The Greatest ETFs of the Market

Dive into the world of ETFs and discover the greatest ETFs of the markets. Learn about strategies, and how they can diversify your portfolio.

Clique aqui para ler em português: https://www.wallstreetinsiderreport.com/p/as-maiores-etfs-do-mercado

Seven17am #keypoints

Daily Educational [Free]:

The Greatest ETFs of the Market

General Vision of the ETF Market

Portfolio Diversification with ETFs

Strategies for Diversification with ETFs

The Greatest ETFs: A Closer Look

Bottom Line

Introduction

In the vast ocean of financial instruments, Exchange-Traded Funds (ETFs) have emerged as a beacon of simplicity and efficiency.

They offer an affordable and manageable way to diversify your investment portfolio, providing access to a wide array of markets and sectors.

This article delves into the greatest ETFs of the markets, offering insights into their performance, strategies, and the benefits they bring to your investment portfolio.

The Greatest ETFs of the Market

The Basics of ETFs

ETFs are investment funds traded on stock exchanges, much like individual stocks.

They offer the benefits of both mutual funds and individual stocks, making them a popular choice among investors.

ETFs typically track an index, a commodity, bonds, or a basket of assets.

They offer a straightforward way to invest in a broad market, a specific sector, or a selected index.

The Allure of ETFs

The allure of ETFs lies in their versatility and accessibility.

They offer exposure to a wide range of sectors and industries, from the broad-based total market funds to the more specific sector-focused funds.

ETFs also offer a level of transparency that's hard to find in other investment vehicles.

Investors can view the ETF's holdings on a daily basis, providing a clear picture of where their money is invested.

General Vision of the ETF Market

The Growth of the ETF Market

The ETF market has experienced significant growth over the past decade.

As of 2023, there are over 3,000 ETFs listed on U.S. exchanges, with assets under management (AUM) totaling over $5 trillion.

This growth is driven by the many advantages ETFs offer, including lower costs, greater liquidity, and tax efficiency.

The Future of the ETF Market

The future of the ETF market looks promising.

As investors become more sophisticated, the demand for innovative and niche ETFs is expected to rise.

Additionally, the advent of thematic ETFs, which focus on specific themes or trends, is likely to attract a new generation of investors.

Portfolio Diversification with ETFs

The Role of ETFs in Diversification

ETFs play a crucial role in portfolio diversification.

By holding a basket of securities, they allow investors to spread their risk across many companies or sectors.

This can help to mitigate the impact of any single security's poor performance on the overall portfolio.

Strategy for Diversification with ETFs

The ETFs are the key of our Alfa Hedge Portfolio.

With them we can establish the universe of assets with 5 markets (Long-Term Treasuries, Dollar, Gold, Stocks Indexes, REITs and Bitcoin) in a simple way.

The Alfa Hedge Portfolio approach is a Dynamic capital diversification that allows the Investor to take advantage of Positive Market Cycles with Controlled Risk.

This form of diversification allows for greater predictability of results and consistent returns over the years, with reduced risks.

Traditional portfolios offer constant allocation to a universe of Assets.

However, the returns from these investments can be variable under different market conditions. The winners "carry" the losers.

Dynamic diversification with ETFs allows for more stable returns, as the allocation of Assets is determined by the market cycle and its historical volatility.

An important point in managing the Alfa Hedge Portfolio is to find the sweet spot of diversification with ETFs.

But the main difference of the Alfa Hedge Portfolio from the assembly of traditional Portfolios is that in it, you don't need to be with all Asset classes at the same time in the Portfolio. You eliminate the "losers" and keep the "winners".

The key is to react of what is happening on the Market Cycle, not try to predict.

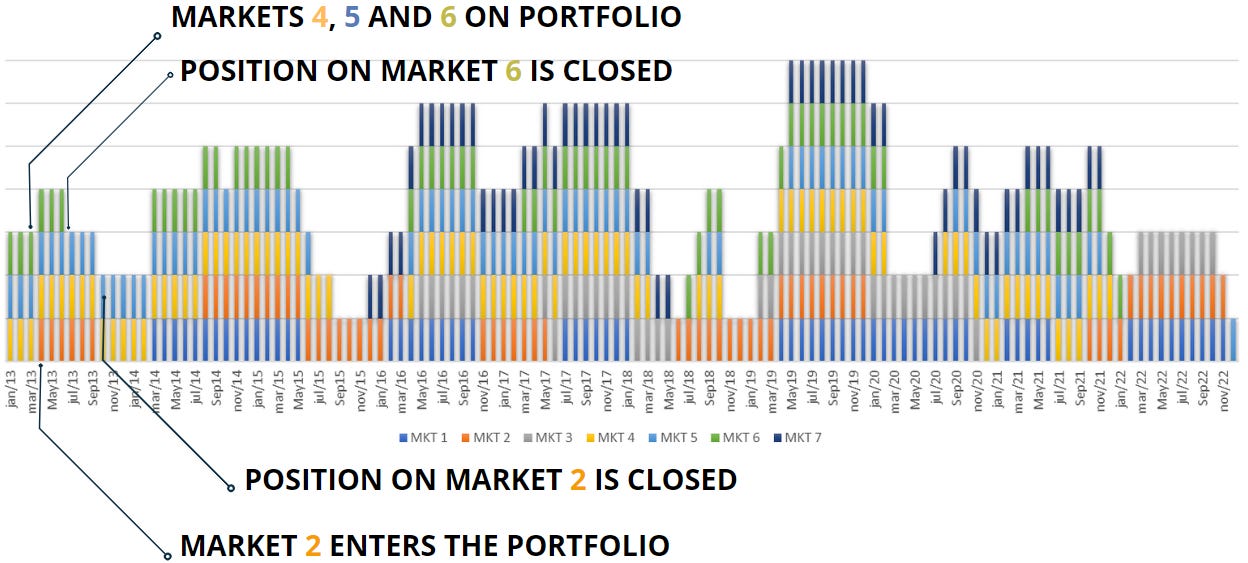

Look at the chart below. It shows the period in which each of the markets was in a Positive Market Cycle and present in the Alpha Wall Street Portfolio with ETFs from 2013 to 2022.

Observe the example from January to November 2013.

1. In January 2013, Markets 4, 5, and 6 were in our Portfolio.

2. In April '13, Market 2 entered a Positive Cycle and consequently entered the Portfolio.

3. In July '13, Market 6 entered a Negative Cycle, and consequently, we closed the position.

4. In October '13, it was Market 2's turn to close the position, leaving only Markets 4 and 5 in the Portfolio.

The Greatest ETFs: A Closer Look

Let's take a closer look at some of the greatest ETFs of the market and what makes them stand out.

SPDR S&P 500 ETF Trust SPY 0.00%↑

iShares Core S&P 500 ETF IVV 0.00%↑

Vanguard 500 Index Fund VOO 0.00%↑

The ETFs SPY, IVV, and VOO are the most traded ETFs in the world, offering exposure to the S&P 500 Index. They are popular choices for investors seeking to replicate the performance of the U.S. large-cap sector.

Vanguard Total Stock Market Index VTI 0.00%↑

VTI is a favorite among investors for its broad exposure to the U.S. stock market. With a low expense ratio and a portfolio that spans across all sectors, it's a solid choice for investors seeking diversified exposure to U.S. equities.

Invesco QQQ Trust QQQ 0.00%↑

QQQ is known for its exposure to the technology sector, with top holdings including tech giants like Apple, Microsoft, and Amazon. Its performance has been impressive, particularly during the tech-driven market rally in recent years.

Bottom Line

The greatest ETFs of the markets offer a blend of performance, diversification, and accessibility.

Whether you're a seasoned investor or just starting out, ETFs provide a straightforward and efficient way to build a diversified portfolio.

As the ETF market continues to evolve, it's certain to offer even more opportunities for investors to explore.

But, accordingly with the Market Cycle, what ETFs do we have on Alfa Hedge Portfólio II right now?

Access now the evolution of the Alfa Hedge Portfolio II clicking on the button bellow

If the button doesn’t work, please click on this link: https://www.wallstreetinsiderreport.com/p/dailyupdate