Decode Wall Street

Decode Wall Street’s Moves From the Inside

Decode Wall Street

with the Wall Street Insider Report Premium

Decode Wall Street’s Moves From the Inside.

Join 2k+ Global Investors across 67 Countries. ↓

INVESTORS DILEMMA

In today’s market, information is everywhere, but clarity is rare.

The internet, once a tool for insight, has devolved into a maze of noise: conflicting opinions, biased analysis, and content written by people who have never managed real capital.

Even professionals face the same challenge: how to cut through the noise and act on signal.

At Zurique Capital, we believe the answer is not more opinions, it’s objective, quant-driven data. Markets move in cycles, and those who recognize the rhythm outperform. Those who chase headlines fall behind.

For more than a decade, our portfolio has consistently outperformed the S&P 500 by applying a disciplined, quant-based approach built on market cycle intelligence.

Alpha Hedge AI Algo Portfolio (08/2008 – 08/2025): 16,195.5%

S&P 500 (08/2008 – 08/2025): 556.93%

The results speak for themselves.

The Wall Street Insider Report was built for investors who want to stop guessing and start compounding wealth with precision. It gives you direct access to the strategy that has delivered market-beating performance, with full transparency, and zero noise.

Decode Wall Street’s Moves From the Inside.

Join 2k+ Global Investors across 67 Countries. ↓

WALL STREET INSIDERS

▶️Read what the Wall Street Insiders wrote about us↓

FULL TRANSPARENCY

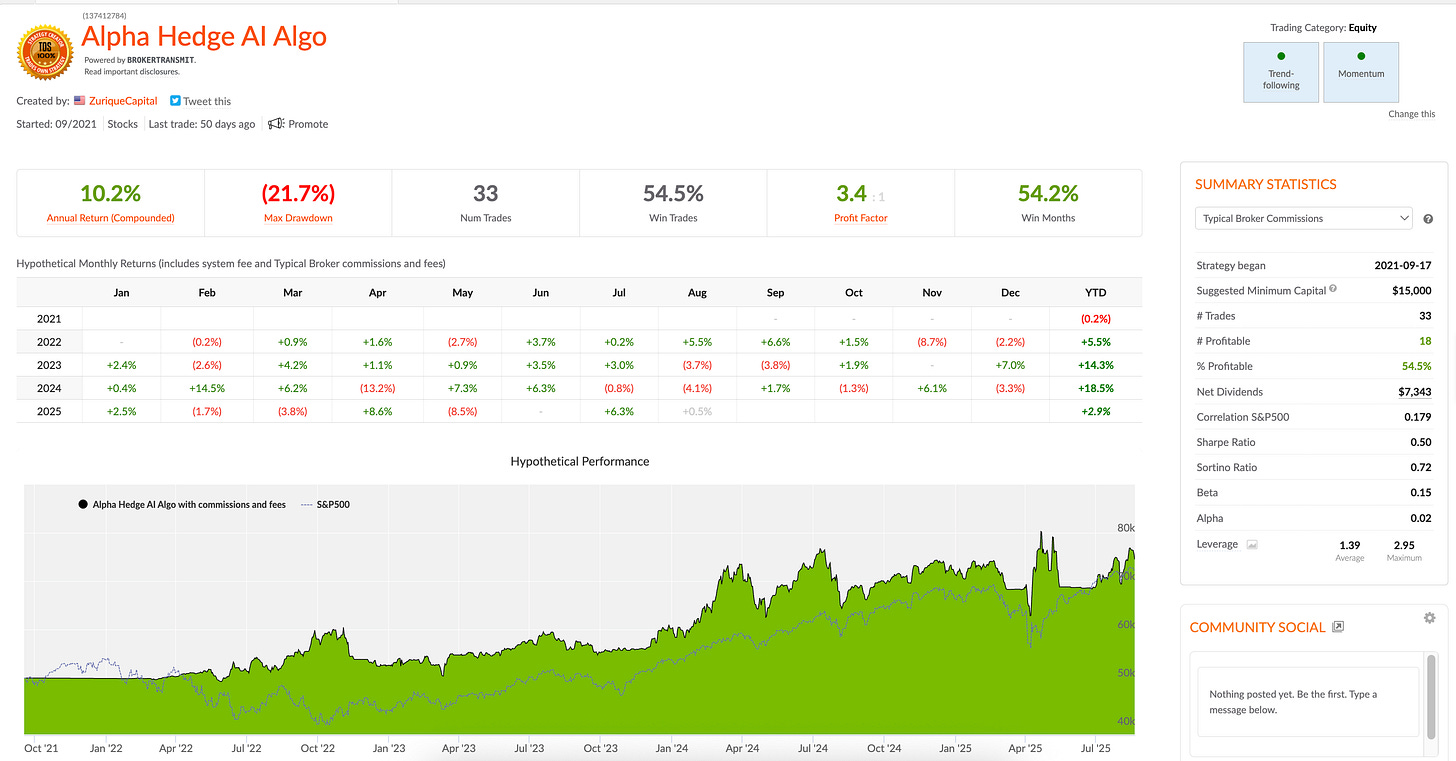

COLLECTIVE 2 ALPHA HEDGE AI ALGO PORTFOLIO

The Collective2 Portfolio was launched on September 17, 2021 with an initial capital of $50,000, not as a simulation, but as a live test of conviction. Every position is executed in a real Interactive Brokers account and mirrored through Collective2, a U.S.-regulated platform in New York.

There are no models, no backtests, and no hypotheticals.

What subscribers see is the same live portfolio we manage, positions in real time, with the full weight of capital behind them.

"Choosing to be a fintech in Wall Street was not an easy decision. Investors often face the dilemma between the desire for exclusivity and the reassurance of large institutions, which can sometimes offer impersonal services. That's where the radical transparency idea came in.”

-Dan Castro, Author of the Wall Street Insider Report & Founder Zurique Capital"

We provide full visibility into the performance of the strategy we run.

Transparency is a core principle: investors see results exactly as they are, enabling informed and confident decisions.

Decode Wall Street’s Moves From the Inside.

Join 2k+ Global Investors across 67 Countries. ↓

STEPS TO BECOMING A WALL STREET INSIDER

1. Invest with the Market Cycle

The Alpha Hedge AI Algo Portfolio adapts with precision to the rhythm of the S&P 500.

In positive cycles, capital is concentrated in a single Alpha asset. In negative cycles, it shifts into a single Hedge asset. This structured, data-driven process replaces speculation with discipline.

2. Optimize Returns, Control Risk

Outperformance is never a matter of luck.

Our portfolio management framework defines when to enter and exit each position, designed to capture gains while containing drawdowns. Over multiple cycles, the strategy has demonstrated consistent market-beating results under robust risk controls.

3. Simplify the Investment Process

Effective investing does not require complexity.

The system is built for efficiency: 15 minutes a month is sufficient to follow the signals. No need for endless analysis of companies or charts, just disciplined execution, clarity, and consistency over time.

THE WALL STREET INSIDER PLAN

#01. Subscribe to Wall Street Insider Report

Upon subscription, you gain access to the Premium Member Area, designed for clarity and direct execution.

Decode Wall Street

Every business day, decode Wall Street. These insights strip away noise and highlight the structural patterns driving Wall Street movements from the inside.Alpha Hedge AI Algo Portfolio

Track positions directly from our live brokerage account. The portfolio is managed with discipline and transparency, reflecting the same strategy that has consistently outperformed the S&P 500 over the past decade.

1. Decode Wall Street

Every business day, receive insights that cut through the noise. Our analysis highlights the structural cycles and forces shaping Wall Street’s moves in real time.

2. Alpha Hedge AI Algo Portfolio Positions:

Track positions in our live brokerage account. Managed with discipline and full transparency, this long-term strategy has consistently outperformed the S&P 500 across multiple market cycles.

#02. Access the Alpha Hedge Portfolio Data and Invest

Subscribers receive the full allocation breakdown of our live portfolio, including assets and weightings, enabling direct replication within their own accounts.

#03. Monitor and Rebalance Monthly

The process requires no more than 15 minutes per month.

Members receive a monthly portfolio rebalance update in the Premium Area, ensuring positions remain aligned with the prevailing market cycle.

WHO I AM

My name is Dan Castro, Investment Management Specialist (University of Geneva, Switzerland) and Founder of Zurique Capital Research.

For more than 11 years, I have developed the Alpha Hedge AI Algo Strategy and trained over 9,000 investors worldwide.

FAQ

Why wouldn't I just manage my own investments?

Good question! Managing investments requires a lot of time, knowledge, and resources. With the Wall Street Insider Report, you get access to a sophisticated investment strategy, backed by statistical models and years of proven results, for a fraction of the cost and time investment.

Who manages the investments?

You should execute the strategy in your home broker according to our guidance on our Monthly Rebalance Report.

What is my return expectancy?

Past returns don't guarantee future returns. In the last 11 years, for our AI-Driven Equities Portfolio, the lowest compounded return over a 5-year period was 140.58% (2014 to 2018), and the highest return over a 5-year period was 656.2% (2017 to 2021). In comparison, the S&P 500 returns for the same periods were 35.72% and 112.75%, respectively.

What is my risk of loss?

For aggressive investors, the highest drawdown in the last 15 years was 30%, and the lowest yearly performance was -22.6%. Considering 15 years of data, the probability of having a negative year over a 1-year period is 20%, over 2 years is 15%, and over 3 years is 0%.

What kind of data does the Alpha Hedge algorithm use?

The algorithm sources statistical data, focusing on technical analysis to identify the best reward/risk points according to the mathematical of the market cycle and make investment decisions.

Are there any investments you don't cover?

We cover US ETFs (Exchange Traded Funds) providing investors with a broad range of possibilities.

Are there any refunds if I don't like the service?

Due to the nature of investment and the quality of our service, there will be no refunds issued.

The story of resilience presented here is truly inspiring and reinforces a fundamental lesson: no one achieves success alone. Often, the ability to face uncertainties and find paths is supported by a mentoring team that offers guidance, support, and a clearer vision of possibilities.

This is exactly the role that the Wall Street Insider Report has played and continues to play in 2024. By offering strategic insights, planned analyses, and a vision beyond the numbers, it has helped investors navigate complexity, identify opportunities, and maintain resilience even in a challenging scenario.

Resilience is not just about enduring challenges, but about finding ways to thrive amidst them – something that is evident in the impact on markets and the contributions of companies, entrepreneurs, and investors. The Wall Street Insider Report has shown that, with the right support, the impossible can be achieved. Happy 2025!