📊What Pro Investors Think About a Concentrated S&P 500

Today's Wall Street Insights: S&P 500 and Beyond.

Wall Street Insider Report

Decoding the S&P500 Market Cycle and sharing the backstage.

Join +1.5k Wall Street Insiders across 30 US states and 51 countries.

6:00 AM - Early Bird Gets the Worm

What Pro Investors Think About a Concentrated S&P 500

The top 10 companies now make up 35% of the S&P 500 SPY 0.00%↑, surpassing the 2000 Dot-com bubble peak. This highlights a growing dependency on big tech, with Nvidia $NVDA alone contributing 39% of the market cap gain year to date.

Here is the plot: A concentrated S&P 500 can maximize your returns.

The Impact of Market Concentration on Investment Strategies

Example: In a concentrated portfolio of $100,000 invested entirely in one index, a 10% gain results in a $10,000 increase.

In a diversified portfolio of $100,000 spread across 10 indexes ($10,000 each), a 10% gain in one asset yields only a $1,000 increase.

The absolute gain from the concentrated portfolio ($10,000) far exceeds the gain from the diversified portfolio ($1,000), despite the same percentage increase in the asset.

Understanding and leveraging the S&P 500 SPY 0.00%↑ concentration is crucial for long-term success as long as the investor can identify the cycles and enter and exit at the right time.

But this was only one of my market analysis, join me through my day for more insights about the S&P 500 and Beyond. ↓

8:30 AM - Opening Insights

Here’s a practical way anyone can diversify globally

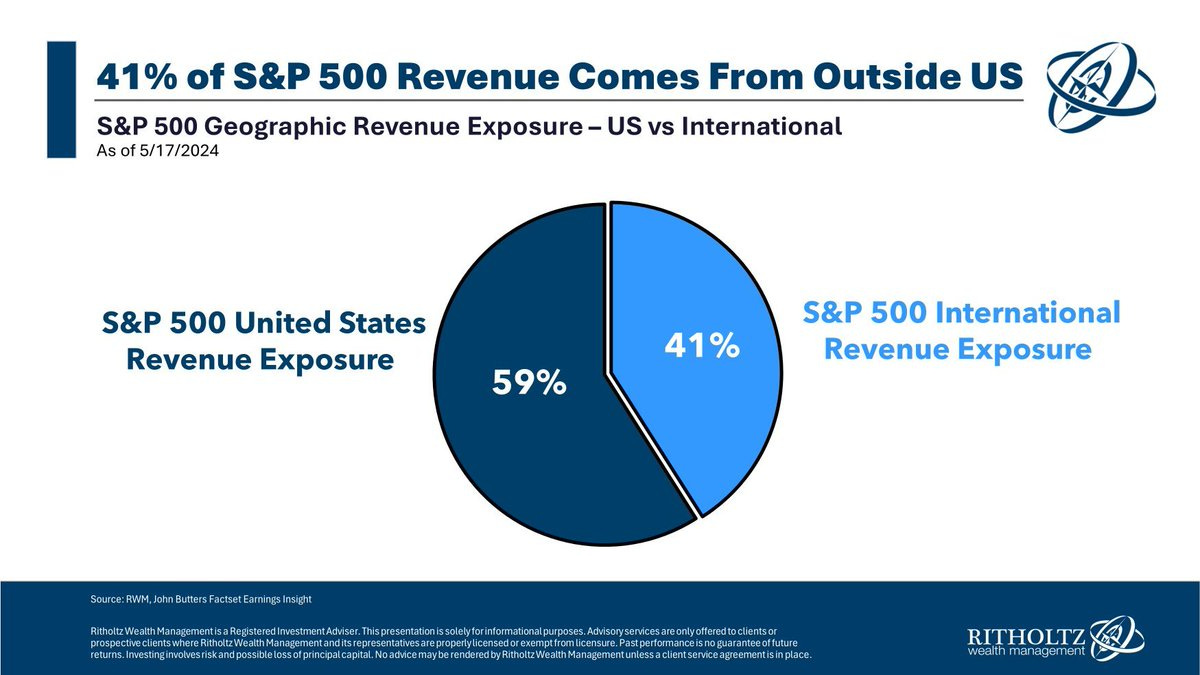

US companies generate about 41% of S&P 500 SPY 0.00%↑ revenues from abroad. This means that investing in US firms is not limited to US exposure alone.

Many US corporations also operate globally, presenting a broader investment landscape. As these international operations expand, investors can enjoy global growth through these firms.

This dual exposure can lead to more significant returns over time. Investors gain the advantage of both domestic stability and international growth potential.

US stocks can be powerful proxies for global market participation. Diversifying within US equities though the S&P 500 SPY 0.00%↑ can provide substantial international exposure.

10:00 AM - Today’s Highlights

S&P 500 Stock Highlight: FSLR 0.00%↑

First Solar is poised for a significant rise, undervalued and now capitalizing on the AI-driven electricity demand surge.

The AI boom has increased global electricity consumption, pressuring grids and pushing companies to seek sustainable energy solutions.

First Solar's stock recently soared 30%, driven by UBS’s recognition of its AI potential and China’s support for the solar sector.

In response, First Solar is expanding its U.S. manufacturing and advancing solar technologies to boost efficiency and margins. This proactive strategy will solidify its position as a leader in the renewable energy market.

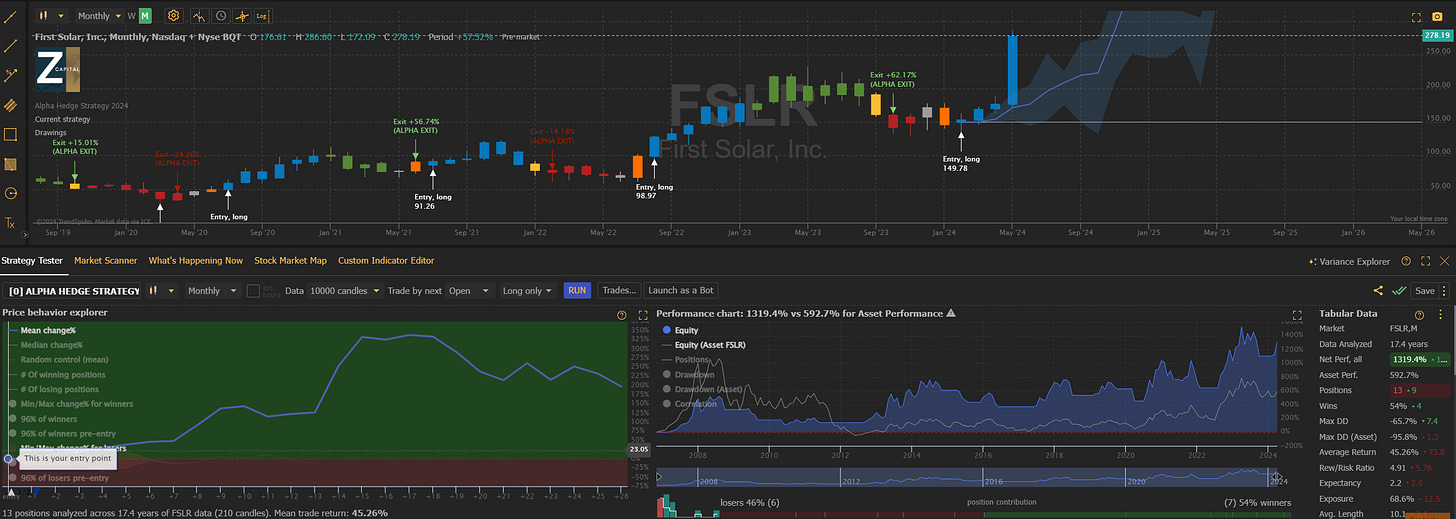

FSLR 0.00%↑ Alpha Hedge Algorithm Analysis

S&P 500 Exposure: 0.05%

Phase Of the Cycle: 3 (Belief Phase)

Alpha Hedge Algorithm Performance: +1,319.4% in 17.4 Years

Buy & Hold Performance: +592.7% in 17.4 Years

12:00 PM - Midday Break

Jack Schwager | Trading Lessons from Market Wizards

I recently watched Jack Schwager | Trading Lessons from Market Wizards video from Investors Underground Channel on Youtube, an this was the top insights I learned.

1. The Secret for Creating a Resilient Investment Strategy

Patience and adaptability are paramount in investing world, as Jack Schwager elucidated in Trading Lessons from Market Wizards YouTube video from Investors Underground channel.

Schwager emphasizes that the real money is made by staying with good long-term positions and adapting to market changes.

By incorporating patience, traders can avoid the pitfalls of emotional decisions and market inefficiencies, thus achieving sustained success.

Ultimately, recognizing the necessity of patience and adaptability allows investors to navigate the complexities of trading with greater ease and effectiveness.

2. A Practical Way That Anyone Can Use to Improve Their Investments

Investors must heed Jack Schwager's advice to enhance their trading acumen.

Practicing patience, adopting technical analysis, and recognizing market inefficiencies are critical steps.

For instance, Warren Buffett's long-term investments and the GameStop short squeeze exemplify these principles $GME.

By integrating these strategies, investors can mitigate risks, capitalize on market anomalies, and achieve superior returns, aligning with the timeless wisdom shared by Schwager.

2:00 PM - Afternoon Grind

5 Reasons Why Investors Should Forget the Dow Jones Index

Tunnel Vision: The Dow's 30 companies offer a myopic view of the market.

Illusions of Grandeur: A limited scope can create a distorted picture of market health.

The Big Picture: The S&P 500's vast coverage of 500 companies paints a more accurate market portrait.

Hidden Gems: Sticking to the Dow means missing out on key market movements and opportunities.

Global Growth Edge: With 41% of S&P 500 revenues from abroad, investing in these US firms offers both domestic stability and international growth.

4:00 PM - Closing Bell

6:00 PM - Key Visuals

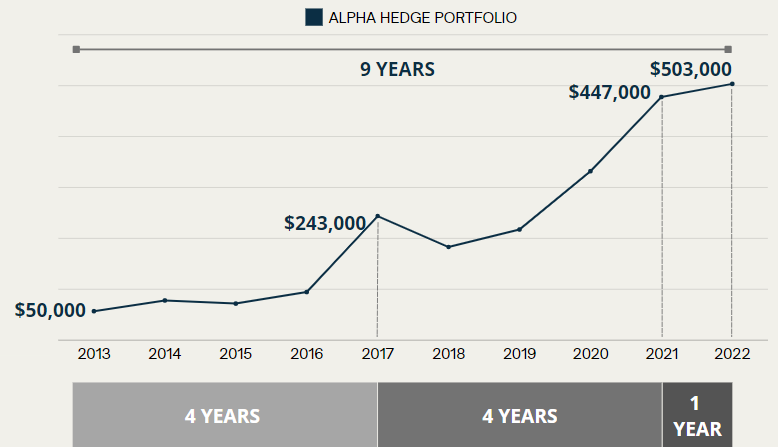

Why Long-Term Investment Strategies Outperform Short-Term Gains

It's imperative reinvesting returns and dividends. Investors harness the power of exponential growth over time.

The ultimate goal is to amass a sizable nest egg, ready to be drawn upon when retirement arrives, ensuring financial stability and peace of mind.

Compounding is the cornerstone of long-term financial health.

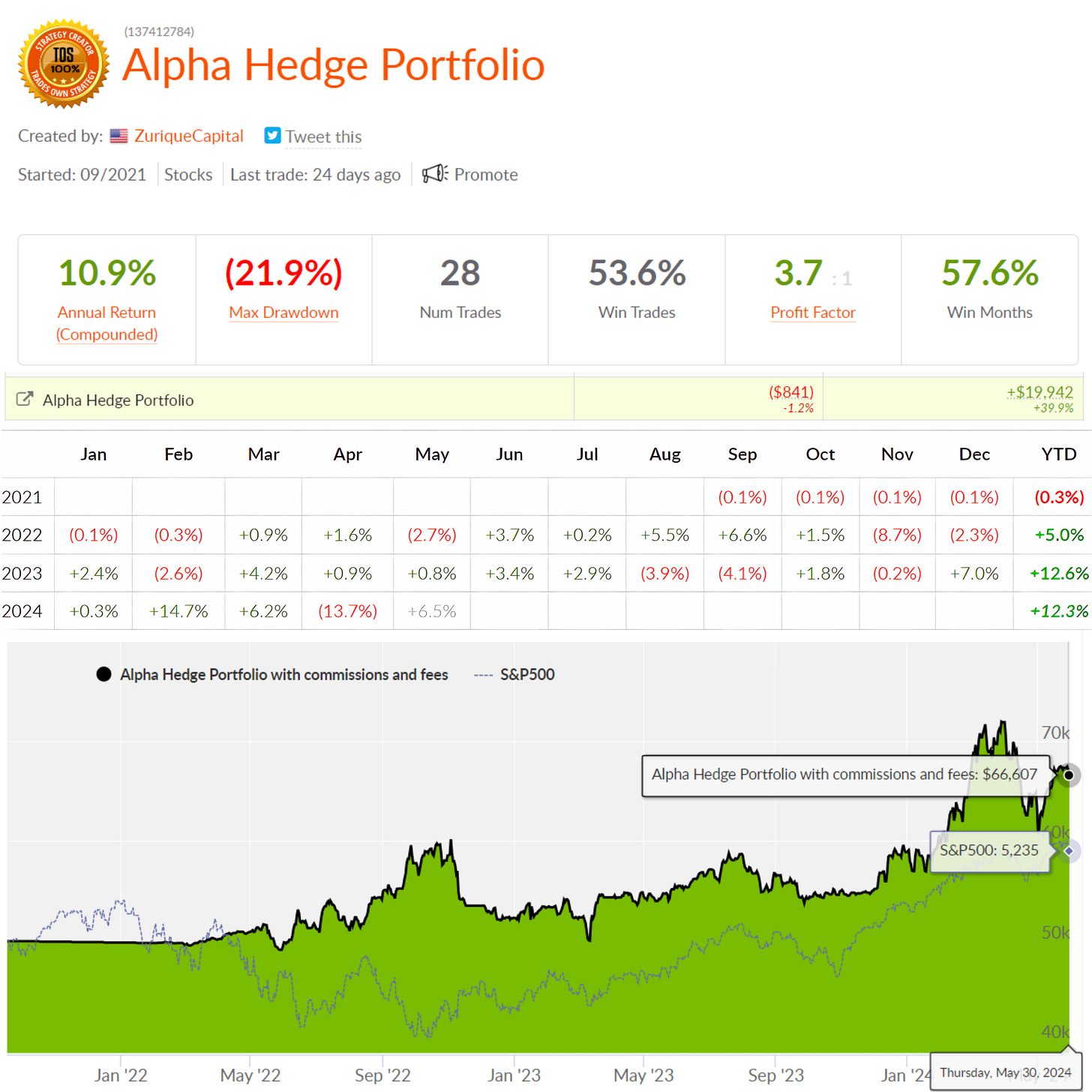

See the power of compounding in our Alpha Hedge Portfolio, It took 9 years to increase by tenfold the initial investment decoding the S&P 500 Market Cycle SPY 0.00%↑.

In 2022 we restarted this journey, and we are sharing the blueprint here in the Wall Street Insider Report. Subscribe today and unlock the Alpha Hedge Portfolio

Know more about our 5-Year Plan and join +1.5k Wall Street Insiders across 51 countries who are scaling 10x their investments .↓