📊Top 4 Data Points for Optimism with the S&P 500

Decode the S&P 500 Market Cycle

Wall Street Insider Report

Decoding the S&P500 Market Cycle and sharing the backstage here in the Wall Street Insider Report.

Join +1.5k Wall Street Insiders across 30 US states and 51 countries.

Top 4 Data Points for Optimism with the S&P 500

The recent record highs in the stock market are underpinned by strong earnings growth, robust cash flow generation, and resilient profit margins, which together provide a solid foundation for optimism with the S&P 500 SPY 0.00%↑ despite concerns about high valuations and market concentration.

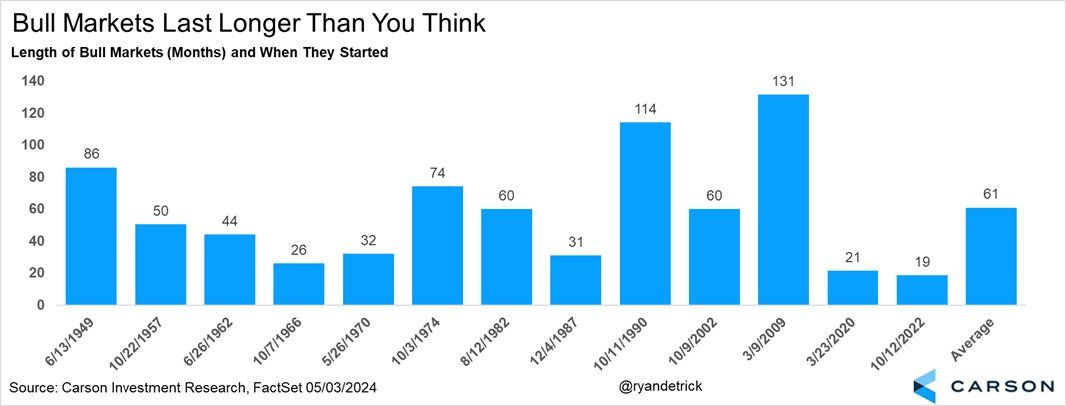

1. Here’s What Data Shows About Bull Markets

Historically, bull markets have an average duration of 61 months, and we are currently approaching month 20 of the current bull market. This prompts questions about the sustainability and potential longevity of this trend.

While valuations are high and some sectors are above average, they haven't reached bubble levels. This raises concerns about the market being overvalued and the risk of a downturn.

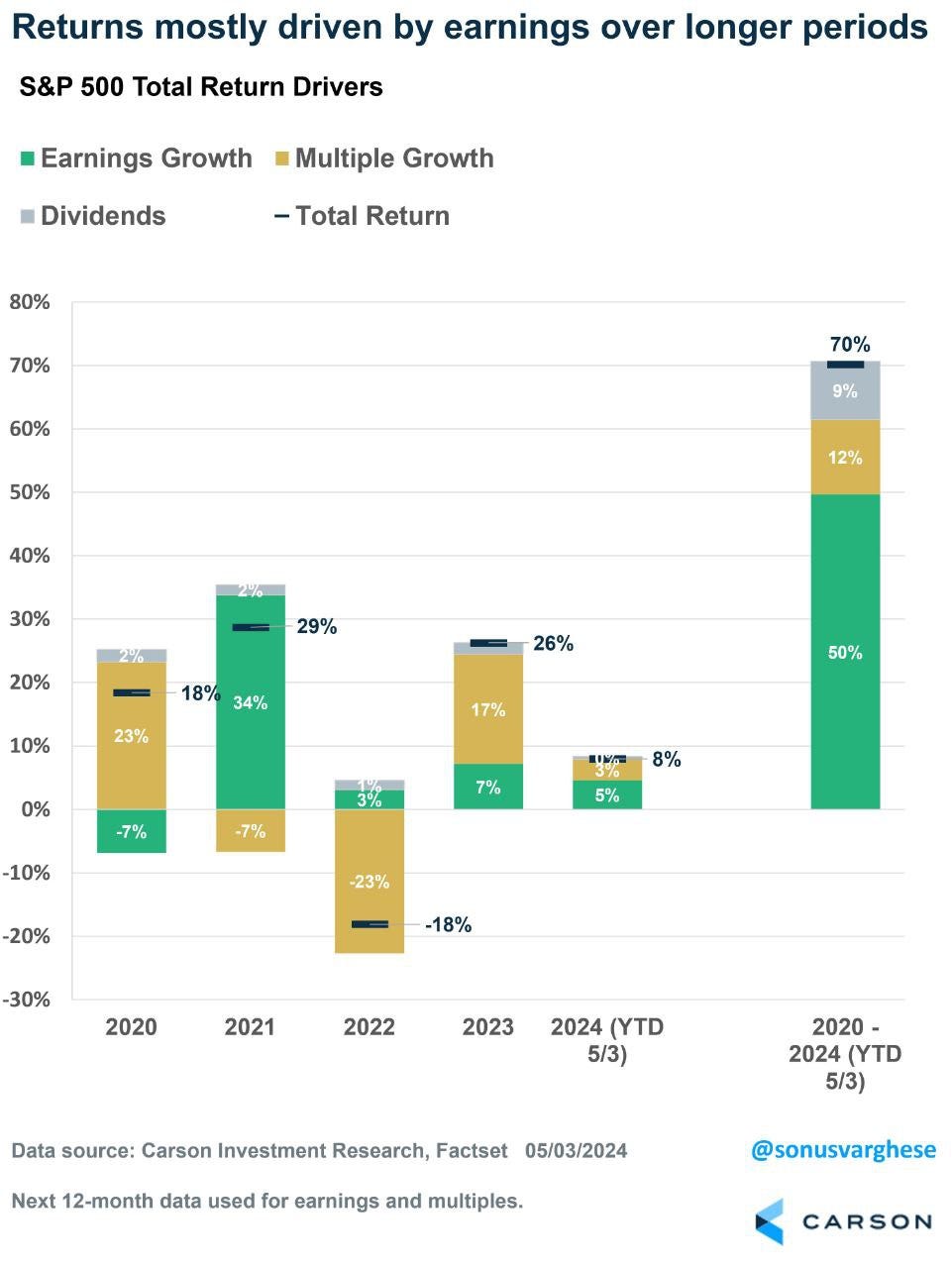

Analyzing market cycles reveals that the initial phase of this bull market was driven by recovery in valuations. Now, earnings growth is gradually supporting the market, indicating a healthier and more sustainable rise.

Given the historical longevity of bull markets and the current earnings growth supporting the market, there is a solid foundation for continued optimism in the S&P 500's performance.

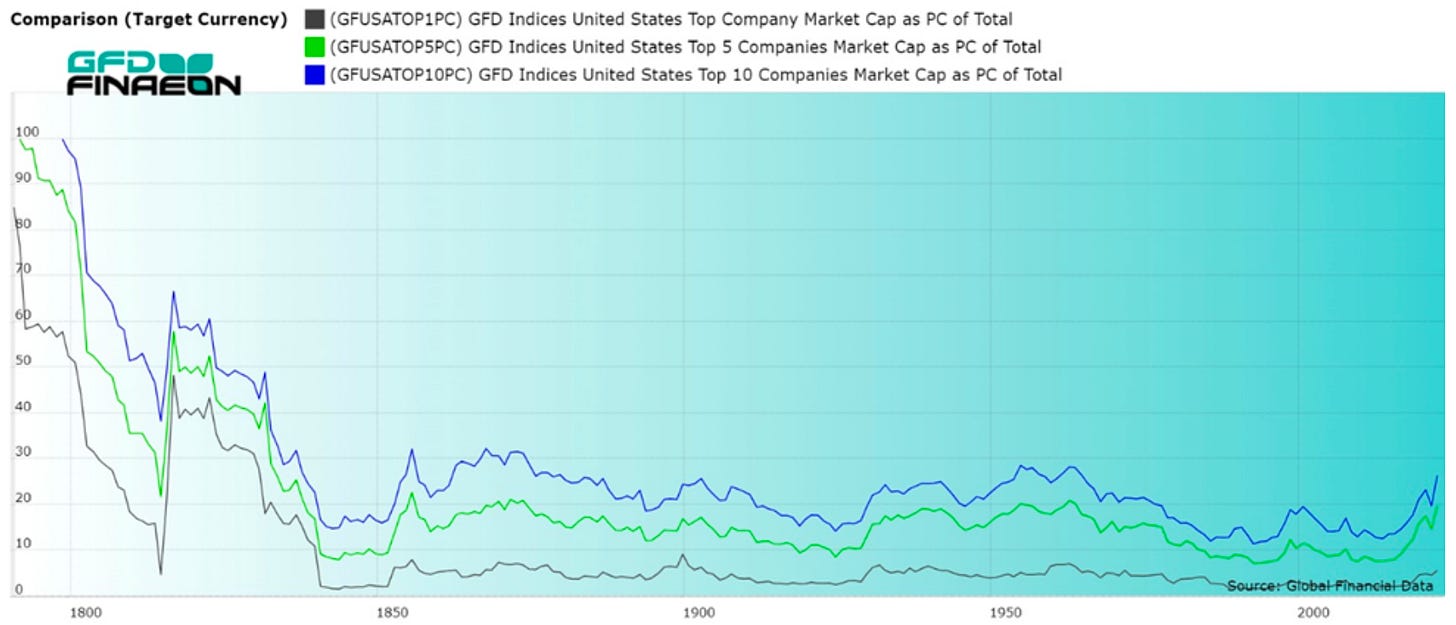

2. High Valuations: What the Data Reveals

The recent record highs in the stock market have sparked debates about their validity. The question is whether high valuations and market concentration undermine these gains.

High valuations and concentration in a few large companies raise concerns about market stability. Despite this, the fundamentals, including earnings and cash flows, support current valuations.

While concentration can be risky, strong fundamentals justify high valuations. The large companies driving these valuations significantly contribute to overall market health.

Although market concentration and high valuations are valid concerns, the solid fundamental support from earnings and cash flows reassures that the market's record highs are well-founded.

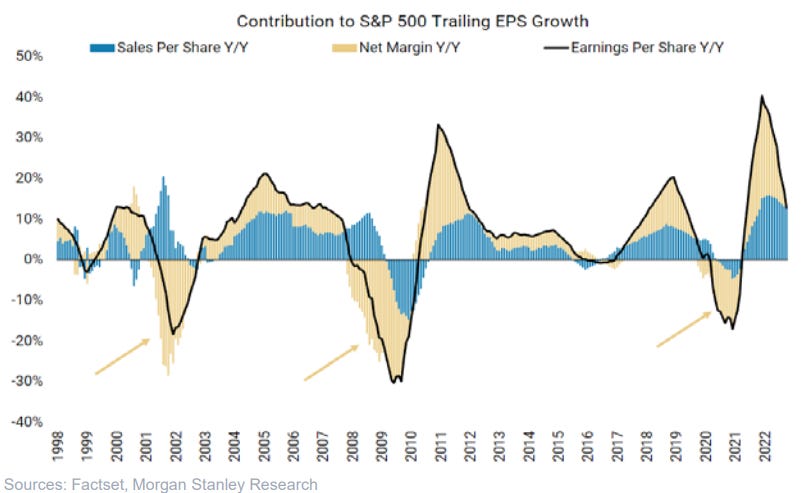

3. Here is What Profit Margins Means of the S&P 500 In 2024

The S&P 500's ascent to record highs raises questions about its sustainability. One critical element is the resilience of profit margins.

Concerns about economic challenges impacting profitability are widespread. Nonetheless, companies have demonstrated efficient cost management, maintaining strong profit margins.

The sustained profit margins amid economic challenges validate the market's high performance, indicating robust financial health and strategic management.

4. Earnings Growth Vs High Valuation Showdown

The S&P 500 has recently hit all-time highs, prompting questions about the underlying drivers. The answer lies in strong earnings growth from companies within the index.

Many analysts argue that these highs are unsustainable due to high valuations. However, significant earnings growth shows companies adapting and thriving, countering this concern.

Despite high valuations, the stock market's performance is fundamentally supported by robust earnings growth, providing confidence in its resilience.

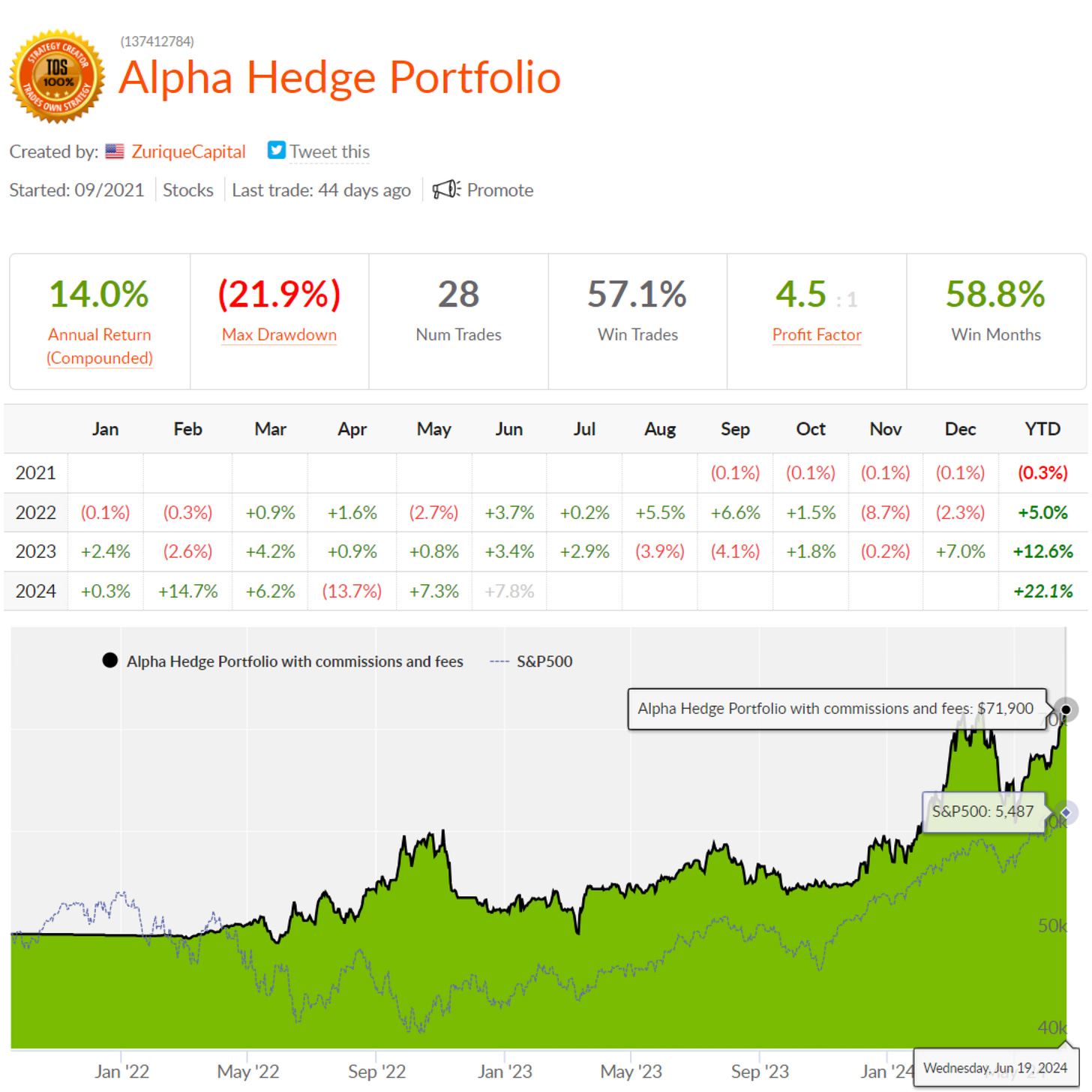

Portfolio Review: 06/19/2024

The Alpha Hedge Portfolio experienced a positive daily performance on Monday, gaining 0.2%, in alignment with the S&P 500's modest rise of approximately 0.3%, marking its 31st record close of the year.

This performance is part of a broader upward trend, reflected in the portfolio's impressive monthly performance of +7.8%.

Over the past decade, our subscribers have outperformed the American Market Decoding the S&P 500 Market Cycle.

You too can make investment decisions based on objective data.

That's where the Wall Street Insider Report comes in. We've developed a unique approach to investment management that puts you back in the driver's seat.

Know more about our 5-Year Plan and join +1.5K Pro Investors and Finance Professionals across 51 countries who are exponentially growing their - and their clients - wealth for over a decade.↓