My Favorite Market Data Source for AI-Powered Analysis

📊Tech-Driven AI Insights on Market Drivers for Wealth Creation

Wall Street Insider Report

AI-Powered Insider-Level Insights to Exponentially Expand Wealth by Decoding Wall Street.

Join our global community of investors who are leveraging cutting-edge technology to build and preserve wealth for future generations.

If the link doesn’t work, copy this link in your browser: https://wallstreetinsiderglobal.com/build-legacy-wealth

My Favorite Market Data Source for AI-Powered Analysis

Tech-Driven AI Insights on Market Drivers for Wealth Creation

Timing and precision are crucial for every investor, having a reliable and advanced market data source can make all the difference.

Among the myriad of tools available today, one platform stands out—TrendSpider. Whether you're a seasoned investor or a newcomer, TrendSpider offers something for everyone.

Let me walk you through why TrendSpider has become my go-to source for market data.

This article is not sponsored by TrendSpider; it’s simply a reflection of my experience and enthusiasm for what I believe to be an indispensable tool for traders.

1. Custom Indicators

Powerful way to automate and customize technical analysis with precision.

Advanced Scripting: Create custom indicators, allowing for flexible, tailored analysis tools.

No-Code Strategy Creation: Build and deploy custom indicators with a drag-and-drop interface, no coding required.

Interoperability: Combine programmable indicators with other tools on the platform for complex, adaptive strategies.

2. Auto-Trade Tool

The Auto-Trade Tool automates trades execution based on your criteria, ensuring precision and efficiency.

Precision Execution: Executes trades exactly when your predefined conditions are met.

Risk Management: Automate stop-loss and trailing stops, integrating risk management into your investing strategy.

Broker Integration: Seamlessly integrates with multiple brokers for reliable and smooth trade execution with minimal slippage.

3. Backtesting Capabilities

TrendSpider elevates backtesting with robust, flexible features to ensure your strategies are ready for live markets.

Script-Based Backtesting: Integrates with the scripting engine to test complex strategies against historical data, from simple crossovers to multi-indicator setups.

Visualized Results: Provides an intuitive visual interface that overlays strategy signals on historical charts, helping you refine and understand your strategy's strengths and weaknesses.

Real-Time Testing: After backtesting, switch to real-time testing to monitor strategy performance in live markets and make adjustments before full deployment.

Whether you’re an experienced investor looking to refine your strategies or a beginner trying to navigate the complex world of financial markets, having a robust market data source is crucial for a tech-driven, AI-powered approach to wealth creation.

Now, let’s explore the top assets our system has identified:

CLOSING BELL OVERVIEW: 08/14/2024

Our AI-driven Algorithm revealed which of these assets have the strongest potential for long-term market gains.

GOOG 0.00%↑ K 0.00%↑ ALBT 0.00%↑ SERV 0.00%↑ CLOV 0.00%↑ ALB 0.00%↑ NU 0.00%↑ DGLY 0.00%↑ SCHW 0.00%↑ LUMN 0.00%↑ $TCEHY GOOGL 0.00%↑ SBUX 0.00%↑ CMG 0.00%↑ UBS 0.00%↑ CAH 0.00%↑ FLUT 0.00%↑ CVNA 0.00%↑ DKNG 0.00%↑ NKE 0.00%↑ ELWS 0.00%↑ OUST 0.00%↑

This is our top findings today:

Follow Zurique Capital on X for exclusive access to in-depth analysis of all assets:

Zurique Capital on X: https://x.com/zuriquecapital

Before investing in these assets, let me tell you that there is an even more efficient way to exponentially grow your wealth by leveraging AI.

If you are looking for:

Harness Market Volatility: Turn fluctuations into growth opportunities.

Wealth Preservation: Minimize losses, reduce costs, and optimize tax efficiency.

Simplified Choices: Evidence-based, AI-driven investment portfolio.

Trust and Transparency: Independent, transparent portfolio construction.

Life Balance: Hands-off solutions provide professional and personal peace of mind with a long-term, low-maintenance portfolio.

Subscribe today to the Wall Street Insider Report Premium and join 1.8K+ Global Investors across 55 countries who are building legacy wealth. Gain access now to:

10-Year Access to the Alpha Hedge Portfolio: Witness and follow the AI-driven investment portfolio in real-time.

Daily Insider-Level AI Analysis: Uncover the layers of US Stocks and ETFs cycles.

Actionable Monthly Analysis: Detailed update of the market cycles.

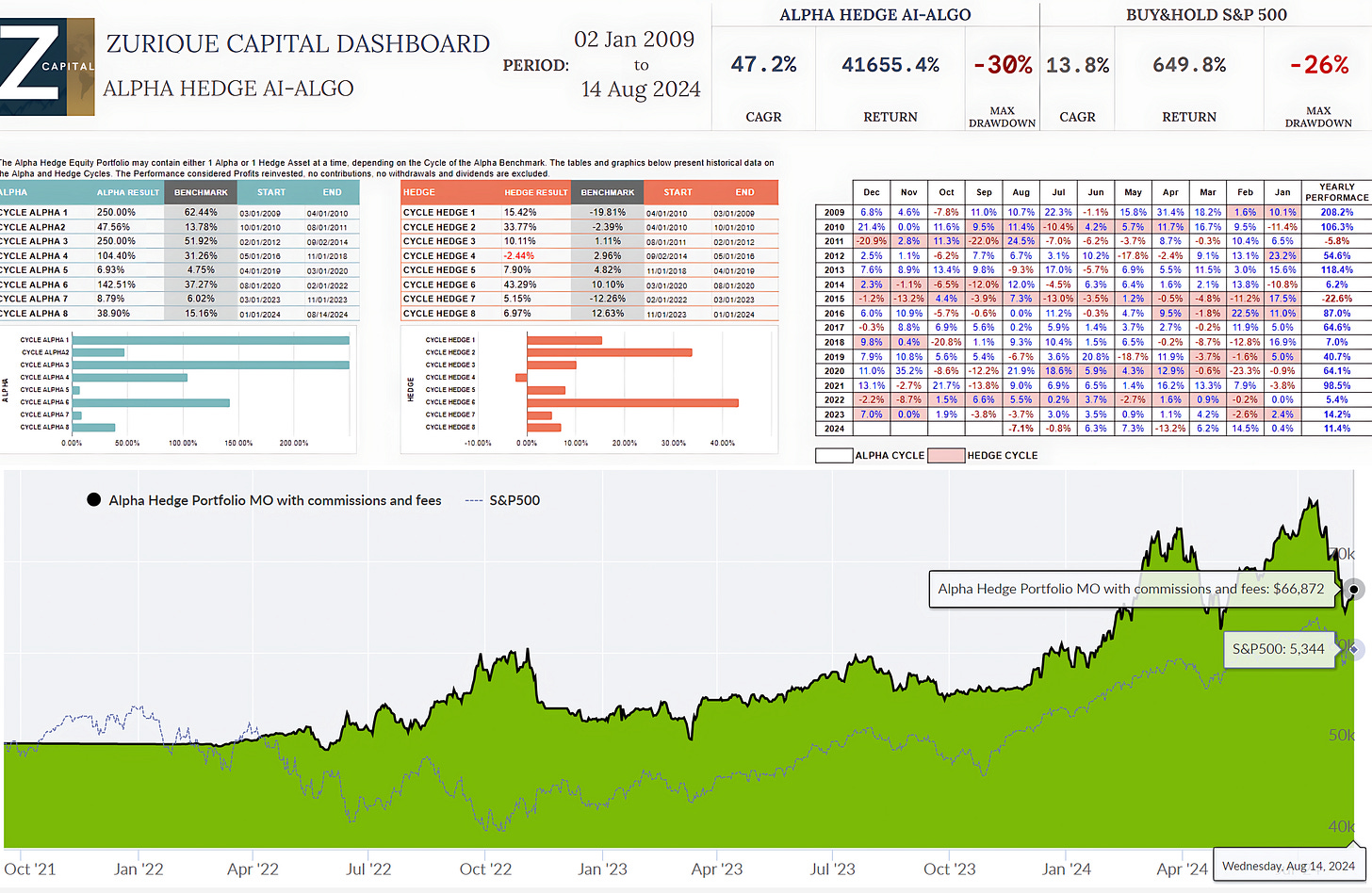

ALPHA HEDGE PORTFOLIO REVIEW:08/14/2024

The Alpha Hedge Portfolio has so far recorded a -7.1% performance for the current month, resulting in a year-to-date gain of 11.4%. Over 188 months, the portfolio has delivered a cumulative return of 41,655.4%, with a compound annual growth rate (CAGR) of 47.2%, compared to the S&P 500's cumulative return of 649.8% and a CAGR of 13.8% during the same period.