The Math Genius Who Revolutionized Wall Street

[Free Course - Lesson 1/4]: Using Mathematics to Make Money: Jim Simons' Lessons

Using Mathematics to Make Money: Jim Simons’ Lessons [Lesson 1/4]

Are You Leaving Money on the Table by Ignoring the Power of Mathematics in Investing?

Most investors stick to the same traditional strategies, relying on instinct, news, or well-known advice. But what if I told you there’s a whole realm of mathematical investing that has allowed certain investors to crush the market year after year?

In Lesson 1: The Math Genius Who Revolutionized Wall Street, we dive into how Simons, a mathematician, used advanced models to achieve an annual return of 66%—a number most seasoned investors can only dream of.

Yet, too many investors continue to underestimate how math and technology can revolutionize their portfolios. The market doesn’t care about feelings or news. It’s driven by data, patterns, and trends that only a select few understand. If you’re still investing without the precision of data science, you’re likely leaving massive gains on the table.

Feeling the urgency? Stick with me because the solution is within your reach.

The Secret Weapon That Puts Investors on Par with Market Insiders

Imagine if you had access to the kind of market insight that’s historically given insider traders an edge—but legally and ethically. That’s exactly what the Alpha Hedge AI Algorithm delivers.

Leveraging cutting-edge AI, this tool empowers investors to spot market trends and anticipate shifts with unmatched precision. It’s like having insider-level foresight without crossing any legal lines. The Alpha Hedge AI Algorithm doesn’t just level the playing field; it tilts it in your favor.

Jim Simons mastered mathematics to generate extraordinary wealth. But with AI-driven investment tools, the ability to anticipate market movements is no longer reserved for a select few. With this, you gain access to strategies that tap into the same mathematical prowess used by some of the greatest investors in history.

Ready to learn more? Let’s dive deeper into the lesson.

The Math Genius Who Revolutionized Wall Street

How Jim Simons’ Mathematical Approach Crushed the Market

Overview of Jim Simons’ Success

Jim Simons, a mathematician, and former NSA codebreaker, achieved unprecedented success in the world of finance.

He outperformed legendary investors like Warren Buffett and George Soros, with an average annual return of 66% over 31 years.

His investment strategy led to exponential growth, turning even a small investment into an immense fortune.

Transition to Quantitative Finance

Simons didn’t start as a typical Wall Street trader. With a background in mathematics and teaching at MIT, he wasn’t a conventional finance professional.

In the 1980s, most traders relied on intuition and traditional market analysis, but Simons sought a more systematized approach.

Development of a Data-Driven Strategy

Early in his career, Simons found emotional, hunch-based trading stressful and inefficient.

He envisioned a system that removed human emotions from decision-making, focusing on mathematical patterns and probabilities to guide his trading.

This shift toward using mathematical models and algorithms marked the birth of quantitative finance, a field Simons pioneered.

Key Insights into Simons’ Strategy

Simons’ approach was similar to a casino model, where the odds are systematically shifted in favor of the trader, reducing risk and increasing the likelihood of success.

His ability to crack the "code" of the markets, identifying patterns others couldn't see, became the foundation of his success.

Now, think about applying similar principles through AI-driven tools—tools that identify these same patterns in today’s volatile market. If this strategy can outperform the greats, imagine what it could do for your portfolio.

Curious to see real proof? Let me show you what our AI-driven strategy can do today.

Harness Market Volatility with This AI Investment Bot

Every day, our Alpha Hedge AI Algorithm scours the market to find assets poised to move. It doesn't just follow the news or ride hype. It uses advanced AI models to analyze volatility and identify the best opportunities for growth.

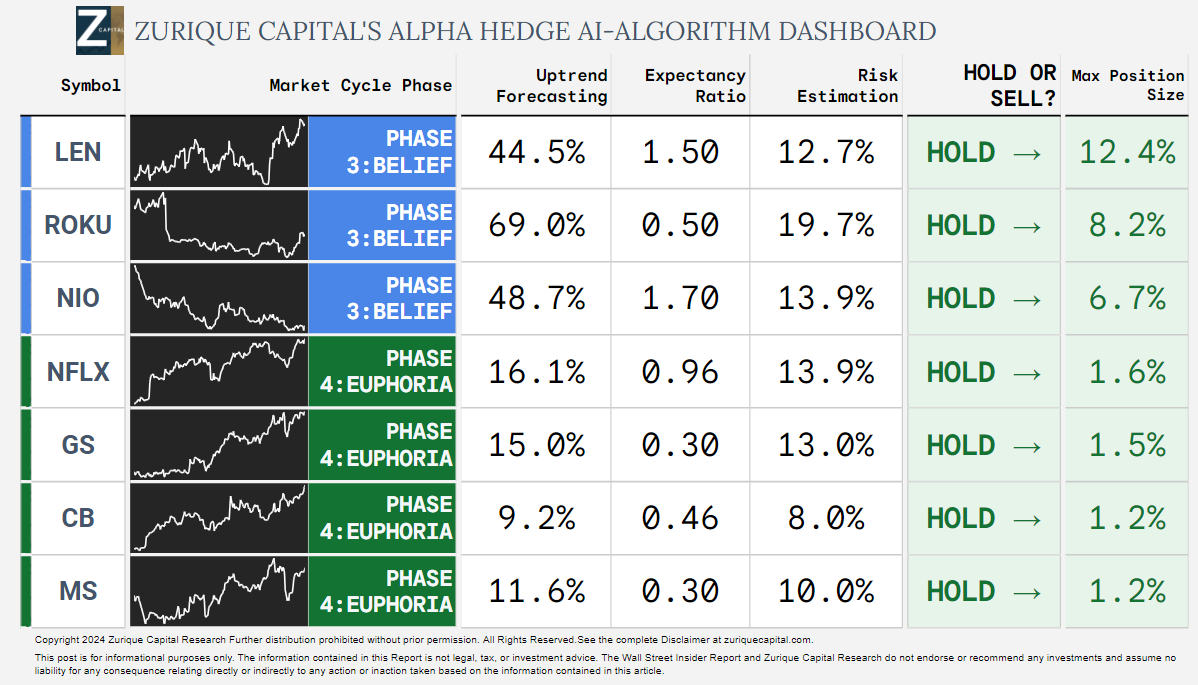

Here are today’s Top 7 Assets, identified by our AI Bot: LEN 0.00%↑ ROKU 0.00%↑ NIO 0.00%↑ NFLX 0.00%↑ GS 0.00%↑ CB 0.00%↑ MS 0.00%↑

Here’s How We Find These Market Opportunities:

Have access to more insights like this every day—ensuring you’re always in a position to make informed investment decisions, even during turbulent market conditions.

Follow our Notes and access all the assets analyzed in the day:

These picks reflect the power of harnessing AI for investment insights—taking advantage of trends most investors miss. And while these assets are valuable, there’s an even more efficient way to exponentially grow your wealth with AI.

Stay tuned, because what comes next could change how you invest forever.

How to Grow Wealth Exponentially with the Alpha Hedge AI Algo Portfolio

Imagine having access to a portfolio that’s constantly optimized by AI—working around the clock to find the best opportunities, adjusting based on market conditions, and protecting your capital. That’s exactly what the Alpha Hedge AI Algo Portfolio offers.

This is a hands-off, long-term solution designed to help you build wealth exponentially. Backed by a live brokerage account for complete transparency, the portfolio reflects the same data-driven strategy that consistently outperformed the market.

The Alpha Hedge AI-Algo Portfolio may contain either 1 Alpha or 1 Hedge Asset at a time, depending on the Cycle of the S&P500.

The tables and graphics below present historical data on the Alpha and Hedge Cycles. The Performance considered Profits reinvested, no contributions, no withdrawals and dividends are excluded.

Alpha Hedge AI-Algo Portfolio Review: 10/11/24

Over the past decade, we developed the Alpha Hedge Algorithm using advanced quantitative methods, machine learning, neural networks, and, more recently, AI to build a portfolio designed to exponentially grow wealth while minimizing risk.

To ensure confidence in our results and uphold our commitment to full transparency, since September 2021, we have shared our performance in real time from a live brokerage account, allowing our clients to track the portfolio’s progress.

Over the past 37 months, the Alpha Hedge Portfolio has delivered a total return of 41.9% (CAGR 12%), compared to the S&P 500's total return of 26.3% (CAGR 8.1%).

The portfolio is currently up 0.8% this month and has gained 17.9% year-to-date.

At a CAGR of 12%, the portfolio doubles capital in 6 years, whereas the S&P 500, with a 8.1% CAGR, takes 8.9 years to do the same.

Why Choose the Alpha Hedge AI-Algo Portfolio?

AI Investment Management: Our AI algorithms continuously adapt to market conditions, mitigating risks associated with unpredictable fluctuations.

Wealth Exponential Expansion: By harnessing AI's predictive capabilities, the portfolio seeks out high-growth opportunities, accelerating your wealth accumulation.

AI Investment Advisor for Tax Optimization: Strategic investment choices are made with tax efficiency in mind, maximizing your net returns.

Transparency: We operate with radical transparency, offering you full visibility into a live brokerage account. Monitor your investments in real-time and see exactly how your assets are managed.

The Alpha Hedge AI Algorithm isn’t a black box—it’s built on radical transparency. You’ll receive daily insights, monthly actionable reports, and real-time updates as the AI adapts to new market trends.

Ready to level up your investments? Subscribe to the Wall Street Insider Report Premium and get access to the Alpha Hedge AI Algo Portfolio. Let AI guide you to market-beating gains, while you focus on what really matters in life.

▶️Read what the Wall Street Insiders wrote about us↓