Strategic Points in Today's Stock Market $LEU $VFC $NIO

+AI Investment Bot: Tech Stocks Trends & Alpha Hedge AI-Algo Portfolio Review: 10/29/24

Strategic Entry Points in Today's Stock Market

New York Call

Every business day, we hold a live meeting with our Brazilian clients, called the New York Call, where we analyze the market, our portfolio, and assets on demand. This is an excerpt from the meeting.

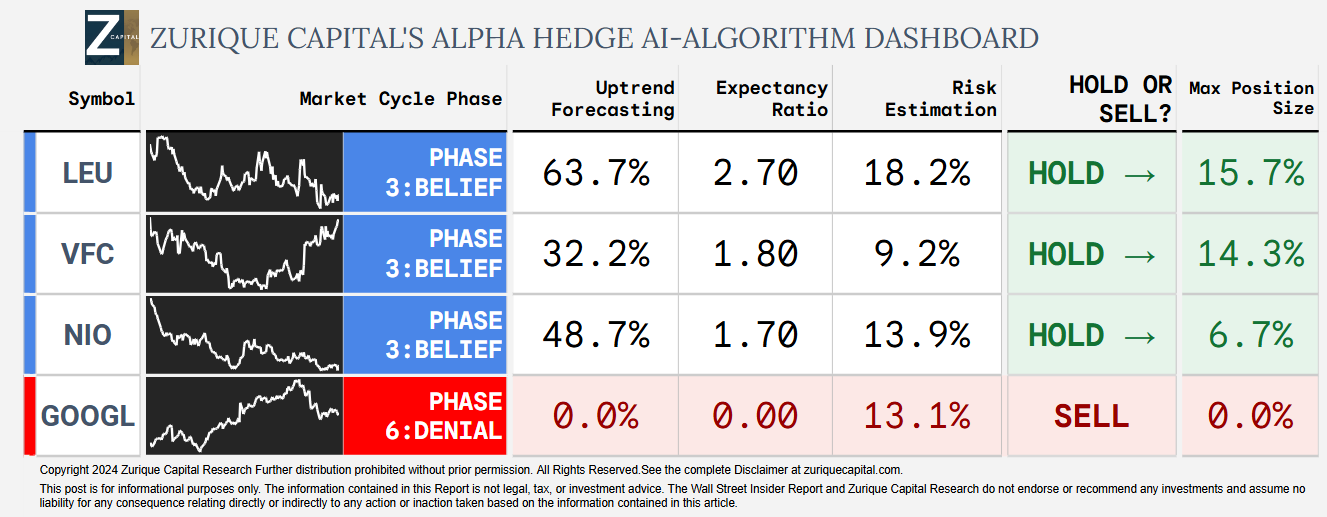

AI Investment Bot: Today's Stock Market Trends

LEU 0.00%↑ VFC 0.00%↑ NIO 0.00%↑ GOOGL 0.00%↑

Alpha Hedge AI Algo Portfolio Review

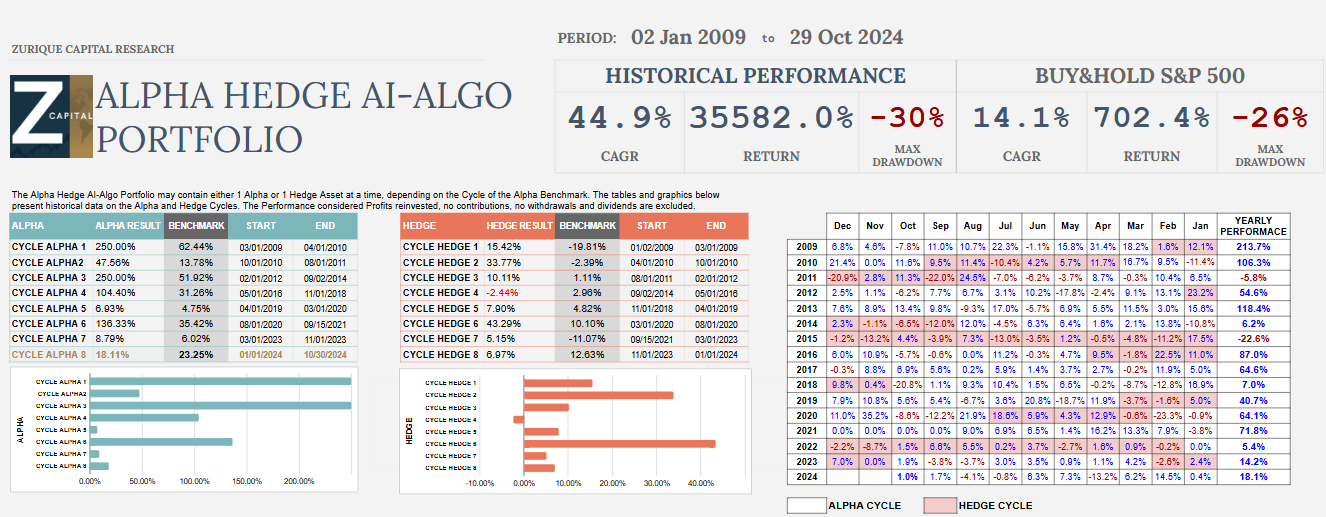

The Alpha Hedge AI-Algo Portfolio may contain either 1 Alpha or 1 Hedge Asset at a time, depending on the Cycle of the S&P500.

The tables and graphics below present historical data on the Alpha and Hedge Cycles. The Performance considered Profits reinvested, no contributions, no withdrawals and dividends are excluded.

Alpha Hedge AI-Algo Portfolio Review: 10/29/24

Over the past decade, we developed the Alpha Hedge Algorithm using advanced quantitative methods, machine learning, neural networks, and, more recently, AI to build a portfolio designed to exponentially grow wealth while minimizing risk.

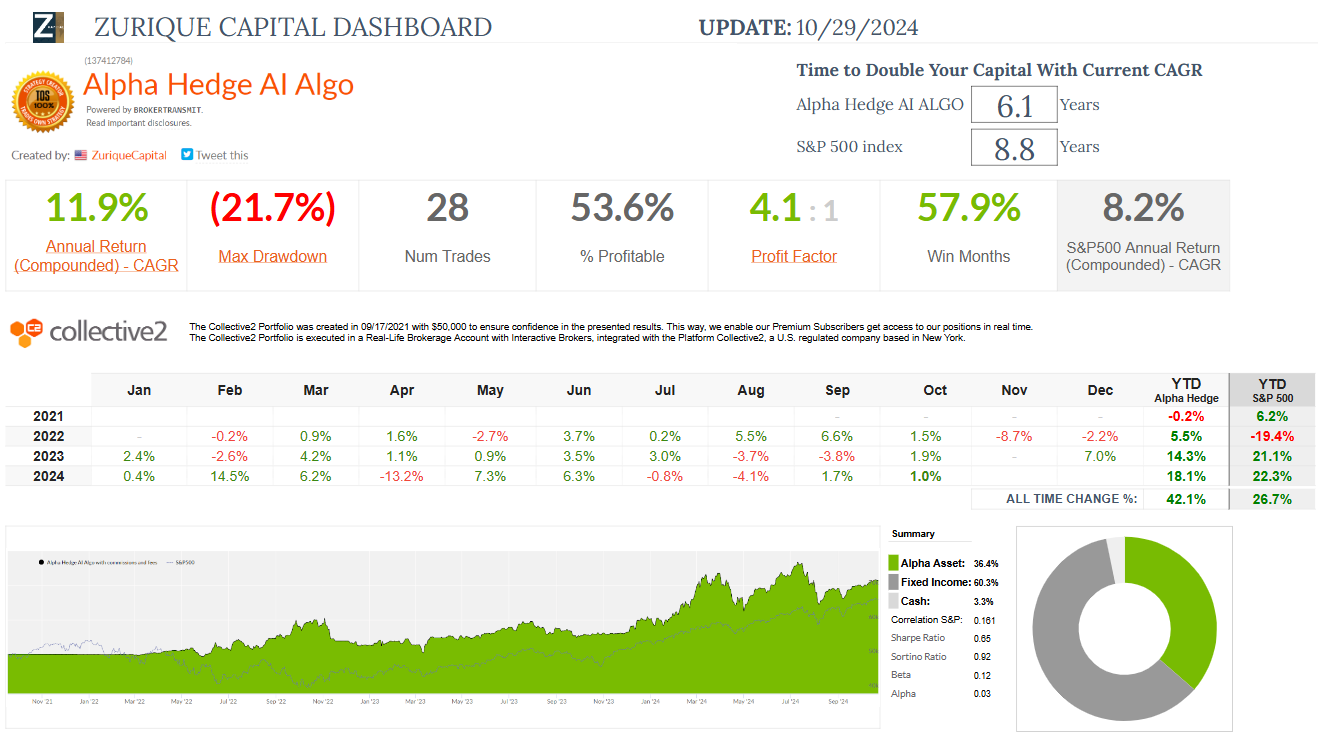

To ensure confidence in our results and uphold our commitment to full transparency, since September 2021, we have shared our performance in real time from a live brokerage account, allowing our clients to track the portfolio’s progress.

Over the past 37 months, the Alpha Hedge AI Algo Portfolio has delivered a total return of 42.1% (CAGR 11.9%), compared to the S&P 500's total return of 26.7% (CAGR 8.2%).

The portfolio is currently up 1.0% this month and has gained 18.1% year-to-date. At a CAGR of 11.9%, the portfolio doubles capital in 6.1 years, whereas the S&P 500, with an 8.2% CAGR, takes 8.8 years to do the same.

The portfolio has experienced a maximum drawdown of 21.7% and has been profitable in 53.6% of its 28 trades, with a profit factor of 4.1.

Why Choose the Alpha Hedge AI-Algo Portfolio?

AI Investment Management: Our AI algorithms continuously adapt to market conditions, mitigating risks associated with unpredictable fluctuations.

Wealth Exponential Expansion: By harnessing AI's predictive capabilities, the portfolio seeks out high-growth opportunities, accelerating your wealth accumulation.

AI Investment Advisor for Tax Optimization: Strategic investment choices are made with tax efficiency in mind, maximizing your net returns.

Transparency: We operate with radical transparency, offering you full visibility into a live brokerage account. Monitor your investments in real-time and see exactly how your assets are managed.

Subscribe now, and let AI work for your financial future.

▶️Read what the Wall Street Insiders wrote about us↓