📊The Down of Diversification

Decode the S&P 500 Market Cycle

Wall Street Insider Report

Decoding the S&P500 Market Cycle and sharing the backstage here in the Wall Street Insider Report.

Join +1.5k Wall Street Insiders across 30 US states and 51 countries.

The Down of Diversification

Despite the long-standing belief in the benefits of diversification, the consistent underperformance of diversified portfolios relative to the U.S. large-cap stock index over the past 15 years raises significant questions about the efficacy of this strategy and its future viability in a rapidly evolving market landscape.

Are Diversified Portfolios a Myth?

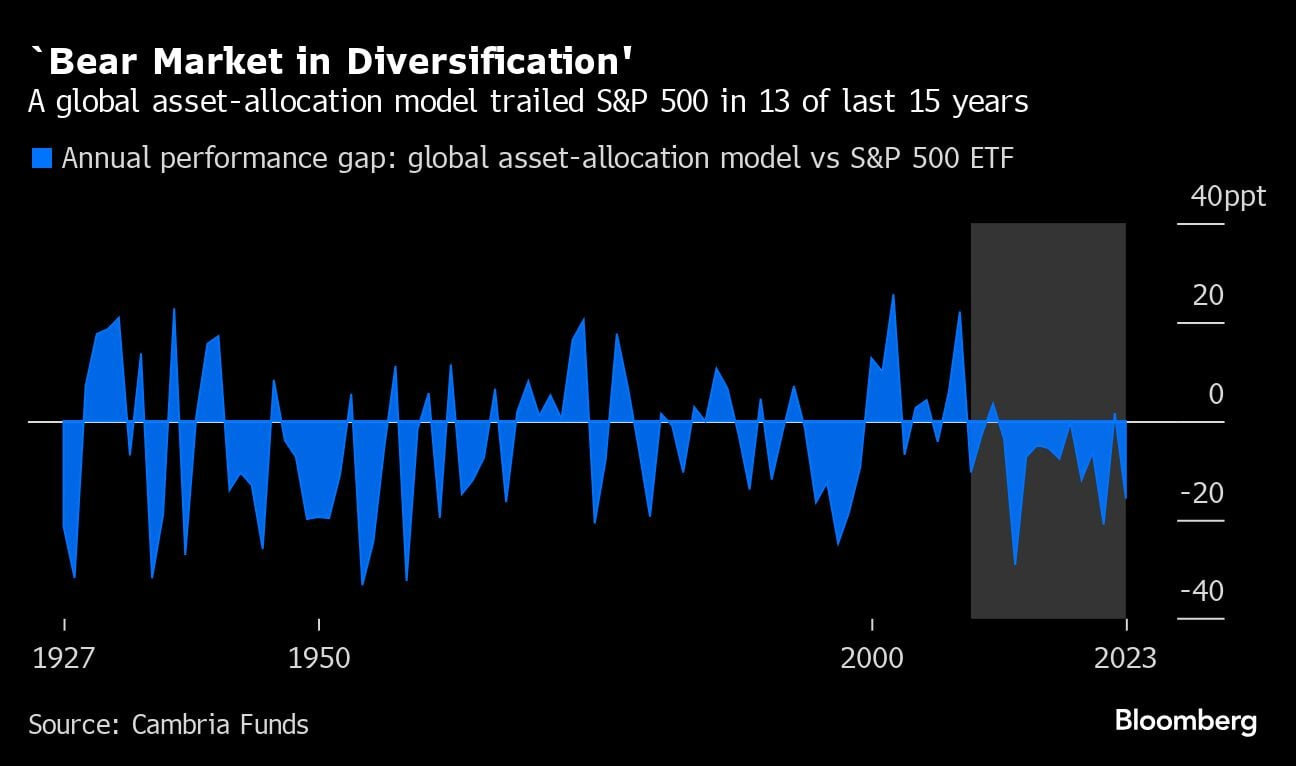

Historically, diversification has been the bedrock of prudent investing. Yet, over the past 15 years, diversified portfolios have lagged behind the U.S. large-cap stock index in 13 of those years, an unprecedented stretch that has only been seen once before in nearly a century of market data.

According to Cambria Funds, diversified portfolios have managed an average annual return of around 6%, but this pales in comparison to the performance of the S&P 500, which has consistently outpaced other asset classes.

US earnings have soared under a regime of easy money, allied with US market dominance, driven by tech giants, especially after March 2020.

Diversification vs Concentration: Psychological Showdown

The underperformance of diversified portfolios has taken a psychological toll on both individual and institutional investors.

Meb Faber, founder of Cambria, refers to this period as a "bear market in diversification." The frustration of trailing the U.S. stock rally creates pressure to abandon diversified strategies in favor of more concentrated investments in high-performing sectors like Big Tech.

Financial advisers like Anthony Syracuse often struggle to convince clients to stick with diversified approaches, highlighting the tension between long-term strategy and short-term performance gains.

But these short-term performance gains have been persisting for 15 years and can last forever. Embrace the concentration and manage risk actively is what investors should do to avoid stress.

If These Managers Found Alternatives to Traditional Diversification ... You Can Too

In response to the ongoing underperformance of diversified portfolios, many big-money managers are shifting their strategies towards alternative assets to boost returns.

Institutions such as pensions, endowments, and foundations, which collectively hold $21 trillion in diversified strategies, are increasingly exploring alternatives to traditional diversification.

This includes a greater focus on U.S. stocks and alternative investments, driven by the need to match or exceed the returns of the S&P 500.

The Down of Diversification

The persistent underperformance of diversified portfolios relative to the U.S. large-cap stock index over the past 15 years has sparked a critical re-evaluation of traditional investment strategies.

The relentless outperformance of U.S. shares challenges the diversification mantra.

The sustainability of this trend depends on various factors, including economic conditions, corporate performance, and technological advancements.

This significant performance disparity underscores the necessity of strategic investment concentration.

While investors typically diversify across various asset classes and regions to mitigate risk, excessive diversification can diminish potential returns. A focused, dynamic portfolio that adeptly interprets the S&P 500 market cycle addresses this issue effectively.

References

Morningstar Inc.

Cambria Funds

Preqin Study on Institutional Investments

Expert Opinions from Meb Faber and Anthony Syracuse

Portfolio Review: 06/14/2024

The Alpha Hedge Portfolio demonstrated a slight positive performance today, mirroring the S&P 500 SPY 0.00%↑, which tipped just below the flatline. Specifically, the portfolio achieved a daily gain of +0.2%, contributing to its robust monthly performance of +5.9%.

Over the past decade, our subscribers have outperformed the American Market Decoding the S&P 500 Market Cycle.

You too can make investment decisions based on objective data.

That's where the Wall Street Insider Report comes in. We've developed a unique approach to investment management that puts you back in the driver's seat.

Know more about our 5-Year Plan and join +1.5K Pro Investors and Finance Professionals across 51 countries who are exponentially growing their - and their clients - wealth for over a decade.↓