Wall Street Insider Report

Decoding the S&P 500 Market Cycle and sharing the backstage here in the Wall Street Insider Report.

Join +1.5k Wall Street Insiders across 30 US states and 51 countries.

Insiders’ Knowledge Hub

Rates Cycle Trend: The Perfect Strategy for Investing in Brazil

Introduction

Investing in Brazil can be challenging due to its economic volatility and historical financial instability.

However, the Rates Cycle Trend strategy offers a structured approach to navigate these challenges and optimize investment returns in the Brazilian market.

This post summarizes the key insights and strategies from Zurique Capital Research's comprehensive guide on leveraging Market Cycles and trend-following techniques for successful investments in Brazil.

Understanding the Brazilian Market

The Brazilian stock market is known for its high volatility, low trading volume, and limited sector diversification.

The country has faced significant economic risks, including debt moratoriums, hyperinflation, and political crises.

These factors contribute to market instability but also create opportunities for fixed income investments, such as bonds, due to high interest rates.

Key Strategies for Investing in Brazil

1. Laddered Bonds Strategy

The Laddered Bonds strategy is ideal for high-interest rate environments.

It involves dividing investment capital into multiple parts and investing in bonds with different maturity dates.

This approach helps mitigate liquidity risk and allows investors to achieve an average return over time while maintaining annual liquidity.

Example 1:

Investment Capital: $100,000.00

Instead of investing the entire $100,000.00 in a Bond maturing in 2029, using Strategy 1, the investor should divide the capital by 5 and invest as follows:

Bond maturing in 2025: $20,000.00

Bond maturing in 2026: $20,000.00

Bond maturing in 2027: $20,000.00

Bond maturing in 2028: $20,000.00

Bond maturing in 2029: $20,000.00

This way, you achieve a return according to the average interest rate of the period, but maintain annual liquidity.

When the Bond maturing in 2025 is redeemed, if the investor does not need the redeemed capital and the interest rate remains on an upward trend, the capital should be reinvested in a Bond maturing after the end of the ladder. In this example, it would be a Bond maturing in 2030.

2. Mark-to-Market Strategy

This strategy is effective in a declining interest rate environment.

It involves selling bonds before maturity to capitalize on their increased market value.

Mark-to-market, or marking a bond to its current market value, provides a realistic view of the investment’s worth, reflecting changes in interest rates, inflation, and credit risk.

Example 2:

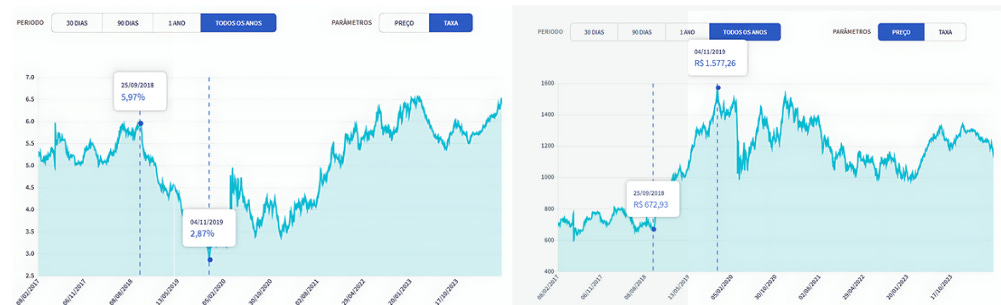

The image below shows two comparative graphs of interest rate trends and prices of the IPCA+ 2045 bond over time. The graph on the left illustrates the evolution of interest rates, highlighting specific points such as a rate of 5.97% on 09/25/2018 and a low of 2.87% on 11/04/2019.

The graph on the right presents the variation in bond prices, with a value of R$ 672.93 on 09/25/2018 and a peak of R$ 1,577.26 on 11/04/2019.

A gain of 134% in 1 year and 2 months.

3. Alpha Hedge Strategy

It is important to clarify that the Alpha Hedge Portfolio presented in this Report to the Premium Subscribers is only executed in the US market, following the S&P 500 Market Cycles.

However, the Alpha Hedge strategy (algorithm) is versatile and can be applied to any country, any asset, and any scenario as requested by our research clients.

It involves monthly analysis to identify the current Market Cycles and make informed buy or sell decisions combining the Laddered Bonds strategy with Mark-to-Market strategy.

Application of Strategies in Different Economic Scenarios

The success of these strategies lies in their adaptability to varying economic conditions.

For example, during periods of high interest rates, the Laddered Bonds strategy helps maintain liquidity and average returns. In contrast, during declining interest rates, the Mark-to-Market strategy maximizes returns by selling bonds at a higher market value.

The Alpha Hedge strategy’s flexibility allows it to perform well in both scenarios, optimizing the investment portfolio based on comprehensive Market Cycles analysis.

Example 3:

The image presents a performance chart of IPCA+ 2045 bonds, highlighting buy and sell signals according to the interest rate cycle over time.

At the beginning of 2018, there is a buy signal marked by a green arrow, followed by the application of Strategy 2 - Mark-to-Market (Alpha).

In mid-2021, a sell signal is indicated by a red arrow, during the use of Strategy 1 - Laddered Bonds (Hedge) to maintain purchasing power and protect capital and profits in a high-interest-rate scenario.

Later, at the end of 2022, another buy signal appears, returning to Strategy 2 - Mark-to-Market (Alpha).

The lines on the chart indicate the variations in bond prices, with the strategies being applied as market conditions change.

Conclusion

Investing in Brazil requires a strategic approach tailored to its unique economic landscape.

The Rates Cycle Trend strategy by Zurique Capital Research offers a robust framework for maximizing returns and managing risks through Market Cycles analysis and trend-following techniques.

By applying the Laddered Bonds, Mark-to-Market, and Alpha Hedge strategies, investors can navigate Brazil’s volatile market and achieve long-term financial success.

Hi Dan. So what is your view on the current situation in Brazil? Rates were falling and therefore we had a good potential for mark-to-market. But as of now rates were held and the economic conditions, due to high spending and increasing deficits, could be a barrier for continued rate decreases. However, with the replacement of RCN by anyone who just takes orders from the current administration, we could see administrative rate cuts. I wish it was music to my ears but "should we stay or should we go?"