Sentiment Shapes the Market: AI Leverages It for Advantage

📊AI for Investment: AI Investment Bot Reveals Today’s Top 7 Assets & AI Investment Management: Alpha Hedge AI Algo Portfolio Review

The Hidden Cost of Uncertainty in Your Portfolio

Many investors today struggle with expanding and preserving their wealth in an increasingly complex financial environment.

Relying on traditional investment models is no longer enough. The research highlighted in the article "Chasing Noise in the Stock Market: An Inquiry into Investor Sentiment and Asset Pricing" reveals that traditional models miss out on critical factors like investor sentiment, leading to inaccurate predictions and poor portfolio performance.

This failure to incorporate the human element into asset pricing leaves your portfolio vulnerable, unable to capture the real drivers of market movements. The result? Missed opportunities and exposure to unnecessary risks.

We’ll introduce a solution that puts you ahead of these market disruptions.

The Power of AI: Your New Competitive Edge in Investing

What if you could get ahead of these obstacles with insights previously only accessible to market insiders?

The Alpha Hedge AI Algorithm, our AI-powered investment tool designed to identify and anticipate market trends with precision. This advanced technology provides legal and ethical foresight—leveling the playing field against those who rely on illegal methods. In fact, the Alpha Hedge AI Algorithm gives you a competitive edge without the legal risks traditionally associated with insider trading.

Insider Trading Definition

It refers to trading a public company's stock or other securities by individuals with access to non-public, material information about the company.

With AI, you can outperform even the best market players—without the uncertainty.

Sentiment Shapes the Market: AI Leverages It for Advantage

The article "Chasing Noise in the Stock Market: An Inquiry into the Dynamics of Investor Sentiment and Asset Pricing" explores the role of investor sentiment in stock market pricing models. It examines how incorporating sentiment measures, in addition to traditional factors, can improve the explanation of asset returns and market anomalies.

The main themes and key points are summarized below:

Introduction and Background

Traditional asset pricing models like the Capital Asset Pricing Model (CAPM) and Fama-French's three-factor model have been used to estimate expected returns based on market risk.

These models have limitations in explaining market anomalies, especially due to behavioral factors like investor sentiment.

The study focuses on how investor sentiment, as a systematic risk factor, can improve asset pricing models and better predict stock market returns.

Investor Sentiment as a Risk Factor

Sentiment measures are created using principal component analysis (PCA) of various sentiment proxies, including liquidity, dividend premium, and consumer confidence.

The study introduces two sentiment indices: a raw sentiment index and a clean sentiment index (which excludes economic-cycle-induced sentiments).

Sentiment-augmented models outperform traditional models, showing that sentiment is a significant factor in explaining excess returns.

Factor Models in Asset Pricing

The study explores the performance of traditional models (CAPM, Fama-French, and Carhart four-factor) and sentiment-augmented models across different portfolios.

The inclusion of sentiment variables leads to more accurate forecasts and reduces pricing errors, indicating that traditional models may not fully capture market dynamics.

Methodology

The analysis uses UK stock market data from January 1993 to December 2020, focusing on non-financial firms with positive book-to-market ratios.

Risk factors such as market return, size, value, and momentum are considered alongside the new sentiment variables.

PCA is applied to construct sentiment indices, which are incorporated into asset pricing models for comparison with traditional models.

Findings

Sentiment-based models significantly improve the explanation of returns in different portfolios, especially in explaining cross-sectional variations in stock returns.

Sentiment indices (both raw and clean) predict excess returns better than traditional risk factors alone.

The study's results indicate that investor sentiment is a vital component in understanding stock price movements and market anomalies.

Conclusion

Investor sentiment is a valuable addition to asset pricing models, offering a deeper understanding of stock market behavior.

The findings suggest that market analysts should consider sentiment measures when forecasting returns, as they can improve the accuracy of asset pricing models.

Implications

The research highlights the importance of behavioral finance in understanding stock market movements, especially in developed markets like the UK.

It calls for further integration of sentiment measures into financial models to better capture investor behavior and market dynamics.

With the Alpha Hedge AI Algorithm, we’ve integrated sentiment analysis to predict market trends—giving investors like you the advantage of forecasting shifts before they happen. This AI-powered system captures market volatility in real-time, creating opportunities where others see risk.

AI Investment Bot Reveals Today’s Top 7 Assets

How This AI Investment Bot Pinpoints the Best Opportunities in Volatile Markets.

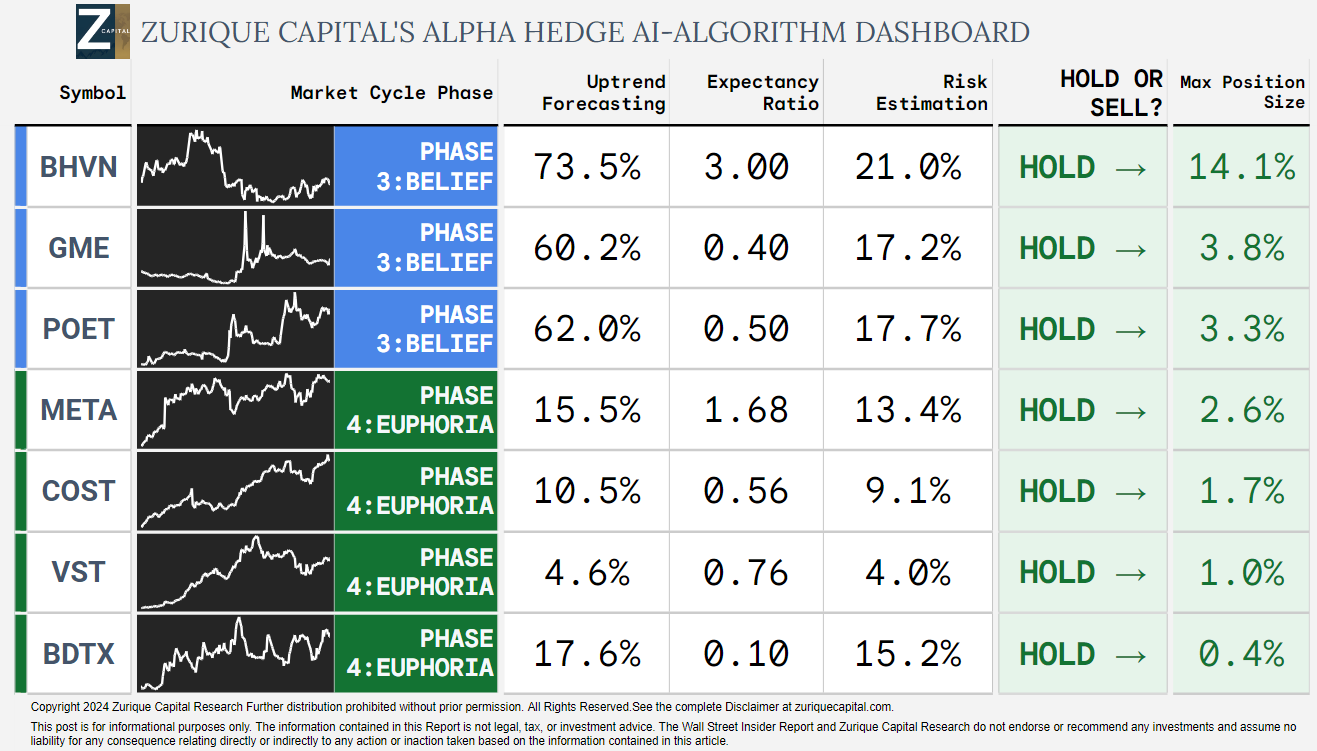

Today, our Alpha Hedge AI Algorithm identified the top 7 assets that present the best opportunities in the market. This isn’t luck—it’s data-driven precision. Our AI analyzes hundreds of data points to find undervalued assets, identify trends, and capitalize on market fluctuations.

Here are today’s top 7 assets:

Here’s How We Find These Market Opportunities:

STEP 1: OPPORTUNITY MARKET SCANNER: The Alpha Hedge AI Algorithm decodes market trends, analyzing market movements to spot assets with high potential for long-term growth. Using sophisticated data processing, it scans thousands of assets to find the most promising opportunities with a focus on future profitability.

STEP 2: USING MATHEMATICS TO MAXIMIZE WEALTH: Mathematical precision is at the core of the Alpha Hedge Algorithm. By analyzing market cycles, it helps pinpoint the perfect moment to buy or sell. This ensures that we not only find high-potential assets but also maximize wealth with minimal risk—ensuring an ideal balance in your portfolio.

STEP 3: TOP MUST-WATCH ASSETS: The Alpha Hedge Algorithm prioritizes assets that are in market Phases 3 or 4, as these show the strongest quantitative data. Any assets outside these phases are excluded, allowing us to focus only on those with the highest potential for growth. Today’s top 7 assets were identified by this AI-powered process.

These assets were chosen because of their potential to capture market movements and generate returns even in unpredictable conditions.

Have access to more insights like this every day—ensuring you’re always in a position to make informed investment decisions, even during turbulent market conditions.

Follow our Notes and access all the assets analyzed in the day:

But the real power of AI goes beyond these daily picks—our AI investment system can consistently identify opportunities to grow wealth exponentially.

Alpha Hedge AI Algo Portfolio: Your Ultimate Wealth-Building Tool

Exponential Wealth Growth Starts with the Alpha Hedge AI Portfolio

Imagine having a hands-off approach to wealth management, where AI handles market volatility, optimizes your tax strategy, and grows your wealth exponentially—all while you focus on what matters most. The Alpha Hedge AI Algo Portfolio does just that, leveraging real-time AI-driven insights to create a long-term wealth-building solution.

Here’s what the Alpha Hedge AI Algo Portfolio offers:

Market Volatility Management: Stay protected even in turbulent conditions.

Wealth Expansion: AI identifies opportunities for exponential growth.

Tax Optimization: Maximize your returns by minimizing your tax burden.

Radical Transparency: We run a live brokerage account that ensures you see every move we make, in real-time.

The Alpha Hedge AI-Algo Portfolio may contain either 1 Alpha or 1 Hedge Asset at a time, depending on the Cycle of the S&P500.

The tables and graphics below present historical data on the Alpha and Hedge Cycles. The Performance considered Profits reinvested, no contributions, no withdrawals and dividends are excluded.

Alpha Hedge AI-Algo Portfolio Review: 09/23/24

Over the past decade, we developed the Alpha Hedge Algorithm using advanced quantitative methods, machine learning, neural networks, and, more recently, AI to build a portfolio designed to exponentially grow wealth while minimizing risk.

To ensure confidence in our results and uphold our commitment to full transparency, since September 2021, we have shared our performance in real time from a live brokerage account, allowing our clients to track the portfolio’s progress.

Over the past 36 months, the Alpha Hedge Portfolio has delivered a total return of 39.6% (CAGR 11.7%), compared to the S&P 500's total return of 24.1% (CAGR 7.5%).

The portfolio is up 0.9% this month and has gained 16% year-to-date.

At a CAGR of 11.7%, the portfolio doubles capital in 6.2 years, whereas the S&P 500, with a 7.5% CAGR, takes 9.6 years to do the same.

Why Choose the Alpha Hedge AI-Algo Portfolio?

AI Investment Management: Our AI algorithms continuously adapt to market conditions, mitigating risks associated with unpredictable fluctuations.

Wealth Exponential Expansion: By harnessing AI's predictive capabilities, the portfolio seeks out high-growth opportunities, accelerating your wealth accumulation.

AI Investment Advisor for Tax Optimization: Strategic investment choices are made with tax efficiency in mind, maximizing your net returns.

Transparency: We operate with radical transparency, offering you full visibility into a live brokerage account. Monitor your investments in real-time and see exactly how your assets are managed.

The Wall Street Insider Report subscribers get access to this powerful portfolio, along with daily insider-level analysis and actionable insights.

Ready to take control of your financial future? Subscribe today to the Wall Street Insider Report Premium for exclusive access to the Alpha Hedge AI Algo Portfolio and transform the way you build wealth.

▶️Read what the Wall Street Insiders wrote about us↓