The Science Behind AI Models for Stock Prediction

LESSON 2/5: Breaking Down AI’s Role in Stock Market Predictions [Free Course]

Breaking Down AI’s Role in Stock Market Predictions [FREE COURSE: Lesson 2/5]

Introduction

How Many Costly Prediction Errors Can You Afford in Your Portfolio?

Despite all the data at our fingertips, why do so many investors still face costly mistakes in predicting market trends? Inaccuracies and errors creep in due to outdated models and the human bias that clouds judgment. Imagine watching your portfolio dip because of an error that AI could have foreseen.

In Lesson 2: The Science Behind AI Models for Stock Prediction, we delve into the core problem of prediction errors. With the help of models for stock prediction, AI adjusts for past mistakes, minimizing the chance of making costly decisions in the future. As seasoned investors, you know even small errors can lead to significant losses. The question is, how much longer can you afford these errors?

Next, let me show you how AI solves this issue, giving investors an edge in predicting the markets with precision.

There’s a solution that doesn't just eliminate prediction errors — it anticipates market trends with more accuracy than ever before.

Get the Edge Once Reserved for Insiders—Legally

Historically, gaining an edge in stock markets required privileged information, which led to the rise of insider trading*.

But now, technology offers a legal and ethical alternative—an even greater edge. The Alpha Hedge AI Algorithm empowers investors by anticipating market trends with the kind of precision that used to be reserved for those with insider knowledge.

This AI solution not only levels the playing field but actually surpasses the advantages of insider trading by relying on real-time, data-driven insights that identify opportunities and minimize risk.

Ready to see how it works in real investment scenarios? Let’s dive into the science behind AI models that make this possible

*Insider Trading Definition

It refers to trading a public company's stock or other securities by individuals with access to non-public, material information about the company.

The Science Behind AI Models for Stock Prediction

Let’s break down how cutting-edge AI techniques solve some of the most persistent challenges in the market:

AI Techniques in Use: A wide array of AI models is employed in stock market forecasting. These include:

Feed-Forward Neural Networks (FFNNs): Simple models where data moves in one direction, used for basic stock price prediction.

Backpropagation Neural Networks (BPNNs): These models learn from past errors and adjust weights to minimize prediction errors, making them popular for financial forecasting.

Recurrent Neural Networks (RNNs): Especially useful for time-series data, these models are designed to recognize patterns over time, which is crucial for predicting stock price movements.

Hybrid Models as a Solution: The article points out that hybrid models—which combine neural networks with other techniques like fuzzy logic, genetic algorithms, and support vector machines (SVMs)—tend to outperform single-model approaches. Hybrid models can tackle both the non-linear relationships in stock prices and the broader patterns of market behavior, resulting in improved prediction accuracy.

Emergence of Deep Learning: Recently, deep learning techniques such as Convolutional Neural Networks (CNNs) and Long Short-Term Memory Networks (LSTMs) have gained popularity due to their ability to process large datasets and complex input data. These models are more effective in capturing intricate patterns in stock prices, leading to more accurate forecasts compared to traditional AI methods.

By leveraging these AI models, you can anticipate stock market movements more effectively, with fewer errors.

But don’t just take my word for it—here’s proof of AI’s real-world performance in action.

How This AI Investment Bot Predicts Today’s Top 7 Market Movers

Curious to see AI-driven predictions in action? Every day, the Alpha Hedge AI Algorithm identifies the top 7 assets most likely to move the market. Today’s selections include: BHVN 0.00%↑ ADBE 0.00%↑ PFE 0.00%↑ APPS 0.00%↑ BABA 0.00%↑ LMND 0.00%↑ GNRC 0.00%↑

This AI investment bot uses cutting-edge technology to process massive amounts of data, identifying hidden patterns that human analysis could miss. By capturing market volatility and recognizing opportunities, these assets reflect the potential AI holds in driving exponential wealth growth.

Here’s How We Find These Market Opportunities:

Have access to more insights like this every day—ensuring you’re always in a position to make informed investment decisions, even during turbulent market conditions.

Follow our Notes and access all the assets analyzed in the day:

While these 7 assets are powerful, there’s a more systematic way to harness AI’s full potential for long-term wealth.

Let me introduce you to the ultimate AI-powered investment solution.

Unlock Hands-Free, AI-Powered Wealth Building with the Alpha Hedge AI Algo Portfolio

Imagine a hands-off solution that grows your wealth exponentially—leveraging the same AI technology that pinpoints today’s top assets. The Alpha Hedge AI Algo Portfolio offers exactly that.

This live brokerage account portfolio benefits from radical transparency and is driven by AI’s ability to analyze market trends in real time. With this portfolio, you gain access to insider-level AI analysis, actionable insights, and a hands-free solution that outpaces traditional investing strategies.

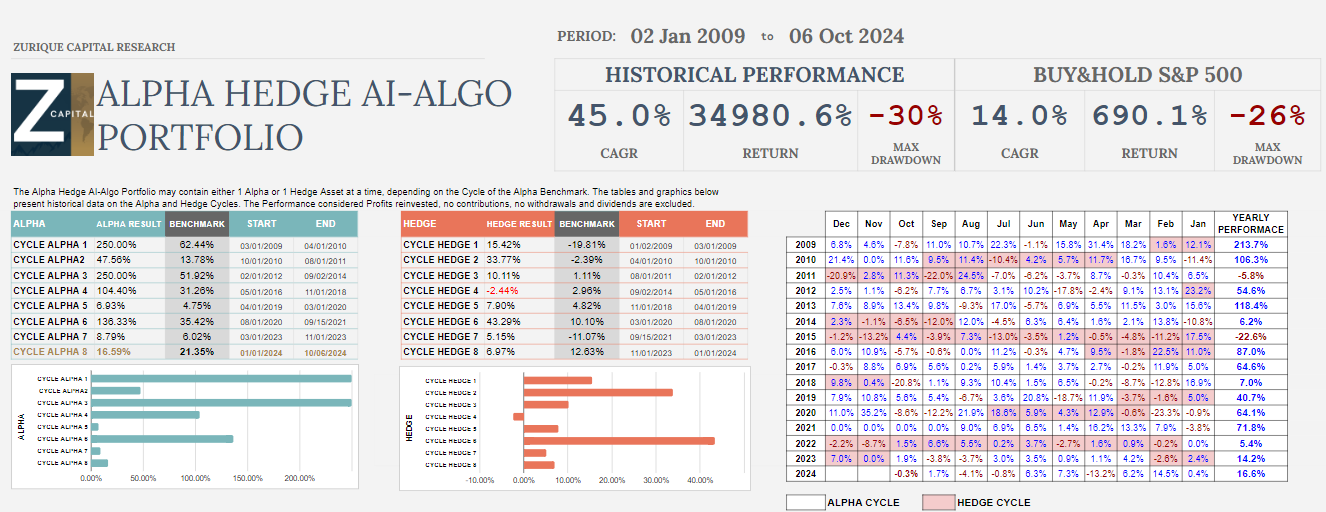

The Alpha Hedge AI-Algo Portfolio may contain either 1 Alpha or 1 Hedge Asset at a time, depending on the Cycle of the S&P500.

The tables and graphics below present historical data on the Alpha and Hedge Cycles. The Performance considered Profits reinvested, no contributions, no withdrawals and dividends are excluded.

Alpha Hedge AI-Algo Portfolio Review: 10/06/24

Over the past decade, we developed the Alpha Hedge Algorithm using advanced quantitative methods, machine learning, neural networks, and, more recently, AI to build a portfolio designed to exponentially grow wealth while minimizing risk.

To ensure confidence in our results and uphold our commitment to full transparency, since September 2021, we have shared our performance in real time from a live brokerage account, allowing our clients to track the portfolio’s progress.

Why Choose the Alpha Hedge AI-Algo Portfolio?

AI Investment Management: Our AI algorithms continuously adapt to market conditions, mitigating risks associated with unpredictable fluctuations.

Wealth Exponential Expansion: By harnessing AI's predictive capabilities, the portfolio seeks out high-growth opportunities, accelerating your wealth accumulation.

AI Investment Advisor for Tax Optimization: Strategic investment choices are made with tax efficiency in mind, maximizing your net returns.

Transparency: We operate with radical transparency, offering you full visibility into a live brokerage account. Monitor your investments in real-time and see exactly how your assets are managed.

Start growing your wealth by subscribing to the Wall Street Insider Report Premium. Gain real-time access to the Alpha Hedge AI Algo Portfolio, daily analysis, and a roadmap to exponential wealth.

Subscribe today and unlock the AI-powered portfolio that’s outperforming the market.

▶️Read what the Wall Street Insiders wrote about us↓