The Ripple Effect: Markets and the 2024 Election Outcome

+AI Investment Bot: Tech Stocks Trends & Alpha Hedge AI-Algo Portfolio Review: 11/06/24

The Ripple Effect: Markets and the 2024 Election Outcome

Today, we're exploring the financial landscape after the unexpected results of the 2024 elections. With Donald Trump securing a second term as the 47th President of the United States and Republicans flipping the Senate, the markets have responded with startling vigor. Let's break down what this means for investors.

Election Shock and Market Euphoria

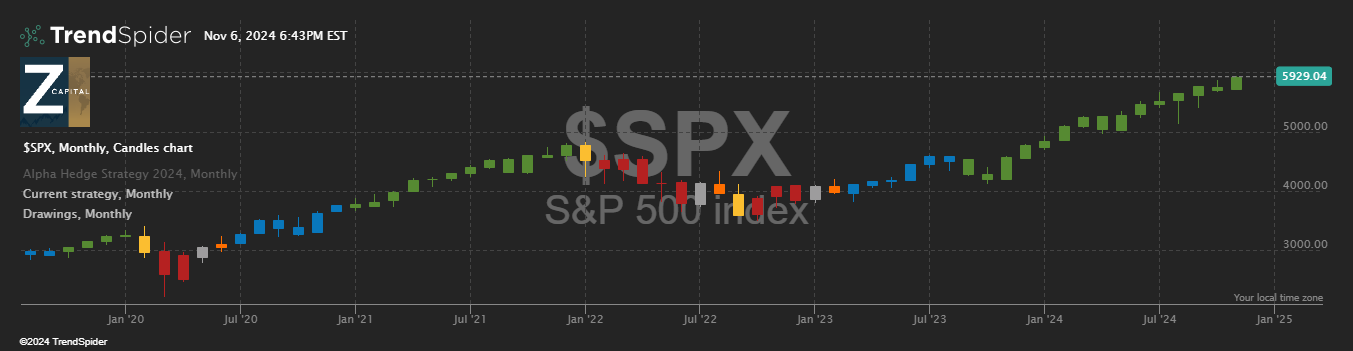

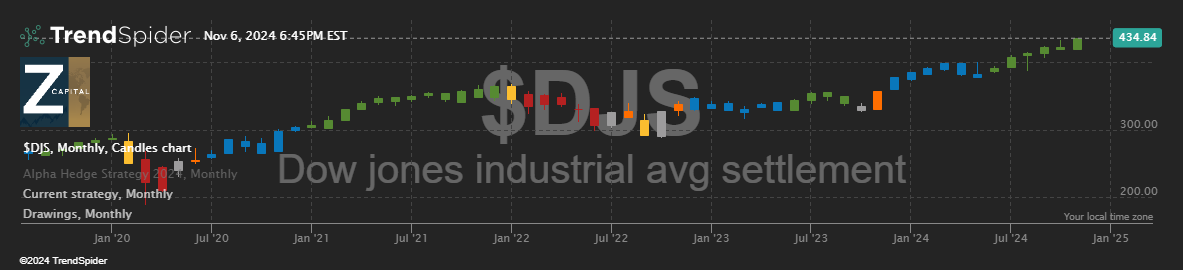

The outcome of the 2024 election left many surprised, with Trump emerging victorious and igniting significant movements in the financial markets. Upon news of the election results, the markets experienced what is known as a "relief rally." Major indexes such as the Dow Jones, Nasdaq, and S&P 500 shot up to record highs, reflecting a euphoric reaction. Investors seemed relieved, embracing predictability over the uncertainty that loomed before the election.

The Dow Jones, in particular, made headlines with a substantial 3.5% jump, equivalent to nearly 1,500 points in a single day—the largest gain seen since 2022. Likewise, the S&P 500 and Nasdaq also surged to new records, marking this rally as unprecedented, especially within a phase four market cycle known typically for moderate returns.

Bitcoin and the "Trump Trade"

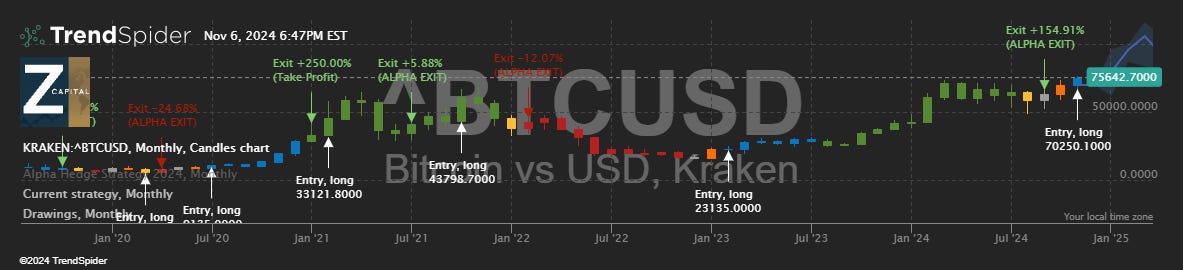

Interestingly, the wave of optimism wasn't confined to traditional markets. Bitcoin and the U.S. Dollar rallied alongside the stock market, a phenomenon some analysts have dubbed the "Trump Trade." Assets like Bitcoin often thrive under regulations perceived as favorable, such as reduced regulation or specific tax treatments. This cycle of speculation mirrors past trends observed during Trump's first term, sparking curiosity about future impacts on cryptocurrency.

Notably, Bitcoin closed a cycle back in September with an impressive 154.92% return, signaling that the current rally could hold significant opportunities for crypto enthusiasts. As we march into the new year, keeping a close watch on these movements will be crucial.

Banking Sector and Algorithmic Insights

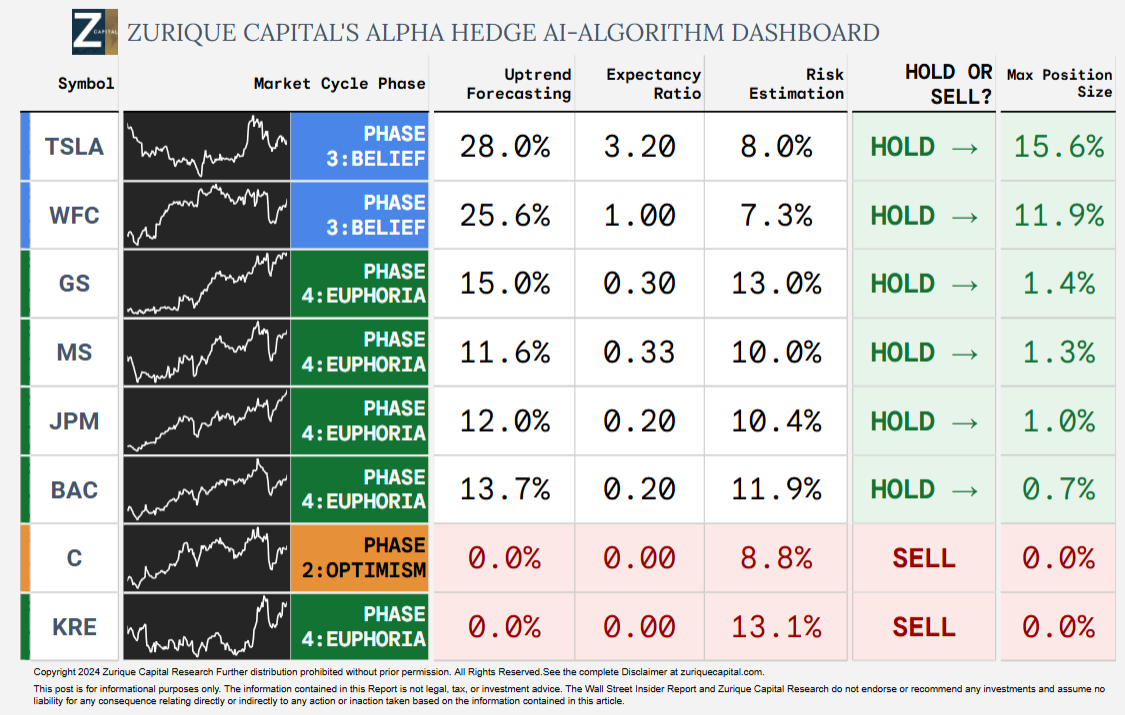

The banking sector has also seen positive outcomes with Trump's policies, often viewed as beneficial for financial institutions. The S&P Regional Banking ETF KRE 0.00%↑ soared over 11%, an exceptional gain in a phase four market.

However, amidst the excitement, caution is advised. Advanced AI algorithms, like the Alpha Hedge Algorithm, are signaling caution, with no position recommended for regional banks despite the robust rally.

Tesla TSLA 0.00%↑, too, presents a complex narrative. Its stock surged over 14%, possibly influenced by Elon Musk's endorsement of Trump. Yet, investors must consider various factors including Tesla's phase three market cycle and recommendations from the Zurique Capital algorithm.

Federal Reserve's Role

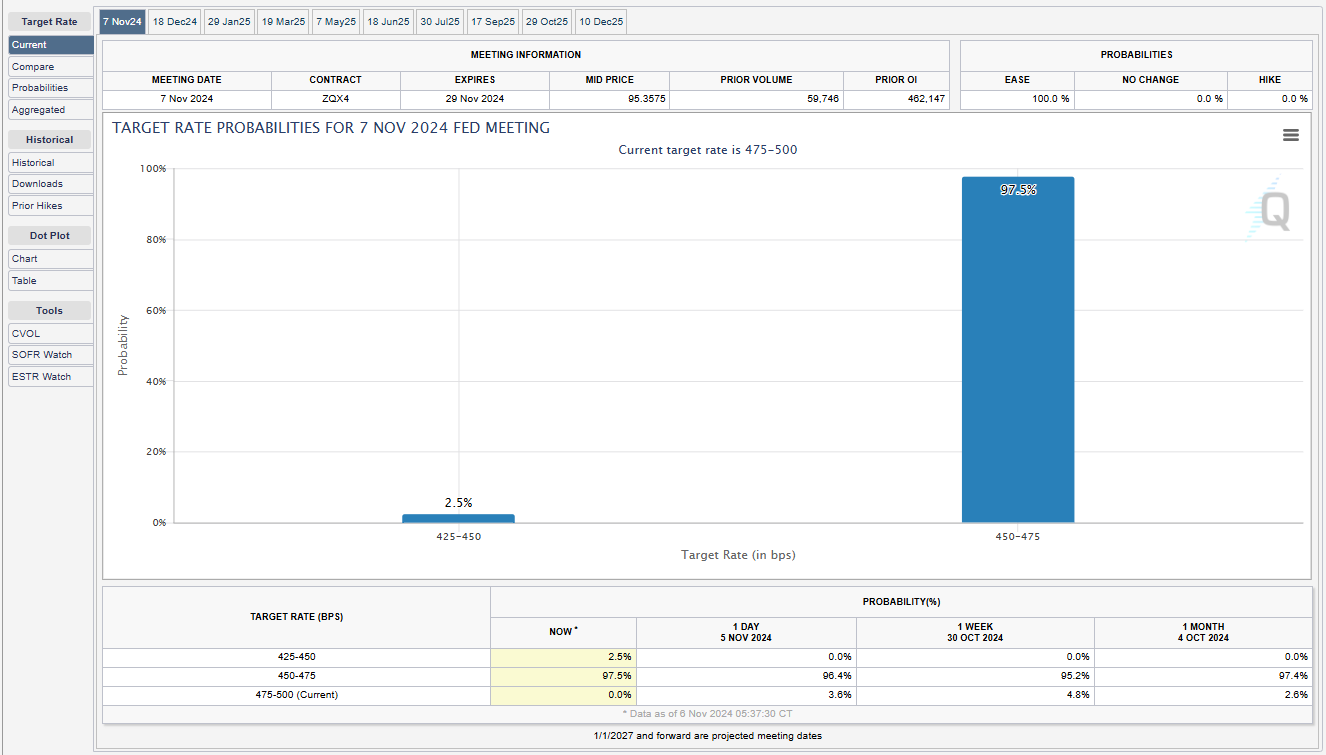

Another critical element in the post-election equation is the Federal Reserve. Their two-day policy meeting coincided with the election, and anticipations for a rate cut were high. The CME FedWatch tool suggested a near-certain chance of a 25 basis point reduction, highlighting the Fed's potential influence alongside the election results. The intersection of politics, economics, and market psychology could play a pivotal role in shaping future policies.

Looking Forward

As the initial wave of market optimism settles, the billion-dollar question remains: what do these changes mean for long-term market stability and investor confidence?

Navigating this new landscape will require paying attention to key factors and potential risks and opportunities.

With so much at play, from political shifts to algorithmic insights and Federal Reserve policies, investors have a lot to consider. As always, stay curious and keep evaluating your strategies. Until next time, keep those brains buzzing and stay tuned for more financial insights.

AI Investment Bot: Today's Stock Market Trends

TSLA 0.00%↑ WFC 0.00%↑ GS 0.00%↑ MS 0.00%↑ JPM 0.00%↑ BAC 0.00%↑ C 0.00%↑ KRE 0.00%↑

Here’s How We Find These Market Opportunities:

Alpha Hedge AI Algo Portfolio Review

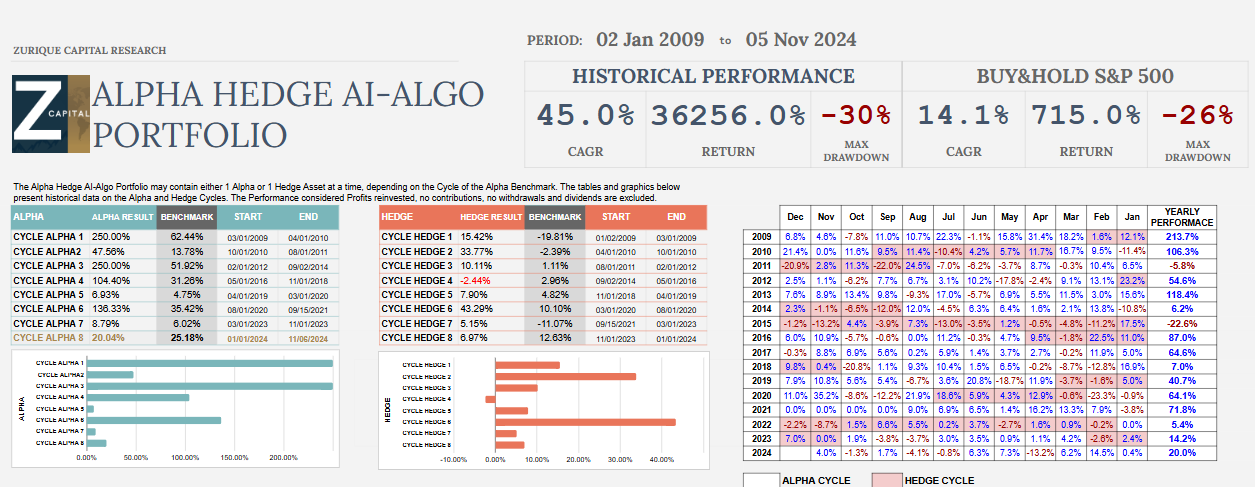

The Alpha Hedge AI-Algo Portfolio may contain either 1 Alpha or 1 Hedge Asset at a time, depending on the Cycle of the S&P500.

The tables and graphics below present historical data on the Alpha and Hedge Cycles. The Performance considered Profits reinvested, no contributions, no withdrawals and dividends are excluded.

Alpha Hedge AI-Algo Portfolio Review: 11/06/24

Over the past decade, we developed the Alpha Hedge Algorithm using advanced quantitative methods, machine learning, neural networks, and, more recently, AI to build a portfolio designed to exponentially grow wealth while minimizing risk.

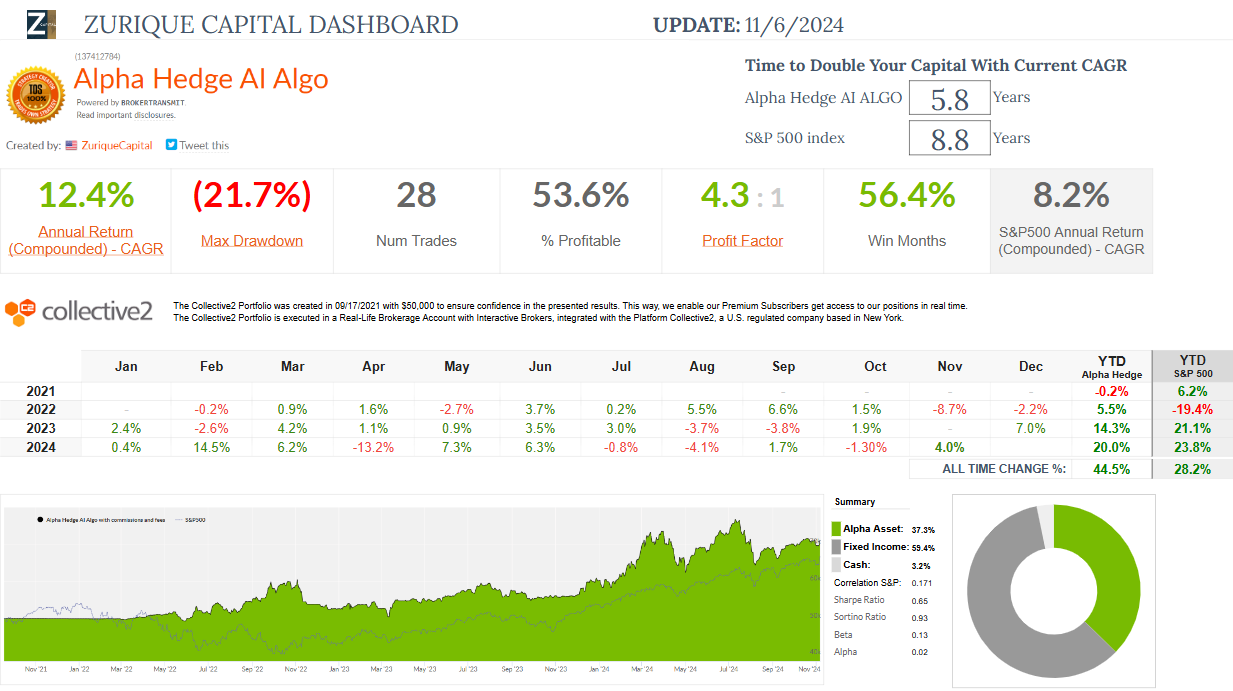

To ensure confidence in our results and uphold our commitment to full transparency, since September 2021, we have shared our performance in real time from a live brokerage account, allowing our clients to track the portfolio’s progress.

Over the past 38 months, the Alpha Hedge AI Algo Portfolio has delivered a total return of 44.5% (CAGR 12.4%), compared to the S&P 500's total return of 28.2% (CAGR 8.2%).

The portfolio is currently up 4.0% this month and has gained 20.0% year-to-date. At a CAGR of 12.4%, the portfolio doubles capital in 5.8 years, whereas the S&P 500, with an 8.2% CAGR, takes 8.8 years to do the same.

The portfolio has experienced a maximum drawdown of 21.7% and has been profitable in 53.6% of its 28 trades, with a profit factor of 4.3.

Why Choose the Alpha Hedge AI-Algo Portfolio?

AI Investment Management: Our AI algorithms continuously adapt to market conditions, mitigating risks associated with unpredictable fluctuations.

Wealth Exponential Expansion: By harnessing AI's predictive capabilities, the portfolio seeks out high-growth opportunities, accelerating your wealth accumulation.

AI Investment Advisor for Tax Optimization: Strategic investment choices are made with tax efficiency in mind, maximizing your net returns.

Transparency: We operate with radical transparency, offering you full visibility into a live brokerage account. Monitor your investments in real-time and see exactly how your assets are managed.

Subscribe now, and let AI work for your financial future.

▶️Read what the Wall Street Insiders wrote about us↓