The S&P Isn’t Strong. Nvidia Is Doing All The Heavy Lifting

Weekly Market & Portfolio Results: The S&P 500 is showing green, but that doesn’t mean strength.

The S&P Isn’t Strong. Nvidia Is Doing All The Heavy Lifting

The S&P 500 is showing green, but that doesn’t mean strength.

■ Weekly Market Results

The S&P Is Still in Phase 6, Here’s What That Means

Where are we in the cycle?

Despite recent rebounds, the S&P 500 remains in a confirmed Phase 6 downtrend.

We’re still in a Protection Cycle.

You might hear optimism from the media or peers. But our AI doesn’t respond to opinion.

It waits for a signal—when both the index and our Alpha Asset move into Phase 2.

That hasn’t happened yet.

If we had followed speculation in August 2023 and shorted the index, we would’ve endured 8 months of false hope.

Instead, we exited long positions only when confirmation appeared—avoiding drawdown and staying in cash.

This is why we don’t chase momentum. We follow cycles.The Alpha Hedge AI was built for this: Not to predict, but to act with precision.

And in volatile markets, precision always beats prediction.

The S&P 500 isn’t rising because the economy is strong. It’s rising because Nvidia is

Don’t assume the S&P 500 is healthy just because it’s green on the screen.

We analyzed the seven heaviest stocks in the index. Only one is in a confirmed Phase 2 uptrend: Microsoft MSFT 0.00%↑ .

Nvidia’s movement matters more because its index weight is nearly 3x that of Tesla, so its gains have a far greater impact on the S&P 500.

Here’s the breakdown:

Apple AAPL 0.00%↑: –6.31%, still in Phase 6. Heavily dragging the index.

Nvidia NVDA 0.00%↑: +15.98%, holding up the entire structure.

Tesla TSLA 0.00%↑: +21.34%, but its low weight limits impact.

Microsoft MSFT 0.00%↑: +4.49%, the only one in an uptrend phase.

Others remain negative.

That’s why you can’t rely on the index alone.

If you’re following the S&P without understanding who’s behind the move, you’re flying blind.

At Zurique Capital, our AI tracks individual asset cycles to understand broader trends.

The market isn’t equal-weighted. And neither should your strategy be.

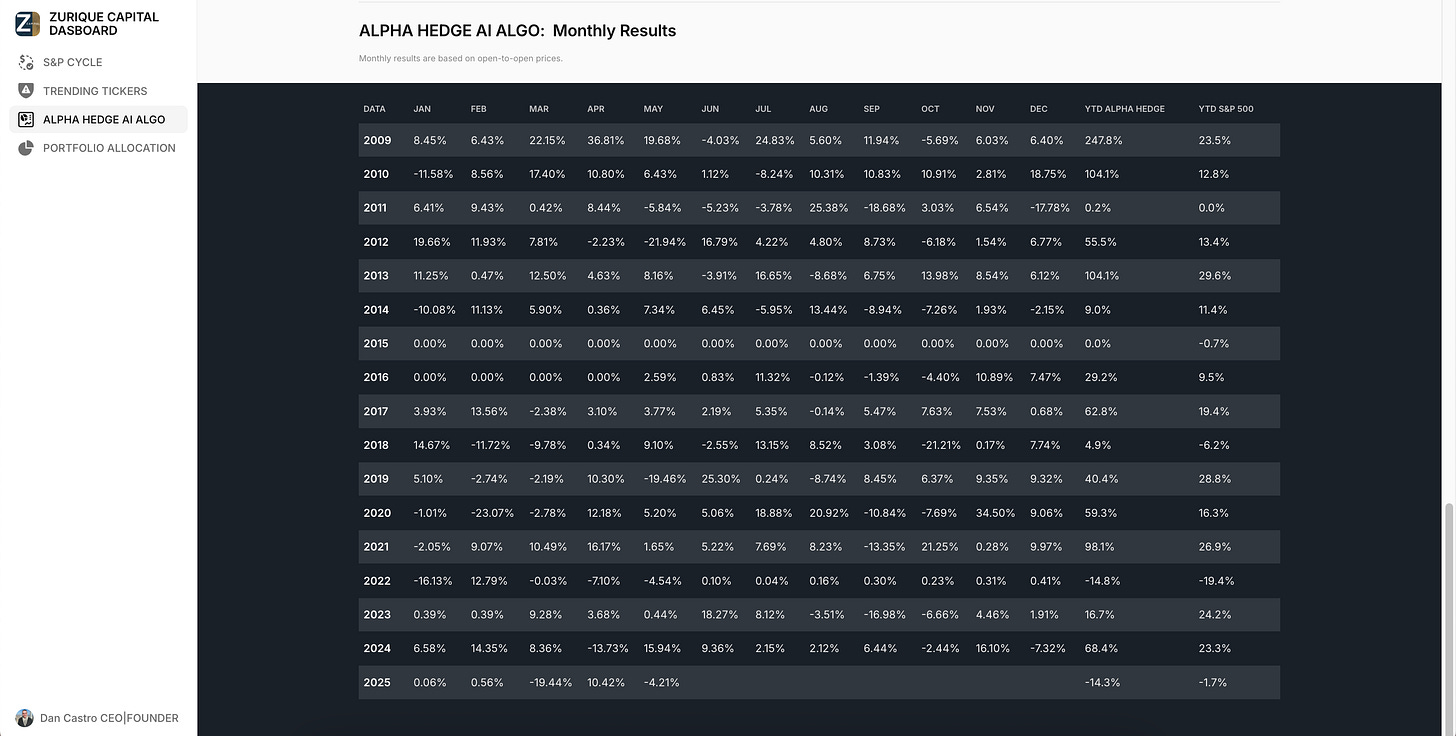

■ Portfolio Results

$50K to $13.8M: One Position at a Time

The Alpha Hedge AI Portfolio doesn’t spread bets.

It concentrates. It protects. And it waits.

By comparison, the S&P 500 delivered +542%, turning $50K into $402K.

We turned the same into $13.8M—with no new contributions and all profits reinvested.

We’re currently in our 17th cycle—9 of them were protection cycles like this one.

In May, while the S&P is up +5.72%, we’re holding cash equivalents, returning +1.23% with zero exposure to equity volatility.

This isn’t luck or leverage.

It’s cycle-based allocation, driven by AI, refined over 15 years.

Are you investing in motion—or in measured moves?

How many of your portfolio decisions are truly backed by data?

*These results expand the current parameters of the Alpha Hedge AI Algo in Aggressive Mode, whereas the Collective2 Portfolio has reflected the Moderate Mode since 2021.

Unlock the Alpha Hedge AI Algo Portfolio ↓