📊Portfolio Update: April/24 Rebalancing

Get full access to our real-life portfolio in real time, and our data-driven market cycle investment strategy

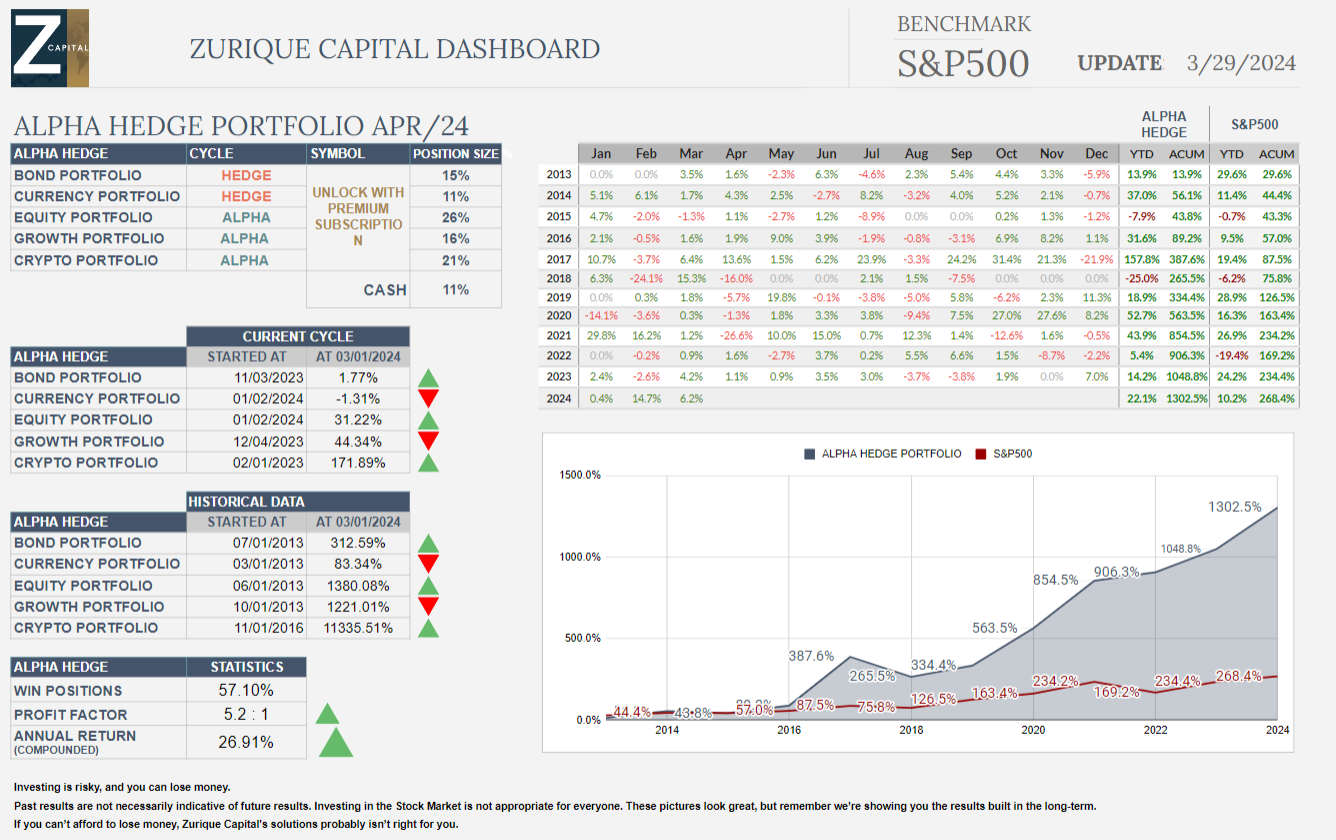

Alpha Hedge Portfolio Result March/2024

2013 to 03/29/2024

The Alpha Hedge Portfolio experienced its fourth consecutive month of gains, closing March with a +6.2%. In 2024, the portfolio has increased by 22.1%.

Markets Evolution: March/2024

2.1. Portfolios Performances

Alpha Hedge Bonds: +1.76%

Alpha Hedge Currency: -0.09%

Alpha Hedge Equity: +7.95%

Alpha Hedge Growth Stocks: +1.33%

Alpha Hedge Crypto: +12.47%

In March 2024, all portfolios, except for the Currency Portfolio, recorded gains. The Crypto Portfolio led the month's performance, followed by Equity, Bonds, Growth Stocks, and lastly, Currency, in that order.

As a result of these outcomes, the Annual Compounded Return has escalated to 26.91% since 2013, and the Profit Factor has improved to 5.2:1.

In 2022, the Alpha Hedge Portfolio increased 10x, yielding a 900% return on the initial investment. This was achieved without any new contributions or withdrawals, with profits and dividends excluded throughout the period.

In 2021, we restarted the 10x journey.↓

Alpha Hedge Collective2 Portfolio

09/17/2021 to 03/29/2024

Understanding the Collective2 Portfolio

The Collective2 Portfolio was established on September 17, 2021, with an initial investment of $50,000 to ensure confidence in the presented results. This Platform allows our Premium Subscribers to access the Alpha Hedge Portfolio in real-time and join us on our journey to increase our portfolio tenfold within a decade.

⚠️*We execute the Alfa Hedge Strategy in a Real-Life Brokerage Account with Interactive Brokers integrated with the Platform Collective2, a U.S. regulated company based in New York.

This way, to ensure confidence in the presented results, we enable Premium Subscribers access to our positions in real time.

Unlock the Alpha Hedge Portfolio ↓