The historical performance of investments during market peaks;

The influence of economic recovery and Fed policies;

The importance of strategic portfolio adjustments to capitalize on these opportunities.

Discover a New Perspective on High-Market Investing

Investors often face anxiety when markets reach new highs, fearing they have missed out on gains and are stepping into a bubble.

Understanding that historical data supports investing during these times can transform hesitation into strategic action.

With this knowledge, you can make informed decisions that potentially enhance your returns, align your portfolio with macroeconomic trends, and maintain a steady course toward long-term wealth growth.

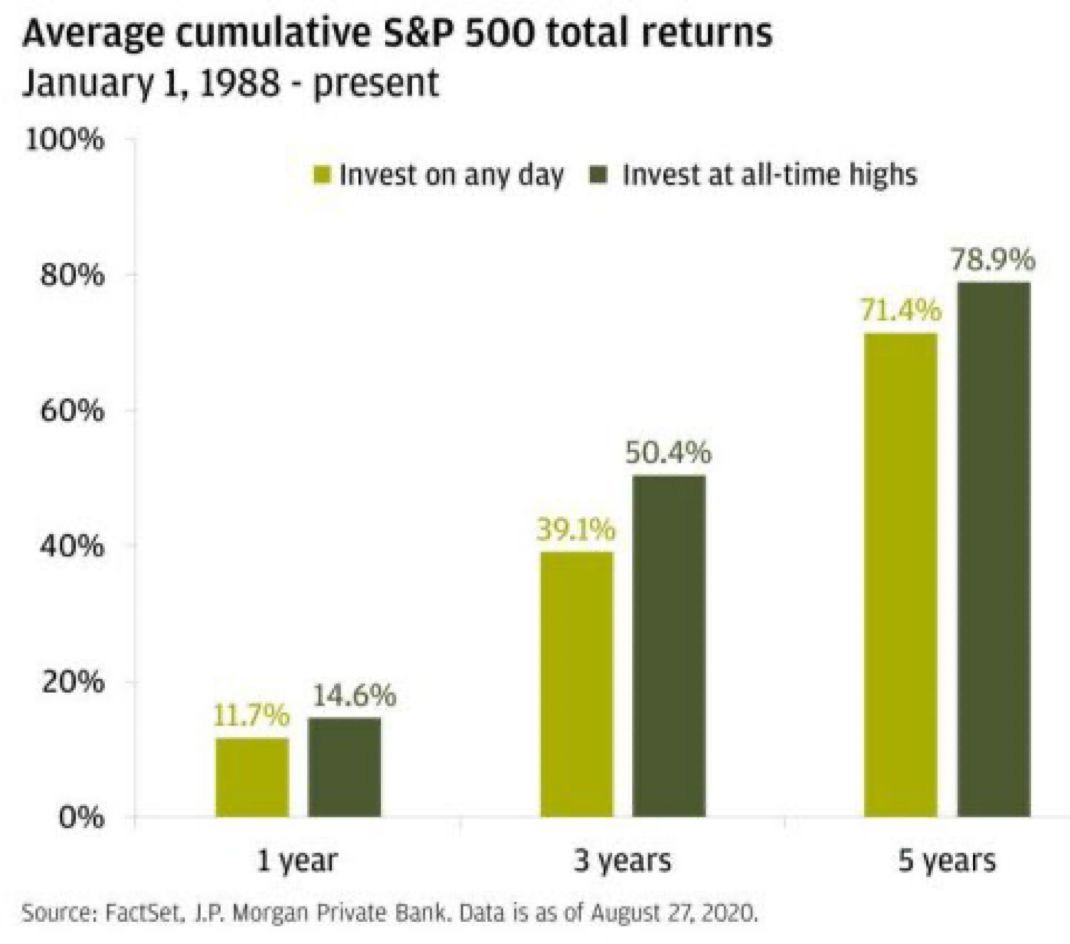

According to a JP Morgan study, investors historically had better performance buying the S&P Index at all-time highs compared to buying at any other time.

Don't Waste Time Waiting for a Market Dip

Typically, investors react to market highs in one of two ways:

FOMO Investing: Jumping in hastily due to fear of missing out, often without a solid strategy, leading to potential overexposure and high risk.

Paralysis by Analysis: Overanalyzing and hesitating, ultimately missing out on opportunities as they wait for a market correction that may not come.

The Data Speaks Volumes: Considerations for High-Market Investments

Lack of Historical Insight: Many investors do not leverage historical data that shows positive returns even when investing at all-time highs.

Overlooking Economic Indicators: Ignoring the broader economic recovery trends and the role of accommodative Fed policies can lead to missed opportunities.

Election Anxiety: Failing to see past the uncertainty of elections, many investors make reactive decisions based on short-term political outcomes rather than focusing on long-term growth.

Inadequate Portfolio Adjustments: Sticking rigidly to their initial allocations without adjusting for current market conditions leaves many portfolios vulnerable.

My Strategy for High-Market Investments

My strategy offers a structured approach to investing at market highs, emphasizing long-term gains and risk management through informed decisions. Here’s how:

Leverage Historical Data:

Invest confidently at market highs, knowing that past investments during these times have yielded higher returns on average.

Recognize that historical trends favor long-term positive outcomes, even when starting at peak levels.

Economic and Policy Awareness:

Understand the significance of economic recovery phases and how they positively impact risk asset returns.

Factor in the Fed’s accommodative policies as a backbone for market stability and growth, reducing fear of immediate downturns.

Election Outcome Perspective:

Maintain a strategic viewpoint that markets can continue to perform well irrespective of election results, focusing on broader trends rather than short-term political fluctuations.

Dynamic Portfolio Management:

Identify the market cycle.

Know the appropriate investor approach for each cycle.

Execute your rebalance (if needed) on the first Monday of each month.

Commitment to Long-Term Investment:

Promote a disciplined approach with a Market Cycles of the S&P500, avoiding reactionary movements based on market noise.

By implementing these strategies, you can transform your investment approach, turning the fear of market highs into an opportunity for calculated growth. Let’s delve deeper into each element and build a resilient investment strategy together.

Over the past decade, our subscribers have outperformed the American Market Decoding the S&P500 Stocks Market Cycle.

You too can make investment decisions based on objective data.

That's where the Wall Street Insider Report Comes comes in. We've developed a unique approach to investment management that puts you back in the driver's seat.

Know more about our 5-Year Plan and join +1.5k Wall Street Insiders across 51 countries who are scaling 10x their investments .↓