Risk Management and Wealth Preservation with AI [Lesson 6/7]

Free 7 Lesson Course: How to Build Legacy Wealth with AI

Meet Your Instructor

Dan Castro

Investment Management Specialist (University of Geneva/Switzerland), graduated in Electronic Engineering.

Founder and CEO of Zurique Capital Research, an American company specialized in Data Analysis, Investment Portfolio construction, Investors Training and Consulting.

Guide of over 1.8K Investors in 55 Countries.

Risk Management and Wealth Preservation with AI

Proper Position Sizing: The Holy Grail of Financial Markets

Welcome back to our course on "How to Build Legacy Wealth with AI." Today, we're taking a critical step forward in risk management by exploring the principles of optimal position sizing using the Kelly Formula.

This lesson will help you understand how to effectively manage risk and preserve wealth, ensuring long-term success in your investment journey.

1. The Importance of Proper Position Sizing

Properly sizing your positions is often considered the Holy Grail of the financial market. The formula for outperforming the market is straightforward: maintain assets in an upward trend and manage risk with optimal position sizing.

Let’s delve into the theory and application of the Kelly Formula, a strategy that has enabled great investors to decode and outperform the market.

1.1. The Kelly Formula: A Key Financial Market Strategy

The Kelly Formula was introduced by computer scientist John Kelly in a 1956 paper, referenced in William Poundstone's book "Fortune's Formula," and later popularized by Edward Thorp in "A Man for All Markets" when he applied the theory to beat the game of Blackjack. It was also applied by Jim Simons, founder of the Medallion and Renaissance hedge funds.

1.2. Understanding the Kelly Formula

The Kelly Formula is based on maximizing the expected logarithm of wealth, which translates to maximizing the expected geometric growth rate. It provides a strategy for bet sizing that leads to the highest possible growth rate in the long run.

In financial markets, the Kelly Formula is used to manage risk and optimize position sizing. By correctly sizing your positions, you can limit losses through sell stops and maintain assets in an upward trend.

1.3. Applying the Kelly Formula

The Kelly Formula can be broken down into 4 key components:

Total Risk Capital: The total amount of money you are willing to risk on a particular investment.

Probability of Positive Results: The likelihood that the investment will yield a positive outcome.

Probability of Negative Results: The likelihood that the investment will yield a negative outcome.

Return/Risk Ratio: The ratio of the potential return on the investment to the amount of money risked.

Kelly Formula (K)

1.4. The Kelly Multiplier Formula

To reduce risk in the financial market, which has an infinite number of variables, a percentage factor, known as the K% FACTOR, is applied to the result of the Kelly Formula. This factor adjusts the aggressiveness of your position sizing, making it more conservative if necessary.

For example, applying a K% FACTOR of 50% means you would only invest half of the calculated Kelly position size, thereby reducing risk.

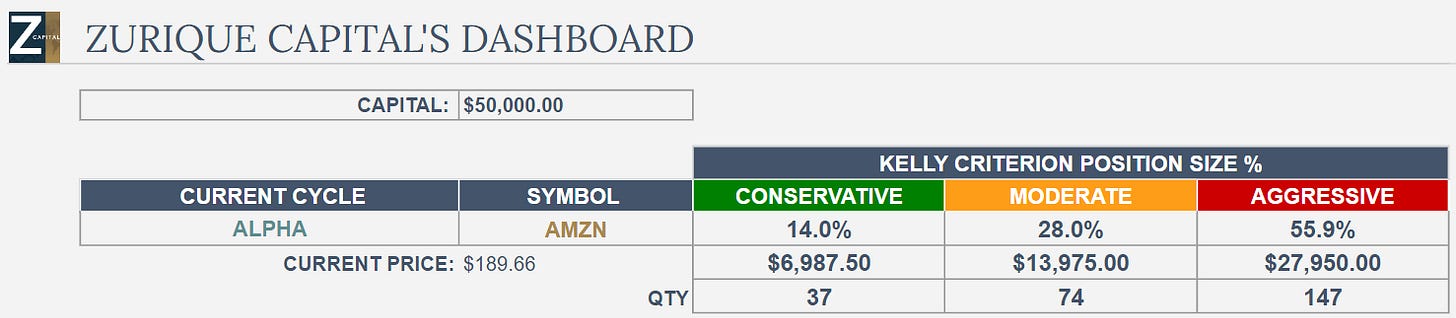

2. Case Study: Risk Management to AMZN 0.00%↑

Let’s examine an example using the Alpha Hedge Strategy Algorithm for Amazon AMZN 0.00%↑, based on data from the TrendSpider Platform on July 17, 2024, with a capital of $50,000.

Total Risk Capital: $50,000

Probability of Positive Results: 58%

Probability of Negative Results: 42%

Return/Risk Ratio: 19.8

Using the Kelly Formula:

K = ((19.8 x 58%) - 42%)/19.8 = 55.9%

The K% factor is related to Risk Tolerance.

Investors must decide their risk tolerance level: Conservative, Moderate, or Aggressive. According to historical statistical data, an efficient parameter to define your risk tolerance is the drawdown you are willing to accept.

Conclusion

The Kelly Formula is a powerful tool for managing risk and optimizing position sizing in the financial markets.

By considering total risk capital, probabilities of positive and negative outcomes, and the return/risk ratio, it provides a mathematical framework for making informed investment decisions.

In our next lesson, we’ll dive into the application of AI-driven strategies for long-term success, ensuring your portfolio not only survives but thrives in various market conditions.

Thank you for joining me today, and as always, feel free to leave any questions or comments below. Let’s continue building your legacy wealth together.