Wall Street Wizardry: Market Analysis With Scientific Lens

+ AI Investment Bot: Top 7 Assets of the Day & Alpha Hedge AI-Algo Portfolio Review: 10/23/24

Wall Street Wizardry: Market Analysis With Scientific Lens

In Wall Street, financial expertise is often seen as the cornerstone of success, one figure stood out by choosing a distinctly different path. Simon, a visionary in his own right, adopted a hiring philosophy that veered away from the norm.

His approach was not only unconventional but revolutionary, preferring the analytical minds of physicists and mathematicians over seasoned financial professionals. What drove this seemingly counterintuitive strategy, and why did it work?

Breaking the Mold: No Finance Experts Allowed

Simon's strategy was clear cut—no finance experts! He sought individuals who could analyze the market through an entirely new perspective, one not clouded by traditional financial theories. This unique view came from across scientific disciplines, found in physics departments and math labs. He believed these individuals had the ability to discern patterns, or as he saw it, the 'matrix', that eluded conventional analysts.

The Science Behind the Strategy

But why was this approach successful? Was it merely the power of mathematics and physics, or was there something more significant at play? Simon perceived the financial markets as a complex physics problem needing sophisticated solutions. While the concept of utilizing math to manage risk is not groundbreaking, Simon's vivid reimagining of it was. By recruiting those who were adept at discovering intricate patterns and relationships, Simon transformed the approach to market analysis completely.

Conclusion

Simon's story exemplifies how breaking from convention and inviting fresh perspectives can yield fruitful outcomes. While traditional finance experts provide value, the success achieved by employing physicists and mathematicians shows the potency of interdisciplinary approaches. It leaves us with a lingering question: In what other areas of business might scientific insight offer profound breakthroughs? The nexus of science and finance suggests an intriguing frontier worth exploring.

AI Investment Bot: Top 7 Assets of the Day

Here’s How We Find These Market Opportunities:

Have access to more insights like this every day—ensuring you’re always in a position to make informed investment decisions, even during turbulent market conditions.

Follow our Notes and access all the assets analyzed in the day:

Alpha Hedge AI Algo Portfolio Review

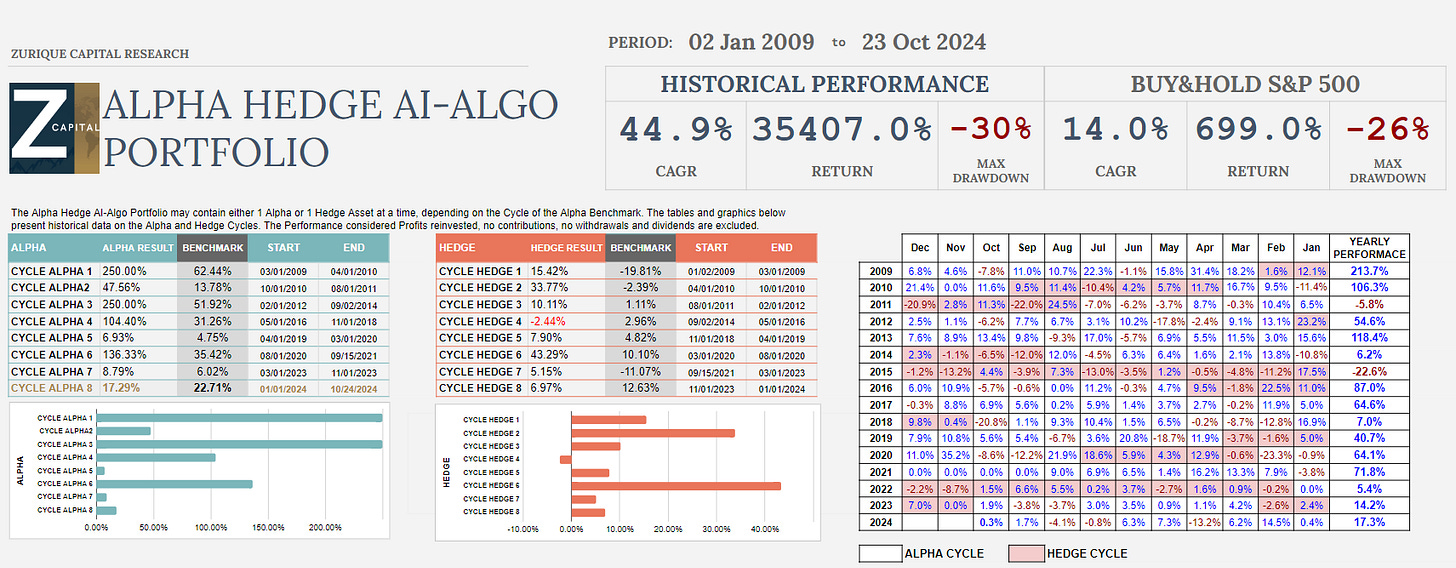

The Alpha Hedge AI-Algo Portfolio may contain either 1 Alpha or 1 Hedge Asset at a time, depending on the Cycle of the S&P500.

The tables and graphics below present historical data on the Alpha and Hedge Cycles. The Performance considered Profits reinvested, no contributions, no withdrawals and dividends are excluded.

Alpha Hedge AI-Algo Portfolio Review: 10/23/24

Over the past decade, we developed the Alpha Hedge Algorithm using advanced quantitative methods, machine learning, neural networks, and, more recently, AI to build a portfolio designed to exponentially grow wealth while minimizing risk.

To ensure confidence in our results and uphold our commitment to full transparency, since September 2021, we have shared our performance in real time from a live brokerage account, allowing our clients to track the portfolio’s progress.

Over the past 37 months, the Alpha Hedge AI Algo Portfolio has delivered a total return of 41.2% (CAGR 11.7%), compared to the S&P 500's total return of 26.5% (CAGR 8.2%).

The portfolio is currently up 0.3% this month and has gained 17.3% year-to-date. At a CAGR of 11.7%, the portfolio doubles capital in 6.2 years, whereas the S&P 500, with an 8.2% CAGR, takes 8.8 years to do the same.

The portfolio has experienced a maximum drawdown of 21.7% and has been profitable in 57.1% of its 28 trades, with a profit factor of 4.1.

Why Choose the Alpha Hedge AI-Algo Portfolio?

AI Investment Management: Our AI algorithms continuously adapt to market conditions, mitigating risks associated with unpredictable fluctuations.

Wealth Exponential Expansion: By harnessing AI's predictive capabilities, the portfolio seeks out high-growth opportunities, accelerating your wealth accumulation.

AI Investment Advisor for Tax Optimization: Strategic investment choices are made with tax efficiency in mind, maximizing your net returns.

Transparency: We operate with radical transparency, offering you full visibility into a live brokerage account. Monitor your investments in real-time and see exactly how your assets are managed.

Subscribe now, and let AI work for your financial future.

▶️Read what the Wall Street Insiders wrote about us↓