The Future of Strategies: How to Stay Ahead of the Curve

🔴Day 1,228 since Zurique Capital publicly unveiled the evolution of the Alpha Hedge AI Algo Portfolio.

The Future of Strategies: How to Stay Ahead of the Curve

A truth about real investing: Tracking the market is not the same as outperforming it.

Today is day 1,228 of publicly sharing the evolution of the Alpha Hedge AI Algo Portfolio, 1,228 days of refining, testing, and proving what a true Alpha strategy can achieve.

Most investors settle for Beta returns, riding the waves of the market. But true wealth builders Alpha, capitalizing on Market Cycles with precision. That’s the difference between tracking the market and beating it.

Alpha portfolios are designed to deliver consistent outperformance, while beta portfolios often settle for market returns.

Beta portfolios aim to replicate market performance by tracking broad indices, offering simplicity but leaving limited room for outperformance.

Alpha portfolios, like our Alpha Hedge AI Algo Portfolio, utilize proprietary strategies and market insights to identify opportunities, dynamically adapt, and maximize returns.

We developed an approach that leverages the psychology of market cycles to dynamically adjust a concentrated portfolio depending on the cycle of the S&P Index for optimal returns and risk management.

This strategy is not just about timing; it’s about precision in aligning with the market’s pulse, which sets Alpha portfolios apart from Beta.

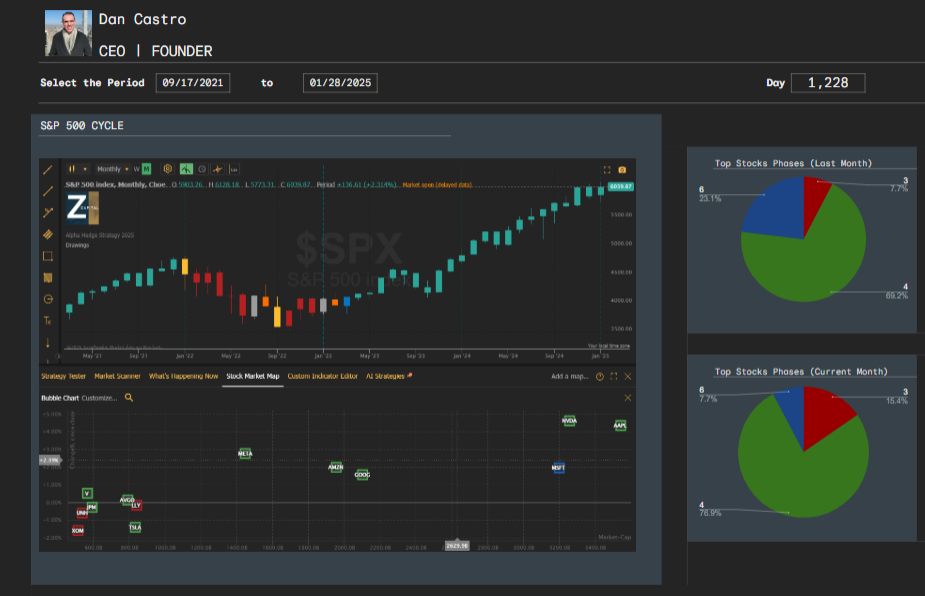

Market Cycle Update:

The Alpha Hedge AI Algo Portfolio is designed to adapt seamlessly to market cycles, focusing on a single asset at a time based on the S&P Index's current phase.

Currently, in Phase 4 of the Cycle, 77% of the top companies in the Index remain in an uptrend, while 33% are in a downtrend—a notable 23% increase in downward trends compared to last month. This dynamic shift highlights both opportunities and risks, with Apple AAPL 0.00%↑ acting as a positive driver for the S&P Index today, while Tesla's TSLA 0.00%↑ performance exerted downward pressure.

Here’s how this strategy is translating into real-world results.

Portfolio Performance Update:

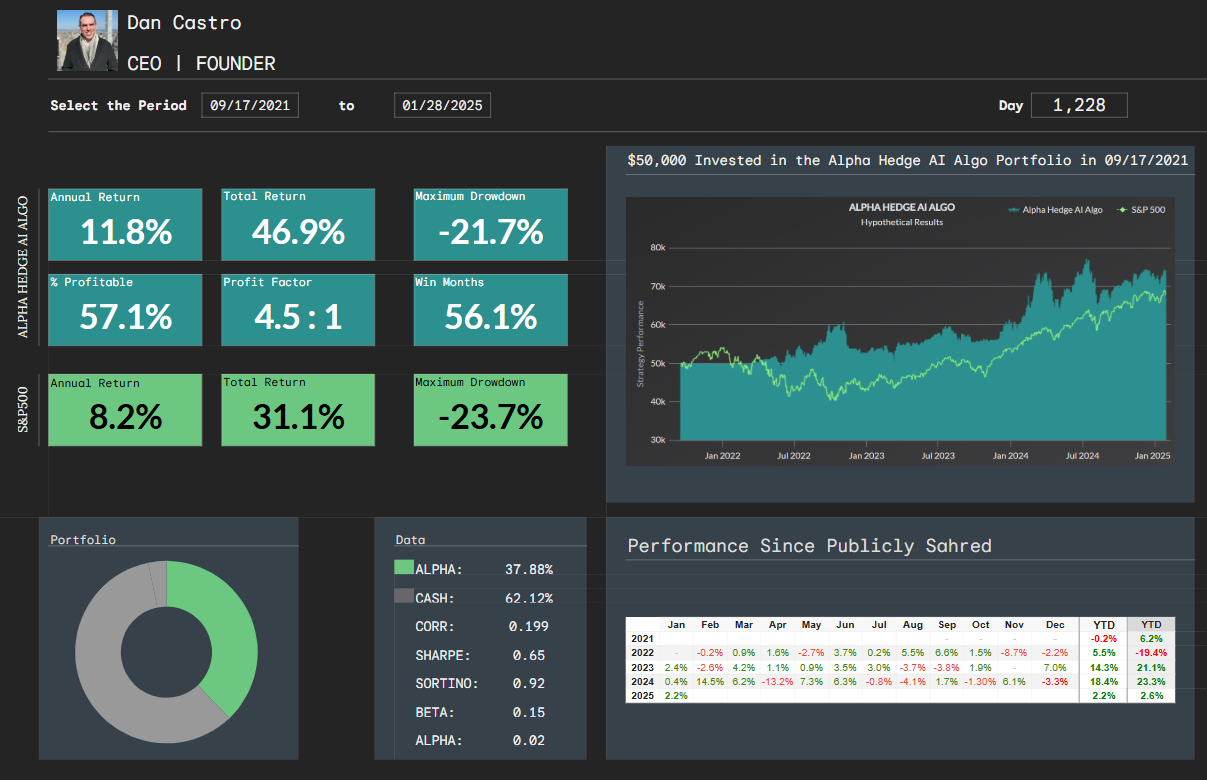

It’s been 1,228 days since we introduced the Alpha Hedge AI Algo Portfolio to the public. As the S&P500 is in uptrend, we have 1 Alpha Asset in our Portfolio.

Over this period, the portfolio has achieved a 46.9% total return, outperforming the S&P 500’s 31.1% total return. With an annualized return (CAGR) of 11.8%, the Alpha Hedge strategy continues to showcase its ability to adapt dynamically to market conditions, compared to the S&P 500’s CAGR of 8.2%.

Are you still relying on beta returns, or are you ready to explore what an AI-driven Alpha strategy can do for your portfolio?

Let’s discuss how you can position yourself for outperformance.

▶️Read what the Wall Street Insiders wrote about us↓