Why 'Buy and Hold' May Not Hold Up

Rethinking Investment for Real Life: Time is not risk management.

Why 'Buy and Hold' May Not Hold Up

Time is not risk management

Imagine this: It’s the year 2000. You’re a proud investor. You bought stocks, confident that markets always go up over time. Then, the dot-com bubble bursts. In a matter of months, your portfolio has plummeted. It feels like you’re drowning, but you remember the mantra: Just hold on. Now, it’s 2008. Another crash. Once again, you tell yourself: Just hold on. Then 2020 hits… and suddenly, you start to wonder: How much more can you take? How much longer do you wait?

Buy and Hold—the strategy popularized and championed as the path to wealth—is simple, elegant, and, for many, comforting. But here’s the truth: Buy and Hold may work on paper, but in real life, the timing matters. Risk matters. And most importantly… time itself runs out.

As an investment strategist, I’ve spent years analyzing what works… and what doesn’t. Today, I want to challenge the belief that Buy and Hold is a one-size-fits-all solution. Let’s rethink how we invest—not just for an economic model, but for real life.

Here’s the big idea I want to share: You can’t afford to wait for decades and hope it all works out. The market doesn’t owe you returns. You need a strategy that adapts, that protects, and that puts you in control of your financial future.

Because while Buy and Hold tells us to "ignore the noise" and "wait for the long term," the harsh truth is this: Some people wait their entire lives.

The Illusion of Simplicity

Buy and Hold feels simple. "Buy great stocks and hold forever." But what’s often overlooked is the effort, skill, and intelligence required to make it work.

Warren Buffett didn’t get his success just by buying and waiting. He actively manages risk. He uses derivatives. He hedges against market movements. In his own words, “Rule number one is never lose money. Rule number two is never forget rule number one."

And yet, most Buy and Hold investors ignore this part. They’re told to weather every storm, even as their portfolio gets battered. The dot-com crash? 2008? 2020? Each time, it can take years to recover… or worse, some stocks never recover at all.

Let me ask you this: If you bought a house, would you sit back and ignore a leaking roof or a crumbling foundation, assuming it will fix itself? No! So why do we take this passive approach with our investments?

Timing Matters

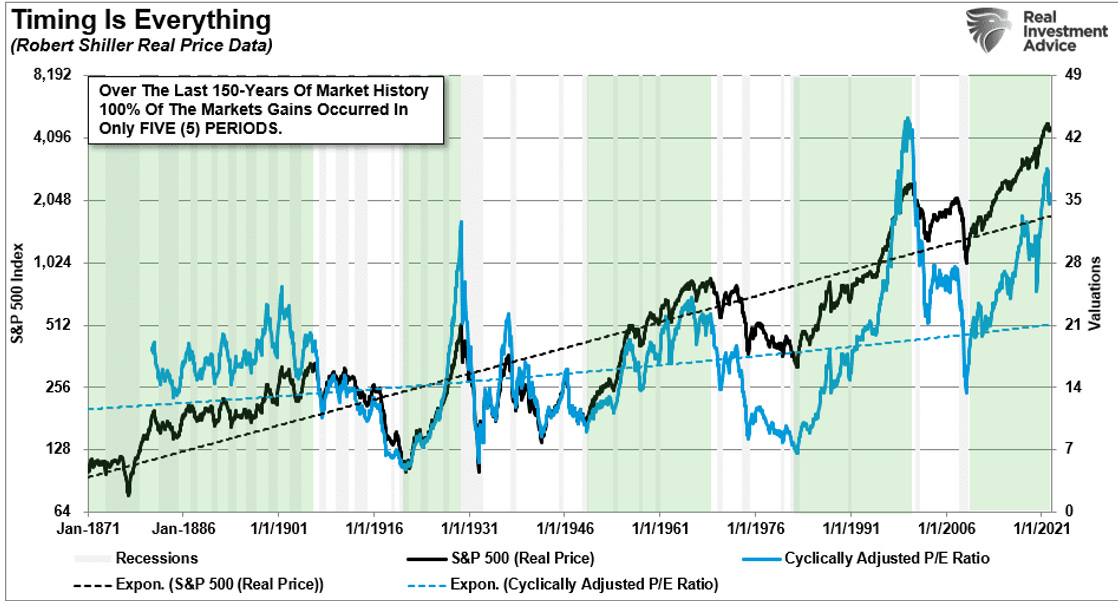

Here’s a fact most people don’t talk about: Timing is everything. If you retire during a market downturn, Buy and Hold doesn’t care. If your "long term" happens to begin in 2000 or 2008, Buy and Hold says: "Tough luck."

Consider this: Historically, there have been decades where returns were negative. In 5 out of 9 major market cycles since 1871, investors actually lost to inflation—for ten years straight. Ten years of waiting, only to see your money worth less.

And what about real life? No one lives forever. One day, you’re going to need that money—for retirement, for your family, for your dreams. Can you really afford to just wait?

Price Always Matters

Another dangerous myth? That prices don’t matter when you Buy and Hold. But let’s be honest: Prices always matter. Whether you’re buying a car, a house, or even a coffee… the price matters.

If you wouldn’t overpay for a Ferrari, why would you overpay for a stock? But many Buy and Hold investors do exactly that. They buy indiscriminately, assuming prices don’t matter because they’re in it for the “long term.”

Here’s a truth bomb: When you ignore price, you risk turning an investment into a gamble.

The Reality of Your Future

Let’s pause for a moment and talk about what really matters: Your life. Your future. Your family.

Imagine you’re 65 years old. You worked hard your entire life, saving diligently. You retire, ready to enjoy the fruits of your labor. But then, the market crashes. Suddenly, that nest egg you worked so hard for is cut in half. What do you do? Go back to work? Delay retirement? Live with less?

This is what happens when we blindly trust Buy and Hold. It’s not just numbers on a screen—it’s your future, your security, your freedom. And you deserve better.

A Smarter Way Forward

So what’s the solution? How do we invest smarter, safer, and with more control?

I believe in a strategy that combines the best of Buy and Hold with something far more important: Risk management and adaptability.

Here’s my approach:

Buy and Hold only when prices and trends are in your favor.

Protect your portfolio during market downturns. Use tools like stop-loss strategies and hedging techniques.

Be active, not passive. Investments require attention—not reckless trading, but disciplined adjustments to manage risk.

Because in the real world, you don’t win by ignoring the market. You win by understanding it… and by staying one step ahead.

Closing Vision

To those who say, “Just hold on,” I say: Hold on to your future. Hold on to your dreams. But don’t hold on to bad advice.

Buy and Hold is not a golden rule. It’s a tool—one of many—and it’s up to you to use it wisely. Be an investor who adapts, who protects, and who controls their financial destiny.

Because at the end of the day, investing isn’t about waiting forever. It’s about living the life you want—when you want it.

▶️Read what the Wall Street Insiders wrote about us↓