📊Why Efficient Frontier Is the Best Bet in Uncertain Times

Maximize Your Returns

Wall Street Insider Report

Expert Guidance in Wall Street. Join +1.5k Wall Street Insiders across 30 US states and 51 countries who are scaling 10x their investments Mastering the Market Cycles.

Asset allocation involves spreading your investments across various asset classes like stocks, bonds, and real estate to optimize the investment portfolio`s performance according to the investor financial goals.

Algorithms can simplify this process, focusing on broad categories of investments rather than individual stocks or bonds.

Asset allocation isn't just about choosing the right assets but aligning these choices with what investors hope to achieve financially, whether it's saving for retirement or your children's education.

Every investment decision carries a trade-off between risk and expected return.

Using concepts such as standard deviation and the efficient frontier, investors can manage these risks to form efficient portfolios that promise the best possible returns with the least risk.

The journey of asset allocation is both a strategic and a highly personalized process, guided by the principles of financial theory and individual risk tolerance.

How do you adjust your portfolio for higher returns in a scenario of increasing market risk?

Everyday our Premium Subscribers send questions through our Wall Street Direct Line, and I recently received this question:

We dynamically adjust the asset allocation based on ongoing evaluations of standard deviation across different asset classes, ensuring that our investments are always aligned with the most favorable risk-return trade-offs.

This approach ensures that as the investments grow through reinvestment of returns, they do so in a manner that is consistent with maintaining a position on the efficient frontier.

Efficient Frontier

Is a fundamental idea in investment theory, particularly in the context of portfolio management. It refers to a set of optimal portfolios that offer the highest expected return for a given level of risk or the lowest risk for a given level of return.

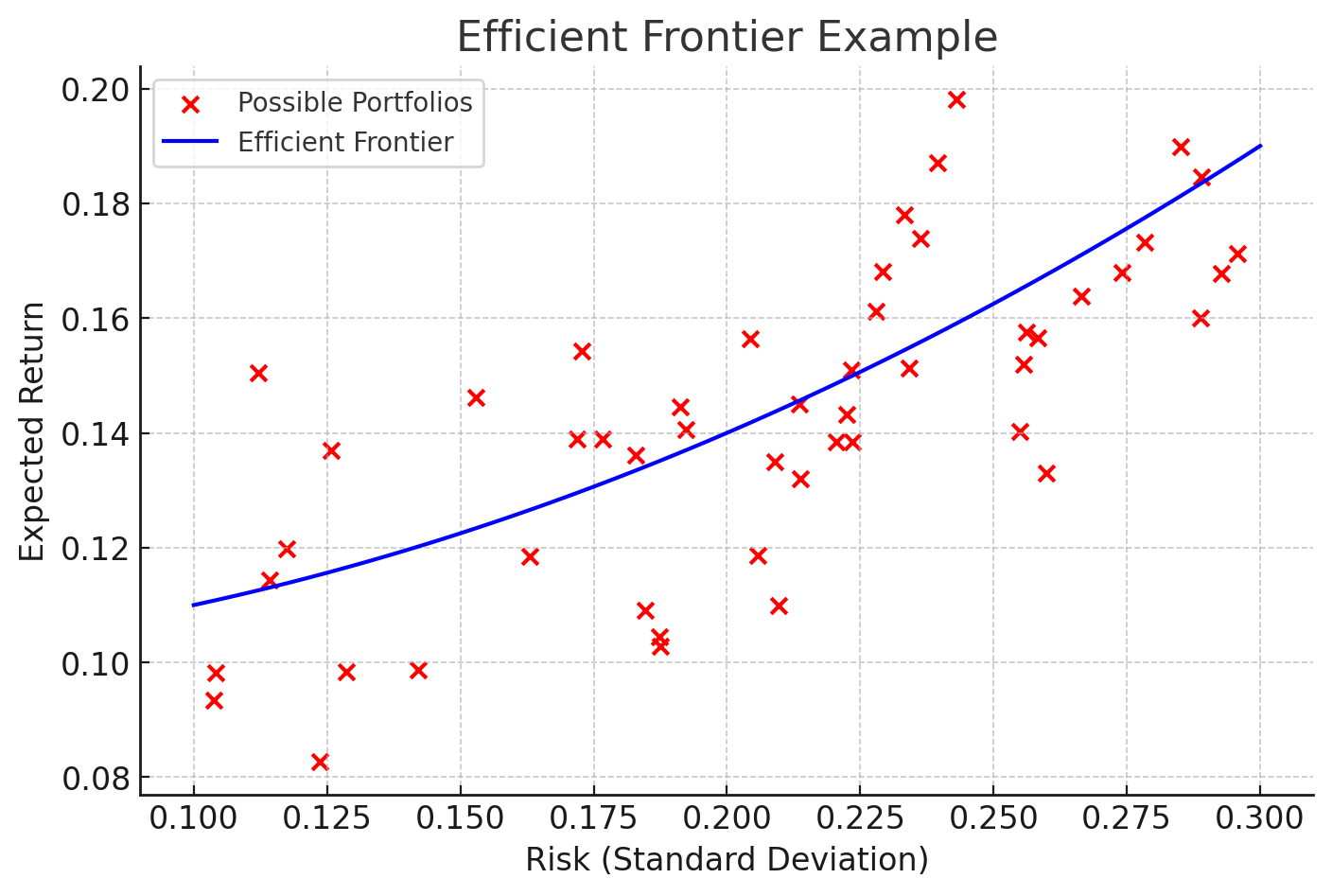

The efficient frontier is visually represented as a curve on a graph where the x-axis represents risk (usually measured as standard deviation) and the y-axis represents return. This curve helps investors identify the best possible investment portfolios that maximize returns without taking on unnecessary risk.

By choosing a portfolio on the efficient frontier, investors can achieve the best balance between risk and return based on their individual risk tolerance and investment goals.

The portfolios that fall below the curve are considered sub-optimal because they offer lower returns for the same risk, or higher risk for the same returns, compared to those on the curve.

Here is an example graph of the efficient frontier. In this graph, the blue curve represents the efficient frontier, which shows the optimal portfolios that provide the highest expected return for a given level of risk. Each point on the curve represents a different portfolio with a unique balance of risk and return.

The red dots represent possible portfolios, illustrating various combinations of risk and return. Portfolios that lie on the blue curve are optimal because they maximize returns for their level of risk, whereas those below the curve (the red dots) are sub-optimal, either offering lower returns for the same risk or higher risk for the same returns.

Given the volatile nature of markets and the sophisticated approach required to navigate them, relying on simple annual returns can severely limit the growth potential of retirement savings.

This is especially true in environments where market conditions fluctuate widely, as my strategy accounts for. By leveraging compound returns, I aim to optimize the growth trajectory of investments, ensuring that each dollar invested works harder over time, thus securing a more robust financial cushion for retirement.

Mastering the Market Cycle

Over the last decade, we have helped our clients scale their investment portfolios by tenfold, mastering the Market Cycles and I sharing the blueprint here, in the Wall Street Insider Report.

If you want expert guidance to elevate the investment journey with personalized support and follow my Portfolio, in Real Time from a Real-life brokerage account, subscribe today and join +1.5k Wall Street Insiders across 30 US states and 51 countries.