The Future of Market Theories: AI's Impact on Predictions

LESSON 1/5: Breaking Down AI’s Role in Stock Market Predictions [Free Course]

Breaking Down AI’s Role in Stock Market Predictions [FREE COURSE: Lesson 1/5]

Why Traditional Models Fail in Today’s Chaotic Markets

The stock market is anything but predictable. Its extreme volatility, non-linearity, and susceptibility to both internal and external shocks make accurate forecasting nearly impossible with traditional models. These outdated approaches simply aren’t equipped to handle the chaotic data that drives market movements.

If you’re relying on these old methods, you’re missing out on opportunities hidden in the market’s complexity. But ignoring these inefficiencies is no longer an option.

That’s why AI is changing the game, offering a way to cut through the chaos.

How AI Puts You Ahead of Insider Traders - Legally

Traditional methods have failed to keep up with today’s fast-paced, data-driven markets. But imagine if you could predict market trends with the kind of accuracy only insiders have.

The Alpha Hedge AI Algorithm empowers investors with insights once reserved for those with privileged information. It’s like having a crystal ball—but it's powered by AI, perfectly legal, and accessible to you.

Using AI, we analyze vast datasets to identify patterns and opportunities that human intuition often overlooks. With this algorithm, you’re no longer at a disadvantage against insider traders—you're right on their level.

Insider Trading Definition

It refers to trading a public company's stock or other securities by individuals with access to non-public, material information about the company.

The Future of Market Theories: AI's Impact on Predictions

Market Theories and AI's Role

Stock Market Complexity: Stock market forecasting has inherent challenges due to its extreme volatility, non-linearity, and susceptibility to both internal and external factors.

Traditional theories like the Efficient Market Hypothesis (EMH) and Random Walk (RW) theory argue that predicting stock prices is practically impossible since market prices already incorporate all available information, and future movements are random.

Efficient Market Hypothesis (EMH) and Random Walk (RW)

EMH: Stock prices fully reflect all available information, making it impossible to consistently outperform the market. Price changes occur randomly due to new information.

RW: Stock prices follow an unpredictable, random path, meaning past movements do not influence future prices. Therefore, forecasting stock prices is futile.

Challenging Traditional Theories: However, newer models such as the Inefficient Market Hypothesis (IMH) and Fractal Market Hypothesis (FMH) challenge the EMH by acknowledging inefficiencies in markets caused by transaction costs, information asymmetry, and human emotions. These models open up opportunities for AI, which can handle non-linear, chaotic data better than traditional models.

Inefficient Market Hypothesis (IMH) and Fractal Market Hypothesis (FMH)

IMH: Markets are not always efficient due to factors like transaction costs and emotions, creating opportunities for investors to outperform the market.

FMH: Markets show fractal patterns, with short-term volatility and long-term trends. Stability arises when investor horizons align, but mismatches can lead to market instability.

AI’s Role in Stock Prediction: AI techniques, especially neural networks, are seen as a powerful tool for understanding and predicting market behaviors. The article argues that AI can help mitigate the limitations of traditional models by processing massive datasets, learning from patterns, and accounting for the inherent chaos and randomness of stock markets. AI’s ability to adapt and evolve makes it highly suited for financial market forecasting, where traditional methods fail to capture complex dynamics.

Now, let’s talk about proof—our AI isn’t just theory, it delivers real results.

How Our AI Investment Bot Predicts the Best Assets

Results matter. Today, our Alpha Hedge AI Algorithm has identified the top 7 assets that are primed to take advantage of current market conditions.

These assets aren’t picked randomly—they’re the result of our AI investment bot’s sophisticated analysis of market volatility, trends, and patterns that human traders simply can’t process fast enough.

BTI 0.00%↑ NVAX 0.00%↑ ADM 0.00%↑ DAL 0.00%↑ MPW 0.00%↑ APP 0.00%↑ BLK 0.00%↑

Here’s How We Find These Market Opportunities:

Have access to more insights like this every day—ensuring you’re always in a position to make informed investment decisions, even during turbulent market conditions.

Follow our Notes and access all the assets analyzed in the day:

But there’s more. The Alpha Hedge AI Algo Portfolio goes even further, optimizing your entire investment strategy.

Unlock the Power of AI with the Alpha Hedge Portfolio

The Alpha Hedge AI Algo Portfolio is designed to help you grow your wealth exponentially by harnessing the power of AI.

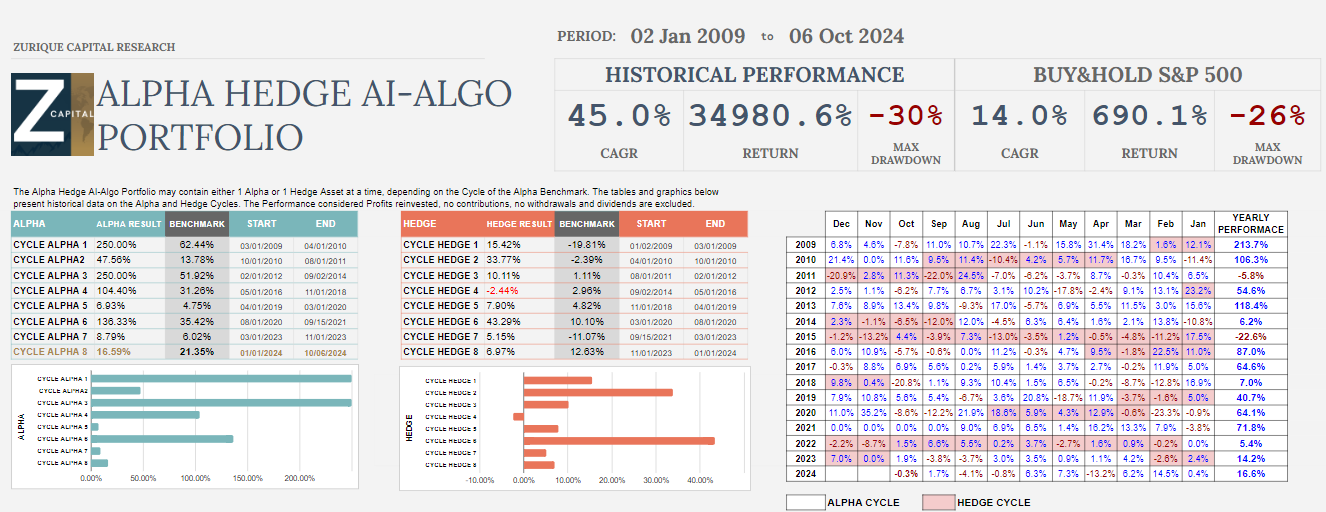

The Alpha Hedge AI-Algo Portfolio may contain either 1 Alpha or 1 Hedge Asset at a time, depending on the Cycle of the S&P500.

The tables and graphics below present historical data on the Alpha and Hedge Cycles. The Performance considered Profits reinvested, no contributions, no withdrawals and dividends are excluded.

Alpha Hedge AI-Algo Portfolio Review: 10/04/24

Over the past decade, we developed the Alpha Hedge Algorithm using advanced quantitative methods, machine learning, neural networks, and, more recently, AI to build a portfolio designed to exponentially grow wealth while minimizing risk.

To ensure confidence in our results and uphold our commitment to full transparency, since September 2021, we have shared our performance in real time from a live brokerage account, allowing our clients to track the portfolio’s progress.

Over the past 37 months, the Alpha Hedge Portfolio has delivered a total return of 40.3% (CAGR 11.7%), compared to the S&P 500's total return of 24.9% (CAGR 7.7%).

The portfolio is currently down 0.3% this month and has gained 16.6% year-to-date.

At a CAGR of 11.7%, the portfolio doubles capital in 6 years, whereas the S&P 500, with a 7.7% CAGR, takes 9.4 years to do the same.

Why Choose the Alpha Hedge AI-Algo Portfolio?

AI Investment Management: Our AI algorithms continuously adapt to market conditions, mitigating risks associated with unpredictable fluctuations.

Wealth Exponential Expansion: By harnessing AI's predictive capabilities, the portfolio seeks out high-growth opportunities, accelerating your wealth accumulation.

AI Investment Advisor for Tax Optimization: Strategic investment choices are made with tax efficiency in mind, maximizing your net returns.

Transparency: We operate with radical transparency, offering you full visibility into a live brokerage account. Monitor your investments in real-time and see exactly how your assets are managed.

By subscribing to the Wall Street Insider Report, you’ll gain access to the Alpha Hedge AI Algo Portfolio, daily insider-level AI analysis, and actionable insights that will help you stay ahead of the market. Don’t wait—leverage AI to secure your financial future.

▶️Read what the Wall Street Insiders wrote about us↓