Most Investors Think Small: It’s Costing Them Millions

Day 1,237 Decoding Wall Street with an AI-Powered 1-Asset Portfolio

Most Investors Think Small: It’s Costing Them Millions

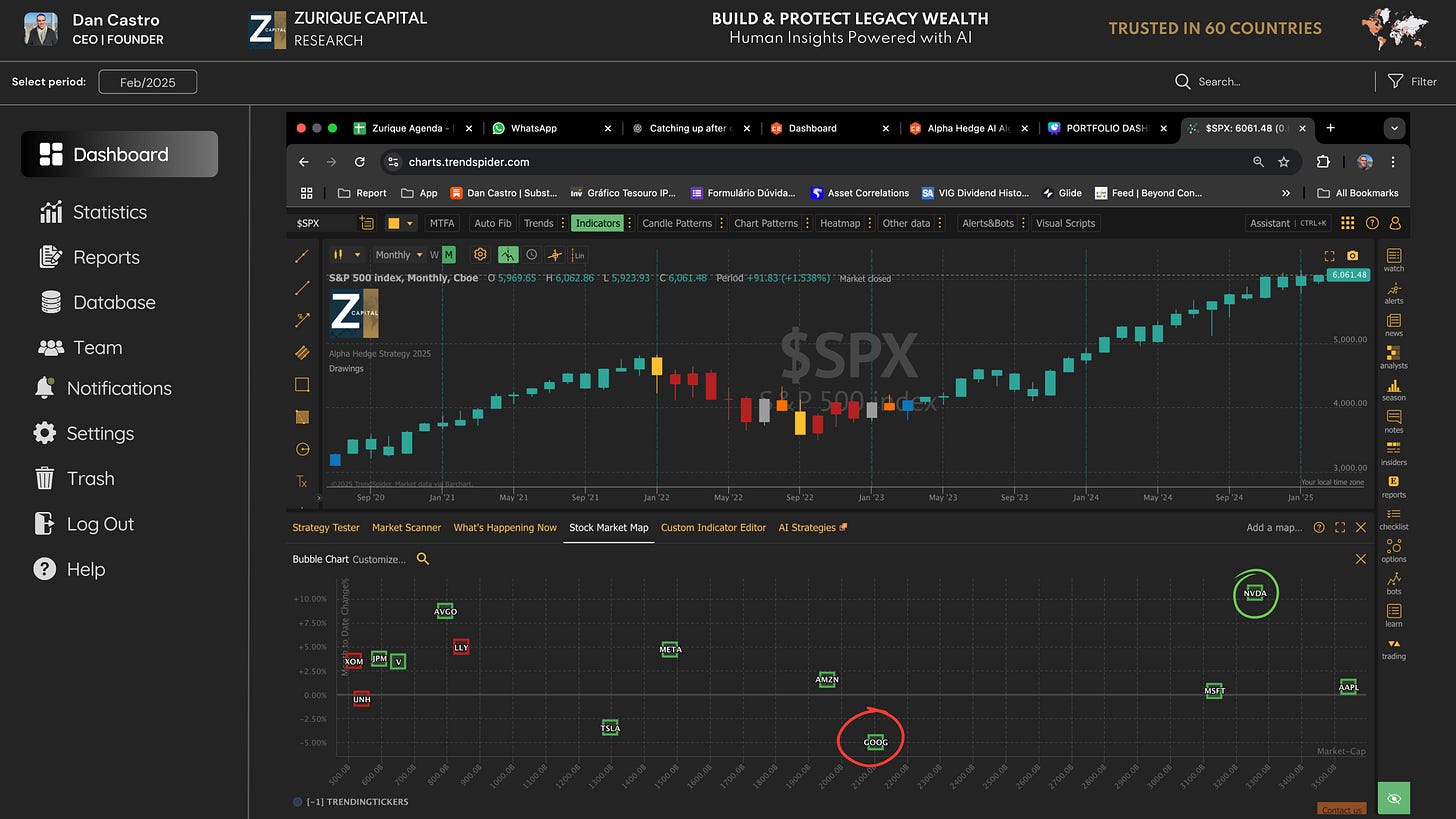

S&P Cycle Analysis + Top Market Cap Stocks

S&P 500 Holding Steady in Phase 4.

The market’s structure remains stable as our AI-driven analysis continues mapping the S&P 500 cycle. By tracking the highest market cap stocks, we identify key shifts that shape broader market trends.

AAPL 0.00%↑ NVDA 0.00%↑ MSFT 0.00%↑ AMZN 0.00%↑ META 0.00%↑ TSLA 0.00%↑ AVGO 0.00%↑ GOOG 0.00%↑ JPM 0.00%↑ LLY 0.00%↑ V 0.00%↑ UNH 0.00%↑ XOM 0.00%↑

As mentioned yesterday, NVDA 0.00%↑ gained strength and now lead the month to date performance. while GOOG 0.00%↑ remains under pressure.

Subscribe the Wall Street Insider Report for real-time AI-driven market insights.

Alpha Hedge AI Algo Portfolio Review

The Alpha Hedge AI Algo Portfolio

This portfolio operates on a clear principle: adapt to the market cycle.

It holds one asset at a time, selecting an Alpha when the trend favors growth and shifting to a Hedge when conditions turn defensive. This tactical approach aligns with the S&P 500’s broader movements, aiming to keep returns strong while managing risk.

Here’s how this approach is playing out in real time:

1,237 Days Since Launch

Here’s how this precision strategy is playing out in real time:

Total Return: 52.9% | CAGR: 12%

S&P 500 Over Same Period: 36.7% | CAGR: 8.5%

This strategy proves that concentration beats unnecessary diversification, allowing the portfolio to remain agile and efficient.

See the full Alpha Hedge AI Algo Portfolio — Subscribe to the Wall Street Insider Report.

▶️Read what the Wall Street Insiders wrote about us↓