Study: U.S. and Brazilian Interest Rates & Currency Movement

Alpha Hedge AI-Algo Portfolio Review: 11/14/24

Comparative Study of U.S. and Brazilian Interest Rates & Currency Movement

New York Call

Every business day, we hold a live meeting with our Brazilian clients, called the New York Call, where we analyze the market, our portfolio, and assets on demand. This is an excerpt from the meeting in Portuguese and AI-Dubbed in English.

🔰 In Portuguese ↓

🤖AI-Dubbed in English (in test) ↓

(The AI-powered version is still a work in progress, but we’re actively working to enhance the experience. Thank you for your understanding.

In recent months, there has been considerable movement in interest rates and currency valuations, particularly concerning the American and Brazilian markets. Let's delve into these trends to understand the dynamics at play.

The American Interest Rate Trend

Currently, the American interest rates are in downtrend. This indicates a broader trend towards lower interest rates in the future, despite the recent hikes.

The Brazilian Interest Rate Situation

In contrast, Brazil is witnessing an upward trend in its interest rates, marked by ascending peaks and troughs. This signifies a steady increase, which theoretically should make the Brazilian Real more attractive to foreign investors. The expectation would be for these investors to take advantage of low-interest loans abroad and invest in Brazil, reaping the benefits of higher returns.

Unpacking the Currency Valuation Phenomenon

Given the current interest rate environment, one might anticipate a stronger Brazilian Real relative to the Dollar. However, contrary to this logic, we are observing an appreciation of the Dollar against the Real.

The U.S. Dollar Index, represented by the ETF UUP 0.00%↑, shows a 3.12% increase this month, denoting the Dollar's appreciation not just against the Real but relative to a basket of global currencies.

The Bigger Picture

The current appreciation of the Dollar suggests that its influence is outweighing the attractiveness of higher interest Rates in Brazil.

This broader strength of the Dollar might be attributed to global economic conditions, investor sentiment, or other macroeconomic factors at play.

Understanding these trends is crucial for investors and analysts as they navigate the complex interplay of interest rates and currency values.

Keeping a close eye on these movements can help make informed decisions in international investments and economic strategies.

Alpha Hedge AI Algo Portfolio Review 11/14/24

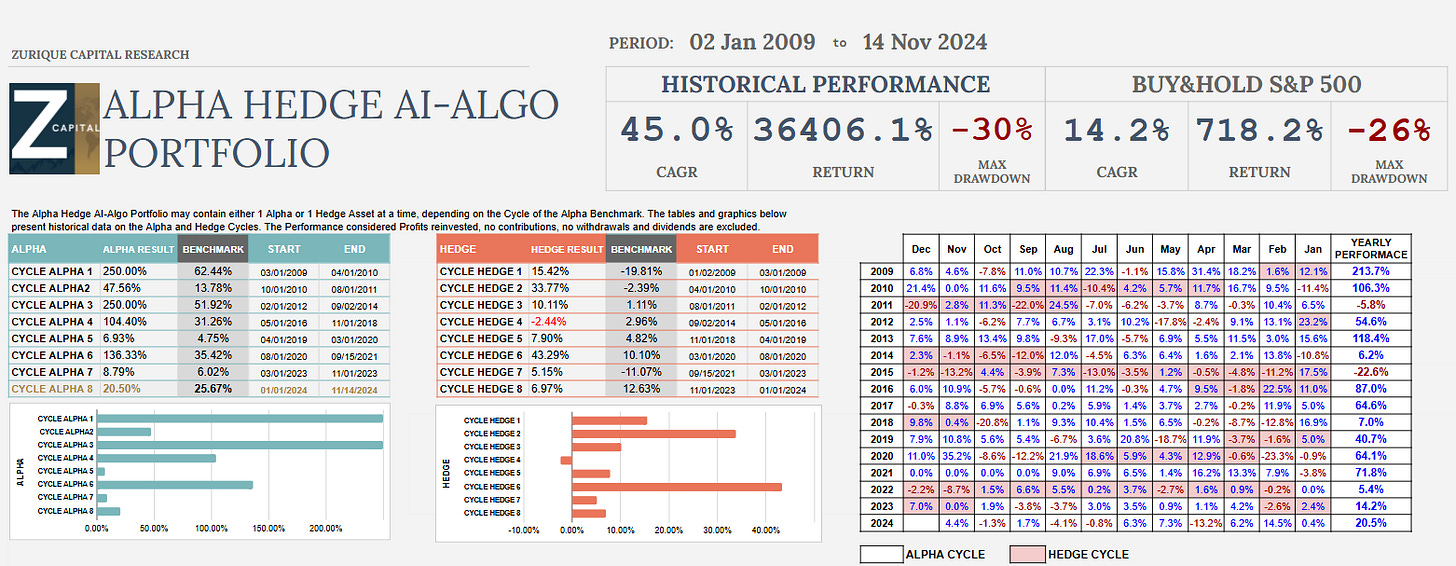

The Alpha Hedge AI-Algo Portfolio may contain either 1 Alpha or 1 Hedge Asset at a time, depending on the Cycle of the S&P500.

The tables and graphics below present historical data on the Alpha and Hedge Cycles. The Performance considered Profits reinvested, no contributions, no withdrawals and dividends are excluded.

Over the past decade, we developed the Alpha Hedge Algorithm using advanced quantitative methods, machine learning, neural networks, and, more recently, AI to build a portfolio designed to exponentially grow wealth while minimizing risk.

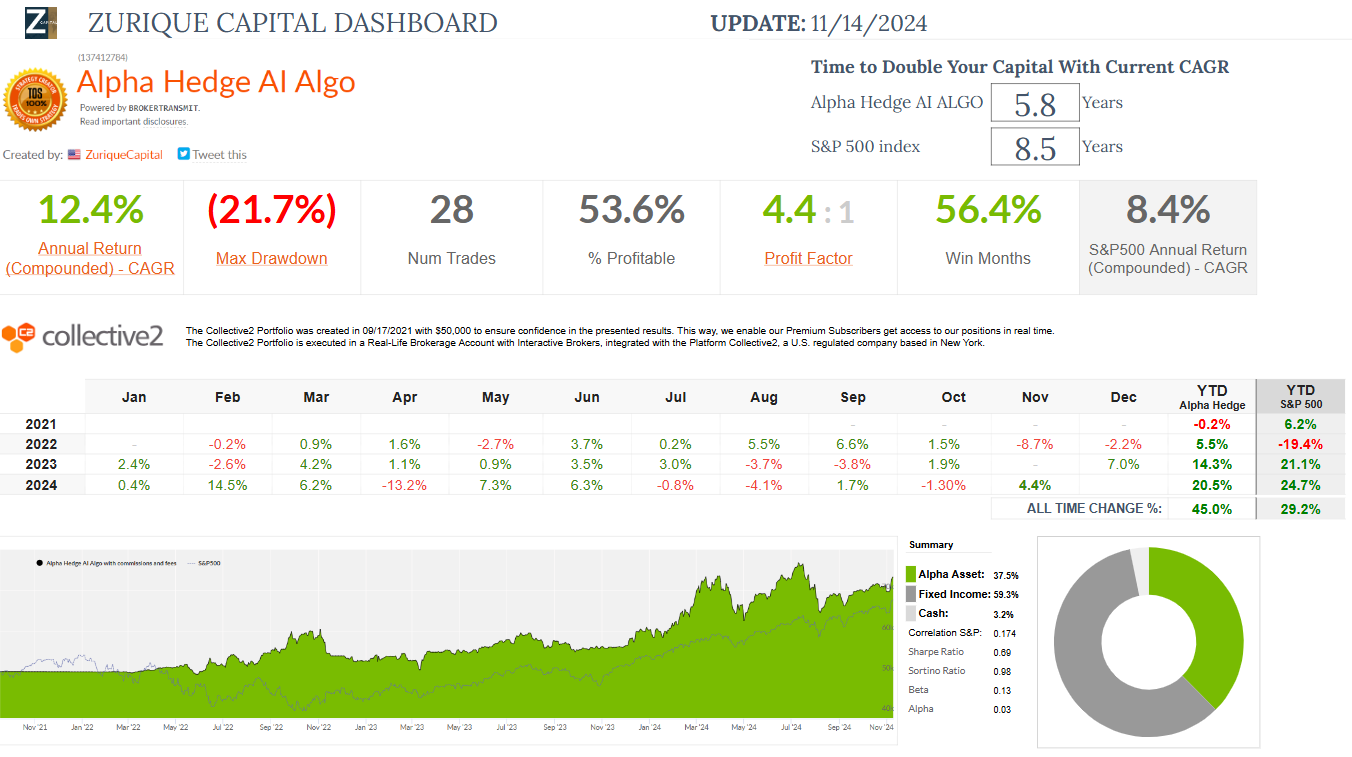

To ensure confidence in our results and uphold our commitment to full transparency, since September 2021, we have shared our performance in real time from a live brokerage account, allowing our clients to track the portfolio’s progress.

Why Choose the Alpha Hedge AI-Algo Portfolio?

AI Investment Management: Our AI algorithms continuously adapt to market conditions, mitigating risks associated with unpredictable fluctuations.

Wealth Exponential Expansion: By harnessing AI's predictive capabilities, the portfolio seeks out high-growth opportunities, accelerating your wealth accumulation.

AI Investment Advisor for Tax Optimization: Strategic investment choices are made with tax efficiency in mind, maximizing your net returns.

Transparency: We operate with radical transparency, offering you full visibility into a live brokerage account. Monitor your investments in real-time and see exactly how your assets are managed.

Subscribe now, and let AI work for your financial future.

▶️Read what the Wall Street Insiders wrote about us↓