Unlock Today's Market Winners: AI-Driven Stock Picks Revealed

📊Solving the Market + Alpha Hedge Portfolio Review: 07/30/2024 Updates

Wall Street Insider Report

AI-Powered Insider-Level Insights to Exponentially Expand Wealth by Decoding Wall Street.

Join our global community of investors who are leveraging cutting-edge technology to build and preserve wealth for future generations.

If the link doesn’t work, copy this link in your browser: https://wallstreetinsiderglobal.com/build-legacy-wealth

SOLVING THE MARKET: 07/30/2024

Our algorithm decodes the top 30 most significant market movements of the day:

AMZN 0.00%↑ BRX 0.00%↑ CNO 0.00%↑ FSLR 0.00%↑ META 0.00%↑ NVCR 0.00%↑ NVDA 0.00%↑ PINS 0.00%↑ PSA 0.00%↑ PYPL 0.00%↑ SNAP 0.00%↑ MSFT 0.00%↑ AMD 0.00%↑ SBUX 0.00%↑ CRWD 0.00%↑LMND 0.00%↑ SWKS 0.00%↑ MRK 0.00%↑ ANET 0.00%↑ EA 0.00%↑ QCOM 0.00%↑ MDLZ 0.00%↑ SYK 0.00%↑ GOOG 0.00%↑ QQQ 0.00%↑ QXO 0.00%↑ SNOW 0.00%↑ SOXL 0.00%↑ MTCH 0.00%↑ PG 0.00%↑

By applying the Alpha Hedge Algorithm to these assets, we decode the data for this assets, and this are our top findings:

AMZN 0.00%↑ BRX 0.00%↑ CNO 0.00%↑ FSLR 0.00%↑ META 0.00%↑ NVCR 0.00%↑ NVDA 0.00%↑ PINS 0.00%↑ PSA 0.00%↑ PYPL 0.00%↑ SNAP 0.00%↑

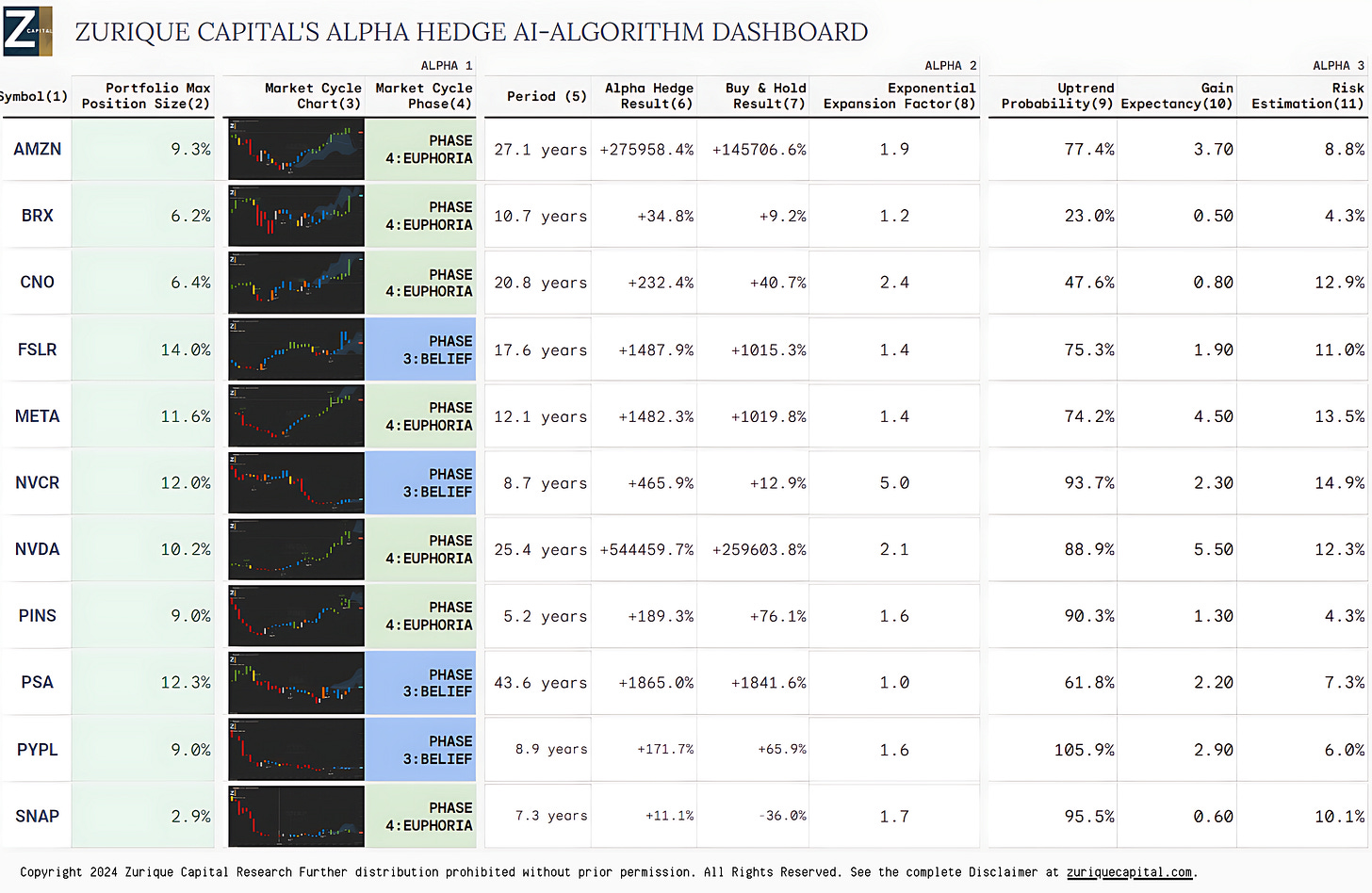

The spreadsheet columns are defined as follows:

1: Symbol: Asset Symbol;

2: Portfolio Max Position Size: Maximum Position Size calculated by the Alpha Hedge AI-Algorithm. Calculated to maximize returns and protect capital in downturns. The higher, the better;

3: Market Cycle Chart: Visualization of the Market Phase;

4: Market Cycle Phase: Phase of the Market Cycle based of the Alpha Hedge AI-Algorithm. It determines the optimal entries and exits for positions;

5: Period: Analysis period;

6: Alpha Hedge Result: Performance of the Alpha Hedge AI Algorithm Applied to the Asset. Without any new contributions or withdrawals, with profits reinvested and dividends excluded;

7: Buy & Hold Result: Performance of Buying and Holding the Asset During the Same Period;

8: Exponential Expansion Factor: Alpha Hedge Result over Buy & Hold Result;

9: Uptrend Probability: Probability of Uptrend calculated by the Alpha Hedge AI-Algorithm. Calculated based on historical data of long-term trends. The higher, the better.

10: Gain Expectancy: Probability of Uptrend calculated by the Alpha Hedge AI-Algorithm. Calculated based on historical data of long-term trends. The higher, the better;

11: Risk Estimation: Gain Expectancy calculated by the Alpha Hedge AI-Algorithm. Calculated based on the downturns Standard-Deviations. The lower, the better.

Investing in these stocks has yielded multiples returns using the Alpha Hedge Algorithm. However, leveraging AI can exponentially expand your wealth even more efficiently:

Harness Market Volatility: Turn fluctuations into growth opportunities.

Wealth Preservation: Minimize losses, reduce costs, and optimize tax efficiency.

Simplified Choices: Evidence-based, AI-driven investment portfolio.

Trust and Transparency: Independent, transparent portfolio construction.

Life Balance: Hands-off solutions provide professional and personal peace of mind with a long-term, low-maintenance portfolio.

Subscribe today to the Wall Street Insider Report Premium and join 1.8K+ Global Investors across 55 countries who are building legacy wealth. Gain access now to:

10-Year Access to the Alpha Hedge Portfolio: Witness and follow the AI-driven investment portfolio in real-time.

Daily Insider-Level AI Analysis: Uncover the layers of US Stocks and ETFs cycles.

Actionable Monthly Analysis: Detailed update of the market cycles.

ALPHA HEDGE PORTFOLIO REVIEW: 07/30/2024 UPDATE

The Alpha Hedge Portfolio is currently experiencing a monthly performance of -4%, bringing the year-to-date performance to +15.4%. Over the past 34 months, the portfolio has achieved a cumulative performance of +44.4%, significantly outperforming the S&P 500, which recorded a +21.9% gain over the same period.