📊The New Portfolio Theory of Diversification

How The Modern Portfolio Theory on investment strategies revolutionized portfolio diversification became old, and why It's not the best way to diversify on modern financial markets.

#keypoints

Daily Educational Content [Free]:

The Myth of Diversification

The Old Theory of Diversification

The New Theory of Diversification

Case Study [Free]:

2022 Bear Market

Bottom Line

The Myth of Diversification

In the world of finance, few theories have made as much of an impact as the Modern Portfolio Theory (MPT).

This groundbreaking concept, developed by Nobel laureate Harry Markowitz, has fundamentally transformed the way we approach investing.

Let's dive into the world of MPT and discover how it continues to shape our financial landscape but in modern finance It is not the best approach for diversification.

The Old Theory of Diversification

In the mid-20th century, Harry Markowitz introduced a novel idea that would forever change the investment world.

His Modern Portfolio Theory suggested that risk and return are not just properties of individual investments, but of the entire portfolio.

This concept was a radical departure from traditional investment strategies, which focused on analyzing securities individually.

The Essence of MPT

At its core, MPT is about maximizing returns while minimizing risk through diversification.

It's like putting all your eggs in different baskets, so if one basket falls, you don't lose all your eggs.

Diversification is the ingredient in MPT. This theory is based on spreading investments across a variety of assets, investors can mitigate risk.

Even if one asset performs poorly, others may perform well, balancing out the overall portfolio performance.

But, have you ever questioned yourself why hold an asset with poorly performance? Read this post about how to become an Alpha Investor in Wall Street.

The Impact of Modern Portfolio Theory

Markowitz's work laid the groundwork for future financial theories.

His insights paved the way for the Capital Asset Pricing Model developed by William Sharpe, another Nobel laureate.

This model, which further refined the concepts of risk and return, owes its existence to the foundations laid by MPT.

In this post we explained why Sharpe Index is not the best way to analyze Risk/Return.

Modern Portfolio Theory in Practice

Today, MPT is used by individual investors, financial advisors, and robo-advisors alike to construct, diversified portfolios.

Whether you're a novice investor or a seasoned professional, understanding MPT can help you make investment decisions.

The New Theory of Diversification

When it comes to investment diversification, many people think of the old adage about not putting all your eggs in one basket.

This typically translates to buying a basket of assets, instead of a large batch of a single asset.

However, as an insider in the world of Wall Street, you need to take diversification a step further. You should think in terms of capital diversification, not just asset diversification.

Let's say you have $10,000 to invest and you're eyeing a stock that currently costs $100. If you were to apply all your capital to buying this stock, you might think you're putting all your money into a single asset.

But if you adopt the view of capital diversification, and decide that you would sell if the stock fell below $95, you're only risking 5% of your capital.

A $10,000 trade - when that's all you have to invest - might seem massive, but if your operational procedures for this trade state that you're only willing to lose $5 per stock, you're only betting $500. The capital you're trading is much smaller compared to the total available.

And while using all your capital to allow yourself to enter a position virtually ties you to that operation until you're willing to exit it, your exposure is minimal. This is exactly how a Wall Street insider thinks.

Although a barrage of small losses over time can bleed your capital, the goal is to hold onto assets that gain 10%, 20%, or even 100% more in value.

Will many of your positions lose a little money? Yes. But before entering any position, you know exactly what you're willing to lose and have an exit plan.

But what about the ones that don't lose? The positions that keep going up, up, and up? That's where you make your mega money.

You don't go to the beach when it's cold and raining, do you? By following theAlfa Hedge Portfolio, you will end up knowing when it is riskier and it is essential to keep a close eye on all the Assets you already own.

An important point in managing the Alfa Hedge Portfolio is to find the sweet spot of diversification. Within our algorithm, we currently filter the Assets within a set of markets.

But the main difference of the Alfa Hedge Portfolio from the assembly of traditional Portfolios is that in it, you don't need to be with all Asset classes at the same time in the Portfolio. You eliminate the "losers" and keep the "winners".

The key is to react of what is happening on the Market Cycle, not try to predict.

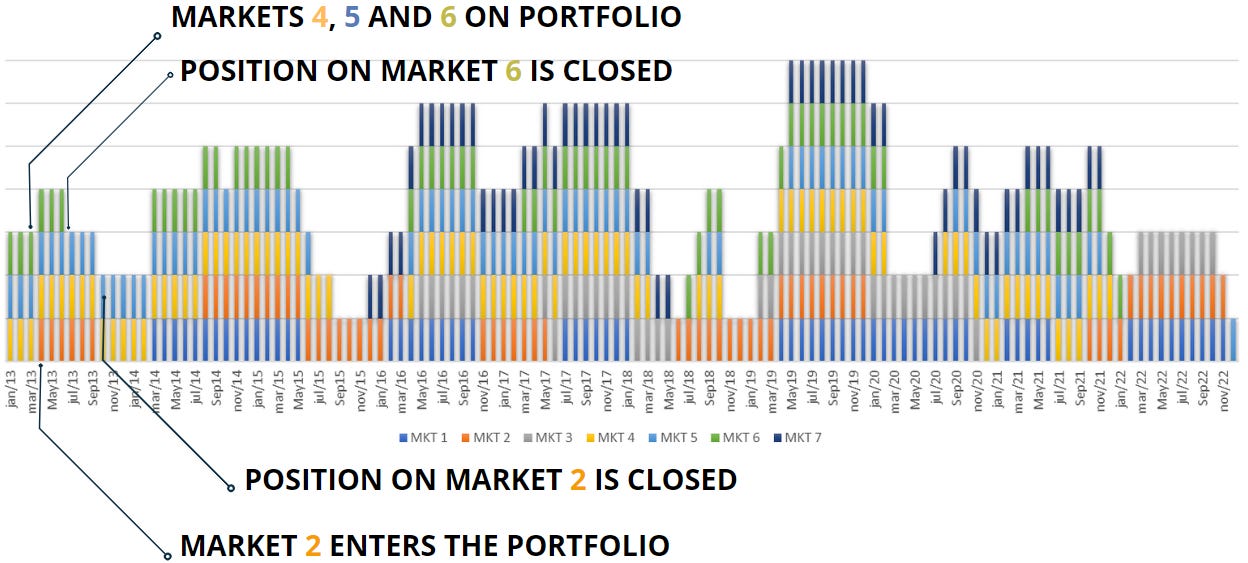

Look at the chart below. It shows the period in which each of the markets was in a Positive Market Cycle and present in the Alpha Wall Street Portfolio from 2013 to 2022.

Observe the example from January to November 2013.

1. In January 2013, Markets 4, 5, and 6 were in our Portfolio.

2. In April '13, Market 2 entered a Positive Cycle and consequently entered the Portfolio.

3. In July '13, Market 6 entered a Negative Cycle, and consequently, we closed the position.

4. In October '13, it was Market 2's turn to close the position, leaving only Markets 4 and 5 in the Portfolio.

Diversification and ETFs

Exchange-traded funds (ETFs) are a perfect asset to put your dynamic diversification in action.

These funds offer easy access to a wide range of asset classes, making diversification more accessible to the average investor.

By investing in ETFs, you're effectively putting Dynamic diversification to work.

📈Case Study: 2022 Bear Market

One of the greatest symbols of the Old Portfolio Diversification is the 60/40 Portfolio. As Bonds and Stocks were historically uncorrelated, the investor saw this diversification as a safe territory. Until 2022…

In 2022, the 60/40 Portfolio saw the worst performance since the 1929 crash.

The blue line shows the SPY 0.00%↑ ETF that follows the S&P500 index (-20.28% in 2022). The orange line is the TLT 0.00%↑ ETF that follows the US Treasuries with +20 years to maturity (-29.69% in 2022).

So, the 60/40 Portfolio in 2022 (with this assets) had a -25% performance in 2022.

Using a dynamic approach, holding only Alfa hedge assets (yellow lines) on uptrend during2022 this Bear Market, the investor had a positive year.

Using this system made possible had a 5.5% positive year in 2022.

In what time of the Market Cycle are we now?

It depends on what market. Bonds? Stocks?

Every business day we update the evolution of the Alfa Hedge Portfolio II.

Premium Subscribers have full access to our Alfa Hedge Portfolio II in a Real-Life Brokerage Account in Real Time.

Bottom Line

More than half a century after its inception, Modern Portfolio Theory continues to be a guiding light in the investment world.

But not abandoning Its principles of risk management (this are as relevant today as they were when Markowitz first introduced them) the investors can get an edge by applying a dynamic system to their Portfolios.

If you liked this content, you will love the others contents of our Report.👇

Wall Street Insider Report

Demystify the MARKET CYCLES investing SMARTER in Wall Street

Theory + Action: Learn & Replicate a High Performance + Low Maintenance + Long-Term Portfolio

Join +13k Global Investors and Really Master the Market Cycle Investing