📊My Favorite Metric for Measuring Wealth

Why Percentages Mislead Your Investment Gains

Wall Street Insider Report

Expert Guidance in Wall Street. Join +1.5k Wall Street Insiders across 30 US states and 51 countries who are scaling 10x their investments Mastering the Market Cycles.

My Favorite Metric for Measuring Wealth

Why Percentages Mislead Your Investment Gains

When it comes to investing, understanding how to measure your wealth accurately is crucial.

Traditional metrics like percentage returns and win/loss ratios can often be misleading, offering only a partial view of your financial success.

To truly gauge the effectiveness of your investment strategy, you need to look beyond these superficial numbers and focus on metrics that provide a comprehensive and realistic picture of your wealth.

In this article, I will introduce my favorite metric for measuring wealth.

These metric not only highlight the growth of your investments but also gives you a clearer understanding of your financial progress.

By incorporating these metric into your investment analysis, you can refine your strategies, manage risks more effectively, and ultimately achieve greater financial success.

What is the Win/Loss Ratio?

The win/loss ratio, also known as the success ratio, is a simple yet powerful tool used by investors to compare the number of winning trades to the number of losing trades over a specific period.

This ratio doesn't take into account how much was won or lost, but rather the frequency of wins versus losses.

Key Takeaways

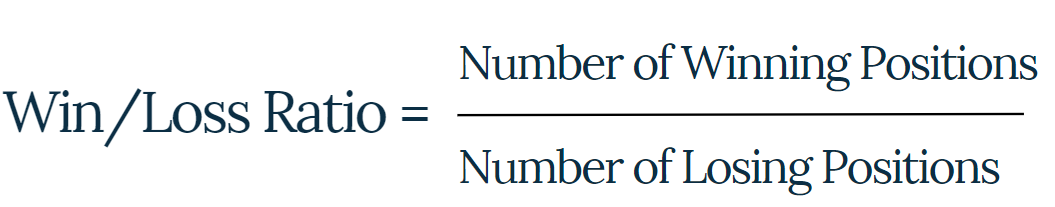

Win/Loss Ratio Definition: The number of winning positions divided by the number of losing positions.

Success Indicator: It helps indicate how many times an investor will have money-making positions relative to money-losing positions.

Strategy Evaluation: Investors use this ratio to rate the success of their investment strategy.

Calculating the Win/Loss Ratio

Calculating the win/loss ratio is straightforward. Use the following formula:

Interpretation of the Win/Loss Ratio

More than 1.0: Indicates more winning positions than losing positions .

Less than 1.0: Indicates more losing positions than winning positions .

Equal to 1.0: Indicates an equal number of winning and losing positions.

Active investors should regularly review their win/loss ratios to stay on top of their trading efforts and avoid significant financial losses.

At the moment I write this article, the Alpha Hedge Portfolio has a Win/Loss Ratio of 3.58 in 32 months (more than 1.0).

Limitations of the Win/Loss Ratio

Despite its usefulness, the win/loss ratio has limitations. It doesn't account for the monetary value of wins and losses. For instance, a win/loss ratio of 2:1 might seem positive, but if the losing positions have larger dollar losses than the winning positions, the investor still has a losing strategy.

The Concept Portfolio Value Creation

When it comes to measuring the success of investments, many investors focus on percentage returns.

However, a more insightful approach is to evaluate Portfolio Value Creation.

This metric assesses wealth in terms of actual dollars.

Alpha Hedge Collective 2 Portfolio Value Creation

Portfolio Value Creation = $69,352 - $50,000 = $19,352

Understanding the Collective2 Portfolio

The Collective2 Portfolio was established on September 17, 2021, with an initial investment of $50,000 to ensure confidence in the presented results. This Platform allows our Premium Subscribers to access the Alpha Hedge Portfolio in real-time and join us on our journey to increase our portfolio tenfold within a decade.

⚠️We execute the Alfa Hedge Strategy in a Real-Life Brokerage Account with Interactive Brokers integrated with the Platform Collective2, a U.S. regulated company based in New York.

Why Dollars Matter More Than Percentages

Real Wealth Measurement

Percentage returns, while useful, can sometimes be misleading. They don't always reflect the actual dollar value added to an investor's portfolio. For instance, a 10% return on a $10,000 investment adds $1,000, whereas the same 10% on a $100,000 investment adds $10,000. The percentage is the same, but the impact on wealth is significantly different.

Portfolio Value Creation steps in to provide a more accurate representation by showing how much actual wealth is generated. It encompasses all sources of value—dividends received, capital gains, and benefits from stock buybacks—giving a holistic view of the investment's performance.

The Importance of Portfolio Value Creation

Comprehensive Performance Evaluation

By focusing on Portfolio Value Creation, investors can gain a comprehensive understanding of an investment's performance. This approach accounts for all sources of value, providing a clearer picture of the wealth generated.

Long-Term Investment Strategy

Portfolio Value Creation encourages a long-term investment perspective. By considering dividends, capital gains, and buybacks, investors can better assess the sustainability and growth potential of their investments.

Combining Indicators for a Holistic View

To truly understand your investment success and risk profile, consider both the win/loss ratio and Portfolio Value Creation. A high win rate might not guarantee success if the Portfolio Value Creation is low.

Regular Review of Investment Strategy Metrics

To maintain trading success, it’s essential to habitually review your win/loss ratios, and Portfolio Value Creation. This practice can help you stay on top of your investment efforts, refine your strategies, and minimize financial losses.

Bottom Line

For investors, the win/loss ratio offers a snapshot of success by comparing the number of winning positions to losing positions.

However, to gain a comprehensive view of a Portfolio performance, it's crucial to consider the risk/reward ratio and the Portfolio Value Creation.

Regularly reviewing these metrics will help investors refine their strategies and manage risks effectively.

Remember, understanding the nuances of these ratios and their interplay can significantly enhance your investment success.

Over the past decade, our subscribers have outperformed the American market Mastering the Mathematical Cycles of the Market..

You too can make investment decisions based on objective data.

That's where the Wall Street Insider Report Comes comes in. We've developed a unique approach to investment management that puts you back in the driver's seat.

Know more about our 5-Year Plan and join +1.5k Wall Street Insiders across 51 countries who are scaling 10x their investments .↓