📊The Ideal Investment Strategy for Pension Plans

+Market Divergence, Poker Tactics in Investing, Buybacks and Growth, Vanguard Example & Portfolio Review. Top 6 Daily Insights Decoding the S&P 500 Market Cycle

Wall Street Insider Report

Decoding the S&P500 Market Cycle and sharing the backstage here in the Wall Street Insider Report.

Join +1.5k Wall Street Insiders across 30 US states and 51 countries.

7:00 AM - Morning Kickoff

“So here’s the question on every investor’s mind: Is concentration bad? Well, bad for who? For portfolio managers, it’s terrible. It’s hard to outperform the index when the largest stocks are leading."

-Michael Batnick

This is true for the outdated Portfolio managers. Even Pension Plans are shifting from complex strategies, a transparent, simple index approach.

8:00 AM - Insiders Picks

The Ideal Investment Strategy for Pension Plans

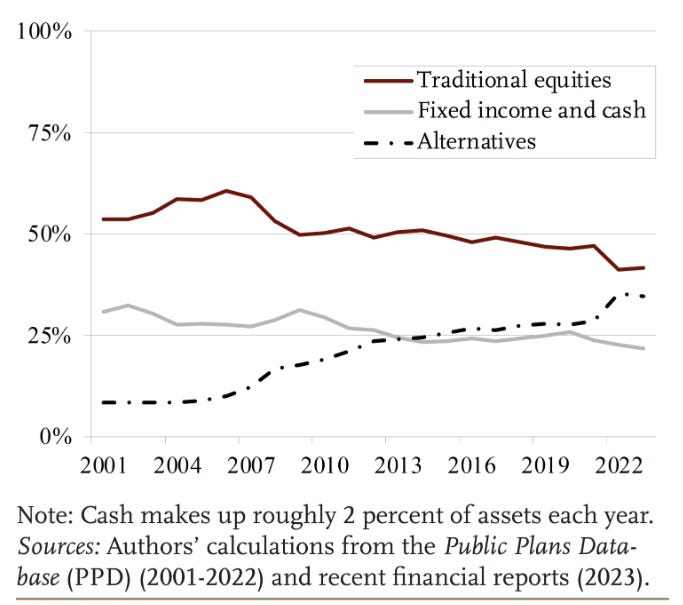

Why do public pension plans increasingly rely on alternative investments and active management? The key finding is that their returns have been virtually identical to a simple 60/40 index strategy since 2000, but worse post-GFC.

Pension plans have shifted away from traditional equities and bonds to alternatives, aiming for higher returns. However, the increased complexity and active management have not significantly outperformed simple index investing.

Analyzing this, the returns of public plans have matched the 60/40 portfolio long-term, but they lagged behind post-2008. The data suggests that the complexities and fees of active management are not justified by higher returns.

If public pension plans cannot anticipate higher long-term returns from complex strategies, a transparent, simple index approach might be more effective. Sticking with passive investing could streamline operations and potentially improve performance.

10:00 AM - S&P500 Data Points

How Anyone Can Understand the Current Market Divergence

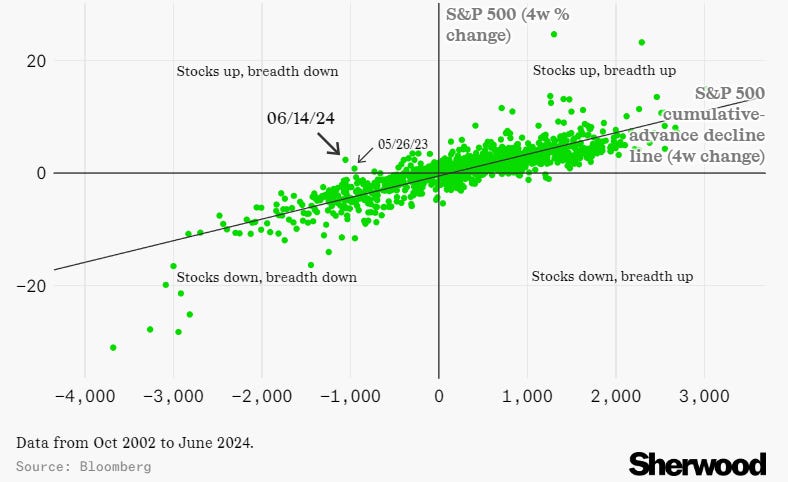

Why is the US stock market rising while many stocks are falling? The answer lies in the low market breadth we are witnessing.

The divergence between mega-caps like Nvidia NVDA 0.00%↑ and the rest of the market is striking. This low breadth is highlighted by the S&P 500's rise despite a significant decline in its cumulative advance-decline line.

Analyzing this, the surge in mega-cap stocks continues to drive the market upward, overshadowing the broader weakness. This pattern echoes a similar situation from May 2023, driven by the AI boom and mixed economic signals.

While historical data offers limited guidance, the concentrated profit growth in mega-caps and stable GDP projections suggest this divergence might persist without a dramatic resolution. Uncharted waters don’t necessarily spell disaster; they could mean a steady journey ahead.

12:00 PM - Lunch Break

Misconceptions About Replicating Winning Poker Tactics in Investing

Why is it challenging for investors to replicate a winning poker strategy? While poker data suggests avoiding large bets without strong hands, the investment world presents different dynamics.

In poker, betting only with strong hands like AA or AK-suited seems optimal. However, opponents quickly adapt, rendering this strategy ineffective. Investors, unlike poker players, don’t face direct reactions from others but encounter other complexities.

Investors struggle to identify “strong hands” due to inherent uncertainty and market variability. Overconfidence in recent performers and constant market noise lead to misguided decisions and excessive trading.

The unpredictability of markets and behavioral biases often result in poor investment outcomes. A disciplined, patient approach, despite market noise, is essential for long-term success.

2:00 PM - S&P500 Drivers

The Challenge of Balancing Buybacks and Growth

Why are tech giants pouring billions into stock buybacks? The answer lies in their strategy to boost shareholder value amidst strong earnings growth and favorable interest rates.

Apple AAPL 0.00%↑ leads the charge with a staggering $83 billion in buybacks, significantly raising its earnings per share. This approach reflects confidence in their stock's value and future prospects.

However, not all tech titans are following suit. Amazon AMZN 0.00%↑ and Tesla TSLA 0.00%↑ , for example, have opted out of buybacks, instead prioritizing reinvestment in growth opportunities like AI infrastructure and debt reduction.

The divergence in strategies highlights different corporate priorities: immediate shareholder returns versus long-term business growth. As Goldman Sachs projects buybacks to exceed $1 trillion by 2025, the impact of these decisions will shape the market landscape. While stock buybacks can enhance value, the balance between short-term gains and sustainable growth remains crucial.

4:00 PM - Second Half Strategies

Avoiding Costs in Your Investment Strategy with Vanguard Example

Why do I favor stocks as the best asset class? They offer a simple and effective way to own a piece of the world's best businesses, making wealth-building effortless.

Historically, stocks have provided exposure to global companies with minimal effort. However, my preference for stocks has evolved beyond their returns.

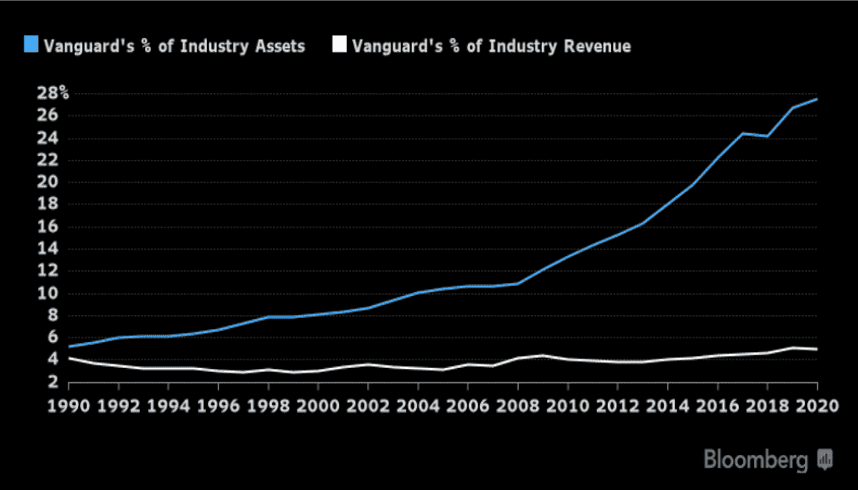

The main advantage of stocks is what they lack—high fees and opaque practices. Thanks to Jack Bogle, the founder of Vanguard, the investment industry has seen a significant reduction in fees, benefiting all investors.

Bogle's efforts have saved retail investors over $1 trillion, enabling us to access low-cost, diversified stock index funds/ETFs. This reduction in fees has democratized investing, making stocks a superior choice for long-term wealth creation. Stocks not only deliver returns but do so with transparency and efficiency, solidifying their position as the greatest asset class.

Asset Growth: Vanguard has seen substantial growth in its market share of industry assets, indicating its increasing popularity and the large influx of investments into its funds. This growth is particularly pronounced in the last decade (2010-2020), likely due to the widespread adoption of low-cost index funds and ETFs which Vanguard is known for.

Revenue Growth: Despite the significant increase in assets, Vanguard's revenue share has not grown as dramatically. This can be attributed to Vanguard's low-cost fee structure, which, while attracting a large volume of assets, generates less revenue per dollar of assets compared to traditional mutual funds with higher fees.

6:00 PM - Portfolio Review: 06/20/2024

The Alpha Hedge Portfolio experienced a daily decline of -0.9%, while its monthly performance remains positive at +6.9%.

This comes as the S&P 500 SPY 0.00%↑ fell approximately 0.2% after briefly exceeding 5,500, failing to extend its streak of record closes, which now stands at 31 for the year.

Over the past decade, our subscribers have outperformed the American Market Decoding the S&P 500 Market Cycle.

You too can make investment decisions based on objective data.

That's where the Wall Street Insider Report comes in. We've developed a unique approach to investment management that puts you back in the driver's seat.

Know more about our 5-Year Plan and join +1.5K Pro Investors and Finance Professionals across 51 countries who are exponentially growing their - and their clients - wealth for over a decade.↓

I have just finished reading the Wall Street Insider Report from June 21, 2024, and I am impressed with the depth and clarity of the information presented. I want to congratulate you on the exceptional work.

The analysis about market concentration and its implications for portfolio managers was particularly enlightening. The suggestion that a simple and transparent index approach may be more effective than complex strategies is an interesting viewpoint and certainly worth exploring.

In addition, the discussion about the current market divergence and the dependence of the U.S. stock market on mega-cap stocks was fascinating. The idea that this divergence may persist without a dramatic resolution is a perspective that challenges many common assumptions.

Finally, I really enjoyed the section about poker tactics and investment. The comparison between the two approaches was unique and clearly illustrated the complexities of investing.

Overall, I think this report provides valuable and insightful view of the current financial market. I look forward to reading more of your work in the future.