This Formula Changed Investing Forever. No More Guesswork.

Unveiling the Sharpe Ratio

This Formula Changed Investing Forever.

No More Guesswork.

“What if I told you that a single formula could turn the chaos of investing into a clear path to smarter decisions? No, it’s not magic—it’s mathematics. And it has revolutionized the way we evaluate investments. But here’s the twist: while it’s incredibly simple to use, few truly understand its power.

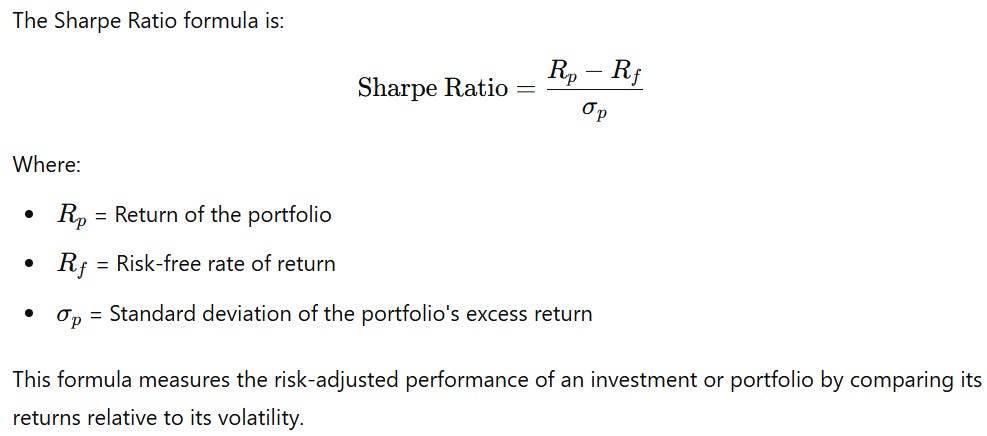

Today, I want to introduce you to one such tool—the Sharpe Ratio—and how it can change the way you think about risk and reward.

Balancing Risk and Reward: Your Superpower in Investing

The Sharpe Ratio is not just a financial formula—it’s a mindset shift. It teaches us that success in investing isn’t about chasing the highest returns but about balancing those returns with the risks we take. In a world where uncertainty is the only constant, understanding this balance is your superpower.

Risk vs. Reward: What the Roller Coaster Teaches Us About Investing

Let’s start with what the Sharpe Ratio does. Imagine you’re at a carnival, deciding between two roller coasters. One is wildly unpredictable, with sharp drops and loops. The other is smooth and steady. The thrill of the ride is like your investment return, but the bumps and twists? That’s your risk.

The Sharpe Ratio helps you decide which ride—or investment—is worth it. It tells you how much extra return you’re getting for every unit of risk you endure. If an investment gives you a return of 10% but feels like a stomach-churning ride, is it worth it? The Sharpe Ratio quantifies that trade-off, showing you where your money works hardest.

Decoding the Numbers: The Sharpe Ratio in Action

Now, let’s make it real. Picture two mutual funds. Fund A delivers 15% returns, but its volatility is so high you can’t sleep at night. Fund B offers a modest 10%, but with stability that feels like a calm lake. Without a tool like the Sharpe Ratio, you might focus solely on returns and pick Fund A. But the Sharpe Ratio reveals a hidden truth: Fund B might offer better risk-adjusted performance, meaning you’re rewarded more consistently for the risk you take.

This tool has been instrumental in optimizing portfolios, helping investors avoid the lure of high returns without considering the hidden risks. It’s like choosing the tortoise over the hare—not as exciting, but far more reliable.

No Perfect Formula: The Limits of the Sharpe Ratio

But here’s where it gets interesting. No tool is perfect. The Sharpe Ratio assumes that returns follow a normal distribution—a neat bell curve. Yet, in the real world, markets are messy, with unpredictable spikes and crashes.

It’s also prone to manipulation. Adjusting the timeframe or cherry-picking data can skew results. So, while the Sharpe Ratio is a powerful ally, it’s not the whole story. Think of it as a compass, not a GPS. It points you in the right direction but doesn’t guarantee a smooth journey.

Transforming Uncertainty Into Opportunity

So here’s my challenge to you: Start thinking like a risk-adjusted investor. Don’t just chase high returns; ask yourself, “What am I sacrificing in terms of risk?” Use tools like the Sharpe Ratio to dig deeper and make smarter, more informed decisions.

Because investing isn’t about winning the lottery—it’s about building a legacy, step by calculated step. And with the right tools, you can turn uncertainty into opportunity and chaos into clarity.

▶️Read what the Wall Street Insiders wrote about us↓