Riding Market Waves: Simons' Secret Strategy Revealed

[Free Course - Lesson 2/4]: Using Mathematics to Make Money: Jim Simons' Lessons

Using Mathematics to Make Money: Jim Simons’ Lessons [Lesson 2/4]

Are You Missing Out on Market Opportunities Hidden in Plain Sight?

Many seasoned investors pride themselves on their ability to read the market. Yet, despite access to an overwhelming amount of data, why do so many still miss critical opportunities? The answer lies in the underutilization of comprehensive data—a common pitfall even among experienced professionals.

In our lesson, “Riding Market Waves: Simons' Secret Strategy Revealed,” we delve into how legendary investor Jim Simons overcame this very challenge. Simons didn't just skim the surface; he plunged deep into financial reports, historical trends, and even seemingly unrelated events to uncover patterns others overlooked. By doing so, he found a way to interpret market dynamics holistically, capturing gains where others saw only noise.

Consider this: while most investors focus on headline numbers, vital signals influencing market movements often hide in the details. Ignoring these can lead to missed opportunities and suboptimal portfolio performance. The urgency is clear—relying on incomplete data is no longer an option in today's fast-paced markets.

Feeling the weight of untapped potential? You're not alone. But what if there was a way to harness the full spectrum of available data effortlessly?

Imagine transforming this challenge into your greatest asset with a solution that deciphers complex data for you, unveiling opportunities akin to insider knowledge—but entirely legal and ethical.

Unlock Market Secrets with AI—No Insider Information Needed

In a world where data is king, the ability to sift through vast information and extract actionable insights is paramount. Previously, only those with illicit insider information could anticipate market shifts with pinpoint accuracy. But what if you could achieve even greater precision without crossing any ethical lines?

The Alpha Hedge AI Algorithm—a groundbreaking advancement that empowers investors to identify and anticipate market trends with unprecedented accuracy. This isn't just about crunching numbers; it's about leveling the playing field. Through the power of artificial intelligence and sophisticated mathematical models, you're equipped with insights that rival those of market insiders.

Imagine making investment decisions with the confidence that comes from having a deep understanding of market undercurrents—spotting opportunities others miss and navigating volatility with ease. The Alpha Hedge AI Algorithm doesn't just match the foresight of insider traders; it surpasses it, all while maintaining the highest ethical standards.

Discover how this is possible by exploring the strategies of those who've mastered the market waves. Our lesson, “Riding Market Waves: Simons' Secret Strategy Revealed,” offers a glimpse into these innovative approaches.

Riding Market Waves: Simons' Secret Strategy Revealed

In the quest to outperform the market, few have achieved the legendary status of Simons. His approach redefined investment strategies by embracing methods that others overlooked. Let's delve into the core principles that propelled his success:

Advanced Quantitative Analysis Simons didn't stop at surface-level data. He sought out subtle, repeatable patterns—the "tiny whispers" in the market—that could signal future movements of stocks and commodities. By finding order in chaos, he identified opportunities invisible to most.

Deep Dive into Data Beyond standard financial metrics, Simons and his team examined a vast array of information, including historical trends and seemingly unrelated events. For instance, they discovered a consistent increase in certain stock prices leading up to Christmas—a pattern that, while its cause remained unknown, presented a reliable opportunity for profit.

Focus on Short-Term Trends Recognizing the potential in volatile commodity markets like oil and gold, Simons capitalized on minor imbalances in supply and demand. His agility allowed him to "ride the waves," much like a surfer who knows precisely when to act.

Rigorous Technical Analysis Rather than predicting the future, Simons meticulously mapped the present. Using mathematical formulas, charts, and tables, he gained a comprehensive understanding of existing market trends, setting himself apart from competitors who relied on intuition.

These strategies underscore a fundamental shift—from relying on gut feelings to embracing a data-driven approach that uncovers hidden market dynamics.

But theory is just the beginning. Seeing these principles in action demonstrates their true power. What if you could access an AI-driven process that identifies top-performing assets daily, leveraging these very strategies?

How an AI Investment Bot Unveiled Today's Top Market Opportunities

Staying ahead of the market requires more than intuition—it demands cutting-edge technology. Today, we're excited to share how our AI investment bot, powered by the Alpha Hedge Algorithm, identified top-performing assets poised for growth.

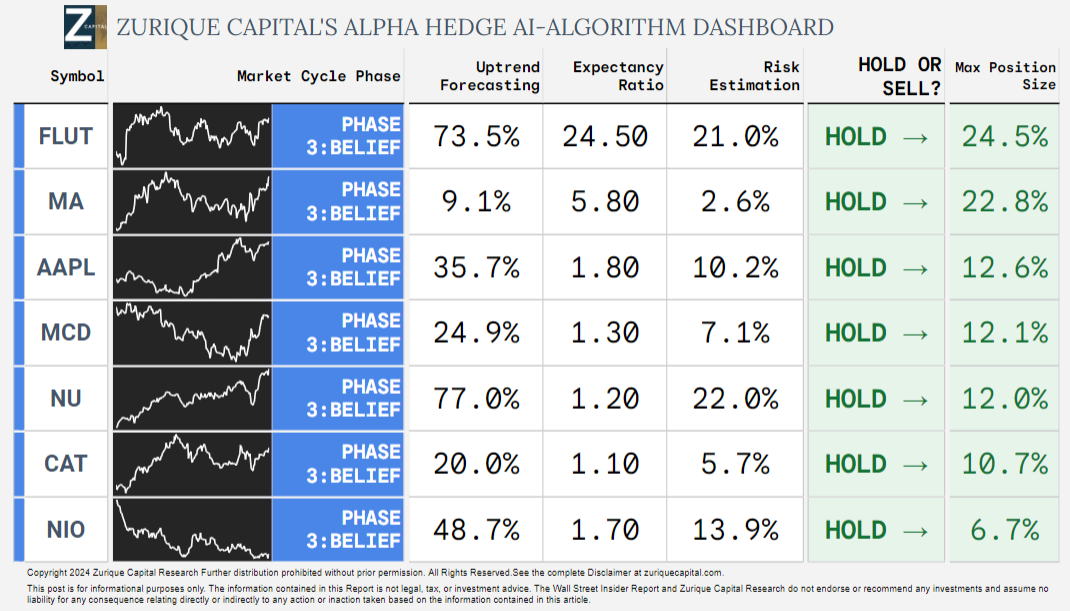

Today's Top Assets Identified: FLUT 0.00%↑ MA 0.00%↑ AAPL 0.00%↑ MCD 0.00%↑ NU 0.00%↑ CAT 0.00%↑ NIO 0.00%↑

Here’s How We Find These Market Opportunities:

Have access to more insights like this every day—ensuring you’re always in a position to make informed investment decisions, even during turbulent market conditions.

Follow our Notes and access all the assets analyzed in the day:

Our AI-driven process scans vast amounts of market data in real-time, detecting patterns and signals often invisible to the human eye. By analyzing financial reports, market trends, and global events, the algorithm anticipates shifts in market dynamics with remarkable precision.

This approach doesn't just react to market volatility—it harnesses it, turning fluctuations into opportunities for strategic investment. It's like having a seasoned analyst working around the clock, but with the speed and efficiency only AI can provide.

Imagine integrating this level of insight into your investment strategy. While these assets offer significant potential, there's a more streamlined way to capitalize on such opportunities consistently.

What if you could access a curated portfolio that leverages this AI technology, providing a hands-off, long-term solution for exponential wealth growth? Discover how the Alpha Hedge AI Algo Portfolio can transform your investment approach.

Alpha Hedge AI Algo Portfolio—Your Gateway to Exponential Wealth Growth

Recalling the challenges many investors face—overlooking critical data, missing subtle market signals, and navigating volatility—the solution becomes clear: leveraging AI to elevate your investment strategy.

The Alpha Hedge AI Algo Portfolio offers a transformative approach. By utilizing advanced AI technology, this portfolio provides a hands-off, long-term solution designed to grow your wealth exponentially. It's not just about picking stocks; it's about strategically positioning your investments based on comprehensive, data-driven insights.

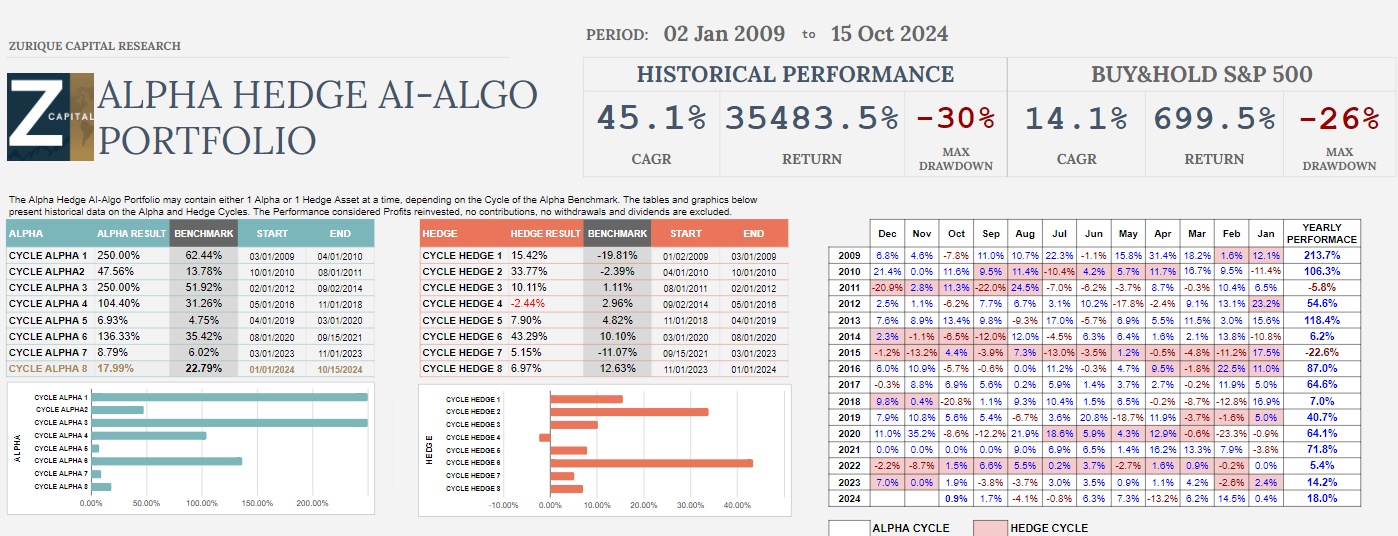

The Alpha Hedge AI-Algo Portfolio may contain either 1 Alpha or 1 Hedge Asset at a time, depending on the Cycle of the S&P500.

The tables and graphics below present historical data on the Alpha and Hedge Cycles. The Performance considered Profits reinvested, no contributions, no withdrawals and dividends are excluded.

Alpha Hedge AI-Algo Portfolio Review: 10/14/24

Over the past decade, we developed the Alpha Hedge Algorithm using advanced quantitative methods, machine learning, neural networks, and, more recently, AI to build a portfolio designed to exponentially grow wealth while minimizing risk.

To ensure confidence in our results and uphold our commitment to full transparency, since September 2021, we have shared our performance in real time from a live brokerage account, allowing our clients to track the portfolio’s progress.

Over the past 37 months, the Alpha Hedge AI Algo Portfolio has delivered a total return of 42.0% (CAGR 12.0%), compared to the S&P 500's total return of 26.3% (CAGR 8.1%).

The portfolio is currently up 0.9% this month and has gained 18.0% year-to-date. At a CAGR of 12.0%, the portfolio doubles capital in 6.0 years, whereas the S&P 500, with an 8.1% CAGR, takes 8.9 years to do the same.

The portfolio has experienced a maximum drawdown of 21.7% and has been profitable in 53.6% of its 28 trades, with a profit factor of 4.1.

Why Choose the Alpha Hedge AI-Algo Portfolio?

AI Investment Management: Our AI algorithms continuously adapt to market conditions, mitigating risks associated with unpredictable fluctuations.

Wealth Exponential Expansion: By harnessing AI's predictive capabilities, the portfolio seeks out high-growth opportunities, accelerating your wealth accumulation.

AI Investment Advisor for Tax Optimization: Strategic investment choices are made with tax efficiency in mind, maximizing your net returns.

Transparency: We operate with radical transparency, offering you full visibility into a live brokerage account. Monitor your investments in real-time and see exactly how your assets are managed.

We understand the desire for a reliable, effective investment strategy that doesn't require constant oversight. The Alpha Hedge AI Algo Portfolio is designed with you in mind—providing peace of mind while your investments work harder for you.

Ready to Elevate Your Investment Game?

Join the ranks of informed investors taking advantage of this revolutionary approach. By subscribing to the Wall Street Insider Report Premium.

▶️Read what the Wall Street Insiders wrote about us↓