📊The Maestros of Meltdown

Dive into the world of 'Chaos Kings', financiers who make fortunes from disaster, with insights on their strategies, and the influence they wield on the financial world.

#keypoints

Daily Educational Content [Free]:

The Maestros of Meltdown

Dissecting the Strategies of the 'Chaos Kings'

The Allure of Doom-Mongers

Characterization of Nassim Nicholas Taleb and Mark Spitznagel

The Debate Over Tail Risk Models

Key Insights: Taleb's Influence and Spitznagel's Persistence

Criticisms of Traditional Asset Management

Case Study [Free]:

The 2008 Crash

Bottom Line

The Role of Ego and Urgency in the Narrative

The Maestros of Meltdown

Dissecting the Strategies of the 'Chaos Kings'

Dive into the world of 'Chaos Kings', financiers who make fortunes from disaster, with insights on their strategies, and the influence they wield on the financial world.

'Chaos Kings'

"Chaos Kings", a term coined by Scott Patterson, alludes to a breed of financiers who find their fortunes in the heart of financial turmoil.

The very antithesis of the popular image of a investor, these individuals swim against the tide, flourishing during market crashes rather than during its highs.

From the eye of the storm, they emerge victorious, bagging profits from what many perceive as financial calamities.

The Allure of Doom-Mongers

Unlike traditional traders, these so-called 'Chaos Kings' are not daunted by bleak market forecasts.

They are the financial world's doom-mongers, thriving in turbulence, and making their fortunes out of mayhem.

Elevated Status of the Chaos Kings

There's something inherently intriguing about those who dare to dance with disaster.

They go against the grain, challenging the status quo, and in doing so, elevate themselves to a status that's often shrouded in mystery and allure.

Profiting from Pandemonium

Their strategy? Simple.

They buy low-cost, overlooked derivatives, betting on the fall of the market rather than its rise.

They are essentially waiting for the house of cards to fall, and when it does, they rake in substantial returns.

Characterization of Nassim Nicholas Taleb and Mark Spitznagel

The Prophets of Peril

Taleb and Spitznagel are no ordinary traders.

They've been called mavericks, rebels, even prophets of peril, for their unique approach to investing.

They're the chaos kings who've mastered the art of profiting from pandemonium.

Empirica's Unconventional Strategy

The pair founded the hedge fund Empirica, adopting a strategy of regular losses by investing in undesirable derivatives contracts.

This approach, while unconventional, served as a form of insurance for their clients against disastrous market events.

The Debate Over Tail Risk Models

Predicting the Unpredictable

The big question in financial circles is whether disasters, deemed random by many, can actually be predicted.

This stirs an intense debate, particularly surrounding tail risk models, which focus on the probability of extreme events.

Tail-Risk Hedging: Insurance or Lottery?

There's also skepticism about the true worth of tail-risk hedging.

Is it a wise investment to mitigate potential losses, or is it like buying complex lottery tickets, hoping for the big win when disaster strikes?

Key Insights: Taleb's Influence and Spitznagel's Persistence

Taleb's Controversial Persona

Despite his controversial online antics, Taleb's ideas have significantly influenced the financial world.

His seminal work, "The Black Swan" has made him a symbolic figure for unexpected downturns.

Spitznagel's Resilience

Spitznagel, on the other hand, is an emblem of persistence.

Despite suffering regular losses, he sticks to his strategy, managing his fund Universa with the hope of generating substantial returns during market distress.

Criticisms of Traditional Asset Management

The Warning to Conventional Asset Managers

The 'Chaos Kings' caution against the perils of traditional asset management, arguing that their failure to prepare for significant market shocks does more harm than good.

A Cautionary Tale

Case in point: US pensions giant Calpers. Cancelling its insurance from Universa right before the Covid-19 crash led to significant losses, serving as a stark reminder of the importance of preparing for the unexpected.

📈Case Study

The 2008 Crash

The fact is the Chaos Kings loose money 95% of the time, that’s a statistic the investors can avoid learning how to identify the trends even in the markets crashes.

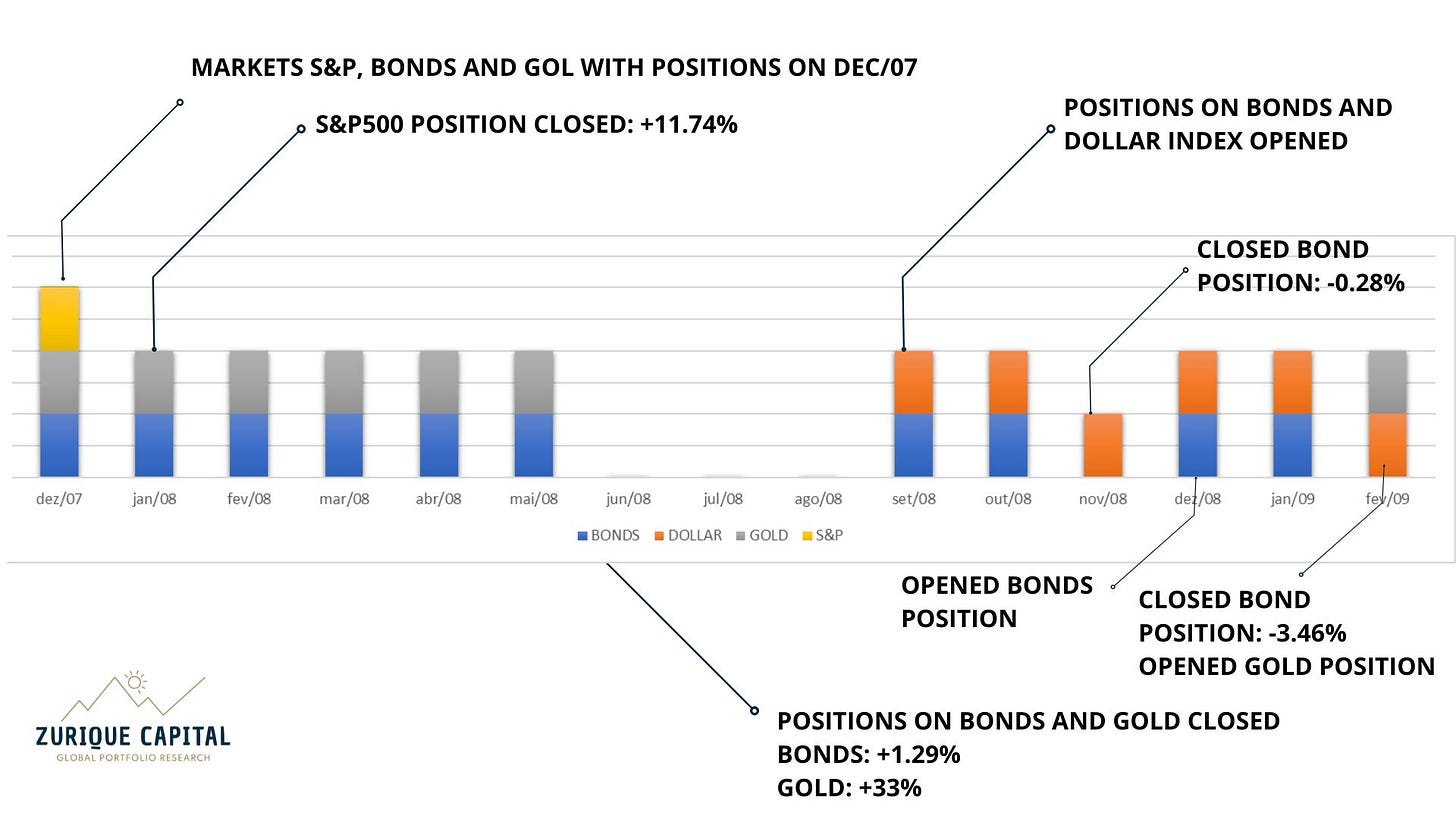

Let’s dive into the timeline of 2008 crisis of the Alfa Hedge Dynamic Portfolio (from Dec/07 to Feb/08).

From Dec/07 to Feb/08 the S&P Index fell 50%. But with the Alfa Hedge dynamic Portfolio algorithm, 5 positions were closed during this period.

3 positives positions in S&P, Gold and Bonds (+11.74%, +33% and +1.29%).

2 negatives positions on Bonds (-0.28% and -3.46%).

1 position on Dollar was open in the period but closed after Feb/08.

📶Full transparency Information

This case study was a backtest data, we only started to execute the Alfa Hedge Portfolio algorithm in Real-Life in 2013.

Alfa Hedge Portfolio I (Closed)

*closed in Dec/2021

Alfa Hedge Portfolio II Update 2023-09-15

But as seen on 2022 Bear Market on our Alfa Hedge Portfolio II, our hedge positions worked really well. As the S&P index fell -19% in 2022, our Portfolio closed with +5.5%.

In what time of the Market Cycle are we now?

Every business day we update the evolution of the Alfa Hedge Portfolio II.

Premium Subscribers have full access to our Alfa Hedge Portfolio II in a Real-Life Brokerage Account in Real Time.

Bottom Line

The Role of Ego and Urgency in the Narrative

The narrative of the 'Chaos Kings' is riveting.

It's a high-stakes drama, with sizable egos, urgent warnings, and dire predictions.

More importantly, it forces us to question our preparedness for unforeseen events, pandemics, climate change, and the overall financial health of the global economy.

"Chaos Kings" is more than a tale of two contrarian traders; it's an incisive commentary on the nature of risk, the illusion of safety, and the unpredictability of markets.

It challenges conventional wisdom and forces us to confront the uncomfortable possibility that disaster could be around the corner, and that's precisely where some make their fortunes.

If you liked this content, you will love our Report.👇

Wall Street Insider Report

Demystify the MARKET CYCLES investing SMARTER in Wall Street

Theory + Action: Learn & Replicate a High Performance + Low Maintenance + Long-Term Portfolio

Join +13k Global Investors and Really Master the Market Cycle Investing