📊Monthly Portfolio Rebalancing

Uncover the best strategy of Portfolio Rebalancing and optimization of investments.

July/2023 Portfolio Rebalancing

15 minutes/month is all the investors need to rebalance the Alfa Hedge Portfolio on the first Monday of each month.

But it took 10 years to us to develop this system.

Uncover the best strategy of Portfolio Rebalancing and optimization of investments.

Here is our step by step.

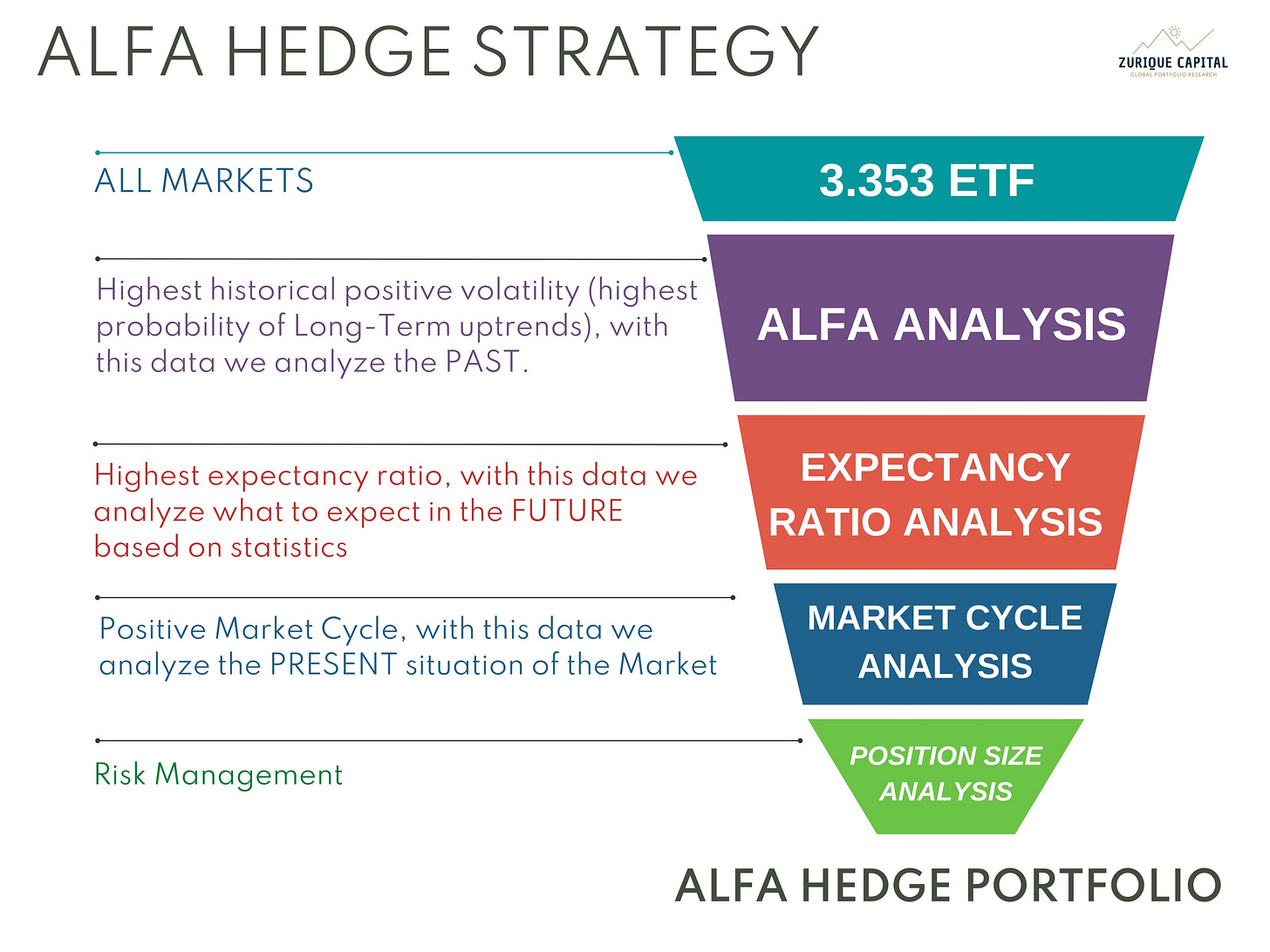

1. Establish the universe of assets of the Alfa Hedge Portfolio

The first step is to establish the universe of assets of the Alfa Hedge Portfolio. We identify all the ETFs available in the US by market using the TradingView Platform and the site etfdb.com.

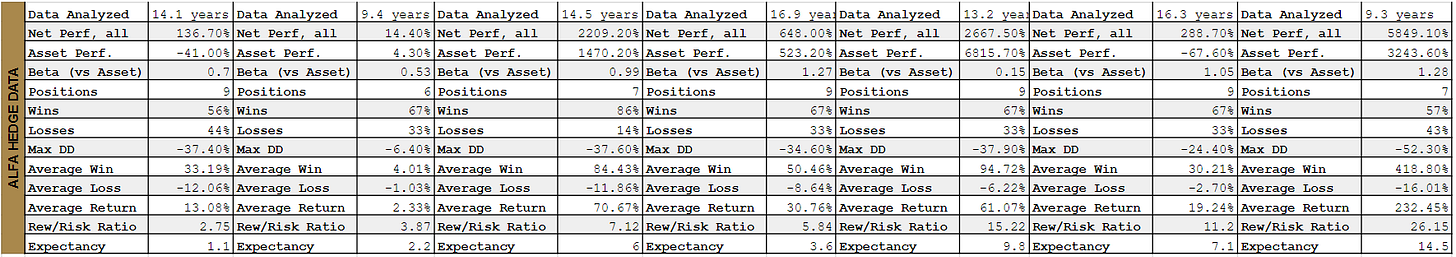

2. Alfa Analysis

By the weekend before the first Monday of the month using our algorithm created on the TrendSpider Platform to identify the ETFs with the highest historical positive volatility (highest probability of Long-Term uptrends).

With this data we analyze the PAST.

3. Expectancy Ratio Analysis

Also with TrendSpider Platform, we collect the statistical data of the ETFs. We search for the highest expectancy ratio.

With this data we analyze what to expect in the FUTURE based on statistics.

4. Market Cycle Analysis

In this step we identify the Market Phase of each ETF.

With this data we analyze the PRESENT situation of the Market.

Combining the Data of the steps 2, 3 and 4, we have all the Data to calculate the Alfa Hedge Rating.

For each market, we have now an Alfa ETF, they are the Benchmarks of each Market for our Portfolio, not necessarily this are the most negotiated ETFs, but the ones with highest Alfa Hedge Rating.

We start this process with 3.353 and finishes with at most 7 assets on the Portfolio.

Know more about this clicking here

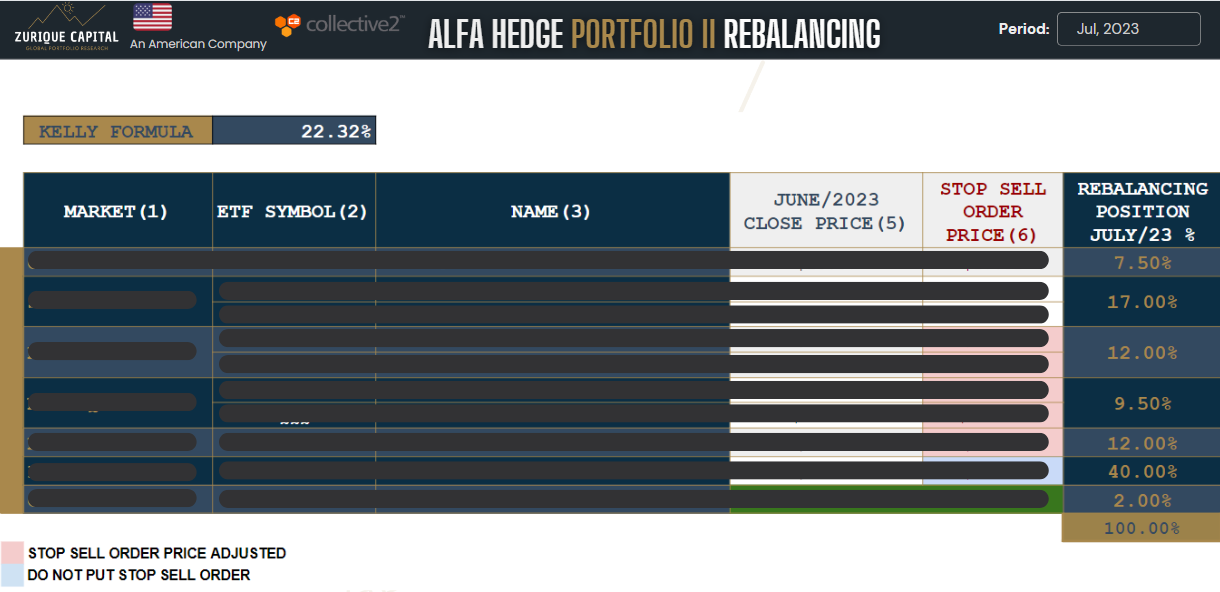

5. Risk Management Process

For this step, our algorithm uses the Kelly Formula to establish the optimized position for each ETF.

The Kelly Formula takes into account four key components:

Total Risk Capital: This is the total amount of money that you are willing to risk on a particular bet or investment.

Probability of Positive Results: This is the probability that the bet or investment will result in a positive outcome.

Probability of Negative Results: This is the probability that the bet or investment will result in a negative outcome.

Return/Risk Ratio: This is the ratio of the potential return on the bet or investment to the amount of money risked.

This are the information we share with our Premium Subscribers by the beginning of each month.

Execution

The final step is execute the rebalancing adjusting the positions.

This execution takes 15 minutes/month.

July/23 Monthly Rebalancing

Accordingly with the Market Cycle, what Markets do we have on Alfa Hedge Portfolio II right now?

Access now👇